It's easy to understand why investors are attracted to unprofitable companies — for example, Salesforce.com, the software-as-a-service company that lost money for years while its recurring revenue grew, would certainly have made a big profit if you held its shares since 2005. But the harsh reality is that many loss-making companies burn through cash and go bankrupt.

Considering this risk, we Solid Bioscience (NASDAQ:SLDB) shareholders should be concerned about the company's cash burn. For the purposes of this article, we define cash burn as annual (negative) free cash flow, which is the amount a company spends each year to fund growth. The first step is to compare the cash burn to its cash reserves to find the “cash runway”.

Check out our latest analysis for Solid Biosciences

Does Solid Biosciences have a long-term cash runway?

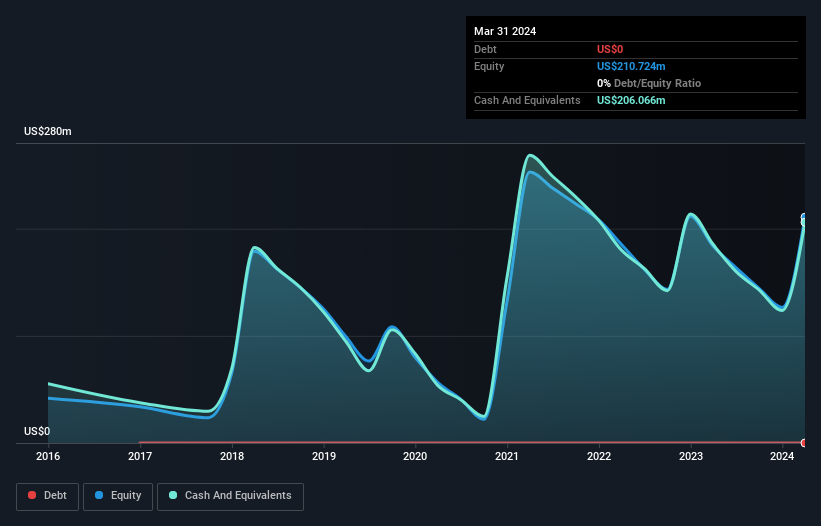

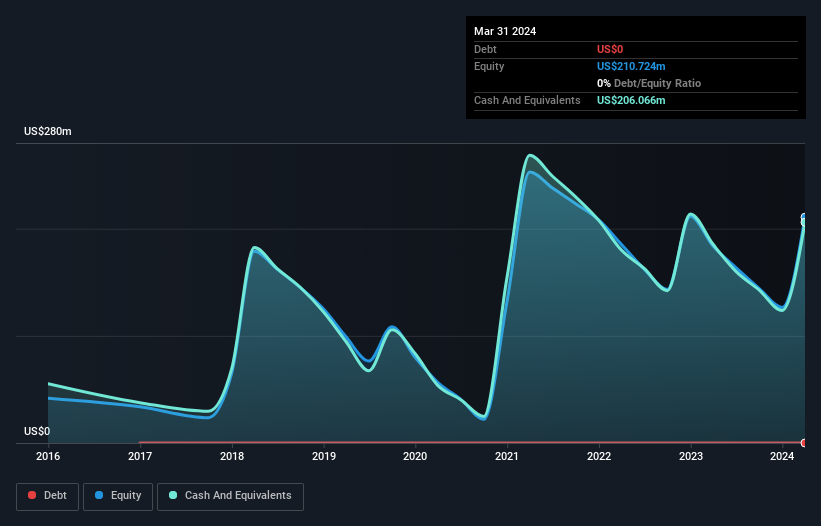

Cash runway is defined as the length of time it would take a company to run out of funds if it kept spending at its current cash burn rate. When Solid Biosciences last reported its balance sheet in May 2024 for March 2024, it had zero debt and US$206 million in cash. Importantly, its trailing twelve-month cash burn was US$93 million. So it had a cash runway of 2.2 years from March 2024. Arguably, that's a prudent and reasonable runway length. The image below shows how its cash balance has changed over the past years.

How has Solid Biosciences' cash burn changed over time?

We consider Solid Biosciences an early-stage business as it is not currently generating revenue. Therefore, we can't look at sales to understand growth, but we can look at the change in cash burn to get an idea of how spending is trending over time. In fact, the company's cash burn has decreased by 9.4% over the past year, suggesting that management is maintaining a fairly stable rate of business development, even as spending is declining slightly. Obviously, however, a key factor is whether the company will expand its operations going forward. That's why it makes a lot of sense to take a look at our analyst forecasts for the company.

Can Solid Biosciences raise capital easily?

Despite reducing its cash burn recently, shareholders should consider how easy it will be for Solid Biosciences to raise more cash in the future. Companies can raise capital through either debt or equity. Many companies will end up issuing new shares to fund future growth. Comparing a company's cash burn to its market capitalization can give us an idea of how many new shares a company would have to issue to fund one year of operations.

Solid Biosciences' cash burn was $93 million, roughly 30% of its market cap of $313 million. That's a sizeable cash burn, and shareholders will suffer significant dilution if the company has to sell shares to cover operating expenses over the next year.

Are you concerned about Solid Biosciences' cash burn?

In our analysis of Solid Biosciences' cash burn, we find the company's cash runway reassuring, but the cash burn relative to its market capitalization is a bit worrying. Companies that burn cash are always risky, but considering all the factors we've discussed in this short article, we're not too worried about the rate of cash burn. Apart from that, we'll look at the various risks affecting the company and 5 warning signs for Solid Biosciences (Three of them are unpleasant for us!) It’s something you should know about.

of course, You may find a great investment by looking elsewhere. Take a look at this free A list of interesting companies and growth stocks according to analysts' forecasts

Have feedback about this article? Concerns about the content? contact Please contact us directly. Or email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We use only unbiased methodologies to provide commentary based on historical data and analyst forecasts, and our articles are not intended as financial advice. It is not a recommendation to buy or sell stocks, and does not take into account your objectives, or your financial situation. We seek to provide long-term focused analysis driven by fundamental data. Note that our analysis may not take into account the latest price sensitive company announcements or qualitative material. Simply Wall St has no position in any of the stocks mentioned.