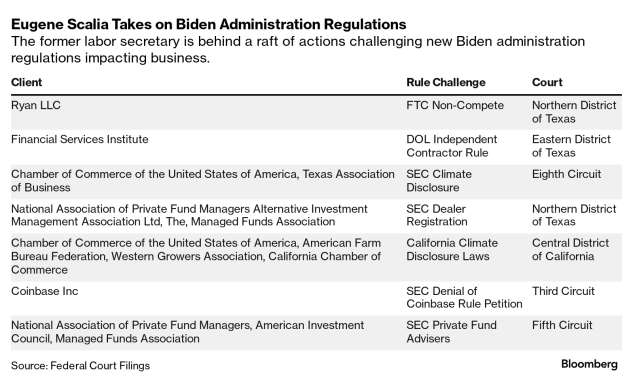

Mr. Scalia, the son of the late conservative icon Supreme Court Justice Antonin Scalia, has filed six challenges to federal authorities on behalf of corporate interests since September. He is fighting pollution disclosure rules, worker non-competes, and an alternative definition of independent contractor to independent contractor, which he created when he was U.S. Secretary of Labor.

His private practice at Gibson, Dunn & Crutcher heats up as the Biden administration issues rules for frequently blocked issues in Congress and the conservative-dominated Supreme Court becomes increasingly hostile to executive power. It's starting to happen.

“It's a bit of a perfect storm,” Scalia, 60, said in an interview. She said, “Courts have been wary of the limits of agency authority, and agencies have been very aggressive in trying to push those limits.”

The younger Scalia specializes in arcane types of work aimed at breaking rules under the Administrative Procedure Act. The nearly 80-year-old statute sets out procedures federal agencies must follow when making proclamations, including providing adequate notice of proposals, including time for public comment, and ensuring compliance with the law. are doing.

Mr. Scalia led the first lawsuit under the law in 1994 against the now-defunct Interstate Commerce Commission. A challenge under the APA was so unusual at the time that when Scalia asked his Gibson Dunn colleagues if they had ever tried one, no one said they had.

Dan Gallagher, who served as a securities regulator under President Obama and is general counsel for Robinhood Markets Inc., said it was a “backwater law.”

“Inside” Vantage

Gibson Dunn now has an administrative law group founded by Scalia that specializes in fighting agency regulations. His number of APA challenges in 2023 is three times what he was in the same year a decade ago, according to Bloomberg Law Analysis, and such cases are skyrocketing overall.

“Government agencies are doing a lot of the work that we expected Congress to do,” said Ron Levin, a law professor at Washington University in St. Louis. “Any action taken by an administration is going to be very disturbing to people of the opposite persuasion. That means you're going to disagree.”

Mark Chenoweth, president of the New Civil Liberties Union, said Scalia's role as President Donald Trump's labor secretary was an important one that gave him “an advantage within the executive branch” in the fight against agency overreach. He said that he had achieved this.

According to the group's website, the nonprofit Chenoweth's mission is to prevent violations by the administrative state, and “it is not surprising that government agencies would assert powers never granted to Congress.” Stated.

Today, Scalia's clients include a wide range of corporations and prominent industry organizations. He represents the Chamber of Commerce, a powerful business lobby, in federal and state lawsuits challenging rules requiring companies to disclose certain data on their greenhouse gas emissions.

He is also leading legal strategy for the Banking Policy Institute, a trade group for large banks, which is pushing for caps on credit card late fees and forcing the largest lenders to raise capital levels by 19%. We are active in opposing the bank capital review plan.

This work turned out to be lucrative. Mr. Scalia owned more than $6.2 million in partnership stock at Gibson Dunn before becoming labor secretary, according to financial disclosures.

“Shadow Government”

Mr. Scalia is behind four ongoing battles with the Securities and Exchange Commission over a progressive agenda led by Chairman Gary Gensler. The lawyer, who boasts a 7-0 record against regulators in court, has criticized private funds, dealers and climate disclosures that he claims are outside the bounds of securities regulators while imposing huge costs on companies. Objects to targeted reforms.

He also represented Coinbase Global, the largest U.S. cryptocurrency exchange, in the SEC's December denial of its application for rules governing how to determine whether digital assets are securities. is seeking court review of the decision.

“Frankly, the rulemaking process has made it possible to challenge the rules in court,” said Nicholas Morgan, president of the Investor Choice Advocacy Network. “Speed, volume and short notice periods only translate into rules that are more susceptible to challenge.”

In February, Mr. Gensler's SEC clashed with Scalia in the Fifth Circuit over a rule requiring private funds to detail quarterly fees and expenses to investors. The agency did not respond to a request for comment, but said the rule is a “flexible and thoughtful approach to resolving issues that impact investors and their stakeholders.”

Most notable is Mr. Scalia's lawsuit challenging the Labor Department's new rules on worker classification, rules that would cancel the independent contractor exam that Mr. Scalia approved as labor secretary in 2021, brought by a group called the Financial Services Association. He is acting as an agent for the organization.

“It's clearly unusual for a senior government official to directly challenge the work of his successor,” said Adam Pulver, a lawyer with the left-wing advocacy group Public Citizen. “It's acting like a shadow government.”

The Department of Labor did not respond to requests for comment.

“Permanent Retirement Benefit System”

The second of nine children, Scalia graduated from the University of Chicago Law School and spent his career as a lawyer between Republican administrations and Gibson Dunn. He founded the Gibson Dunn Administrative Law Firm after becoming a partner at Gibson Dunn in 1999.

His challenges to the Dodd-Frank banking law, which imposed hundreds of new rules on companies, were so frequent that some within the agency referred to the 2010 law as the “Eugene Scalia Full Employment Act.” is. SEC officials still expect a challenge from him as they craft controversial rules, according to people familiar with the matter.

“If the Dodd-Frank administration was the Eugene Scalia Full Employment Act, the Biden administration is the Eugene Scalia Permanent Retirement Plan,” said Gallagher, a former SEC commissioner.

As of March, the Biden administration had issued a total of 209 economically significant rules, according to the George Washington University Center for Regulatory Studies. By comparison, during the same period of his administration, President Trump issued 124 rules and President Barack Obama issued 184.

In March, Scalia said on the Bloomberg Intelligence podcast that Biden, like modern-day President Franklin Delano Roosevelt, is likely to become president, even though he doesn't have the congressional majority that authorized Roosevelt to implement New Deal reforms. He said he was trying to behave. “So how does he get there? It's by using agency aggressively and adventurously,” he said.

But courts are increasingly encouraging litigants to try their luck by challenging the rules, said Xiao Wang, a law professor at the University of Virginia. He noted that Republican-appointed legal scholars have issued nationwide injunctions in response to regulatory challenges.

For example, on May 10, a Texas judge granted an injunction temporarily freezing a Consumer Financial Protection Bureau rule that caps credit card late fees at $8. The justices “not only want to take up these cases aggressively, but we also want to rule in favor of administrative law challenges,” Wang said.

The Fifth Circuit has jurisdiction over courts in Texas, Louisiana, and Mississippi, making it a prominent venue for challenges. Scalia has filed three lawsuits in the circuit, two on behalf of the National Association of Private Fund Managers. The nonprofit was reportedly formed in Texas shortly after the SEC released its first proposal to reform private fund advisor rules.

“Many of the lawsuits we have now are primarily due to policy disagreements,” Pulver said. “Twenty years ago, these lawsuits didn't get a lot of attention.”

Scalia said he wants to take advantage of growing skepticism among the courts about the agency's rulemaking.

“One of the big changes since I started practicing law is that courts are now very interested in administrative law,” Scalia said in an interview. “Years ago, it was sometimes difficult just to get the court's attention. Now courts across the country are familiar with and enthusiastic about this area of the law.”

Scalia wasted no time in going to court. Scalia, who represents a Dallas-based tax firm, filed the lawsuit just hours after the FTC adopted a rule in April that almost completely bans non-compete clauses in workers.

“If a federal agency were ever going to pull an elephant out of a rat hole, this is the limit,” Scalia's complaint says. The language echoed an expression his father coined to describe how government agencies try to enact sweeping policies based on narrow laws.