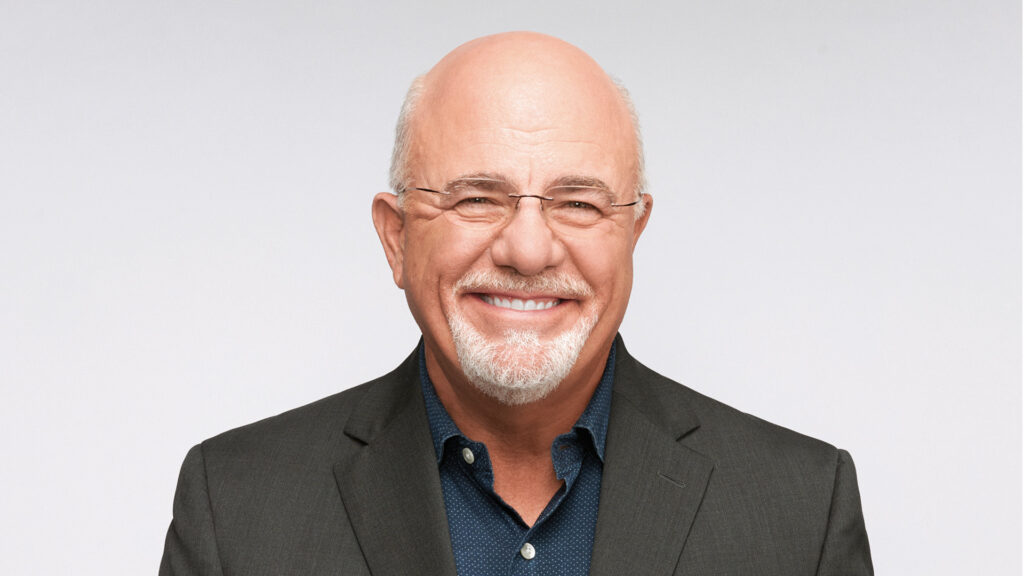

If you're looking to build your wealth, it's wise to seek the advice of a trusted financial professional to help you along the way. Dave Ramsey is one of those experts who has helped many people pay off their debts and live more prosperously, so here's his top advice on building wealth.

Here are Dave Ramsey's 10 best tips for building wealth.

1. Start thinking like a rich person

Ramsay said on the show that it's important to think like rich people because your mindset has a big impact on your financial situation. If you plan for a short period of time, you'll be heading towards bankruptcy. If you think long term, you'll be more like rich people because they act with foresight. Rich people tend to plan for the future and base their decisions on a long-term perspective.

Ramsay gave some examples of things that rich people do.

- Wealthy people have wills and financial plans.

- They plan ahead for their children's education.

- They plan for retirement while they are still young.

- They have proper insurance in place for protection.

The theme here is that slow and steady wins. The goal is to be patient and consistent as you build your wealth. You don't want to withdraw money from your retirement accounts or live below your means. You want compound interest to work in your favor over the long term.

2. Plan your finances

It's hard to save money if you don't know where it's going, so if you want to build wealth, you first need to have a plan and know where it's going.

Ramsay urges his audience to create a budget and document their financial plan, citing research his team conducted that revealed 93% of millionaires create and stick to a budget.

3. Pay off your debts

Once you start planning your finances for the long term, your next priority should be paying off your debts, which will save you money in the long run. Ramsay wants his followers to pay off their debts before they tackle other things to build wealth.

What helps is following Ramsey's debt snowball strategy of paying off your minimum balance first to get momentum and then get to zero debt. Whatever strategy you choose, the goal is to get to zero debt as quickly as possible.

4. Living on less than you earn

Ramsay makes the point multiple times that rich people don't waste their money on foolish purchases. He wants his readers to be rich, not just look rich. While it's tempting to strive for a lavish lifestyle, we all want to live on less than we earn so we can prioritize saving for the future.

Living on less than you earn can give you more money to invest and speed up the wealth building process.

5. Don’t accumulate debt

Once you've paid off your debt, you should avoid further debt in order to build equity. For example, Ramsay doesn't like mortgages and wants you to prioritize buying a home with cash.

But that's not always realistic, so if you can't buy a home with cash, aim to spend no more than 25% of your gross monthly income on housing costs. Ramsay also recommends a 15-year fixed-rate mortgage to avoid falling into a housing shortage and neglecting your retirement savings.

6. Invest in things you understand

On “The Ramsay Show,” Dave stressed that people should avoid investing their money in things they don't understand. Ramsay believes that people lose money because their friends tell them to invest in something cool or trendy. These sophisticated investments are usually not the secret money-making opportunities they are advertised to be.

When you invest in something you don't understand, you risk losing your hard-earned savings because you're relying on speculation and hype instead of focusing on the fundamentals. This leads to his next point…

7. Simplify investing

Ramsey's approach is simple: invest in what you understand and don't buy what you can't afford. He said he has only three investments: his business, real estate that he owns outright, and mutual funds.

I have to reiterate this point again because building wealth isn't usually about finding the secret investment that will get you rich quick. Building wealth is about consistency and simplicity to get you on track.

8. Always invest

When it comes to investing, the key to success is focusing on compound interest and letting your money grow without you having to touch it, and Ramsay frequently emphasizes on his show that the wealthy got to where they are through consistent investments.

9. Invest in your retirement

If you want to build wealth, you need to think long-term, and that often includes planning for retirement.

Ramsey recommends starting by investing in tax-advantaged accounts such as a 401(k) or 403(b) offered by your employer. The goal is to allocate about 15% of your gross income to high-growth mutual funds that will help you save enough to live the lifestyle you want in retirement.

10. Donate generously

The final piece of advice is unconventional, as Ramsay believes the purpose of building wealth is to give back. He urges his listeners to work hard and build wealth in order to help those around them.

Once you get to where you want to be, it's time to help those in need around you.

More from GOBankingRates

Source link