India's life insurance industry is the 10th largest in the world and one of the fastest growing. This strength is no coincidence; it is driven by two key drivers: rapid digitization and understanding of the insurance industry. Changing customer preferences.

Anyone involved in modern life would know that Indians use their smartphones and mobile devices to search for anything they need. Most of these actions today start with a simple Google search, whether it is searching for a mundane household item or researching information for an important life decision like searching for a life insurance plan.

Get cash in minutes!

Best personal loans with lowest interest rates

Apply now

In 2024, understanding what your customers want will no longer be a A luxury item, but a necessity. Some Indian InsurTech companies are already leading the way by intelligently adopting customer preferences. Digital marketing strategy.

To understand this better Life Insurance and Changing Consumer PreferencesHere we take a closer look at the insights uncovered by leading digital marketing agency Techmagnate in their search trends report.

Techmagnate’s Life Insurance Search Trends Report provides insightful data about the life insurance industry, from the most searched keywords to the top brands, and ultimately, what this data says about the people searching for what’s on offer.

Life Insurance Trends in India: Riding the Digital Wave

The adoption of digital processes in the insurance industry has transformed the entire industry. From streamlined online applications to readily available insurance information, these innovations have transformed the life insurance It's now more accessible and user-friendly than ever before.

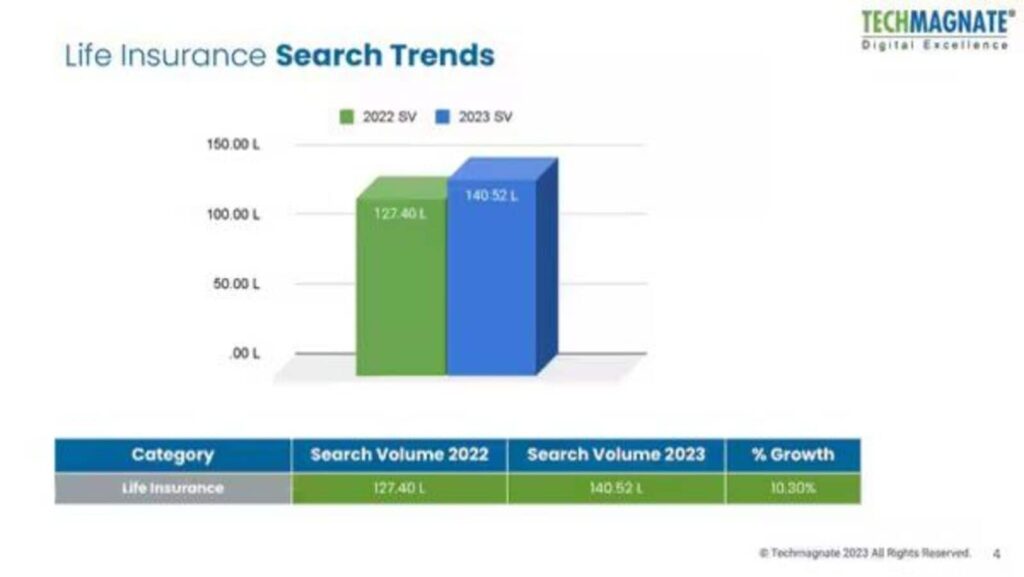

According to the report, searches for “life insurance” are expected to grow by 10.30% in 2023 alone, highlighting the growing preference for digital convenience.

“We are a leading provider of services to our customers,” said Sarvesh Bagla, CEO and founder of Tech Magnates. 27,800 Keywords We conducted a study in the life insurance industry and discovered some interesting search patterns. We discovered new brands that are gaining popularity in search volume and learned about the preferred budget for life insurance. These insights are essential for brands to understand the changing customer preferences for targeted digital marketing campaigns.”

Life Insurance and Customer Satisfaction: Putting People First

The rising trend in life insurance isn't just down to technological advances — it's also about a growing focus on priorities. customer satisfaction We've achieved more than ever before. Our strong risk management practices and commitment to timely claims processing have built trust and confidence in the industry.

Initiatives such as simplified communication channels and complaint handling mechanisms further demonstrate the brand's focus on understanding and addressing customer needs.

Understanding life insurance trends from Techmagnate report

So what specifically do people’s search patterns reveal about the life insurance industry?

For one, established brands continue to capture people’s attention and search preferences, mobile devices have become a marketer’s best friend, and connecting with people within the confines of local branches and local languages is a game changer.

Let's take a closer look.

Brand Powerhouse

When it comes to searching for the best life insurance plan, there are a few brands that stand out as trusted, go-to providers: Life Insurance Corporation of India (LIC) tops the charts in terms of search volume (68.86 Million in 2023), followed by Max Life Insurance (11.87 Million in 2023) and HDFC Life Insurance (11.46 Million in 2023).

These brands consistently dominate search results and have established a strong presence in the minds of customers, which is reflected in search volume.

Beyond the Giants

Techmagnate's report highlights some notable trends in search behavior: Most people continue to search for specific insurance companies, accounting for 91.81% of searches. Additionally, users may also directly search for well-known insurance companies they already know and trust, such as LIC or HDFC.

But we're also seeing an increase in broader searches that aren't tied to a specific brand.Best Life Insurance“or “Term Insurance Benefits” indicates a growing interest in exploring different options. Users are looking at different insurance companies and comparing the market before deciding.

The Importance of Mobile

As more people turn to their smartphones for everyday tasks, like managing their finances and insurance, user-friendly mobile apps have become a must-have for brands.

The number of searches for LIC Digital increased from 31,910 in 2022 to 40,970 in 2023, registering a growth of 28.39%. Similarly, the number of searches for HDFC Life Insurance App increased from 16,150 in 2022 to 19,410 in 2023, registering a growth of 20.19%.

Apps like LIC Digital and HDFC Life Insurance App have seen a significant increase in search volumes, highlighting the importance of a mobile-first strategy.

Think local

Another interesting insight from the report is the prevalence of “near me” searches in the life insurance space: “near me” searches increased 32.10% from the previous year (2022).

This surge indicates that consumers are increasingly looking for insurance services locally. 99.29% of brand-related queries With non-branded searches at 0.71%, it's clear that local search preferences are becoming more prominent in this industry. This highlights the importance for insurance companies to prioritize local SEO and effectively engage with potential customers. Incidentally, leveraging their brick-and-mortar locations is also how these companies gain an advantage over fintech disruptors.

A similar trend is evident in the personal loan industry: with a commanding market share of 99.62%, unbranded local search continues to be a key driver of personal loan trends.

Native language search

Dialect search volume, which represents searches made in regional languages such as Tamil, Gujarati, and Hindi, 19.06% in 2023 Searches reached 11.18K compared to 2022's 9.39K.

This increase indicates a growing preference for searches in native languages and highlights the importance of catering to diverse linguistic preferences in your digital marketing strategy.

The Future of Life Insurance

Leveraging the power of search insights is paramount for insurers to stay ahead of the curve. By understanding emerging trends in the life insurance industry, evolving customer preferences, optimizing digital experiences, and prioritizing mobile accessibility, insurers can better serve the needs of their target audience.

Techmagnate's Life Insurance Search Trends Report provides a valuable roadmap for navigating this dynamic landscape, with unique insights that can help the industry customize offerings, strengthen digital presence, and build stronger relationships with customers.

Remember, in the digital age, your customers are at the wheel of your search bar, and the key to earning their trust and loyalty is to understand what they're looking for.

Disclaimer: This article is a paid publication and has no journalistic/editorial involvement of Hindustan Times. Hindustan Times does not endorse/support the content of the article/advertisement and/or the views expressed herein. Hindustan Times is not responsible or liable in any manner whatsoever for anything stated in the article and/or any views, opinions, statements, declarations, assertions etc. expressed in the article. This article does not constitute financial advice.

3.6 Million Indians visited us in a single day and chose us as their platform for Indian General Election Results. Check out the latest updates here!