The number of searches for personal loans in India is rapidly increasing, indicating an unprecedented evolution in customer behavior. Personal loan searches range from emergencies, home and car purchases, weddings, vacations, and more. What opportunities do these search trends present for financial institutions and loan providers? Techmagnate, India's leading digital marketing agency, has the answer.

Amid the dynamic landscape of India's financial sector, non-banking financial companies (NBFCs), traditional banks and lending institutions have a unique opportunity to leverage the proliferation of financial services. Personal loan market search trends.

Report from major Techmagnate digital marketing agency in indiaWe analyzed search trends in the personal loan industry based on volume, query type, and even market share.

By digging into data and insights from recent search trends, financial institutions can strategically enhance their digital marketing efforts and reach a growing audience whose needs are still underserved.

Understand personal loan search trends in India

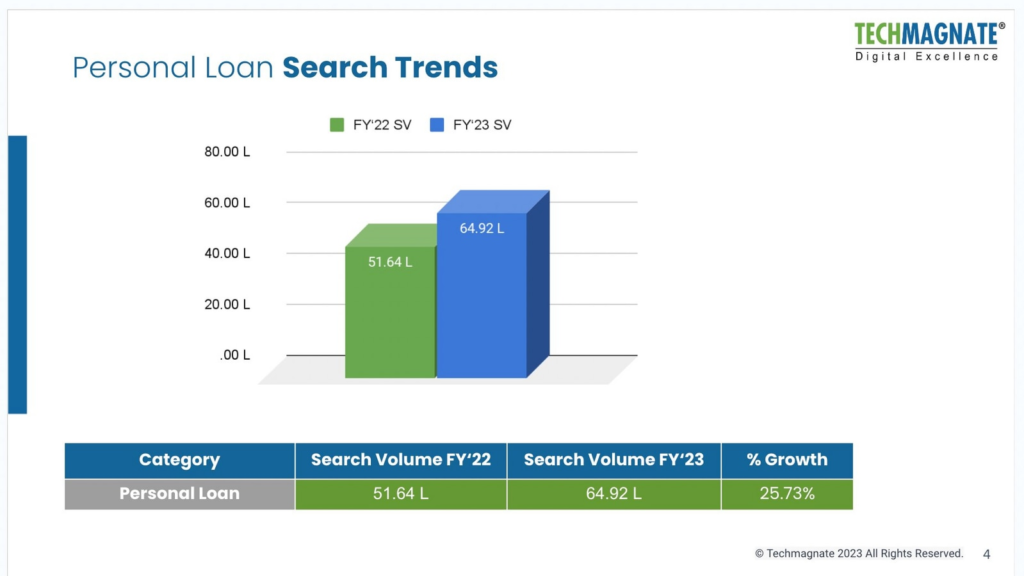

Comprehensive analysis with Techmagnate 18,000 keywords It has been revealed that the overall Indian personal loan industry has witnessed a significant increase in search volume. 25.73% increase from 51.64L From 2022 search 64.92L Search for 2023.

Personal Loan Industry in India: Market Status

According to data from the Reserve Bank of India (RBI), personal loans in August 2023 increased by 30.8% year-on-year. While the RBI has warned banks and lending institutions to introduce strict checks on loan disbursements, the data at hand supports what people are looking for.

Furthermore, the total amount of credit given to the borrower is 47.7 trillion rupees In August 2023, it stood at Rs 36.7 trillion, up from Rs 36.7 trillion a little over a year ago.

Leading the way: Top 5 Indian brands for personal loans by search volume

Data from Techmagnate's Search Trends Report shows the top 20 brands by search volume (SV) in India, and in this article, we will take a closer look at the top 5.

It's no surprise that a big player in the Indian market would do so. HDFC Bank, SBI, Bank of Baroda (BoB), ICICI Bank and Axis Bank. We lead the industry in search volume.

- HDFC Bank has been through a great deal. 7.12% Search volume increased from 2022 to 2023, solidifying our position as a top brand.

- In case of HDFC, the market share is 23.46% It shows that consumer interest in personal loans is taking a large share.

- SBI, on the other hand, was in second place but saw a slight decline in search volume of -2.52%, reflecting a slight drop in interest from FY22 to FY23.

- Despite the decline, SBI maintains a significant market share. 17.62%highlighting its enduring excellence.

- Bank of Baroda has experienced tremendous growth. 158.61% Search volume has increased, indicating a significant increase in consumer interest.

according to Sarvesh BaglaThese search trends reveal valuable opportunities for brands, says the CEO and founder of Techmagnate. “Our Personal Loan Search Trends Report clearly shows that more and more Indians are looking for loans every year. Data shows that searches across the industry are increasing year on year. 19% last year.

Meanwhile, the number of searches for instant personal loans is increasing. 31% And for searches from Tier 2 and Tier 3 cities, 55% Of total search volume. All these numbers clearly indicate that there is an opportunity for banks, NBFCs and fintechs to connect with people searching for their products. ”

Download the report to see the complete list of brands.

Personal lending in the digital space: 3 niche opportunities for success

Keeping in mind the RBI's warning, NBFCs, banks and lending institutions should recognize the momentum in exploring lending trends in India and adjust their digital strategies to capitalize on the growing interest.

How can these institutions move forward to meet consumer needs and evolving behaviors? A strong digital marketing strategy must lead the way by leveraging available niche opportunities.

Techmagnate's report identifies three distinct opportunities within search trends that financial institutions and fintech companies should explore.

a) Search for low credit scores

b) Local search for “nearby” or personal loans

c) Language search

- personal loans with low credit scoreAs a search trend report engineerThis shows that searches for “personal loans with low credit scores” are steadily increasing. 55.57% within a single financial year.On the surface, people are looking for ways to increase their income while understanding how difficult it is to get approved for a loan due to a low score.Moreover, while people are doing these special searches, there are also many financial institutions that offer loans to people with low credit scores.Still, it is worth noting that 55.57% The growing number of searches for “low credit score personal loans” remains an untapped niche market. NBFCs and lending institutions can position themselves as comprehensive financial partners that cater to the unique needs of credit-challenged individuals.

- Use local search for personal loans“Nearby” or local search data presents the most interesting opportunities for financial institutions.While you might expect branded keywords to take the lead, it's non-branded searches that garner the most volume across the country.The non-brand category, which represents general local searches without a specific brand, saw a steady 16.65% increase in search volume.

Boasting an overwhelming market share, 99.62%Unbranded local search continues to be a key driver of local interest in the personal loan industry.

3. Harness the potential of linguistic searchEven in language searches, the contribution of non-brand keywords is staggering. 95.32% market share.Although overall branded search volume is increasing, non-branded search volume continues to create the most powerful opportunity for financial institutions to connect with consumers.

All of these examples allow you to effectively take advantage of the diverse local landscape of personal loan searches with a comprehensive local marketing strategy that addresses both branded and non-branded categories.Innovative strategies brands should consider

- Develop customized financial products that take into account the risk factors associated with low credit scores.

- Empower consumers with educational content and dispel misconceptions about getting a loan with imperfect credit.

- Work with credit bureaus to effectively assess and manage risk.

- Meeting people's needs through interactive language content.

- Implement a strong local search strategy to meet the needs of people looking for personal loans near you.

At the inner Auto finance search trendsa similar configuration is seen for local services.

Digital frontier of financial marketing

As Techmagnate's Search Trends Report shows: The evolution of the search landscape for personal loans in Indiathe synergy of data-driven insights and innovative digital marketing strategies can propel NBFCs, banks, and lending institutions to unprecedented heights.

By adapting to changing consumer preferences and exploiting niche opportunities, these institutions can not only stay ahead of their competitors, but also help strengthen the financial side of a diverse and growing market.

Get ahead of the digital marketing game. Download the Personal Loan Search Trends Report now.

Disclaimer: This article is a paid publication and has no journalistic/editorial involvement of Hindustan Times. Hindustan Times does not endorse/subscribe to the content and/or views of the articles/ads mentioned here. Hindustan Times shall not be responsible or liable in any way for anything and/or views, opinions, announcements or declarations expressed in the article. (plural), affirmations, etc. are mentioned/featured in the same content.

Unlock a world of benefits! From insightful newsletters to real-time inventory tracking, breaking news and personalized newsfeeds, it's all here, just a click away. Log in here!