Absa Group, one of Africa's largest diversified financial services firms, is looking to build stronger ties with Chinese companies as part of its global expansion strategy amid growing investment and trade between China and Africa.

Through the subsidiary, which was officially launched in Beijing in early May, the Johannesburg, South Africa-based bank will focus on strengthening ties with state-owned enterprises, private companies, banks and development finance institutions, according to Absa China CEO Klaus-Dieter Kaefer.

“Absa's strategy in China is to use our offices to strengthen links with the headquarters of Chinese companies operating in Africa,” he said.

Have questions about big stories and trends from around the world? Find the answers on SCMP Knowledge, our new platform that provides explainers, FAQs, analyses and infographics and other curated content from our award-winning team.

Absa already has a healthy customer base and will be looking to promote itself and build closer relationships with potential customers in mainland China, he added.

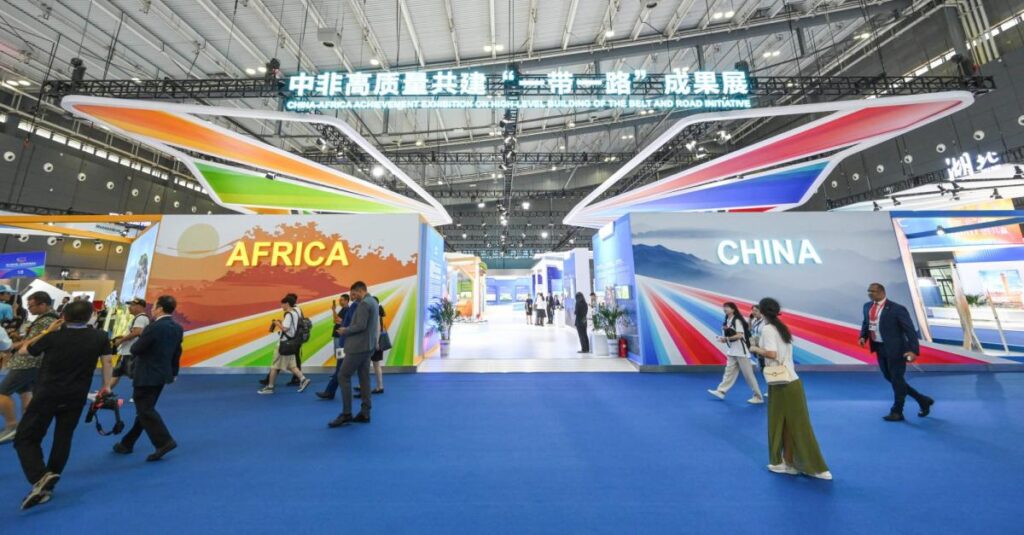

Visitors walk in front of an exhibition of China-Africa achievements at the 3rd China-Africa Economic and Trade Expo held in Changsha, central China's Hunan province, in June last year. Photo: Xinhua News Agency alt=Visitors walk in front of an exhibition of China-Africa achievements at the 3rd China-Africa Economic and Trade Expo held in Changsha, central China's Hunan province, in June last year. Photo: Xinhua News Agency>

Absa's Beijing office operates under a Wholly Foreign Enterprise Licence, which allows it to provide general advisory services and research to China-based clients on transactions across Africa.

“To be clear, we do not operate in China, we do not operate domestically,” Kaempfer said. “What we do is build relationships and advise on Absa Group's capabilities in Africa, and our operations are actually carried out in Africa.”

Plans to open the China office were revealed in May last year by Zhu Kai, principal and head of China Corridor at Absa Corporate and Investment Bank. The office was initially scheduled to open at the end of 2023, but the licence was only granted in December and the team was subsequently hired, delaying the opening until last month.

China's total trade with Africa in 2023 will rise 1.5% from the previous year to $282.1 billion, while the continent's trade deficit with the world's second-largest economy widened 36.4% to $65 billion, according to Chinese customs data released in February.

Total Chinese investment in Africa is expected to reach nearly $11 billion in 2023, the highest level since at least 2005, according to data from the American Enterprise Institute, a Washington-based think tank.

“We believe what makes Absa an attractive banking and financial services partner is the quality and depth of our network. Our core business is in Africa and we have been operating there for over 100 years,” Kaempfer said.

The bank has a strong presence in many sectors, he added.

“We are a leading provider of renewable energy finance across the African continent and have highly talented teams in mining, minerals, trade finance and debt.”

This article originally appeared in the South China Morning Post (SCMP), the most authoritative news source on China and Asia for more than a century. For more SCMP articles, visit the SCMP app or follow SCMP on Facebook. twitter P a g e Copyright © 2024 South China Morning Post Publishers Ltd. All rights reserved.

Copyright (c) 2024. South China Morning Post Publishers Ltd. All rights reserved.