India's life insurance sector is ranked 10th in the world and is one of the fastest growing sectors. This strength is not a coincidence; it is due to rapid digital adoption and Understand changing customer preferences.

Anyone involved in modern life knows that Indians use smartphones and mobile devices to search for their needs. Well, most of these journeys start with a simple Google search, whether you're looking for everyday household items or information for important life decisions like finding a life insurance plan.

In 2024, it will no longer be possible to understand what your customers want A luxury but a necessity. Some insurtech companies in India are already leading the way by smartly integrating customer preferences into their services. Digital marketing strategy.

To understand this better The Evolving Life Insurance Landscape and Consumer PreferencesLet's dive into the insights revealed by Techmagnate, a leading digital marketing agency, in its Search Trends Report.

Techmagnate's Life Insurance Search Trends Report provides insightful data on the life insurance industry, from the most searched keywords to the top brands, and ultimately the people looking for the products on offer. Uncover what your data tells you.

Life insurance trends in India: Riding the digital wave

The adoption of digital processes in the insurance sector has transformed the entire industry. From streamlined online applications to readily available insurance information, these innovations have made life insurance a reality. Now more accessible and user-friendly than ever.

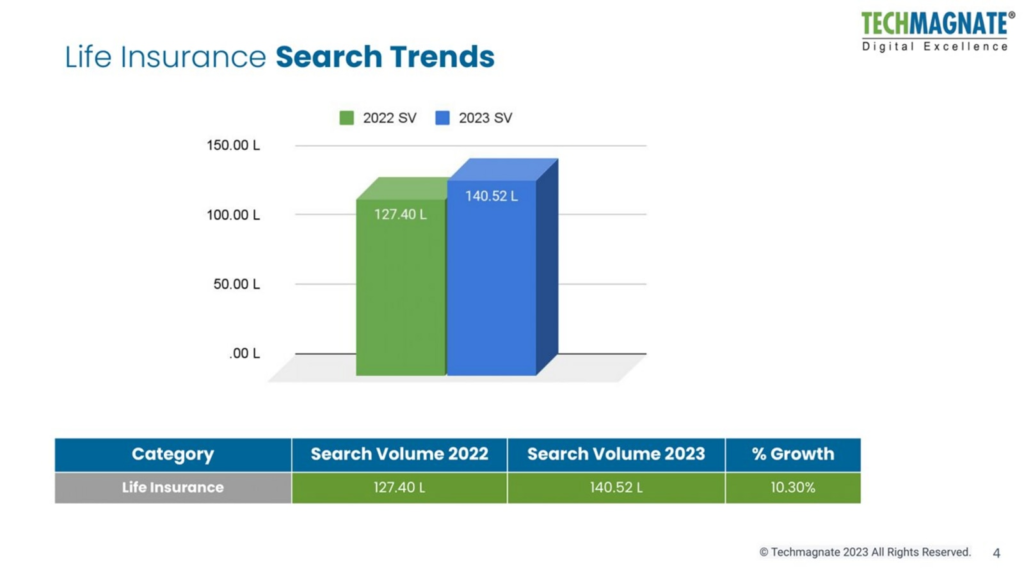

According to the report, searches for “life insurance” will increase by 10.30% in 2023 alone, highlighting the growing preference for digital convenience.

Sarvesh BaglaCEO and Founder of Techmagnate, said: “We investigated 27,800 keywordsWe researched the life insurance space and found some interesting search patterns. We discovered new brands that are gaining popularity in search volume and also learned about preferred budgets for life insurance. These insights are essential for brands to understand the evolution of customer preferences for targeted campaigns in digital marketing. ”

Life insurance and customer satisfaction: Putting people first

Advances in technology aren't the only thing driving life insurance trends.Prioritization is receiving increasing attention customer satisfaction Like never before. Strong risk management practices and a commitment to timely claim resolution build trust and credibility within the industry.

Initiatives such as simplified communication channels and grievance redress mechanisms further demonstrate that the brand is focused on understanding and addressing customer needs.

Deciphering life insurance trends from Techmagnate's report

So what exactly do people's search patterns reveal about their life insurance landscape?

One is that established brands continue to capture people's attention and search preferences. Mobile His device has to become a marketer's best friend and connecting with people nearby in local branches and local languages will be a game changer.

Let's take a closer look.

brand influencer

As you search for the best life insurance plans, certain brands stand out as reliable and go-to insurance companies. Life Insurance Corporation of India (LIC) leads in terms of search volume (68.86L in 2023), closely followed by Max Life Insurance (11.87L in 2023) and HDFC Life Insurance (11.46L in 2023) .

These brands consistently dominate search results and establish a stronghold in the hearts of their customers, which is reflected in their search volume.

Get the complete list of top-performing brands and platforms from the report.

Beyond the giants

Techmagnate's report shows notable trends in search behavior. Most people continue to search for a particular insurance company, and he accounts for 91.81% of searches. Additionally, users may also directly search for well-known insurance companies with names they already know or trust, such as LIC and HDFC.

However, searches for broader terms that are not specific to specific brands are also on the rise.These searches are something like “The best life insurance”or “Term insurance benefits” It shows an increased interest in considering different options. Users are becoming more open to considering different insurance companies and comparing the market before making a decision.

Mobile related matters

As more and more people rely on their smartphones for everyday tasks like managing their finances and insurance, it's essential for brands to have easy-to-use mobile apps.

The number of searches for LIC Digital will increase from 31.91 thousand in 2022 to 40.97 thousand in 2023; 28.39% growth. Similarly, the number of searches for HDFC Life Insurance app increased from 16.15 thousand in 2022 to 19.41 thousand in 2023, 20.19%.

Apps like LIC Digital and HDFC Life Insurance App have seen a significant increase in search volume. The importance of a mobile-first strategy.

think locally

Another interesting insight from this report is the prevalence of “near me” searches in the life insurance space. “Near-me” searches increased by 32.10% compared to the previous year (2022).

This surge reflects a growing preference among consumers to find insurance services locally. In such a search, 99.29% of brand-related queries With 0.71% of non-branded queries, it's clear that the industry is increasingly favoring local search. This highlights the importance for insurance companies to prioritize local SEO and effectively engage with potential customers. Incidentally, leveraging brick-and-mortar locations can give these companies an edge over fintech disruptors.

Similar trends can be seen in the personal loan industry. With a dominant market share of 99.62%, unbranded local search continues to drive personal loan trends.

Search for local language

Local language search volume has increased, representing searches made in regional languages such as Tamil, Gujarati, and Hindi. 19.06% in 2023the number of searches reached 1,118,000, compared to 939,000 in 2022.

This increase indicates a growing preference for linguistic search and highlights the importance of accommodating diverse language preferences in digital marketing strategies.

The future of life insurance

Harnessing the power of search insights is paramount for insurance companies to stay ahead of the curve.by understanding Emerging trends in the life insurance sector, Evolving customer preferences, optimizing digital experiences and prioritizing mobile accessibilityinsurance companies can better meet the needs of their target customers.

Techmagnate's Life Insurance Search Trends Report provides a valuable roadmap to navigate this dynamic landscape. Armed with some unique insights, the industry will be able to: Customize your services, strengthen your digital presence, and build stronger relationships with your customers.

Remember, in the digital age, your customers are in control of the search bar. The key to unlocking customer trust and loyalty lies in understanding what your customers are looking for.

Disclaimer: This article is a paid publication and has no journalistic/editorial involvement of Hindustan Times. Hindustan Times does not endorse/subscribe to the content and/or views of the articles/ads mentioned here. Hindustan Times shall not be responsible or liable in any way for anything and/or views, opinions, announcements or declarations expressed in the article. (plural), affirmations, etc. are mentioned/featured in the same content. This article does not constitute financial advice.

Unlock a world of benefits! From insightful newsletters to real-time inventory tracking, breaking news and personalized newsfeeds, it's all here, just a click away. Log in here!