Mexico's international remittance market

DUBLIN, April 12, 2024 (GLOBE NEWSWIRE) — “Business and Investment Opportunities in Mexico's International Remittances Market – Analysis with Transaction Value and Volume, Remittances to and from Key Countries, and Consumer Statistics – 2024 “Q1” report added to ResearchAndMarkets.com Recruitment.

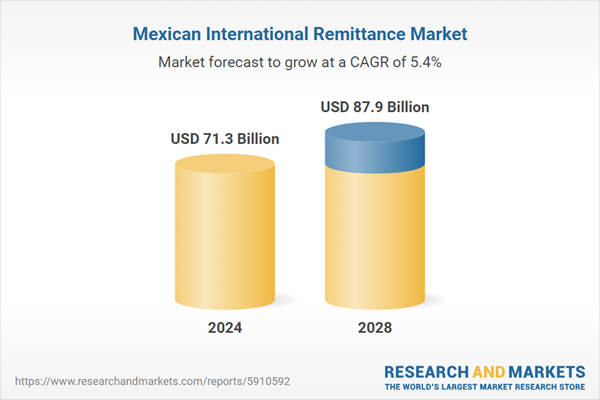

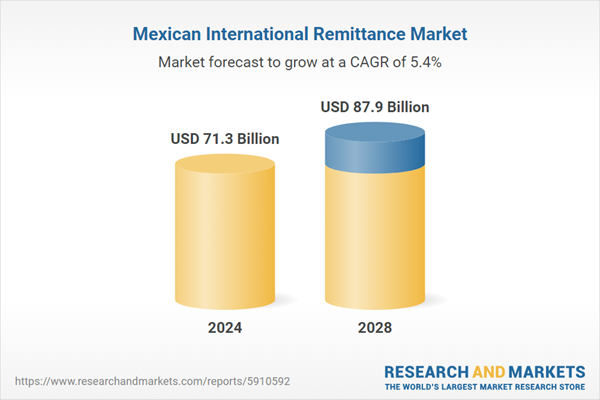

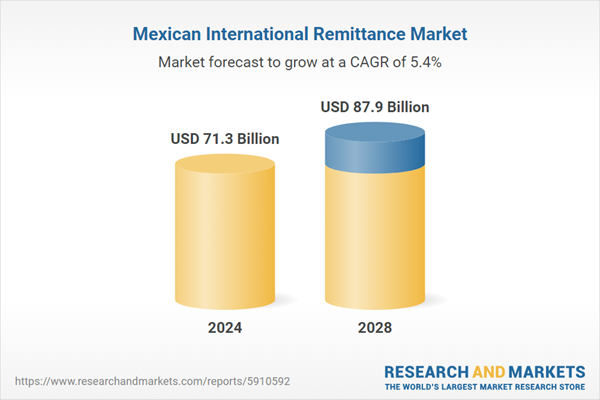

Mexico's international inbound remittance market will grow by 8.7% in 2023 and reach USD 71.26 billion in 2024. Over the forecast period (2024-2028), the market size is expected to register a CAGR of 5.4% from USD 65.58 billion. In 2023, it is expected to reach USD 87.88 billion by 2028.

Mexico's remittance outflow market grew by 4.7% in 2023 and reached USD 1.23 billion in 2024. Over the forecast period (2024-2028), the market size is expected to register a CAGR of 2.9%, increasing from USD 1.17 billion in 2023. In 2023, it is expected to reach USD 1.38 billion by 2028.

This report provides a comprehensive analysis of the Mexico international remittance market and international remittance market. It covers transaction value, transaction volume, average value per transaction, key market players, market opportunities by channel, consumer profile, and source/receiver country.

In Mexico, the remittance industry is expected to grow at an accelerated pace over the medium term. In particular, Mexico is the second largest recipient of remittances from overseas after India. Due to the peso's appreciation in 2023, many immigrants in the United States will be forced to increase the amount of money they send back to their home countries. This trend is expected to continue into 2024, driving the growth of inward remittances.

To tap into a growing market, companies are entering into strategic partnerships to simplify money transfers. Furthermore, global payment companies are also looking to enter Mexico's remittance sector. This is expected to drive the merger and acquisition trend in 2024. Overall, the publisher maintains positive growth prospects for the Mexican remittance market over the next three to four years.

Robust construction sector, major employer of Mexican immigrants, drives record remittances to Mexico

The US government has been spending heavily on infrastructure projects, and this trend is expected to continue into 2024. Since the outbreak of the pandemic, the government has taken various measures and policies to restore economic growth, including increasing spending on the construction sector.

The US-based construction market is one of the major employers of Mexican immigrants. The outlook for the construction industry remains positive over the medium term as the government spends billions of dollars through her CHIPS and Suppression of Inflation Act. This will further expand employment opportunities for Mexican immigrants and further increase remittance flows to Mexico.

Companies are forming strategic alliances to simplify remittances for Mexicans in 2024

The remittance market is expected to experience significant growth over the medium term. As a result, payment providers are forming strategic alliances in the Mexican market to tap into a growing market over the next three to four years.

NuBank partnered with Felix Pago in January 2024 to expand into the fast-growing Mexico-based remittance market. The partnership will allow 5.5 million Mexican users to receive money from the United States through WhatsApp. Mexico's remittance industry is dominated by a small number of traditional incumbents. Through this partnership, Nubank seeks to simplify the remittance process and strengthen its value proposition.

The move into the remittance market is part of NuBank's strategy to expand and diversify in Latin America. Going forward, the publisher expects global remittance service providers to also enter the Mexican market, thereby driving the competitive environment and industry growth over the next three to four years.

Companies sign acquisition deals to take advantage of Mexico's high-growth remittance industry

Mexico's remittance industry is expected to see high growth over the medium term, and global companies are also eyeing expansion in this sector through mergers and acquisitions. This trend is expected to gain further momentum in 2024.

Airwallex, a global money transfer service provider, announced plans to acquire Mexico-based MexPago in October 2023. By acquiring MexPago, Airwallex will not only be able to enter Mexico's remittance market, but will also receive the coveted e-payment fund license. MexPago also provides Airwallex with access to interbank electronic payment systems. The expansion in Mexico builds on similar cross-border payments partnerships that Airwallex has announced over the past few years.

Many other global companies are eyeing Mexico's growing remittance market. UK-based fintech company Paycend entered into a partnership with Visa in September 2023. This partnership is part of the company's strategy to expand its remittance services in Mexico. From a short to medium term perspective, the publisher expects an increasing number of global companies to expand their footprint in the Mexican remittance market.

Key attributes:

|

report attributes |

detail |

|

number of pages |

130 |

|

Forecast period |

2024 – 2028 |

|

Estimated market value in 2024 (USD) |

$71.3 billion |

|

Projected market value to 2028 (USD) |

$87.9 billion |

|

compound annual growth rate |

5.4% |

|

Target area |

Mexico |

range

International inbound market opportunity trend analysis in Mexico

International inbound market opportunity trend analysis by channel in Mexico

-

Digital (transaction value, transaction volume, average amount per transaction)

-

Mobile (transaction amount, transaction volume, average amount per transaction)

-

Non-digital (transaction value, transaction volume, average amount per transaction)

International remittance analysis of Mexican consumer profile

-

Analysis by age group of callers

-

Analysis by sender income

-

Analysis of callers by occupation

-

Analysis of beneficiaries by occupation

-

Analysis by purpose

International remittance flow analysis in Mexico (country to state/region)

-

Market opportunities by major sending countries (transaction value, transaction volume, average amount per transaction)

-

Market Share by Transfer Channel by Key States/Regions

International outbound market opportunity trend analysis in Mexico

International Outbound Market Opportunity Trend Analysis by Channel in Mexico

-

Digital (transaction value, transaction volume, average amount per transaction)

-

Mobile (transaction amount, transaction volume, average amount per transaction)

-

Non-digital (transaction value, transaction volume, average amount per transaction)

International remittance analysis of Mexican consumer profile

-

Analysis by age group of callers

-

Analysis by sender income

-

Analysis of callers by occupation

-

Analysis of beneficiaries by occupation

-

Analysis by purpose

International remittance flow analysis in Mexico (from state/region to country)

-

Market opportunities by major sending countries (transaction value, transaction volume, average amount per transaction)

-

Market Share by Transfer Channel by Key States/Regions

For more information on this report, please visit https://www.researchandmarkets.com/r/pl5n38.

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source of international market research reports and market data. We provide the latest data on international and regional markets, key industries, top companies, new products and latest trends.

attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900