Even when a company is making a loss, it is possible for shareholders to make a profit if they buy a good company at an appropriate price. For example, biotechnology companies and mining exploration companies often lose money for years before achieving success with a new treatment or mineral discovery. But the harsh reality is that too many loss-making businesses run out of cash and go bankrupt.

Considering this risk, I decided to consider the following. Omega Therapeutics (NASDAQ:OMGA) shareholders should be worried about its cash burn. In this article, we define cash burn as the amount of cash a company spends each year to fund growth (also known as negative free cash flow). The first step is to compare its cash burn to its cash reserves to uncover its 'cash runway'.

Check out our latest analysis for Omega Therapeutics.

Does Omega Therapeutics have long-term funding potential?

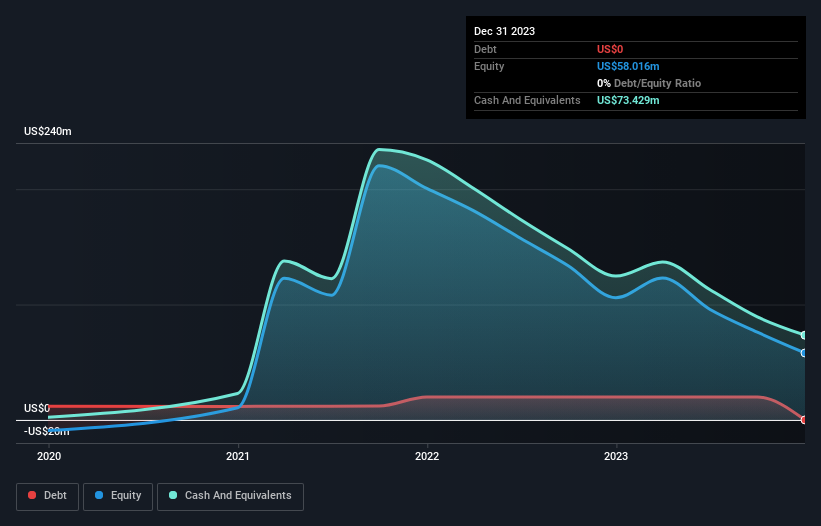

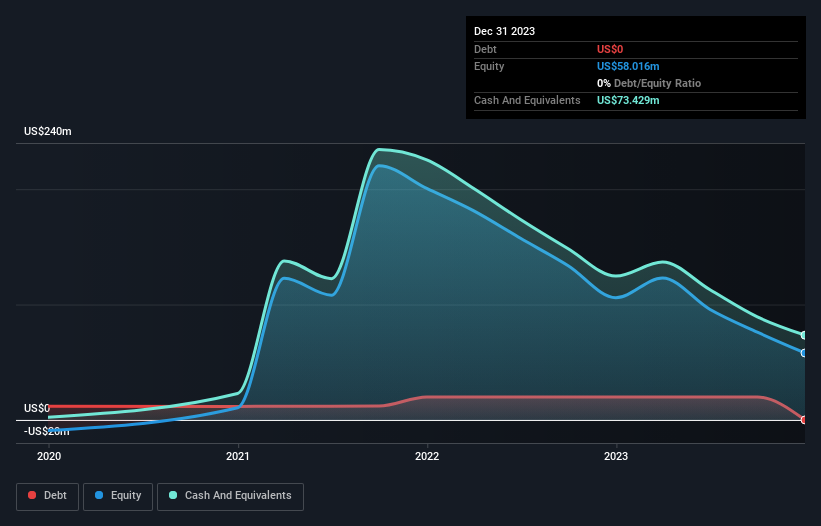

A company's cash runway is calculated by dividing its cash holdings by its cash burn. When Omega Therapeutics last reported its December 2023 balance sheet in March 2024, it had zero debt and cash worth US$73m. Last year's cash burn was US$101m. In other words, the cash runway as of December 2023 was approximately 9 months. This is a fairly short cash runway, indicating that the company needs to either reduce its annual cash burn or replenish its cash position. You can see how its cash balance has changed over time in the image below.

How fast is Omega Therapeutics growing?

Over the past twelve months, Omega Therapeutics kept its cash burn stable. That's not too bad, but revenue growth of 49% was definitely positive. Looking back, I think we have grown quite steadily. The past is always worth studying, but it is the future that matters most. So it might be worth taking a peek at how much the company is expected to grow over the next few years.

Will Omega Therapeutics easily raise more funding?

Omega Therapeutics appears to be doing well, but we'd like to see how it could easily raise more capital to accelerate growth. The most common ways for publicly traded companies to raise more money for their operations is by issuing new shares or taking on debt. Many companies end up issuing new shares to fund future growth. You can compare a company's cash burn to its market capitalization to find out how many new shares a company needs to issue to finance its operations for one year.

Omega Therapeutics' cash burn of $101 million represents about 51% of its market capitalization of $196 million. This is a large outlay compared to the overall value of the company, so if shares need to be issued to fund further growth, it could result in significant damage to shareholder returns (through significant dilution). There is a gender.

Are you worried about Omega Therapeutics' cash burn?

In this analysis of Omega Therapeutics' cash burn, we think its revenue growth is reassuring, but its cash burn relative to its market capitalization is a bit worrying. Looking at the factors mentioned in this short report, we think its cash burn is a bit risky, which makes us a bit nervous about this stock. Upon further investigation, 4 warning signs for Omega Therapeutics Two of these cannot be ignored.

If you want to check out another company with better fundamentals, don't miss this free A list of interesting companies with a high return on equity, low debt, or a list of growing stocks.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary using only unbiased methodologies, based on historical data and analyst forecasts, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.