Japanese embedded finance business and investment opportunity market

DUBLIN, May 22, 2024 (GLOBE NEWSWIRE) — “Japan Embedded Finance Business and Investment Opportunities Data Book – 75+ KPIs for Embedded Finance, Insurance, Payments and High Net Worth Segments – Updated Q1 2024” report , ResearchAndMarkets.com Recruitment.

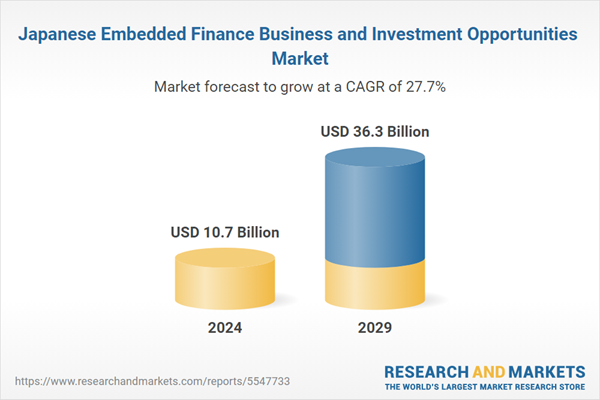

Japan's embedded finance industry is expected to grow by 38.8% on an annual basis to reach USD 10.66 billion in 2024. The embedded finance industry will grow steadily during the forecast period and is expected to register a CAGR of 27.7% between 2024 and 2029. The country's embedded finance revenue is expected to reach US$36.29 billion by 2029, up from US$10.66 billion in 2024.

The report provides an in-depth data-centric analysis of the embedded finance industry, covering market opportunities and risks across various sectors in lending, insurance, payments, and asset-based finance sectors. The report includes 75+ KPIs at country level to provide a comprehensive understanding of Embedded Finance market dynamics, market size, and forecast.

Japan's embedded finance market has seen significant growth and innovation in recent years, driven by partnerships between traditional financial institutions, technology companies, and startups. Embedded finance, which integrates financial services into non-financial platforms, is also gaining traction in Japan due to its potential to improve customer experience and drive revenue growth for companies.

Best Embedded Finance Platforms in Japan 2023-2024: Japan's embedded finance market is considered to be still in its infancy compared to other countries. This may impact the availability and maturity of some platforms. However, there are some powerful options to consider.

-

Plaid: This is the easiest way for users to connect their bank accounts to your apps. Plaid gives developers the tools they need to create user-friendly experiences. Plaid has enabled millions of users to connect their accounts to their favorite apps. Plaid can be implemented in minutes with just a few lines of code.

-

Stripe: The new standard for online payments. Stripe is the perfect platform to run your internet business. For leading companies around the world, this platform processes billions of dollars annually. Stripe creates the most flexible and powerful tools for Internet commerce. Whether the customer is creating a subscription service, on-demand marketplace, e-commerce store, or crowdfunding platform.

-

Wallester: Wallester is a regulated company that holds a financial license. Visa Official Partner and Visa Principal Member. Wallester Business provides businesses with a solution to open accounts and instantly issue an unlimited number of Visa virtual and physical cards. It allows businesses to manage all corporate expenses on a single smart platform.

-

AlphaPoint: AlphaPoint is a global financial technology company that provides the next generation of exchanges, brokerages, payment networks, and digital asset infrastructure that powers banking. Its full suite of products provides reliable, secure, scalable and customizable solutions for trading, payments, lending and storage.

-

Spreedly: Spreedly is a platform for payment orchestration and is available on the App Store. Organizations that are growing rapidly, entering new markets, and looking to reduce compliance burdens or payment costs are often unable to adapt their infrastructure to accept payments according to business needs.

Japan's growth drivers: The Japanese government has actively promoted a cashless society with the aim of improving the efficiency, reducing costs, and increasing transparency of financial transactions. Initiatives such as the My Number system and cashless payment rebates are encouraging businesses and consumers to adopt digital payment methods, creating opportunities for embedded financial platforms. Several key market drivers are driving the growth of embedded finance platforms in Japan.

Digital payments in Japan: Japan's digital payments market is also evolving, with the government aiming for 40% of transactions to be cashless by 2025. The most popular digital payment service in Japan is PayPay, which was established in 2018 as a joint venture between Yahoo Japan and Softbank. PayPay accounts for about 40% of the market, and its next largest competitor, NTT Docomo's dPay, accounts for about 22%. PayPay's strong market share is largely due to its cashback campaigns and free services offered to small merchants to attract both sellers and buyers.

-

High level of cryptocurrency awareness in Japan: Japan is also a well-developed cryptocurrency hub. Although Japan's cryptocurrency market has experienced difficulties in the past, such as the hacking of cryptocurrency exchange Coincheck in 2018, government regulations since 2018 have strengthened the security and transparency of Japan's cryptocurrency ecosystem. . Recently, famous companies such as DMM and Rakuten have introduced their own virtual currency wallets and exchange systems. In particular, Rakuten's decision to allow the use of Bitcoin and Ethereum to top up users' Rakuten Cash balances in February of this year expanded the scope for the use of cryptocurrencies in everyday transactions. Japan has a lot of potential for crypto-related companies wanting to enter the market, especially because of the high level of awareness of cryptocurrencies in Japan.

Japan's key innovations and partnerships: Japan's embedded finance has several unique characteristics. First, the enabler is typically the license holder. In the embedded finance space, players typically fall into three categories: brands, enablers, and licensees. However, the enabler (as a second category player) acts as a license holder (as a third category player). The second unique feature is that financial companies are users of embedded finance. This is because the speed of digital transformation in traditional financial companies is relatively slow and traditional financial companies are looking to leverage embedded finance to accelerate their digital transformation.

-

In November 2023, Stripe, the enterprise financial infrastructure platform, announced expanded support for JCB, Japan's leading card network and one of the world's top payment networks. JCB is currently available on Stripe in 39 countries and territories, making it easy for businesses in these markets to accept payments from his 154 million JCB cardholders.

-

In October 2021, Orenda, an embedded financial services platform, partnered with Nium, a global payments and card issuance leader, to enable Orenda to leverage Nium's suite of banking-as-a-service (BaaS) APIs. announced that it will provide a no-code service. , an end-to-end serverless banking infrastructure for clients.

Key attributes:

|

report attributes |

detail |

|

number of pages |

130 |

|

Forecast Period |

2024-2029 |

|

Estimated market value in 2024 (USD) |

$10.7 billion |

|

Projected market value to 2029 (USD) |

$36.3 billion |

|

compound annual growth rate |

27.7% |

|

Target area |

Japan |

range

Japan's embedded finance market size and forecast

Embedded finance by major sectors

-

retail

-

logistics

-

Telecommunications

-

manufacturing industry

-

consumer health

-

others

Embedded finance by business model

-

platform

-

patron

-

Regulatory body

Embedded finance with a decentralized model

-

unique platform

-

Third party platform

Japanese embedded insurance market size and forecast

Built-in insurance by industry

-

Insurance built into consumer products

-

Built-in insurance in travel and hospitality

-

insurance built into the car

-

Embedded insurance in healthcare

-

Built-in insurance for real estate

-

Embedded Insurance in Transport and Logistics

-

insurance embedded in someone else

Embedded insurance by consumer segment

Built-in insurance by offer type

Built-in insurance by business model

-

platform

-

patron

-

Regulatory body

Built-in insurance by distribution model

-

unique platform

-

Third party platform

Embedded insurance by distribution channel

-

embedded sales

-

Bank sales

-

Broker/IFA

-

tied agent

Built-in insurance by insurance type

Embedded Insurance in the General Insurance Sector

Japan's embedded loan market size and forecast

Embedded Financing by Consumer Segment

-

Business Loans

-

personal loans

Embedded financing by the B2B sector

-

Embedded financing in retail and consumer goods

-

Embedded Financing in IT and Software Services

-

Embedded financing in media, entertainment and leisure

-

Embedded financing in manufacturing and distribution

-

Loans embedded in real estate

-

Other built-in financing

Embedded financing with the B2C sector

-

Embedded financing in retail shopping

-

Financing built into home improvements

-

Embedded financing in leisure and entertainment

-

Embedded financing in healthcare and wellness

-

Other embedded financing

Embedded Loans by Type

-

BNPL lending

-

POS rental

-

personal loan

Embedded financing by business model

-

platform

-

Supporter

-

Regulatory body

Embedded financing with distribution model

-

unique platform

-

Third party platform

Japanese embedded payment market size and forecast

Embedded payments by consumer segment

Embedded payments by end-use sector

-

Embedded payments in retail and consumer goods

-

Payments embedded in digital products and services

-

Payments embedded in utility bill payments

-

Embedded payments in travel and hospitality

-

Embedded payments in leisure and entertainment

-

Embedded payments in health and wellness

-

Payments embedded in office supplies and equipment

-

Other embedded payments

Built-in payments by business model

-

platform

-

patron

-

regulatory body

Incorporating a decentralized payment model

-

unique platform

-

Third Party Platforms

Size and forecast of Japan's embedded asset management market

Market size and forecast for Japan's asset management and finance industry

Asset-Based Financing by Asset Type

Asset-based financing by end users

For more information on this report, please visit: https://www.researchandmarkets.com/r/yf5rsi

About ResearchAndMarkets.com

ResearchAndMarkets.com is a leading global source of international market research reports and market data providing up-to-date data on international and regional markets, key industries, top companies, new products and latest trends.

attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900