esemelwe

Thesis

The US natural gas industry has been in growth mode for over a decade. Accommodating this growth requires extensive infrastructure and capital investment. The most discussed infrastructure topics for natural gas are pipelines or export terminals. What does not get discussed, is the compression equipment market that supplies the equipment necessary to send the molecules down the pipe.

This is a niche market with only three significant suppliers, all of which are nearly maxed out in terms of excess capacity. This presents both a problem and an opportunity.

The problem arises from the continued ramp in natural gas production to support both domestic consumption and growing LNG exports. It is as simple as more production requires more compression. The opportunity to increase profitability on existing assets continues to grow as the last remaining idle units are placed into service, and the lead time on new units is just shy of a full year.

Archrock (NYSE:AROC) stands the tallest amongst its peers to be the largest beneficiary from the industry-wide deficit in compression equipment. Not only is AROC the largest provider in the industry (with some spare capacity), but it also has the lowest debt levels amongst its peers. This allows the company to divert more funds toward new equipment purchases to capture the significant growth that is anticipated over the next decade.

Natural Gas Bull Cycle

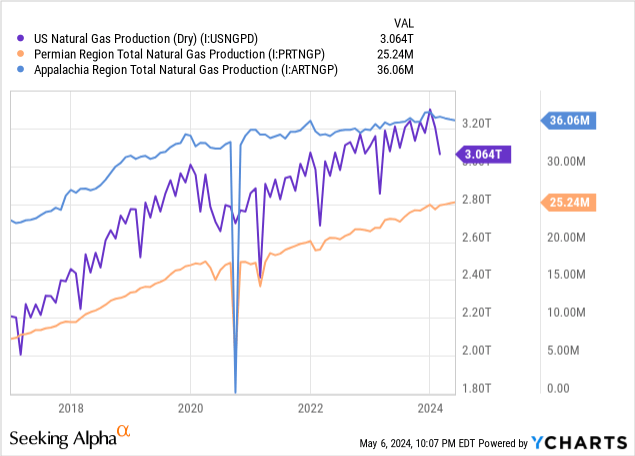

Since 2017, natural gas production has steadily grown from roughly 75 BCF/d to over 100 BCF/D. While the Marcellus production has been more or less flat since 2020, the Permian continues to grow. Ironically, this growth out of the Permian Basin is fueled by continued production of oil.

The region pulls out significant amounts of natural gas that is entrained in the fluid stream. Natural gas typically accounts for 25% of the total volumes out of the Permian. Production in the Permian Basin is expected to continue to grow for the remainder of this decade, thus driving up associated natural gas production as well.

Despite the challenges to commodity prices, there are two dynamics that will continue to propel US natural gas production to record levels.

1. Permian natural gas is ‘free’. The revenues generated by natural gas compared to oil makes NG almost irrelevant for producers from an economic standpoint. Natural gas take away is a problem that needs to be solved to prevent interferences with production.

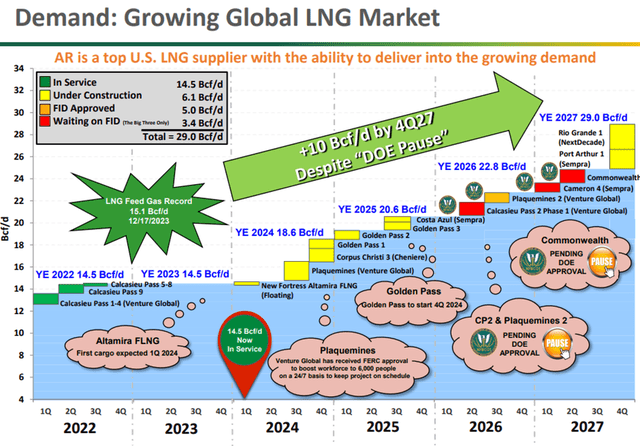

2. LNG exports stand to increase the consumption of natural gas by 4–5 BCF/d in the next 12 months. A second wave of projects is slated to come online in 2026 and 2027 to more than double the current exported volume.

From this, we can see that there is momentum on both the supply and consumption ends of the natural gas ecosystem. AROC has the benefit of sitting in the middle between both of these drivers by being a part of the midstream sector.

LNG Export Timeline (AR Investor Presentation)

Ultimately, the compression segment is similar to many of the other midstream sectors, as long as the molecules keep moving down the pipe, they will continue to get paid, regardless of the commodity price.

Archrock is Positioned to Capture More Market Share and Higher Levels of Profitability

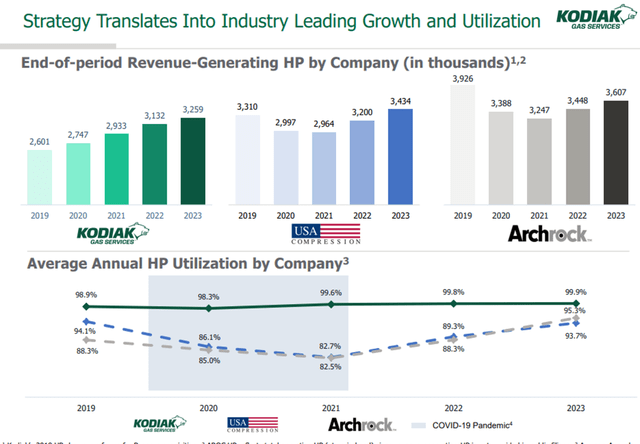

To get a sense of the industry, the image below shows both total capacity and utilization. Archrock has a slight lead in revenue generating equipment over peers USA Compression (USAC) and Kodiak Gas Services (KGS). Overall, the core three providers have extremely comparable capacities and utilization factors.

Compression Market Summary (KGS Investor Presentation)

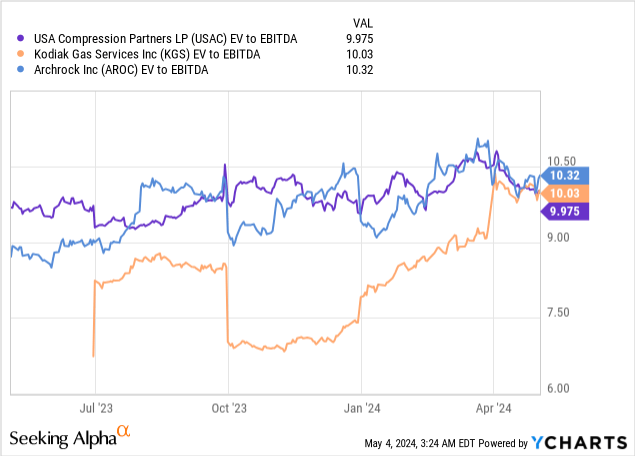

The similarities even extend into the valuation realm when comparing the EV to EBITDA ratios. All three trade at an EV to EBITDA ratio of roughly 10x, falling into the awkward ‘not cheap but not expensive’ zone.

The main differentiator for these three companies is what happens AFTER the EBITDA. By definition, EBITDA is BEFORE interest and taxes. The impact of interest and tax expenses drives a fundamental difference in performance on the way to the bottom line.

When the amount of debt is factored in, we can see that AROC has a significant financial advantage over its fellow peers as a result of having the lowest interest expense. The next closest competitor in interest expenses would be USAC, which spent $62 million more in financing costs during 2023. This allows AROC to spend more capital on growth projects without taking on additional debt.

| USAC | KGS | (AROC) | |

| 2023 EBITDA | $512M | $438M | $450M |

| Interest Expense | $170M | $222.5M | $108M |

| % of 2023 EBITDA | 33% | 51% | 24% |

NOTE: Links to each company’s 2023 annual report are attached to the above hyperlinks.

In an industry that is nearly maxed out in excess capacity, the company that is the most adept at efficiently deploying growth capital will be the first in line to serve customer’s needs and capture market share.

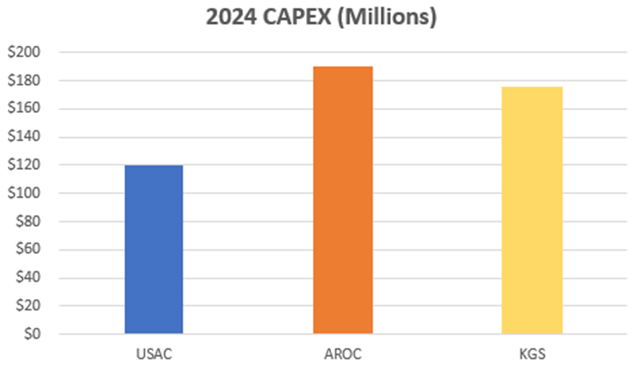

In 2024, AROC will be the industry leader in growth CAPEX spend by deploying $190 million on new equipment. This will be the second consecutive year that AROC spent at this elevated rate without increasing debt levels.

Conversely, AROC’s main competitors are in a different financial situation. Kodiak’s level of spend parallels that of AROC, but will most likely require a debt draw. In the opposite direction, USAC is reducing its CAPEX spending to retain cash and prepare for the $1.6 billion in debt that is due in 2026.

Given the diverging actions of investment, coupled with a stronger balance sheet, I believe 2024 will be the moment AROC begins to pull away from the pack.

CAPEX Spending by Company (10-K Reports)

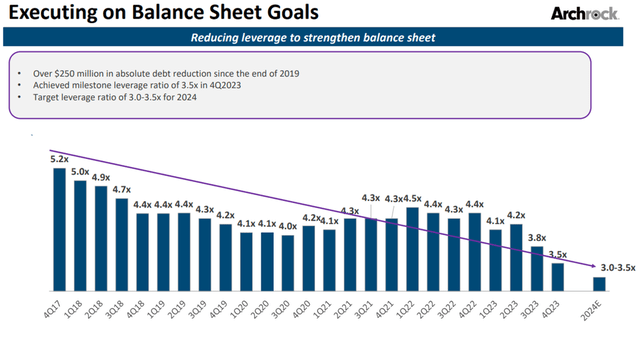

AROC exited 2023 as the industry leader in leverage ratio, with a respectable multiple of 3.5x. This gives the company a 0.5x lead on both USAC and KGS.

Having this financial head start will allow AROC to achieve a debt to EBITDA ratio of 3.0-3.5x by year-end. AROC is able to achieve this by spending responsibly while also reaping the benefits of placing 214,000 horsepower into service during 2023. The additional earnings power is projected to grow 2024 EBITDA to $525 million for a 17% YOY growth rate.

AROC Investor Presentation

Dividend Growth and Coverage

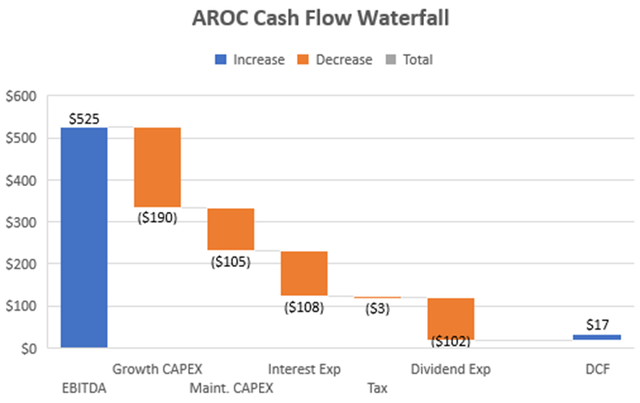

Earlier this year, AROC announced it was increasing the quarterly dividend by 6.5% to $0.165/share. This produces a modest 3.3% yield at current prices. With a total dividend expense of $102 million for the year, investors may be wondering if this can be sustained while also funding a large growth capital plan.

To ease potential concerns, AROC raised 2024 full-year EBITDA guidance to $525 million after Q1 earnings. Using 2024, guidance, I developed a free cash flow model for AROC. The output of that model showed that even after a massive amount of CAPEX spending and a dividend raise, AROC is still positioned to exit 2024 with a slight cash build. How the company plans to allocate funds is outlined in the cash flow waterfall below.

Given the highly contracted nature of the compression business, a solid Q1 earnings report and raising full-year guidance gives a high degree of confidence in the safety of the dividend. Using the waterfall below, it can also be seen that there is adequate room for a subsequent dividend raise as the year progresses.

AROC Cash Flow Waterfall (AROC Investor Presentations)

Q1 Earning Results

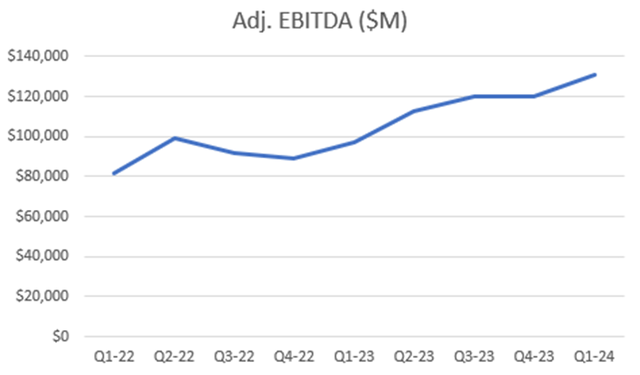

Q1 results also showed record EBITDA generation, coming in at $131 million or a 35% YoY improvement from Q1 2023. This is yet another data point in a multiyear trend of EBITDA growth. At the current rate of EBITDA generation, the company is on pace to meet the midpoint of EBITDA guidance ($525 million) by year end. This will be further aided by 19,500 horsepower of new equipment being placed into service in March.

2 year EBITDA Growth Trend (AROC Investor Presentation)

CFO Douglas Aron provided the following color on the momentum AROC is building moving into the rest of the year in the AROC Q1 conference call.

First quarter 2024 exit utilization remained near an all-time high at 95% and but was down slightly compared to the fourth quarter of 2023 primarily because we took delivery of 19,500 horsepower of new build units in March that were included in the total available horsepower but not reflected in total operating horsepower as the units did not begin generating revenue until April.

We exited the first quarter with near record utilization of 95% and based on what we see in the Markets Day, we expect to be able to maintain utilization in the mid-90s this year. Given high levels of horsepower utilization for Archrock and the industry, we’re maintaining the pricing prerogative and capturing additional rate increments.

As mentioned by the CFO, this momentum goes beyond just deploying new equipment. Overall profitability of all of AROC’s assets is on the rise, allowing the company to also approve a $50 million share buyback plan. CEO Bradley Childers further discussed the driving factors in improved profitability, as well as the planned method to reward shareholders over the long run.

The first quarter marks our 10th consecutive quarter of sequential increases in our monthly revenue per horsepower, which increased by 5% to $20.62. Continued price increases and strong cost control drove an increase in our gross margin percentage to 65% up 700 basis points year-over-year and 100 basis points compared to the last quarter.

Our recently declared quarterly dividend per share was up 10% on an annual basis, and our Board of Directors recently approved an extension of our share repurchase authorization with renewed available capacity of $50 million.

I would offer as a differentiator against any other public compression company that we, I believe, are the only ones delivering both growth in horsepower, growth in dividend and a share repurchase program. And so I think all of those are shareholder friendly. And things that owners of Archrock have both appreciated and will continue to appreciate into the future.

Overall, AROC appears to be on solid footing moving forward.

Valuation

As mentioned earlier, the current valuation of AROC is 10x on an EV to EBITDA basis. While this is on the expensive side, it does not give an accurate assessment of the potential EBITDA growth over the next several years.

Competitor USAC has referenced that the current capital investments are able to achieve low 20% rates of return. Applying this to the current $190 million of growth investments being pursued in 2024 gives approximately $38 million in EBITDA growth potential. I will bump this down to $35 million for conservatism.

If we assume no further rate escalation (which seems unlikely at this time), 2025 exit EBITDA will grow to approximately $560 million. At the current enterprise value, this gives a future EV to EBITDA ratio of 8.4x which is significantly more attractive for a stable midstream business.

Using this framework, shares look attractive up to $22/share. This top level would generate an EV to EBITDA ration of 9.25x. Again, this is assuming no increase in rates for existing equipment over the same time period.

Risks

Supply chain risks continue to plague the compression market. Competitors USAC and KGS have sited that engine delivery times are exceeding 40-45 weeks for delivery. This is not inclusive of final assembly and/or delivery.

Should the supply chain deteriorate further, future growth rates for AROC could be challenged. Lack of equipment will inhibit the company’s ability to serve customers’ needs, resulting in both a degraded growth proposition and loss of market share.

As a compensatory measure for this risk, I like that both USAC and AROC have idle capacity that could be monetized for a near term solution. Executing this option may raise the total maintenance CAPEX spend and result in a cash burn for the full year.

Summary

AROC is an industry leader in the natural gas compression business. At the surface, there is not much that differentiates AROC from USAC or KGS. However, the advantage lies in the lower interest expenses compared to peers.

Having lower interest expenses allows the company to deploy more capital in growth initiatives to increase market share and future earnings potential. This is supportive of both future EBITDA and dividend growth.

AROC is fundamentally structured to harvest the largest financial benefit from the continued growth in natural gas production that is expected to occur over the remainder of this decade. As a result, I rate AROC as a BUY below $22/share.