I recently read about a study in MIT Technology Review that looked at the relationship between intelligence and success. The researchers were trying to understand the relationship between smartness and wealth.

They concluded: “The most successful people are not the most talented, they are simply the luckiest.”

I believe this is true. There is no correlation between knowledge and wealth. Warren Buffett once said,

“If history was all that was needed in the money game, the richest people would be librarians.”

The truth is, smart people have all the tools and ideas at their disposal to get rich, but they often don't use them. They tend to make the same mistakes over and over again.

Here are some of those mistakes. Can you relate to any of them? If you can avoid making them, wealth will come naturally.

1. Over-optimizing financial decisions

In my own journey, I have noticed a tendency among highly intelligent people to fall into the trap of over-optimization.

They spend countless hours researching and analyzing to make what they consider to be the “perfect” financial decision, whether it's investing in stocks, buying insurance, or choosing a mortgage plan.

The irony here is that in our quest for the best option, we often miss the best opportunities. The lesson? Keep it simple.

Money is a really simple concept.

- When you borrow money, you have to pay it back with interest, which means you end up paying back more than you borrowed.

- You probably won't always have money to work. We all get sick or injured. And most of us can't work until we're older. So think about your future income.

- Take control of your spending. You can build wealth by structurally spending less than you earn.

- It is better to be an owner than a lender. If you receive interest on a savings account, you are lending money. The profits are constant. If you are the owner of stocks, real estate, or a business, the profits are higher.

- If it doesn't make you money, there's no point. Forget about opportunities you don't understand.

Keeping that in mind will save you a lot of financial trouble in the future.

2. Follow the herd

Herd mentality, also known as the madness of the crowd, is a powerful psychological phenomenon in which people copy the actions and decisions of others, abandoning their own analysis and beliefs.

In investing, this can lead to speculative bubbles and huge losses.

Following the crowd isn't just an investing phenomenon. Herd behavior is prevalent in society. Think about buying cars, clothes, accessories, going on vacation, etc. We tend to want what other people want.

So try to step away from the crowd. Make your own path. Enjoy the simple life.

3. Dwelling too much on the past

Hindsight bias is the tendency to convince ourselves that we accurately predicted an event before it happened. This can lead people to conclude that they will be able to accurately predict other future events.

Many investors selectively remember their successes and forget their failures, which distorts their perception of their investing ability.

“If it's worked in the past, it'll work again.”

Probably. But it's not a guarantee. The same goes for our careers. We can't expect to always be able to earn an income with our existing skills. Just think of all the jobs that no longer exist.

Relying on hindsight bias can lead us to take excessive risks based on patterns of perception that may not hold true in the future.

4. Trying too hard

Regret aversion is the tendency to avoid decisions that are likely to lead to regret, even if those decisions may be economically beneficial.

Investors often hold onto losing investments for long periods of time or avoid buying undervalued assets for a few reasons.

- They are too afraid of making the wrong investment decision.

- In contrast, they may also fear missing out on big money by missing out on hot stocks.

- Or they have become unwilling to properly evaluate their own position.

This bias can lead to irrational behavior, such as trying too hard to make money, which can result in excessive risk taking or excessive risk aversion.

To overcome regret avoidance, stay centered. Balance is key.

5. Treat money differently depending on where it comes from

Mental accounting refers to the tendency to treat money differently depending on where it comes from and what it is used for.

For example, some people may be more inclined to splurge on luxuries from their tax refund than to save or pay off debt, simply because they consider it “extra” money.

The same goes for holiday bonuses. Most people would rather spend it than invest it. Why? Money is money.

We should treat all money equally, regardless of how hard or easy it was to get it.

6. Focus on losses

Loss aversion is the tendency to prefer avoiding losses over obtaining equivalent gains.

In investing, this can manifest itself in holding losing investments for long periods in the hope of breaking even, rather than cutting losses and reallocating resources more effectively.

This bias stems from the psychological pain that accompanies financial losses, and because losses are more emotionally painful than gains, we tend to focus on them. As stock-picking legend Peter Lynch put it:

“People who succeed in the stock market accept regular losses, setbacks, and surprises. Disastrous declines don't scare them away from trading.”

This was my biggest mistake when I started investing. I had a bad experience the first time I bought stocks so I focused too much on the potential for loss.

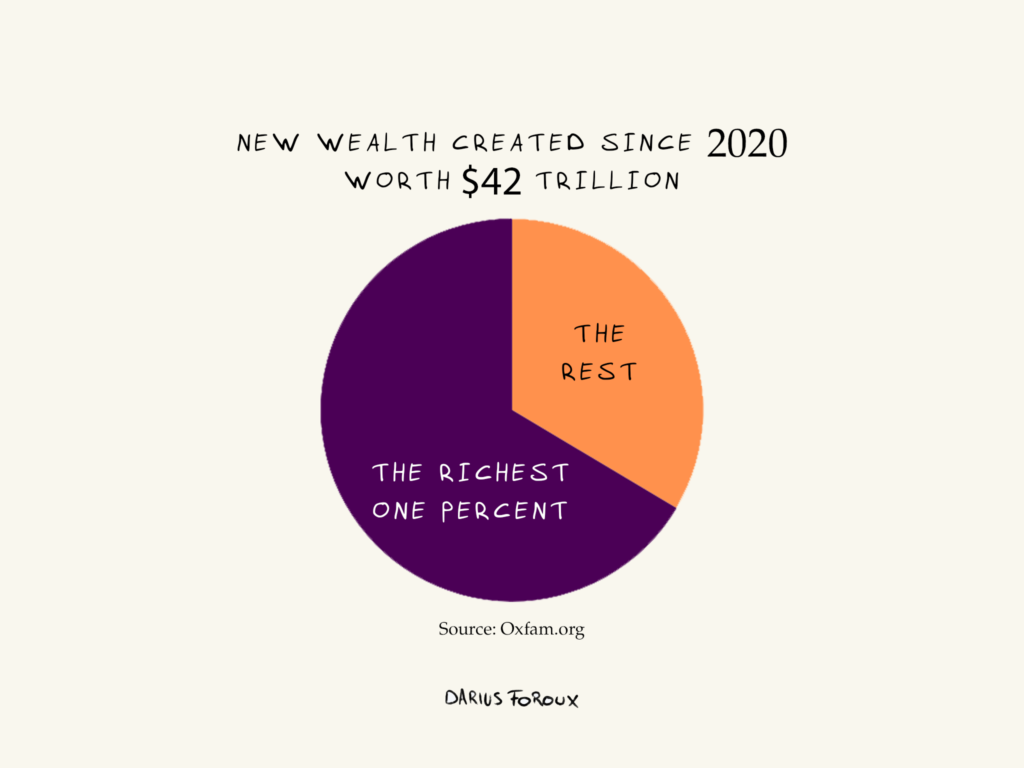

In fact, this is a common misconception about stocks and Wall Street: Many people think it's just for the rich, that guys in suits are scamming the public. Sure, there may be some truth to that.

But there's no denying that the stock market is the biggest wealth generator on the planet, so try to focus on that instead.

7. Confirmation Bias

Confirmation bias is the tendency to seek out, interpret, and remember information that supports our existing beliefs, while ignoring or discounting information that contradicts them.

This bias can lead individuals to make choices based on incomplete or biased information, significantly affecting financial decision-making.

When you have an idea for investing in something, you may start looking for evidence to support your idea. It's easy to cherry-pick the pros of any investment, but when it comes to your own money, you have to also voice the cons.

Questioning your own beliefs. This is probably one of the hardest things to do. think I have a great idea.

But that optimism shouldn't get in the way of making sound financial decisions.

Understanding and addressing these psychological biases can help anyone make better financial decisions — that's how we achieve long-term wealth and success.