(Bloomberg) — Mexico's leading presidential candidates claudia sheinbaum He said he expected Petroleos Mexicanos, the world's most indebted oil producer, to refinance its bonds ahead of their 2025 maturity.

Most Read Articles on Bloomberg

“It necessarily has to be 2025 because next year some of the debt is due to mature and we need to address that,” he said in an interview on the sidelines of Mexico's annual banking conference. Stated. Acapulco. “Perhaps the current CEO and president of Pemex will leave us with a long-term plan.”

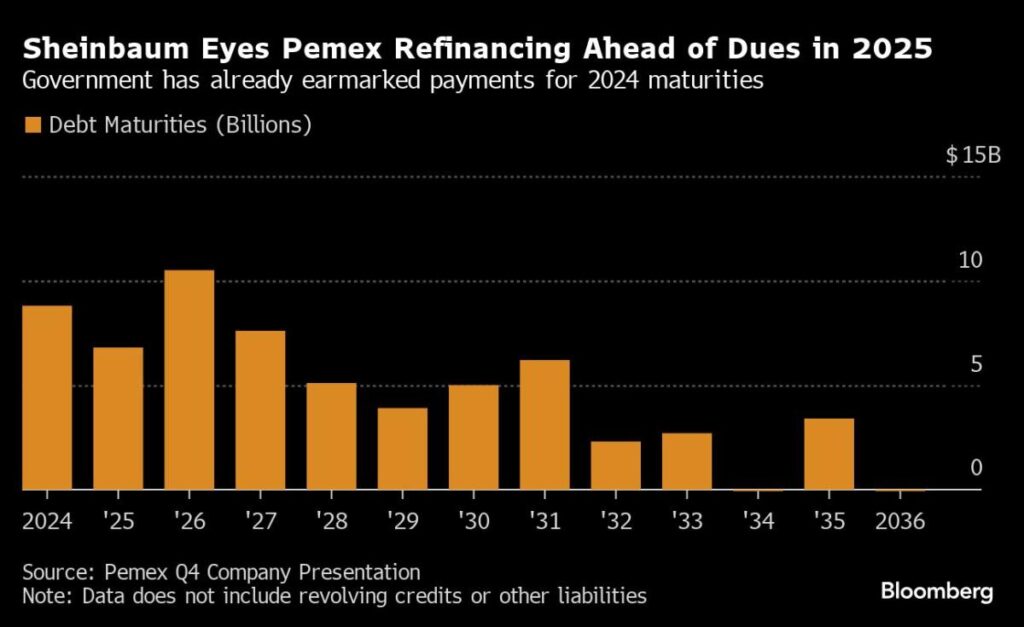

Analysts and investors agree that Pemex is one of the biggest challenges that Mexico's next president will inherit. The company has a debt burden of about $106 billion, of which $6.8 billion is due in 2025.

Sheinbaum, a former Mexican mayor from the ruling Morena party, sees himself as the natural successor to President Andres Manuel López Obrador. AMLO's popularity as president is helping him lead the race with 58% of voters willing to vote, according to Bloomberg Poll Tracker. Mexicans will elect a new president on June 2nd.

Read more: For the latest information on Mexico polls, check out our Bloomberg poll tracker.

She added that her team needs to build on the plans left by the current administration and management and establish a timeline for Pemex to develop other business options.

“We have to work on two fronts. One is refinancing the debt and allowing that refinancing to be related to oil production and refining,” she said . Pemex's entry into other energy sources and other types of power generation; ”

Pemex's oil and gas production has fallen to more than half of what it was 20 years ago. Debt reduction is key to boosting production, as money that could be spent on repairing aging infrastructure will be used to pay interest. The company's debt burden is so high that access to markets is hampered, and refinancing its bonds could be costly as global interest rates remain high.

The company has about $8.8 billion in debt due by the end of 2024, according to its latest financial results. López Obrador's government has promised to pay for most of it.

Sheinbaum said he would consider appointing a Pemex CEO with both financial expertise and experience in the oil sector. She has someone in mind for the position, but will only reveal her name at the “appropriate moment,” she said.

pemex strategy

Lately, Pemex has relied on tax breaks and cash injections from the government to stay afloat. AMLO has generously supported the company, providing 1.37 trillion pesos (about $80 billion) in funding during his administration.

Sheinbaum, an environmental engineer and former Mexico City mayor, said last month that he expected to increase Pemex's oil production to about 1.8 million barrels per day (down from about 1.5 million barrels a day now) over the next few years as the government focuses on spark ignition. The paper outlined an energy strategy that includes measures to limit the increase in energy consumption. Growth of green energy.

Read more: Mexico's next leader will inherit oil giant's $106 billion in debt

new project

Scheinbaum said in an interview that the company's future plans, which include participating in lithium mining, are financially viable. Funding for the energy initiative will come partly from the private sector and partly from additional revenues from projects carried out during López Obrador's administration, such as the purchase of a plant from Spanish company Iberdrola.

The administration will also look for ways to improve Pemex's environmental record as it confronts issues such as methane emissions.

“We have to move forward with our vision of decarbonizing our economy, of how far and for how long we can continue to produce oil,” he said. “Natural gas will continue to be a very important fuel in the future.”

–With assistance from Carlos Manuel Rodríguez, Paola Vega Torre, and Rafael Gayol.

(Updates with details of Pemex's debt burden and adds comment from Sheinbaum starting in paragraph 8)

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP