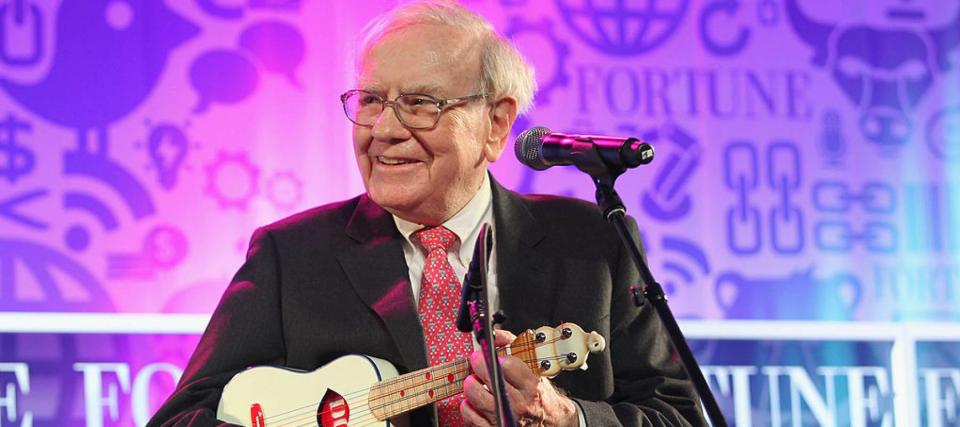

Warren Buffett is widely considered one of the most successful investors of modern times.

From 1964 to 2021, his company Berkshire Hathaway achieved a compound annual return of 20.1%. This significantly exceeded his S&P 500's compound annual return of 10.5% over the same period.

Do not miss it

Buffett's legendary investing career has made him one of the richest people on the planet, with a net worth of more than $114 billion, according to Forbes.

However, despite his vast wealth, Buffett does not live a lavish lifestyle.

In fact, he still lives in the Omaha home he bought in 1958 for $31,500. When it comes to his diet, he doesn't indulge in champagne and caviar every day, instead favoring McDonald's and Dairy Queen.

In an age where we are constantly bombarded with images and videos of influencers' lavish lifestyles, it's important to remember that a boring approach is often the best when it comes to building wealth.

Here's a look at three valuable lessons from Buffett's famously frugal approach to money.

Get into the habit of saving money

Saving money is not easy in today's economic climate. Savings continue to dwindle due to rampant inflation. Companies are announcing large-scale layoffs. Living paycheck to paycheck has become the norm for many people.

That's not what Buffett wants. During an episode of The Dan Patrick Show, Buffett was asked what he thought was the biggest mistake people make when it comes to money.

“You don't develop the habit of saving properly early on,” the legendary investor replied. “Because saving money is a habit. And then you try to get rich quick. It's very easy to get back on track slowly. But it's not easy to get rich quickly.”

In other words, instead of trying to become a millionaire overnight, it may be wiser to develop the habit of slowly and steadily saving money and building a nest egg.

forget about lambo

If money were no object, what kind of car would you drive? Mercedes, Bentley or Maranello Prancing Horse?

These may be what we think of as “rich people's cars,” but they're not in Buffett's garage.

In fact, he is known to be particularly frugal with cars.

“You have to understand, he keeps the car until I say, 'I'm getting embarrassed, it's time to buy a new car,'” his daughter once said in the documentary.

After all, we're talking about a guy who once had a vanity license plate that read “THRIFTY.”

read more: 3 Big Mistakes You Make with Cash Back Credit Cards That Charge You Every Time You Swipe Your Credit Card

There are many reasons why you should think twice before purchasing a luxury car.

The first is depreciation. A car starts depreciating in value from the moment you drive it off the lot. An analysis by iSeeCars found that as of 2022, cars that are five years old on average have lost 33.3% of their original value. Luxury brands tended to lose even more value. His five-year average depreciation rate for the Mercedes S-Class was his 51.9%. For the BMW 7 Series, it was 56.9%.

Additionally, luxury cars can be more expensive to maintain and insure than economy cars. Therefore, you will have to pay more than the purchase price. Additionally, luxury cars can be expensive to repair once the warranty period expires.

Remember that there is also an opportunity cost. The money you spent on an expensive car could have been put into your investment portfolio and made a profit every year. This potential benefit can double over time, creating an opportunity cost. And it can add up.

buy quality and value

Buffett's frugality is particularly evident in his investment style.

“Whether it's socks or stocks, I like to buy quality products when prices are low,” he wrote in a 2008 letter to Berkshire Hathaway shareholders.

Buffett, in particular, is a proponent of value investing, a strategy that buys stocks that are trading below their intrinsic value.

It's obvious where he got that idea. Buffett was a student of Benjamin Graham, widely known as the “father of value investing.”

“Ben Graham once taught me this: 'Price is what you pay. Value is what you get,'” Buffett wrote in 2008.

Investors can provide a margin of safety by buying shares in companies that are trading at a discount to their intrinsic value.

But that doesn't mean Buffett picks up every stock on the floor. Oracle of Omaha also looks for companies with durable competitive advantages.

You can see what those companies are like by looking at Buffett's portfolio. Berkshire's largest publicly traded stocks are Apple, Bank of America, Chevron, Coca-Cola, and American Express, all companies with strong positions in their respective industries.

So what do you do if you have to choose between quality and price? As long as the price is “fair”, it's better to focus on quality.

In Buffett's own words, “It's far better to buy a great company at a fair price than a fair company at a great price.”

Is there a better way to find value?

Of course, buying high-quality value stocks isn't the only smart way to invest.

Amid rampant inflation and economic uncertainty, veteran investors are still finding effective ways to invest millions of dollars outside of the stock market.

For example, prime commercial real estate has outperformed the S&P 500 over 25 years. With the help of new platforms, retail investors can now take advantage of these types of opportunities. It's not just the super wealthy.

With a single investment, investors can own institutional real estate leased by brands like CVS, Kroger, and Walmart, and earn stable income locked into a grocery store on a quarterly basis. can do.

This article is for information only and should not be construed as advice. PROVIDED WITHOUT WARRANTY OF ANY KIND.