Investors who shorted Tesla (TSLA) found out the downside this week, losing roughly $3.5 billion in market valuation, according to data from S3 Partners reported by CNBC.

Traders who take a short position are making a bet against a stock: they borrow shares, sell them, and hope to be able to cover their position later by buying cheaper shares and pocketing the difference.

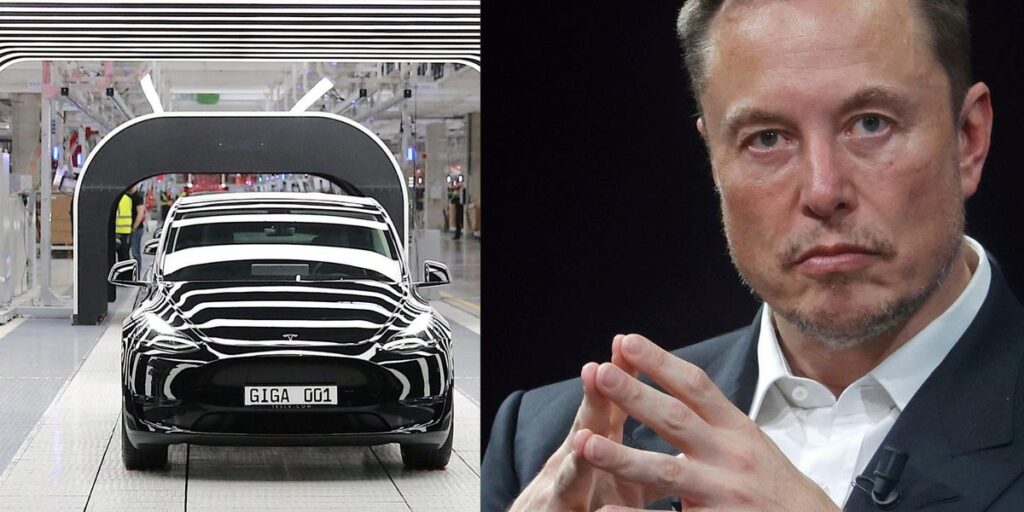

The electric-car maker may have been on the right track after its sales fell for the second straight quarter, dropping 4.7% from a year ago. But the results still beat Wall Street expectations. CNBC reported the consensus estimate of 439,000 units. Tesla reported 443,956 units.

The slight recovery surprised short sellers, and despite the overall setback caused by falling sales, the market reaction was immediately positive. Traders have sent the company's shares soaring by about 22% since Monday.

According to MarketBeat, the current short interest balance is 105.38 Million shares, or 3.30% of the total shares.

On Tuesday, Elon Musk hit up X and responded to the results with a series of retweets, including a video showcasing Tesla's Autopilot feature and boasting that anyone who tries it will never use anything else, and a statement that Tesla is the only publicly traded stock he owns.

He didn't forget about short sellers: In a tweet reply the same day, he warned that bettors against the stock would “disappear” after the company resolves issues with its autonomous technology and its Optimus humanoid robot, a remark that also included Bill Gates by name.

A feud erupted between the two billionaires in 2022 when it was revealed that the former Microsoft CEO had shorted $500 million in Tesla shares. It is unclear whether Gates still holds any short positions.

Tesla's beta version of its full self-driving (FSD) software was first released in 2020. But it still requires a human to be at the wheel, at Level 2 out of the industry standard of 5. As for Optimus, in an earlier earnings call, Musk said he thinks a “sentient” humanoid would be “more valuable than everything else combined,” and promised its release next year.

Tesla's deliveries provide a preview of what investors can expect from Tesla's second-quarter earnings, due to be released on July 23. Analyst consensus remains with a “hold” rating on the company's stock. Earnings per share estimate is $0.60, up from $0.59 a month ago.

The company has missed expectations for each of the past three quarters, according to MarketWatch data, and in its most recent quarterly results, the company reported a 9% decline in revenue compared to the prior year.