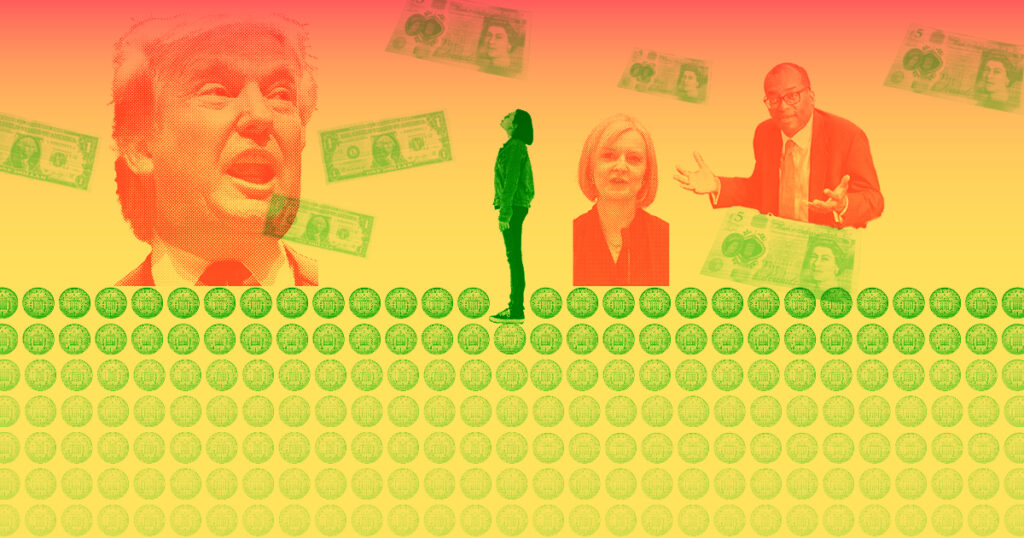

The most extraordinary political crisis in British history occurred when British Prime Minister Liz Truss and then Chancellor of the Exchequer Kwasi Kwarteng caused economic chaos by announcing unfunded tax cuts for high earners to boost economic growth. One was triggered.

Their “mini-budgets” took the market by surprise and were widely criticized for appearing to rely on the unreliable theory of “trickle-down economics.” But this is a persistent idea, and over the past 50 years taxes on the wealthy have fallen dramatically across advanced democracies. Margaret Thatcher, Ronald Reagan and Donald Trump all argued that by freeing up money for the wealthy, they could hire more workers, pay better wages and invest more. He argued that it could be done, and was elected by promising significant tax cuts for high-income earners.

In the study, first published as a research paper in 2020, David Hope and Julian Limberg of the LSE Institute of International Inequality and King's College London examine the significant changes in wealth over 50 years in 18 rich countries. We analyzed the economic effects of tax cuts.

LSE iQ: What is the future of capitalism?

Capitalism and free markets have lifted billions of people out of poverty around the world. However, it has also been criticized for widening the gap between rich and poor, and more and more people are feeling left behind. This episode of the LSE iQ Podcast explores this issue.

The rich get richer, while unemployment and economic growth remain unaffected.

Cutting taxes on the wealthy causes them to negotiate more aggressively for their own compensation at the direct expense of workers, lowering income distribution.

Their conclusion was that the rich got richer and there was no significant effect on unemployment or economic growth. This was really shocking. After the LSE's press release, it received extensive media coverage around the world, went viral on social media, and was quoted by prominent economists and politicians. As a result, the paper became the most downloaded paper in his 18-year history on LSE Research Online, a database of all research produced by LSE academics.

Dr. Hope explained: It has been downloaded approximately 150,000 times. To put this in some context, I think his previous research papers in that series were downloaded an astonishing 200 times. In that respect, it was quite different from the norm.

“I already knew all this. Thank you Captain Obvious”: Discussing wealth, taxes, and “fairness” in polarized times

“For someone who has never had a Twitter account, going viral on Twitter was quite an experience. Many colleagues also sent me memes about the paper in the days following the publication. Since such opportunities are rare, we decided to include them at the beginning of the many academic presentations we subsequently made on the paper. ”

Dr. Linberg added: “It was actually quite interesting because more or less he got two kinds of reactions. One was, 'That can't be true and we don't believe this.' And he also said, “You're socialists, that's all.”

“And the other reaction was, 'Well, this is all we already knew.' Thank you, Captain Obvious, although there was little basis between those two extremes. This was very surprising, and it actually reinforced our belief that we need a data-driven approach that goes a little beyond this political polarization.”

The average citizen appears to be largely uninformed about how taxes on the wealthy have truly fallen dramatically over the past 40 years.

Dr. Limberg explained that the most intense reactions on Twitter came from the United States, including a tweet from prominent politician Elizabeth Warren.

Dr Hope added: “Maybe we were a little naive in not thinking about this ahead of time, but this is obviously a very partisan, polarizing, politically contentious issue, especially in the United States. Yes, in part because there have been major changes in taxes on the wealthy as we progress through Democratic and Republican administrations, particularly the significant tax cuts under the George W. Bush and Donald Trump administrations. So I think this tax cut has had a big impact on the political dynamics of the country, and that's why people were so interested in it.”

In explaining why tax cuts for the wealthy have done nothing to boost the economy, Dr. Hope draws on economist Thomas Piketty, who argues that capitalism threatens the democratic order unless it is reformed. Mentioned.

“Our results are very consistent with Thomas Piketty's work, which shows that what happens when you cut taxes on the wealthy is that they seek their rewards at the direct expense of workers. This suggests that they will negotiate more aggressively and that income distribution will decline. So this newspaper article actually has to do with rent-seeking among CEOs and executives, and rent-seeking increases when taxes on the wealthy are lowered. ”

Rent-seeking is the effort to increase the share of existing wealth without creating new wealth. Rather, it's like a greedy child demanding a bigger slice of the pie so that everyone else gets less.

There is no evidence that cutting taxes on the wealthy creates economic growth. ”

Dr Hope added: “I think there are serious and fairly obvious policy implications of this paper, especially when you're concerned about inequality, that you don't cut taxes for the wealthy to boost the economy.” Support for tax cuts for the wealthy I think it is especially important to have this type of discussion because those who do so may frequently engage in these types of discussions in favor of economic interests.

“In 2017, when Donald Trump introduced the Tax Cuts and Jobs Act, he told Americans it would be rocket fuel for the U.S. economy. A study of 18 developed countries spanning more than 50 years found that We found no evidence that it was true.”

Dr. Hope and Dr. Linberg continued their research to find out why ordinary Americans support tax cuts for the wealthy.

Dr. Hope said: “The general public seems to be largely uninformed about how taxes on the wealthy have really fallen dramatically over the past 40 years. If you give them that information, they are more likely to support tax cuts for the wealthy.” And we find that these effects are especially strong for Republican voters.”

Dr David Hope and Dr Julian Limberg spoke to Joanna Bale, Senior Media Relations Manager at LSE..

Are you interested in this kind of research?

Sign up to receive our newsletter: a bi-monthly digest of the latest social science research articles, podcasts and videos from LSE

subscribe