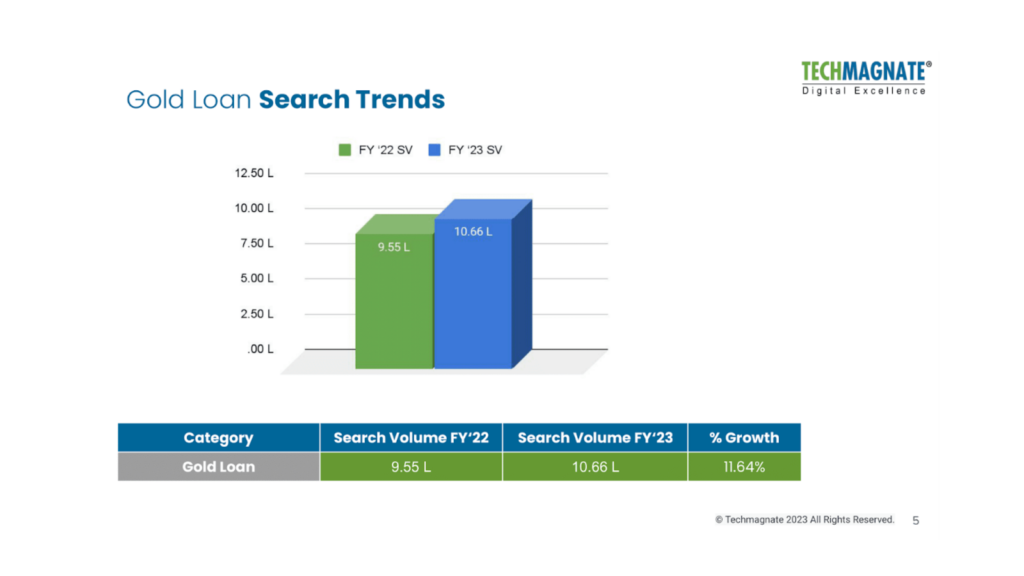

The Indian gold loan industry is currently experiencing rapid growth. The number of searches for gold loans in India increased by 11.64% in FY2023, while the amount of gold loans disbursed also increased. For loan providers, these numbers are very useful and help them connect with customers on a large scale.

According to a leading publication, the portfolio of bank loans backed by gold jewelery has experienced a significant increase. 16.2% This growth can be attributed to banks' competitive interest rates on these loans, which have become more attractive than those offered by non-banking financial companies (NBFCs).

moreover, Bajaj Finserv In 2022, the Indian gold loan market will be worth approx. $55.52 billion.Forecast shows growth trajectory at compound annual growth rate (CAGR) 12.22% The market size is expected to expand from 2023 to 2029 $124.45 billion By the end of 2029.

On the other hand, in one report, Techmagnate, a leading digital marketing agency New Delhi provides an overview of user search behavior related to gold loans in India. One of the most important takeaways from this report is that searches for gold loans have increased significantly in his 2023 fiscal year.

The data in these reports supports the rise in searches for gold loans in India, and the evolution of customer behavior can be seen from both sides. People in India are willing to take loans with gold as collateral to meet their growing aspirations and needs.

This means that Indian providers and financial institutions Gold loan search trends Go to market and boost your digital marketing efforts to accelerate growth. Of course, the key here is to allow them to grow with great responsibility.

Gold Loan Search Trends in India:landscape condition

According to a study conducted by Techmagnate, the search volume for gold loans increased by 11.64% to 10.66L in FY23 from 9.55L in FY22.

In addition, the list of top 10 keywords includes “gold loan interest rate' and 'gold loan calculator” are dominating industry search trends, with year-over-year search volume increasing by 22.22% and 22.30%, respectively.

Stay ahead of the curve: Top 5 gold loan brands by search volume

In the gold loan industry, there are some well-known brands such as: IIFL Finance, Muthoot Finance, SBI, BoB, Indian Overseas Bank appears with the highest search volume. Let's take a quick look at our performance for 2022-23.

IIFL Finance occupies the top position with a search volume of 175,64,000 and market share of 27.88% in FY23. Although there was only minimal growth of 0.52% year over year, it still accounts for the largest share of searches.

Muthoot Finance, which was ranked 2nd with a search volume of 90,83,000 searches and a market share of 14.42% in FY23, saw an increase in search volume of 6.10%.

State Bank of India was ranked 3rd with 56,58,000 searches and 8.98% market share in FY23. Search volume increased by 7.67%, indicating growing consumer interest in the company's gold loan services.

Bank of Baroda was in fourth position with 54,63,000 searches and 8.67% market share in FY23. Search volume increased by a whopping 34.06%.

Indian Outside Bank ranked 5th with a search volume of 41,71,000 searches and a market share of 6.62% in FY23. Search volume growth for this bank was 29.25%.

Highlighting the importance of the newly released report, Sarvesh Baglacommented CEO and Founder of Techmagnate.“Extensive analysis of over 1,400 keywords related to searches for gold loans reveals the evolving nature of customer behavior. Brands can leverage these insights to adapt and strengthen their digital presence. You will benefit most from the data in the report.. ”

Download the report to see the complete list of brands.

Gold Loan Marketing Ideas: Leverage Insights for Growth

The insights shared in this report demonstrate powerful opportunities that brands can leverage for growth. For example, a list of top 10 keywords can be very helpful in developing a digital marketing strategy. Additionally, insights related to local and language searches can also help brands fine-tune their targeting and messaging.

Here are three strategies brands should adopt to start leveraging these insights.

- Take advantage of opportunities within local search

Many customers search for gold loan services locally.Muthoot Gold Loan Near Me“,”gold loan near meHowever, searches from non-brand keywords are also steadily increasing, growing by 21.65% in FY2023.

Ignoring local listings and a fully optimized Google My Business profile is not a viable option for loan companies. You need regional visibility to attract the right traffic and customers.

According to Techmagnate's Gold Loan Search Insights report, searches by non-brand terminology are showing a rapid upward trajectory, reaching a whopping 96.51% market share.

A strong opportunity exists for gold loan providers to understand these searches and create content that answers customers' real questions in regional Indian languages.

Personal loan search trends have seen a similar surge in local languages, accounting for 95.23% of the market share for non-branded keywords.

- Take advantage of mobile app development and marketing

Gold Loan's mobile app also shows interesting search trends. While non-branded keywords showed a growth of 1.23% and a market share of 15.41%, branded keywords accounted for the majority of the market share at a whopping 84.59%.

This creates a unique app marketing opportunity for financial institutions to optimize branded keywords to perform well on the App Store and Play Store. Gold loan lenders can build a strong presence by leveraging targeted keywords and optimizing their app content for brand-specific search terms, which increases visibility, competitiveness, and even Relevance is ensured.

Data-driven insights that enable growth

The Gold Loan Search Trends report shows that consumer interest in online gold loan services is increasing, giving banks and NBFCs a unique opportunity to tap into the untapped potential.

This data shows that the Indian gold loan market is evolving and can be leveraged by brands to focus on multiple avenues such as local content, mobile apps, and local SEO to expand their customer reach .

Loan providers should work with top digital marketing agencies like Techmagnate to fine-tune their SEO strategies and increase their online presence. Because that's the best way to connect with your customers.

Disclaimer: This article is a paid publication and has no journalistic/editorial involvement of Hindustan Times. Hindustan Times does not endorse/subscribe to the content and/or views of the articles/ads mentioned here. Hindustan Times shall not be responsible or liable in any way for anything and/or views, opinions, announcements or declarations expressed in the article. (plural), affirmations, etc. are mentioned/featured in the same content. This information does not constitute financial advice.

Unlock a world of benefits! From insightful newsletters to real-time inventory tracking, breaking news and personalized newsfeeds, it's all here, just a click away. Log in here!