Skift Take

Dennis Schaal

When an online travel company has a fast-growing division, it usually doesn't take much effort to get executives to tout it, but that's not the case with Booking Holdings and its nine-year-old division, Booking.com for Business.

Booking.com for Business has an exclusive partnership with travel management company CWT, which provides the company with 24/7 customer service and fulfillment, as well as flight, car rental and hotel inventory, including loyalty rates and offers from major chains that are normally only available on hotel websites.

With CWT set to be acquired by American Express Global Business Travel, we asked Booking.com what the deal will be.

We also wanted to learn more about the strategy and details around growing this segment, and how business travel may or may not relate to Booking's Genius Rewards program.

Booking.com doesn't release figures for Booking.com for Business, which has a product team based in Singapore, and declined to comment on the matter. Amex GBT also declined to comment.

Booking.com for Business in Numbers

However, Skift was able to find some numbers on Booking.com for Business through its partner company Serko, which runs the Booking.com for Business platform. Serko is a publicly listed company that trades in New Zealand and Australia.

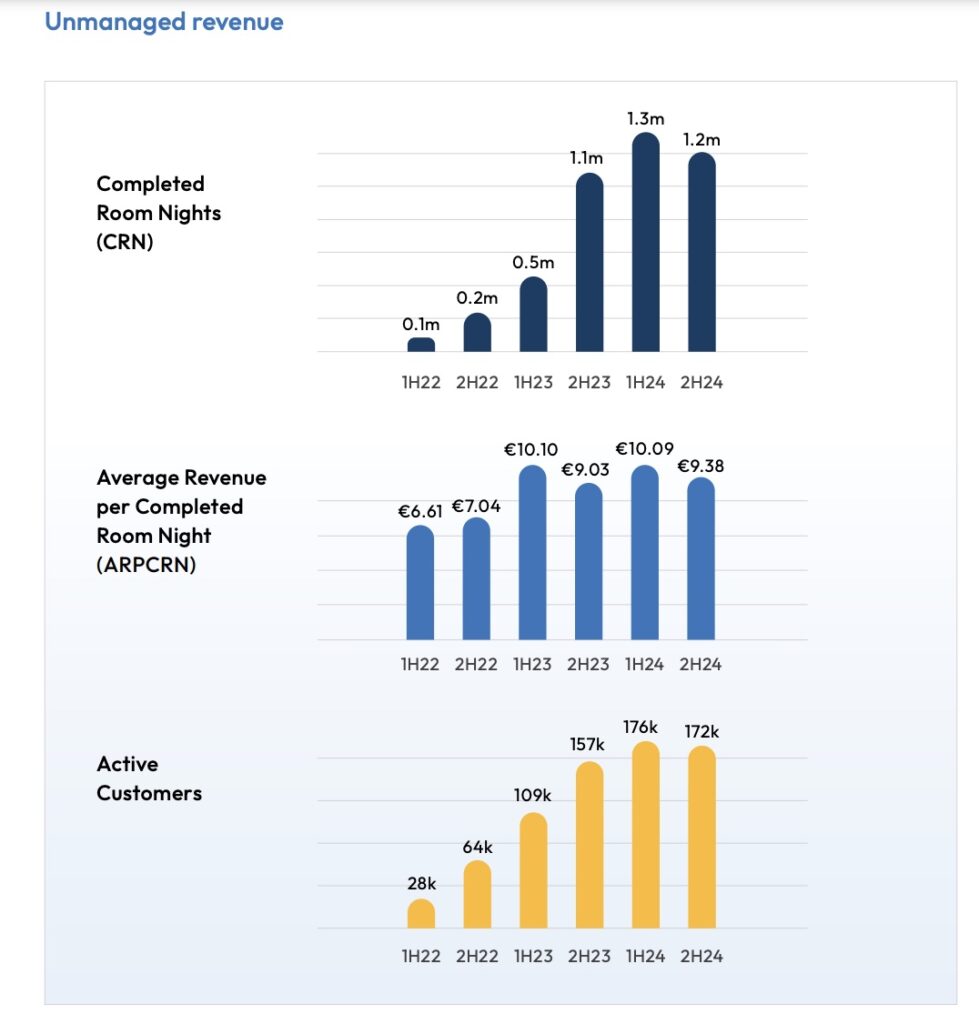

As seen in the graph below, Serko's annual report showed that Booking.com for Business' completed room nights (excluding cancellations) grew 65% to 2.5 million nights in the fiscal year ending March 31, 2024.

Booking.com for Business obtains inventory from multiple sources, including direct relationships with hotels, bed banks, CWTs and a global distribution system. Serko's completed nights count does not include nights booked on the platform by Booking customers from the global distribution system. As such, Booking.com for Business' completed nights count may actually be higher than 2.5 million.

Booking.com for Business accounts for almost all of Serko's unmanaged business travel activity. Unmanaged business travel refers to small to medium-sized businesses that don't have a formal corporate travel policy. These types of companies are Booking.com for Business' target customers.

Booking.com for Business room nights are just a fraction of the total room nights at Booking Holdings, which is expected to generate more than $20 billion in revenue in 2023. The Booking.com for Business room nights that Selko cited represent less than 1% of Booking Holdings room nights.

Instead of commenting on Booking.com for Business, Booking Holdings may want to emphasize that it is focusing on its core leisure travel business and expanding its air travel and AI-related products.

Booking.com for Business Room Nights and Active Customers

The accompanying chart also shows that Booking.com for Business' active corporate clients grew 10% in fiscal 2024 to 172,000. (Note that the number of active clients fell by 4,000 in the second half of the year compared to the first half.)

According to the Booking.com for Business website, clients include the University of Chicago, Rt Motorsports, New York Institute of Finance, Soft Serve and Mark Miller Subaru of Southtown, Utah.

Serco said its revenue, which consists mainly of hotel fees, will grow 4% in fiscal 2024. The chart shows Serco's average revenue per night is 10.09 euros ($11) in the first half of fiscal 2024 and 9.38 euros ($10.22) in the second half.

No one has disclosed Booking.com for Business revenues or CWT revenues from partnerships.

Booking.com for business strategies

In April, Serco announced it had renewed its partnership with Booking.com for another five years.

“Our new five-year partnership with Booking.com, announced on April 30, 2024, marks a major milestone and lays a strong foundation for future global scale,” said Selko. “Together with Booking.com, we are executing on our plans to realize further growth through customer acquisition and activation, as well as the expansion of our product offering.”

In the filing, Selko said other elements of Booking.com for Business' growth strategy include increasing the use of incentives and loyalty rewards to encourage repeat business travelers, as well as improving the post-booking experience to retain customers.

Booking.com also plans to add managed travel program features, which means it's looking to attract larger companies.

Selco announced this week that it had hired David Holyoke, former head of commercial strategy at Airbnb, as head of unmanaged business travel.

Booking Holdings declined to comment for this article, but Joshua Wood, director of business travel at Booking.com, has spoken about the partnership and strategy at least twice at Serko events over the past few years.

Check out one of the interviews in the video below.

Photo credit: Pictured is a business traveller. Booking.com for Business saw a 65% increase in room bookings last year.