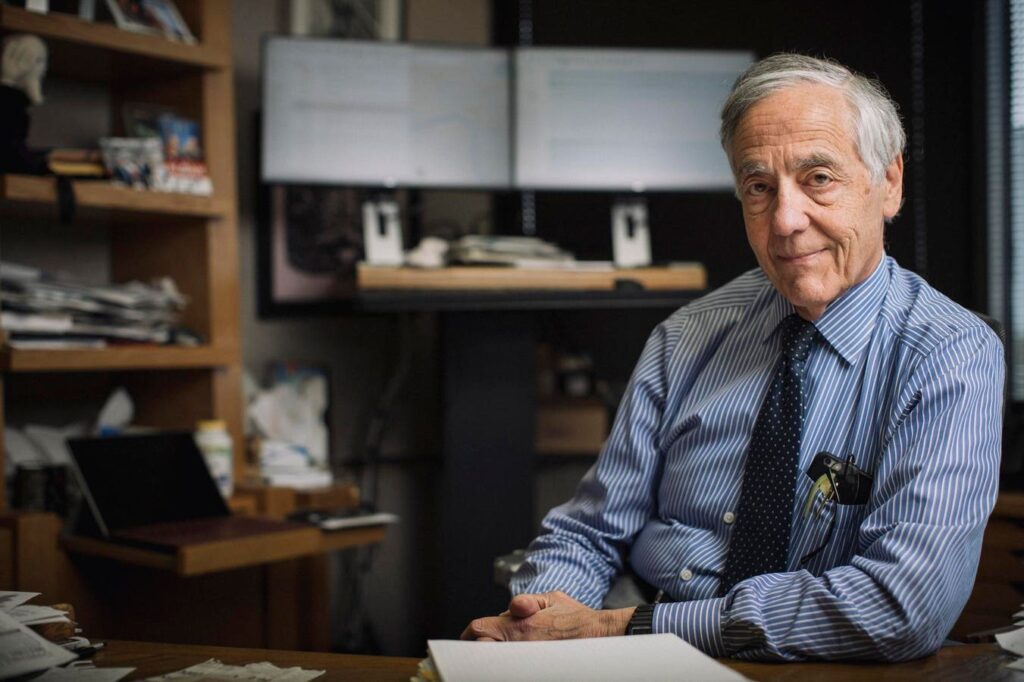

George Kaiser.

Washington Post (via Getty Images)

Oklahoma great said forbes He talked about how he is protecting his investments ahead of what is “almost certainly” a recession.

With the S&P 500 index entering a bear market last week, many U.S. billionaires are convinced that a recession is near. One of them is George Kaiser, one of Oklahoma's richest men, with an estimated fortune of $9.5 billion.

Kaiser, 79, said. forbes “A recession seems almost certain,” he said, predicting an economic downturn in the first two quarters of 2023 and an extended stock market decline. Kaiser said the market is still far from bottoming out, when the stock market hits its lows and starts rising again. “Historical analogies suggest a total decline of 35% from peak, but that history is largely irrelevant as many of the factors are idiosyncratic,” he said.

Kaiser appeared in forbes Having been on the list of America's 400 richest people for more than two decades, he is no stranger to boom-bust cycles. His wealth is concentrated in oil and gas, and other holdings include a 55.8% stake in the publicly traded Bank of Oklahoma (BOKF), a 20% stake in the NBA's Oklahoma City Thunder, and through his personal investors he owns publicly traded companies. and some investments in both private companies. Argonaut Co., Ltd. When oil prices collapsed in 2020, Kaiser's oil business took a hit and his estimated net worth fell to $4.9 billion, a 15-year low. A year later, his fortune has returned to $10 billion, thanks to private equity investments that benefited from a rebound in oil prices and a booming market in 2021.

Currently, stock prices are falling and oil prices are rising further. The price of WTI, the U.S. oil benchmark, has risen by more than a third since the beginning of this year. Kaiser is managing his investments to weather a potential downturn and come out on top. .

“While a recession seems almost certain, our business strategy does not change much as each one marches to a different drummer,” he said. “Each investment business has its own adaptations.”

Kaiser's oil and gas assets include Tulsa-based Kaiser Francis Oil Company and Oklahoma City-based drilling contractor Cactus Drilling, both privately owned, as well as publicly traded natural gas liquids ( This includes a 77.5% stake in Excelrate Energy, a transportation company (LNG). During April. Rising oil prices are a boon for independent oil companies like Kaiser. “We remain aggressive in drilling and production as this is the period of greatest opportunity,” he said.

Bank of Oklahoma's energy lending business received an upside after the Federal Reserve raised interest rates to stem rising inflation. The bank said in its first quarter report that 15% of its total lending consisted of energy loans, totaling $3.2 billion, including $2.4 billion to oil and gas producers, an increase of 6% since the beginning of the year. revealed. When interest rates rise, banks tend to make more money on the spread between the interest paid to customers and the interest earned on their investments. “Energy financing is an opportunity where competitors are in a frenzy, and higher interest rates will widen spreads and improve profitability,” Kaiser said.

Even when the stock market was still hot, growing fears of a recession meant that Mr. Kaiser was anticipating it and investing accordingly. “Our main new response to this is [economic] For a while, the environment was a short hedge (prematurely) on the S&P, but I'm gradually unhedging it in the hopes that I can pretty accurately gauge when to go long when the market capitulates. ' he explained. What that means is that he is betting that his S&P 500 index will fall. So far this year, the S&P 500 index is down 20%.

It's still unclear how deep and long-lasting the recession will be, with Kaiser citing multiple factors, including supply chain issues, the war in Ukraine and rising inflation. Additionally, while average wages in the United States have been rising since 2021, there is a risk that this increase will be eaten up by rising prices for goods and services. Kaiser also expects it will be difficult to attract workers to industries that need more workers, such as hospitality, restaurants, nursing care, education and trucking. “We are blessed to live in interesting times,” he said.

Asked when the stock market will recover, Mr. Kaiser said it has been roughly flat since January, performing better than other billionaires and most other investors, but that the market will recover in March or April next year. I dared to predict that the market would bottom out around April. “If we put all government subsidies back into current tax rates, both domestically and in other countries around the world, personal income would be the driving force,” he said.

Still, Kaiser believes it's foolish to speculate on exactly when the market will rebound. “It's like porn, you know it when you see it.”