Olivier Le Moal

In February 2022, I published a review highlighting Innoviz (NASDAQ:INVZ) as the likely front-runner in the nascent LiDAR space, an industry that might have a 2030 TAM in the many trillions of dollars. In June this year, I published an article showing how Innoviz appeared to be pulling ahead of the pack in the race to commercialization, and here I present an argument that they are on the verge of market domination. The LiDAR industry could be a winner takes most market, and Innoviz might emerge as the winner in the first half of 2024.

Innoviz Technologies now looks sure to be the first LiDAR company with a product driving around on our streets in the BMW 7 series and has improved its product and commercial offering to such a degree that it may sign enough serial production orders in the first half of 2024 to make them the dominant player in this industry.

Commercial Progress and Promises kept

The BMW deal

When I first wrote about Innoviz, they worked as a tier 2 supplier with Magna supplying test products to BMW (OTCPK:BMWYY) for future 7 series vehicles. When I reviewed their progress in July 2023, Innoviz had guided to the start of serial production in the second half of 2023, and they have delivered on that promise. The BMW deal is now SOP, serial production has begun, and Innoviz LiDAR-enabled BMW 7 series vehicles are being produced and available for retail customers.

Innoviz has progressed from a Tier 2 supplier to a Tier 1 supplier for BMW. As a tier 2 supplier, they shipped sensors to Magna, who assembled the complete system and sold them to BMW.

As a Tier 1 supplier, Innoviz is negotiating further contracts directly with BMW and will supply complete systems with no other company involved.

Being a Tier 1 supplier to BMW dramatically increases Innoviz’s profile when dealing with other potential customers and makes an enormous difference to the revenue per car that Innoviz receives. The latest guidance raised income per car to $1,000, more than double the previous guidance.

Explanation of automotive ordering

The automotive industry has a fairly strict ordering process that ensures safety and quality. It begins with the RFI (request for information). This is issued when the buyer is considering a new product; it helps the procurement team familiarize themselves with what is available and is used to write future requests. After the RFI comes the RFP (Request for Proposal), which is more specific and sent to a smaller group of potential suppliers. The RFP intends to discover which suppliers match the buyer’s needs. RFQ (Request for Quotation) comes next; this usually only goes to one or two potential suppliers and generally follows the buyer’s commitment to launch the product. Before the RFQ, it was just a fact-finding mission. At RFQ, it becomes a product search. The final stage is the SOP (standard operating Procedure); this is really a contract about how the deal will operate and is only given to one supplier. Once the SOP is agreed upon, serial production can begin.

Innoviz is now at SOP with BMW for using the InnovizOne product on the 7 series as a Tier 2 supplier through the Tier 1 Magna and RFQ as a Tier 1 supplier with the InnovizTwo for other unnamed BMW cars. (Press release August 2nd)

Technical progress

InnovizTwo is a new, improved product with a higher resolution, extended range, and an advanced software package.

Innoviz has gotten this far because it has excellent products, and the quality appears to be improving. In my review article, the InnovizOne product had a range of 200m and a 10 frames-per-second rate. It was a fixed-performance unit. InnovizTwo has had hardware and software updates, now available as a long-range front-facing unit and a wide-angle side-facing one. The detection range is up to 450 meters, and the number of points captured per second has doubled, giving a high-density point cloud and industry-leading resolutions close to high-definition camera images with the great advantage that a point cloud is three-dimensional.

The InnovizTwo is a significantly improved LiDAR system, it delivers the improvements discussed above with only 1 laser/detector unit rather than the 4 on InnovizOne. As a result, the bill of materials for the InnovizTwo is 70% less than the InnovizOne (Q3 CEO prepared remarks)

BMW is just the start

Getting the first SOP with a prestigious auto manufacturer would be an enormous win for any company. For Innoviz, it looks like the first of many.

Volkswagen

With Volkswagen (OTCPK:VWAGY), Innoviz is negotiating as a Tier 1 supplier with the InnovizTwo product. In 2022, Innoviz announced a design win with Volkswagen, and the process continues progressing. The initial guidance was for SOP in mid-decade, and in March this year, Innoviz provided Volkswagen with the first B samples. The deal with Volkswagen should deliver $1,000 per vehicle, and an SOP announcement could arrive in 2024. Innoviz has said they expect the SOP to cover multiple platforms.

An SOP with Volkswagen added to the one from BMW would mean that Innoviz had captured around 11% of the potential market (assuming they both use Innoviz for all their LiDAR needs). That is already a market-dominating situation, but more is likely to come.

RFI-RFQ-SOP

In Q1 2023, Innoviz reported 10-15 programs in the RFI stage, in the Q3 earnings call the CEO said more than half of them are now in the RFQ stage and most of them are with top 10 OEMs. He said three of these programs are moving quickly. Having conducted financial supplier audits and certified high-volume manufacturing capability, the buyers have begun definitive price negotiations and are discussing post-nomination milestones. This represents three deals that could go SOP in the first half of 2024. Five SOP deals would make Innoviz the biggest player in automotive LiDAR by a very long way.

Smaller deals

Innoviz is working on many smaller deals and deals outside of Automotive LiDAR. I provide a summary here, but they are not part of the central thesis of this article.

The Shuttle is an electric 20-passenger autonomous vehicle that initially operates 24 hours a day in airports. The Shuttle deal is already at SOP, but the OEM remains unnamed.

On the 28th of June, Innoviz issued a press release saying it had signed a letter of intent with the Swiss Autonomous delivery company Loxo. Loxo started testing their vehicle on Swiss roads in January 2023; the LOI covers an increased number of InnovizOne units and applies to the Loxo 2024 fleet.

On the 13th of June, Innoviz announced a deal with Drive Group, a toll road operator, to use LiDAR for vehicle detection.

High-Speed Growth Needs Cash

The speed of this commercial development is much faster than I had expected, even in my recent article, Innoviz: speeding towards commercialization.

High-speed growth causes a problem; it requires a lot of cash.

Three additional OEMS going SOP in the next few months would have likely broken the Innoviz balance sheet, gearing up for serial production is expensive, and the SOPs are approaching well ahead of schedule. The old balance sheet would have caused concern with potential customers as Innoviz may not have had the money to deliver the volume on time; the large OEMs conduct a thorough financial audit and ensure the supplier has the resources to provide the product in the correct volume at the right time.

On the 9th of August, an Innoviz press release announced plans for an unexpected capital raise of $60 million. It was upsized the same day.

The raise (which closed for $65 million) caused a share price fall, partly because the $2.50 per share was significantly below the market price but more because it caused concerns about the money needed. The balance sheet looked pretty strong, and there was no apparent need for the cash. Innoviz did not release the details of the new RFQ deals as they may have been at a sensitive negotiation time.

The CEO said in Q3.

That is why we undertook the capital raise…… it allowed us to move into the final phase of several RFQs.

When discussing these RFQs, he also said:

When we look at who we are competing against most often in these RFQs, it’s not the early-stage LiDAR pure-play companies most investors typically assume; instead, it’s the more established Tier 1s.

The established Tier 1s will use their operating history as their key selling point. In contrast, Innoviz will be using its technology, which I believe is better, and the fact that BMW and VW have accepted Innoviz as a supplier negates the perceived advantage of other suppliers. It is like a snowball; every order makes the next one more likely.

Finances

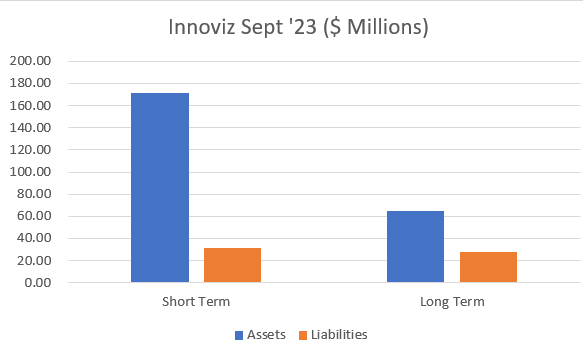

The capital raise in August has left the balance sheet in pretty good shape.

Balance Sheet Summary (Author Database)

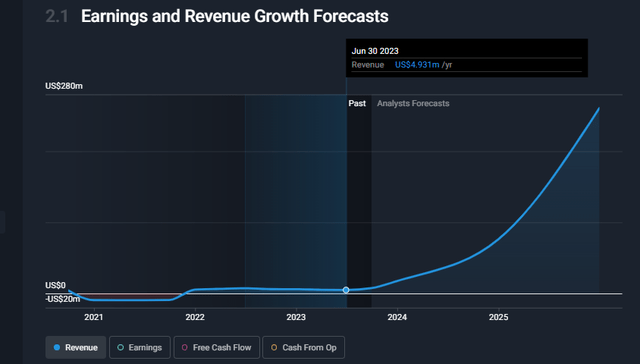

Q3 2023 revenue of $3.5 million was up 135% from Q2 and 297% from Q3 2022. This is explosive growth, and with serial production only beginning, we can expect this to continue into 2024 and beyond. Wall Street Analysts forecast revenue growth of 300% from 2023 to 2024. The forecast revenue points skyward, reaching $260 million in 2025, representing 1,400% growth from current levels.

Forecast Revenue (Simplywall.st)

On the 24th of October, Innoviz issued guidance for Q3 2023, expecting revenue to double quarter over quarter (which it did) and suggested a more significant increase for the fourth quarter.

How Big Will LiDAR Be?

This article has covered only automotive LiDAR, an industry poised to grow dramatically over the coming year. The size of the market and its growth rates are not clearly understood. I tried to use professional research companies for this, but the figures they gave were so spread out that I could not draw any accurate conclusions from them. For instance, Precedence Research predicts a market of $7 billion by 2032, whereas Market Research Future puts the figure at $897 billion. Mordor research gives a figure of over $5 Trillion, and Markets and Markets puts it under $5 billion.

I have attempted to come up with a value using the figures from Innoviz about the number of dollars per car being between close to $1,000.

67.2 million automobiles were sold in 2022, and if they all had a $1,000 LiDAR system on board, then we could forecast $67 trillion as the maximum size of the market. There seems to be little point in trying to work this out more precisely; it would just be meaningless guesswork about what percentage of cars would have what number of LiDAR units, and we already have what we need. Lidar is going to be a vast market.

Valuation and Risks

This article presents a bullish view of Innoviz and is one of four articles tracking the company’s progress. I will continue to update my thesis as time progresses. However, Innoviz is still a small, early-stage company and, as such, should be considered a high-risk investment.

The Risks I see for Innoviz have changed since I wrote my first article. I saw the risks being as follows in order of size.

- Lidar is not accepted or adopted by auto manufacturers

- Innoviz Lidar proves inferior to other technologies

- Major car manufacturers would not sign long-term deals with a new company

- Innoviz would be unable to manufacture at scale

- Innoviz would not be able to generate a profit from operations

I do not believe the first four risks exist now. Innoviz has signed a long-term contract with BMW and is producing products in volume. Risk 5 remains valid, and a new risk has arrived.

Competition is a new risk factor

When I wrote my previous three articles on Innoviz, I assumed the competition would be the other start-up LiDAR companies. The CEO tells us that this is no longer the case. The competitors Innoviz comes across are Tier 1 auto suppliers. Tier 1s are well-established and generally well-funded companies that have built their brand name over many decades. The Auto manufacturers know them well and have great trust in them. Innoviz’s ability to compete in this field is currently unknown and presents a new significant risk.

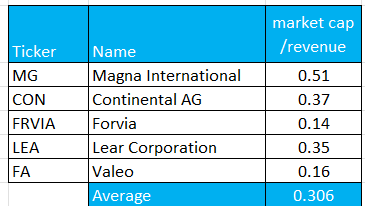

The two biggest Tier 1s are Bosch (a private company) and Denso (a subsidiary of Toyota). The five largest publicly traded Tier 1s are listed in this table below and could be used to form a fair value for Innoviz.

Tier 1 Auto Suppliers (Author Database)

The table uses the current market cap and the revenue on a trailing four-quarter basis. The average of 0.306 and the current Innoviz market cap of $438 million imply they need a revenue of $1.4 billion to justify their current valuation. The Magna figure of 0.51 indicates that an Innoviz revenue of $858 million is required. If revenue continues as forecasted, it will pass this value in 2027 (extrapolating the revenue forecast from Wall Street analysts). Innoviz will still be in the early stages of its growth in 2027.

I am left with two risks.

- Can Innoviz make a profit from operations?

- Can Innoviz win a serial production order as a Tier 1 supplier against this competition?

I think we will know the answer to risk 2 in the early part of 2024. If they fail to sign a deal as a Tier 1 then the revenue forecasts collapse and the bullish thesis goes with it.

As for risk 2, profits, I do not have sufficient information to accurately predict gross margins and EBITDA. I will need a set of accounts when they are operating at volume and will build a model when we get the information. However, I have always believed that everything else can be fixed if a new company can get sales.

Ratings and targets

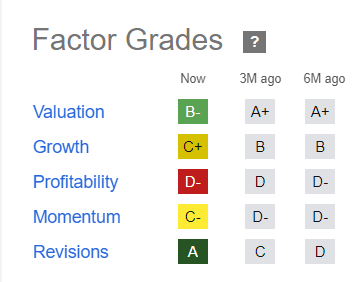

Quant Rating (Seeking Alpha)

Seeking Alpha quant rates Innoviz a hold at 3.10. Profitability, growth, and momentum are the three factors keeping this score low. If Innoviz can deliver on the significant revenue increases it has guided, I expect all three of these to improve dramatically in the coming months.

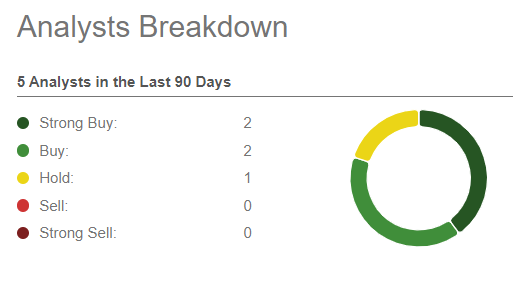

Wall Street is forecasting revenue growth of 1,400% in the next two years, and they give an average one-year price target price of $7.40 (SA Ratings page), an increase of 178%. They are not in universal agreement, with 1 out of the 5 analysts giving a hold rating and forecasting a price increase of only 13% in the next 12 months.

Wall Street Ratings (Seeking Alpha)

Conclusion

The SPAC frenzy of recent years seems to have delivered hundreds of exciting technology companies to the market, most of which provide a compelling story and case for investment, all of which give outlandish forecasts about future revenue growth based on future total markets and as we know the majority of them have delivered very little except a string of broken promises and missed forecasts.

Innoviz is not your typical SPAC. Innoviz has repeatedly delivered on its promises, met its forecasts, and surpassed its guidance. Innoviz is generating real revenues after signing its first serial production deal, dramatically increasing its customer base and moving several customers toward additional serial production deals. It has developed economies of scale in its manufacturing and reduced the bill of materials for its products by as much as 70% by improving the design and capability of its technology.

The first half of 2024 could see Innoviz confirmed as the market leader in this industry, and the potential size of the sector could lead to a significant and sustained rise in the price of Innoviz stock.

I am long Innoviz and will add to my position when an opportunity presents itself.

I will review Innoviz’s performance again in 2024 and closely monitor some key points.

- How many current RFQs get to SOP in the first half of 2024? Two would be good, and three outstanding.

- Does the BMW 7 Series production ramp revenue to the forecast figures?

- Does the BMW InnovizTwo B sample turn into an RFQ?

- VW was initially forecasted to go SOP mid-decade; it could be next year or the one after, but I will be looking for progress.

- Can Innoviz produce at a profit, that is the final and most important question.