German embedded finance business and investment opportunity market

DUBLIN, May 21, 2024 (GLOBE NEWSWIRE) — “German Embedded Finance Business and Investment Opportunities Databook – 75+ KPIs for Embedded Lending, Insurance, Payments and Wealth Sectors – Updated Q1 2024” report has been added. ResearchAndMarkets.com Recruitment.

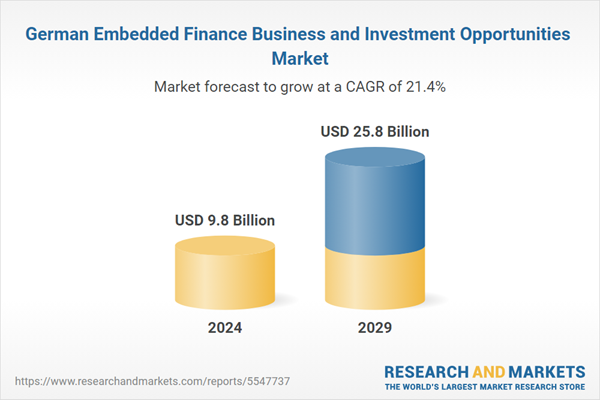

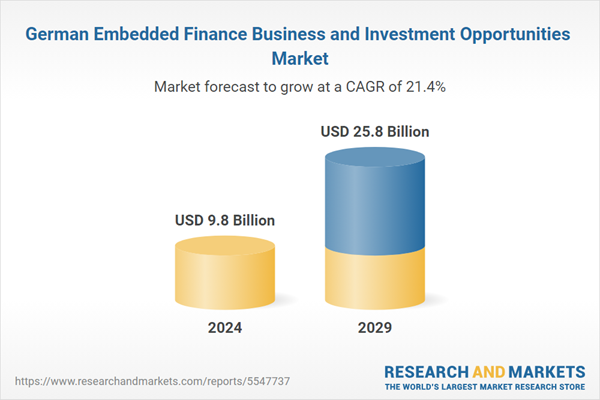

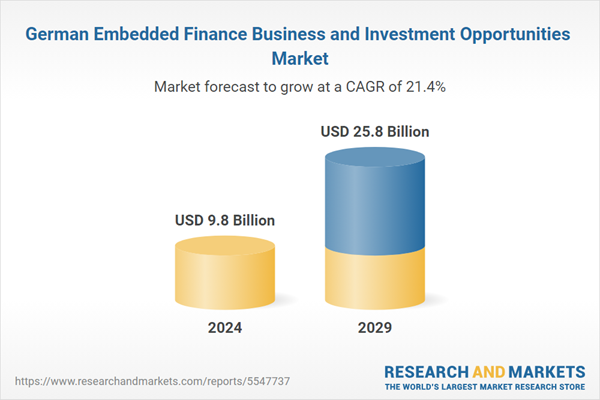

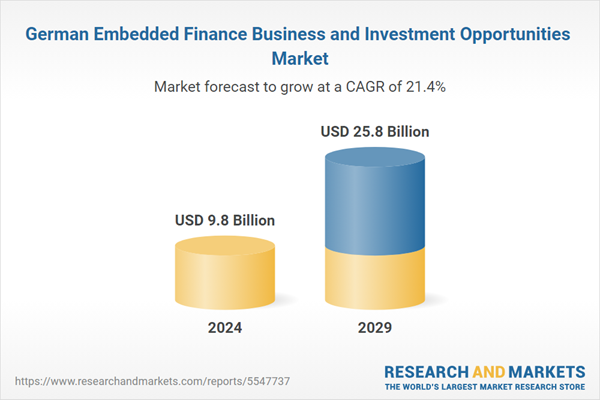

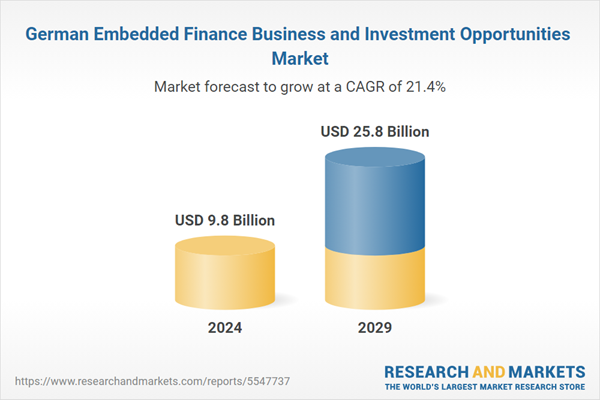

Germany's embedded finance industry is expected to grow by 28.2% on an annual basis, reaching USD 9.79 billion in 2024. The embedded finance industry is expected to grow steadily during the forecast period, registering a CAGR of 21.4% between 2024 and 2029. The country's embedded finance revenue is expected to reach US$25.81 billion by 2029, up from US$9.79 billion in 2024.

The report provides an in-depth data-centric analysis of the embedded finance industry, covering market opportunities and risks across various sectors in lending, insurance, payments, and asset-based finance sectors. The report includes 75+ KPIs at country level to provide a comprehensive understanding of Embedded Finance market dynamics, market size, and forecast.

Germany's embedded finance market is experiencing remarkable growth and innovation due to a variety of factors including technological advances, changes in consumer behavior, regulatory developments and strategic partnerships. Partnerships between banks, fintech companies, e-commerce platforms and other non-financial institutions are becoming increasingly common in Germany. These partnerships enable seamless integration of financial services into everyday activities such as shopping, travel, and digital communication. For example, banks are partnering with e-commerce platforms to offer payment solutions, and fintech startups are partnering with mobility companies to offer insurance and financing options.

Growth drivers in Germany: The embedded insurance wave has gained momentum in Germany in recent quarters, and several startups are riding the wave with innovative product launches. With the growth of Germany's insurtech industry, foreign insurtech companies are planning to expand their presence in Germany. The German embedded finance market is expected to see continued growth in the coming years. As digitalization accelerates across industries and consumer preferences continue to evolve, embedded financial platforms are expected to play an increasingly important role in the financial ecosystem, driving innovation, competition, and value creation.

Strategic Partnerships: The number of strategic partnerships among market players for launching innovative products in the country is increasing and is expected to support market growth over the next four to six quarters.

-

In 2024, in Germany, Solaris, a long-time leader in the banking market, forged unique partnerships with brands such as Samsung Electronics, Grover (technology rental platform) and Navit (B2B mobility platform). Similarly, new generation providers such as Vodeno and Swan are also embarking on interesting partnerships. German automaker Mercedes-Benz is also experimenting with Visa and Mastercard to enable tokenized payments in the car.

-

In July 2021, Zurich Group Company, one of the leading insurance companies in the non-life insurance business, entered into a strategic partnership with Vodafone Germany. Under the partnership, the two companies have launched digital short-term baggage coverage exclusively available to Vodafone Mobile customers in Germany.

Increasing number of start-ups and funding activities: An increase in the number of start-ups and funding activities is expected to further drive the development of the embedded insurance sector. Additionally, the publisher predicts that more insurtech companies in the country will raise funds to improve their platforms over the next four to eight quarters. New and innovative financial products being introduced by market players are putting tremendous pressure on traditional banks to adopt technology to gain a competitive advantage. This has led to increased partnerships and collaboration between traditional financial service providers and technology providers. Market participants within the ecosystem are also raising capital to expand their geographic operations.

In March 2024, German embedded finance platform Solaris secured $103 million (€96 million) in a Series F round. The investment was led by his SBI, one of the early investors in Solaris, with participation from other existing investors. Solaris will provide additional capital, bringing the company's total funding to more than $486 million (450 million euros), through the introduction of the ADAC (Allgemeiner German Automobile Club) credit card program, core capital The company plans to use the proceeds to strengthen its platform and invest in the platform further. .

Key innovations in Germany's embedded finance platforms: Germany's embedded finance sector is full of innovation and is constantly pushing the boundaries of how financial services can be integrated into everyday life.

-

Hyper-personalized financial products: Platforms leverage data analytics and machine learning to personalize financial products. Imagine an e-commerce platform recommending a microloan at checkout based on purchase history and spending habits, or a travel booking app suggesting travel insurance tailored to a specific trip.

-

Smooth in-app payments: Built-in finance streamlines in-app payments, making them faster and more convenient. One-click purchases within ride-hailing apps, instant money transfers within social media platforms, and seamless bill payments through utility apps are all examples of this innovation.

-

Integration with AI chatbots for financial guidance: AI-powered chatbots within embedded finance platforms can provide personalized financial guidance and answer user questions in real-time.

This can range from simple account balance checks to suggesting budgeting strategies and investment options.The future for embedded finance platforms in Germany looks bright due to several factors:The company predicts that the embedded finance market in Germany will grow significantly in the coming years, benefiting from a robust open banking infrastructure and a growing e-commerce sector.

As adoption continues, data security and user privacy will remain paramount, and platforms must prioritize robust security measures and compliance with evolving regulations such as GDPR. However, potential challenges such as consumer trust and adapting the regulatory environment need to be effectively addressed to ensure a level playing field and reduce risks.

Key attributes:

|

report attributes |

detail |

|

number of pages |

130 |

|

Forecast period |

2024-2029 |

|

Estimated market value in 2024 (USD) |

$9.8 billion |

|

Projected Market Value (USD) to 2029 |

$25.8 billion |

|

compound annual growth rate |

21.4% |

|

Target area |

Germany |

range

Embedded finance by major sectors

-

retail

-

logistics

-

Telecommunications

-

manufacturing industry

-

consumer health

-

others

Embedded finance by business model

-

platform

-

Supporter

-

Regulatory body

Embedded finance with a decentralized model

-

unique platform

-

Third party platform

German embedded insurance market size and forecast

Embedded Insurance by Industry

-

Insurance built into consumer products

-

Built-in insurance in travel and hospitality

-

Embedded insurance in the automotive industry

-

Insurance integrated into medical care

-

Insurance built into real estate

-

Built-in insurance in transportation and logistics

-

insurance embedded in someone else

Embedded insurance by consumer segment

Built-in insurance by offer type

Built-in insurance by business model

-

platform

-

patron

-

Regulatory body

Embedded insurance by distribution model

-

unique platform

-

Third party platform

Embedded insurance by sales channel

-

embedded sales

-

Bank sales

-

Broker/IFA

-

tied agent

Built-in insurance by insurance type

Embedded insurance in the non-life insurance field

German embedded financing market size and forecast

Embedded lending by consumer segment

-

business loan

-

personal loans

Embedded financing by the B2B sector

-

Embedded financing in retail and consumer goods

-

Embedded financing in IT and software services

-

Embedded financing in media, entertainment and leisure

-

Embedded financing in manufacturing and distribution

-

Financing embedded in real estate

-

Other embedded financing

Embedded financing with the B2C sector

-

Embedded financing in retail shopping

-

Loans integrated into home renovations

-

Embedded financing in leisure and entertainment

-

Embedded financing in healthcare and wellness

-

Other embedded financing

Embedded Loans by Type

-

BNPL financing

-

POS rental

-

personal loan

Embedded financing by business model

-

platform

-

patron

-

Regulatory body

Embedded financing with distribution model

-

unique platform

-

Third party platform

German embedded payment market size and forecast

Embedded payments by consumer segment

Built-in payment by end-use department

-

Embedded payments in retail and consumer goods

-

Payments embedded in digital products and services

-

Payments embedded in utility bill payments

-

Embedded payments in travel and hospitality

-

Embedded payments in leisure and entertainment

-

Embedded payments in health and wellness

-

Embedded payment in office supplies and equipment

-

Other embedded payments

Built-in payments by business model

-

platform

-

patron

-

Regulatory body

Incorporating a decentralized payment model

-

unique platform

-

Third party platform

German Embedded Wealth Management Market Size and Forecast

Germany asset-based financial management industry market size and forecast

Asset-based finance by asset type

Asset-based finance by end users

For more information on this report, please visit https://www.researchandmarkets.com/r/4x7qgv.

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source of international market research reports and market data. We provide the latest data on international and regional markets, key industries, top companies, new products and latest trends.

attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900