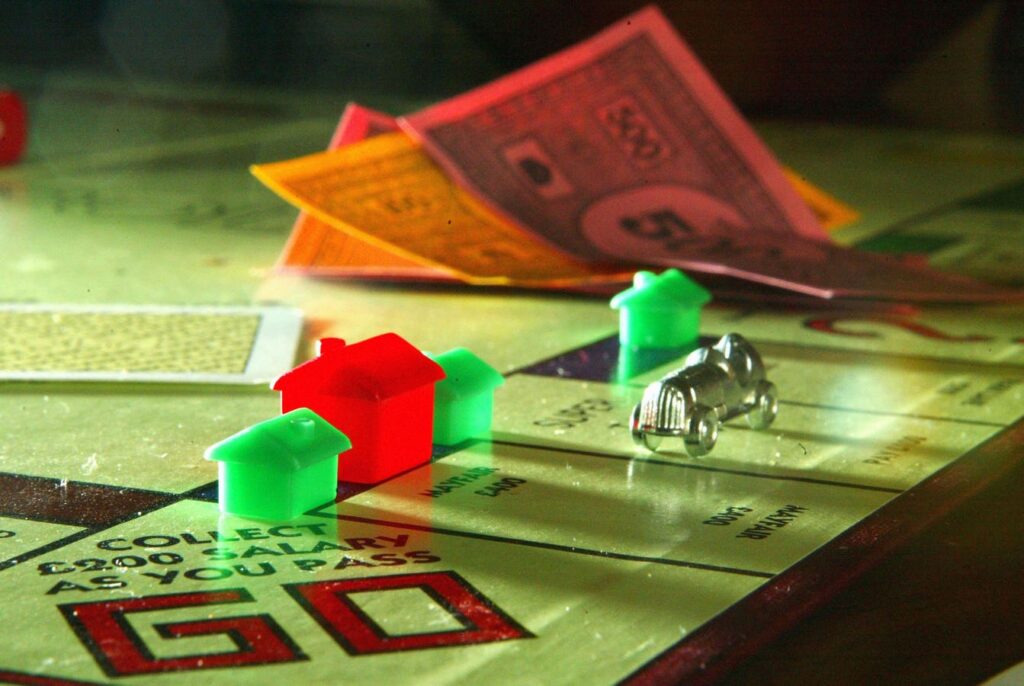

GLASGOW, SCOTLAND – AUGUST 5: Monopoly board adorns the famous London Street House on August 5 … [+]

Most of the financial advice out there sounds the same.

- Spend less than you earn.

- Establish a budget.

- Save or invest for the future.

- Pay yourself first.

- etc.

Recent recognition of research conducted by financial psychologists and financial therapy techniques shows that most financial behavior is not just a matter of arithmetic, but is also a matter of emotions, internalized beliefs, reactions to historical and current exclusion, and more. However, there is still a tendency to ridicule the poor with content that proclaims that improving one's financial situation involves not only calculation but also thinking, especially overcoming the mindset of scarcity.

The idea of looking at the world through the lens of abundance rather than scarcity sounds good in theory, just as the equation of spending less than you earn makes sense on paper, but I don't think it's necessarily good for people who have developed a scarcity mindset. A class they hope to attend someday.

How much is enough?

The process of wealth accumulation is perfectly demonstrated in the classic game of Monopoly. Although hailed as a blueprint for economic freedom, there is an undercurrent of economic domination and dominance that reinforces ideas of scarcity. Once all the real estate is owned and all other players are forced into bankruptcy, there will be a clear winner. Of course, building wealth in real life is not a linear equation, but like the game Monopoly, those with fewer economic resources are only safe in the gray area of chance, relying on community subsidies and low-cost real estate. unable to find shelter. You can own it or put it in jail. This assumes that everyone starts the game with equal access to resources and opportunities.

In real life, many people are caught up in a game that lasts for generations, the sole purpose of which is to maintain the advantage they have been given by putting as much distance as possible between themselves and the less fortunate. , or fighting to rise to some position. equality. From this perspective, the rich may not experience scarcity due to their access to resources, but because of created scarcity, operating for survival, and generational economic trauma, the poor It is possible that people still struggle with the very scarcity mindset that they are often accused of.

Real-life examples of this happen every day, as large corporations swallow small businesses, single-family homes are purchased by commercial companies, and even multi-billionaires like Bill Gates hoard land. While conspiracy theories surrounding the intent of such acts have spread and been debunked, the realization that what one person can have, another cannot have continues to grow during Amazon's Prime Day and Black Friday sales each year. It remains deeply rooted inside. As consumers rush to grab a slice of the sale and billionaires' deep pockets deepen, scarcity is wielded as a weapon, widening the gap between the haves and have-nots.

financial savings

Some perspectives on financial savings point to previously observed or experienced financial trauma. It “requires positive behavior, such as saving to unhealthy extremes,” Canale, A., Klontz, B. (2013) state. First-generation high-income earners may rely on savings because they experienced financial hardship in childhood or adolescence. The constant fear of reliving these experiences can lead to people hoarding cash, aggressively saving a portion of their income, and extreme acceptance of conventional financial advice masquerading as good money habits. It may be motivating to do so.

Financial hoarding can be seen as more than just a response to trauma and can simply be a symptom of greed or entitlement.

Wealth is as much about status as it is about the numbers in your bank account.

Maintaining a level of status that separates you from the next person not only maintains that gap, but can also motivate you to widen it. This book highlights the intersection of wealth and race, highlighting the racial wealth gap, the racial wage gap, and the importance of equitable and inclusive approaches to financial education and career development. Masu.

equality of wealth

Marginalized communities can overcome physical scarcity through education and well-paying careers. Still, they may be looking for clues about how elites and upper classes manage their wealth outside of their communities. Benchmarks of success are extrinsically motivating as demonstrations of wealth, rather than controlling wealth based on intrinsic need. The pursuit of and demonstration of wealth can quickly move from covering basic and luxurious wants and needs to demands for recognition of status within and outside the community. For black communities in particular, the pursuit of wealth means security, not only in material terms such as food, clothing, and shelter, but also as a buffer between racism and class status. To that end, building wealth may look like a battle for dominance within black communities and other communities of color, and a battle to be seen and treated equally by white people regardless of class status. I don't know.

spectrum of scarcity

It is interesting to note how scarcity appears at both ends of the wealth spectrum and can be influenced by different motivating factors. While the idea that a change in mindset is coupled with basic money management education and techniques holds promise in recognizing factors that exist outside of a purely educational perspective, it also It may be dangerous to express this as a matter of changing one's way of thinking. Nor does it examine, inform, or highlight the motives behind the change in the first place. This is why the work of a financial therapist or financial counselor is so important to a team of pursuing financial professionals. Helping clients set goals that align with their values, especially without understanding their intrinsic motivation to achieve their goals, and what others have done and are currently doing. You no longer have to set goals based on