politics

When Donald Trump took office in 2017, the wealthiest 1% of tax filers (those with incomes of $675,000 or more) paid just over 40% of the income taxes collected.

AFP (via Getty Images)

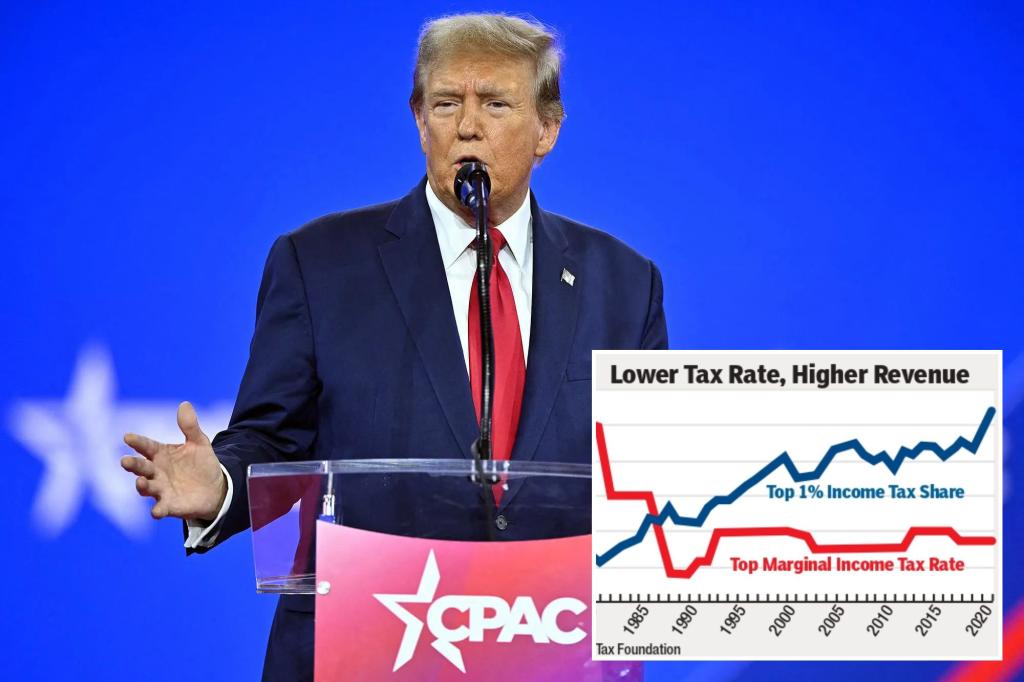

The latest IRS data on who pays income taxes once again shows the benefits of lower tax rates over higher ones.

Bernie Sanders deserves attention.

When President Donald Trump took office, the wealthiest 1% of tax filers (those with incomes of $675,000 or more) paid just over 40% of the income taxes collected.

The 2017 Trump tax cuts effectively lowered the top federal tax rate from 42% to 37%.

Both Joe Biden and Bernie Sanders, then and now, denounced it as a giveaway to the wealthy.

However, the latest IRS tax return data (2021) shows that even with these rate reductions, the 1% pays less It has been confirmed that the burden ratio has almost increased. 46%.

Why is everyone always surprised when something like this happens?

When the top tax rate falls, high-income earners have less shelter and more income.

That shouldn't surprise anyone.

The graph below shows the inverse relationship between the top tax rate applicable and the share of taxes paid by the wealthy.

For example, when Ronald Reagan was elected president, the top income tax rate in the United States was 70%.

The richest 1% of taxpayers paid about 19% of income taxes.

When President Reagan lowered that tax rate to 50% and then to 28% in 1987 (a tax reform that nearly every senator voted for, including Al Gore, Ted Kennedy, and Joe Biden), the wealthy The proportion of taxes paid by the class has decreased. It has increased to 25%.

please think about it. When the top tax rate was 70%, the tax burden paid by the wealthy was less than 20%.

At the current tax rate of 37%, the top 1% pays almost half of all income taxes.

And our data shows that in the early 1960s, before the Kennedy tax cuts, when the top tax rate was 91%, the top 1% paid only 15% of taxes.

Although this inverse relationship between tax rates and taxes paid seems counterintuitive and almost mathematically impossible, there are several explanations for why higher tax rates do not raise much income from the wealthy.

First, when tax rates are high, deductions to avoid paying those higher rates become much more attractive to high-income earners, and are as reliable as crumbs on the kitchen floor attracting mice. It permeates the system.

The same Democrats who are pushing to raise federal tax rates to 50%, 60%, or even 70% to force the wealthy to “pay their share” are the most vocal advocates in Congress for taking back the maximum tax. We think it is extremely ironic that this is the case. The only tax benefit that has ever been devised for the ultra-wealthy is the deduction of state and local taxes.

Green energy tax breaks also provide massive shelter for the wealthy.

High tax rates also divert economic activity and taxable income overseas to low-tax countries.

Ireland has thus become one of Europe's best performing economies.

And finally, high tax rates act as an economic penalty on economic activity and investment, slowing growth.

In that case, there will be fewer wealthy people who will have less income to siphon off.

This election is more like a referendum on whether the U.S. should maintain low tax rates (Trump's plan), as President Biden supports, or raise investment rates above 50%.

If the latter happens, the economy is fairly certain to underperform.

And if history is any guide, Bill Gates, Elon Musk, Jeff Bezos, and Taylor Swift will ultimately end up paying less, not more, taxes.

Arthur Laffer is president of Laffer Associates. Stephen Moore is a senior research fellow at the Heritage Foundation. They are co-founders of the Committee to Unleash Prosperity and co-authors of the book Trumponomics.

Load more…

{{#isDisplay}}

{{/isDisplay}}{{#isAniviewVideo}}

{{/isAniviewVideo}}{{#isSRVideo}}

{{/isSR video}}