Dave Ramsey, a respected and sought-after financial guru known for his candid advice, reveals how wealthy people stay wealthy. Here's what they do:

There is no shortage of rich people on the planet, and the Forbes 2024 Billionaires List proves it. According to Forbes, there are 2,781 billionaires on the list from all over the world, of which 813 are from the United States, the country with the highest number of billionaires compared to any other country. This is 141 more than the 2023 list, with a total wealth of $14.2 trillion. And let's not forget about the billionaires. In 2023, the United States will have about 22 million billionaires, which is about 40% of the world's billionaires.

do not miss it:

-

Are you rich? Here are the conditions necessary for an American to be considered wealthy:

-

The average American couple has this much money saved for retirement. How do they compare??

As the list of millionaires and billionaires grows every year, many will ask how the wealthy built such wealth and how they stay wealthy. On The Dave Ramsey Show, Ramsey explained, “Rich people don't ask, 'How much is down and how much is monthly?' Instead, they ask, 'How much? To avoid paying.'” According to Ramsey, who has an estimated net worth of around $200 million, the rich can keep their money by paying full price. If they can't, they just don't buy it.

“That's what made them wealthy and what keeps them wealthy,” Ramsey said.

“Just because you can pay doesn't mean you can afford it,” Ramsay stressed on social media.

Avoiding buying things you can't afford is one of Ramsay's tips to build lasting wealth. Another is to start thinking like the rich. For Ramsay, this means thinking and planning for the long term. During the show, Ramsay revealed, “If you think and act like the rich, you will become rich.” According to Ramsay, thinking like the rich means having a will, financial plan, and retirement plan from a young age. The rich also buy insurance for protection.

trend: Real estate investing just got a lot easier. This Jeff Bezos-backed startup is Become a homeowner in just 10 minutes. All it takes is $100.

Ramsay advises do not have Living beyond your means and diving into retirement savings early also means thinking like the rich. Thinking like the rich also means avoiding debt. For Ramsey, this includes avoiding a mortgage if possible. But he recognizes that this may be unrealistic for some, so he advises not to spend more than 25% of your fixed income on housing costs and opt for a 15-year fixed-rate mortgage. If you're in debt, Ramsey suggests prioritizing paying off your debts using the snowball method, since you won't get rich if you're stuck in debt.

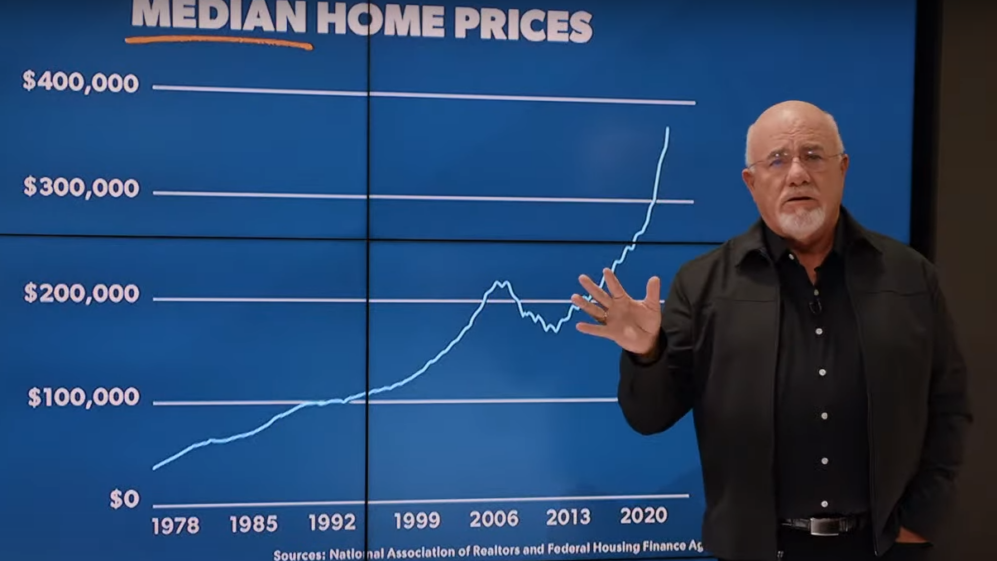

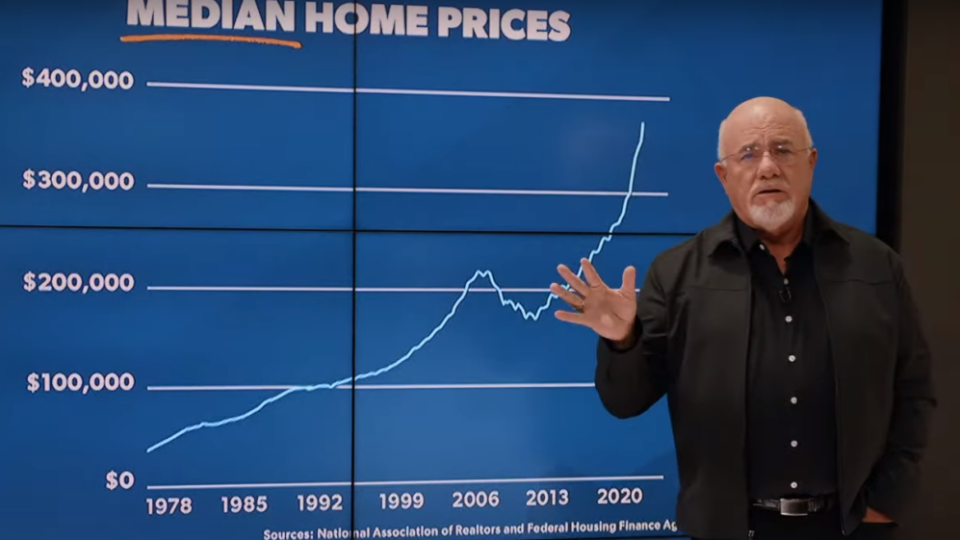

Another way to think like a rich person, according to Ramsay, is to invest in things you understand and avoid investing in what's trendy or “cool.” For Ramsay, this means investing in real estate, mutual funds, and businesses. Investing for retirement is also a good idea, and you can use tax-advantaged accounts like 401(k)s.

The rich stay rich by thinking like rich people. According to Ramsay, getting rich is more about action than knowledge. Ramsay once wrote, “Getting rich is 80 percent action and 20 percent head knowledge,” and added, “Most people know what to do, but they don't do it. If you can control what you see in the mirror, you can be rich and skinny.”

Read next:

Up your stock market game with Benzinga Pro, the #1 “News and Everything Else” trading tool in the “Active Investor's Secret Weapon” – Start your 14-day trial now by clicking here.

Want the latest stock analysis from Benzinga?

The article, Dave Ramsey Explains Why the Rich Stay Rich: “Pay It or Don't Buy It” originally appeared on Benzinga.com.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.