Hispanolistic/E+ (via Getty Images)

investment thesis

HelloFresh (OTCPK:HLFFF) was the first company I wrote about on Seeking Alpha. And now, 120 articles later, I decided it was time to do the following: Revisit my investment thesis and see what's changed for this company over the past 15 months.

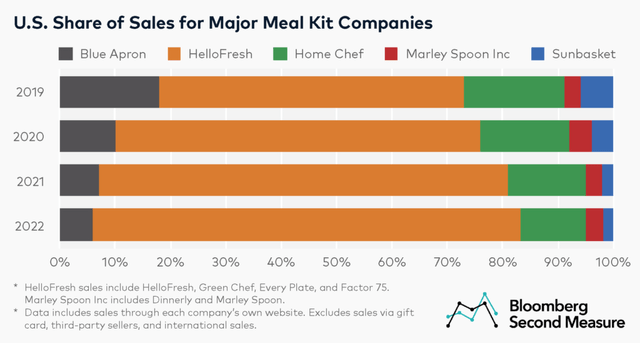

My view of the business is pretty much the same as the detailed investment theory I explained in my last article, and the short version is as follows. HelloFresh is the world's largest meal kit delivery company and continues to dominate its most important markets. The company accounts for 78% of U.S. meal kit sales and is expected to account for 78% of meal kit sales in 2022. That demand will only widen the gap between HelloFresh and smaller competitors.

Bloomberg second measure

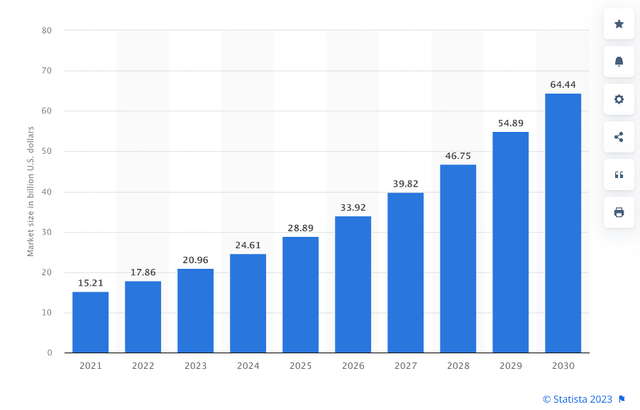

Finally, according to Statista, the global meal kit services market is expected to grow at a CAGR of 17.4% from 2023 to 2030, reaching a total value of $64.44 billion. HelloFresh has seen steady growth growth during the pandemic, and although growth has recently stalled as the world opens up again, it remains an industry leader that is poised for long-term growth once again.

Global meal kit service market size (Statista)

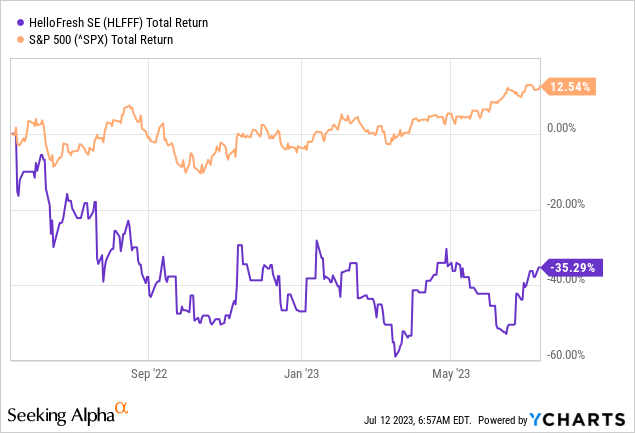

Unfortunately, due to this slowing growth and heavy capex cycle, HelloFresh stock is down about 35% since May 2022 compared to a total gain of 12.5%, so my first Seeking Alpha article So far it has been a bit of a failure. For the S&P 500 (my personal benchmark).

But the stock market doesn't care much about the past, so let's take a quick look at what's happening with HelloFresh from May 2022 onwards and whether it's an attractive investment from this point on. Sho.

How serious is this growth slowdown?

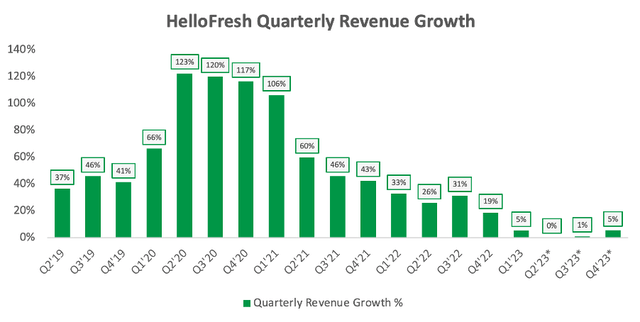

Let me be clear about the biggest reason I think my previous “buy” rating on HelloFresh didn't work out. That is, revenue growth has slowed more rapidly than expected. Reasons include the easing of lockdown restrictions and widespread economic uncertainty over the past six to 12 months due to soaring inflation and rising interest rates.

The chart below shows how much of a slowdown HelloFresh experienced in Q1 2023, with revenue growth only growing at 5% year over year.

Author's work / TIKR

The slowdown is expected to continue throughout the year, with analysts expecting sales growth to range from zero to low single digits in each quarter of 2023, according to TIKR. However, revenue growth is expected to recover slightly to 10.8% in 2024 and 8.2% in 2025. So even though the era of steady 30%+ growth is over, analysts still expect HelloFresh to continue growing.

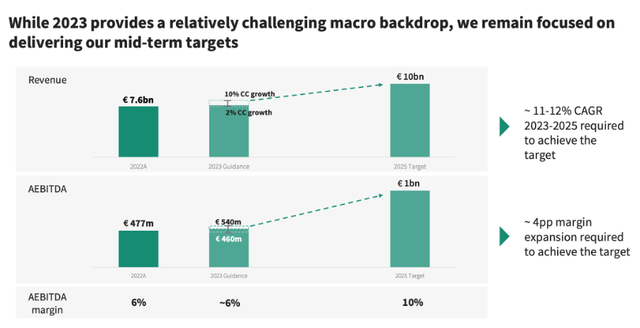

Management is a bit optimistic, as they believe HelloFresh can achieve revenue of 10 billion euros by 2025 (for reference, analysts currently expect 9.5 billion euros). This equates to approximately 11-12% annual revenue growth from 2023 to 2025, according to the latest Capital Markets Day presentation.

HelloFresh 2023 Capital Markets Day Presentation

The company also expects to achieve €1 billion in adjusted EBITDA by 2025, which will require near-significant margin expansion from this point on, but as the latest investment cycle draws to a close. We believe that this is achievable. Start reaping the rewards of these investments.

The capital investment cycle is nearing its end

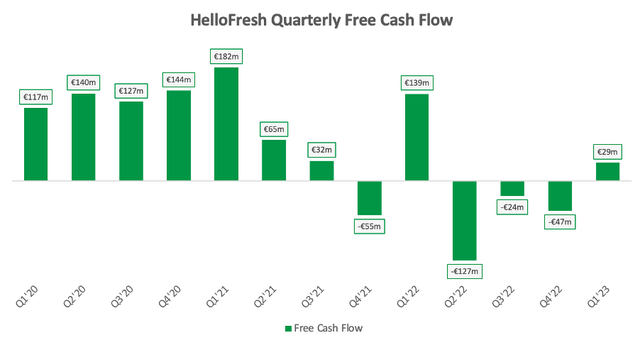

Another factor that has weighed on HelloFresh over the past few years is declining free cash flow. The company is something of a maverick in the meal kit delivery space thanks to its profitability, but I was initially drawn to HelloFresh because of its impressive cash-generating capabilities.

Unfortunately, the company's free cash flow is trending in one direction: decreasing.

Author's work

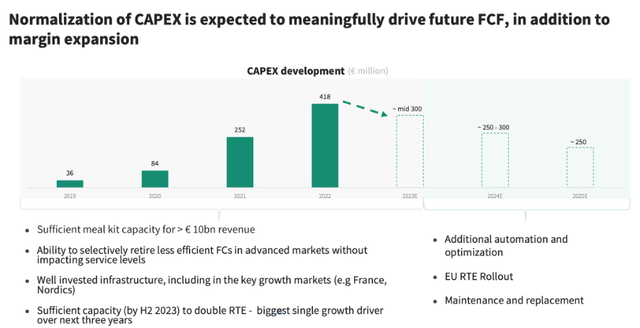

But if you pay close attention, you'll see that there's a good reason for this. HelloFresh has invested heavily in its business and is poised to deliver a lot of value to shareholders over the next 10 years for all the reasons outlined in the slides below.

HelloFresh 2023 Capital Markets Day Presentation

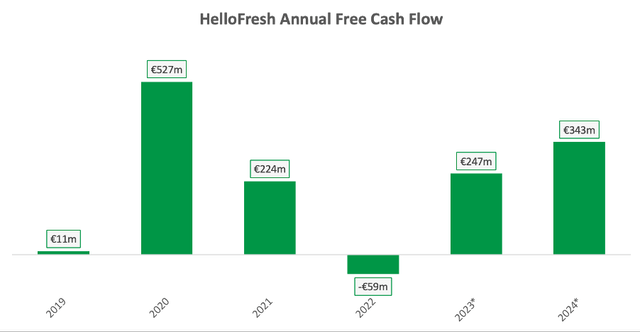

So we can see that these investments will not only boost HelloFresh in the coming years, but that the company's capex is expected to peak and start normalizing in 2022. This should lead to significant free cash flow growth for HelloFresh in 2023 and beyond, which analysts also expect.

Author's works / TIKR

As shown in the graph above, analysts expect free cash flow from HelloFresh to recover significantly as these investments pay off and the latest capex cycle comes to a close, resulting in may become a little more attached to the stock.

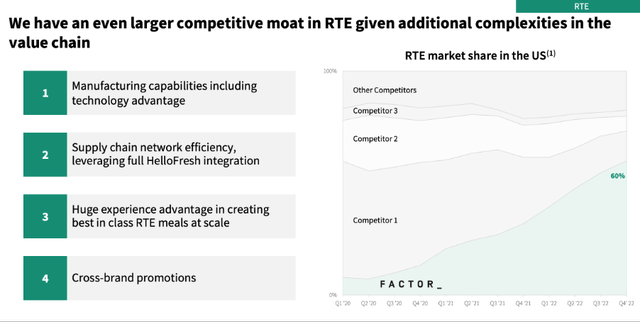

It seems that the factor acquisition was successful.

In late 2020, HelloFresh acquired ready-to-eat (RTE) food company Factor75 (now Factor) for up to $277 million. This feels like very good money spent. HelloFresh's RTE segment accounted for around 12% of its revenue in 2022, but recorded impressive triple-digit growth along with break-even AEBITDA margins. The company now expects revenues from RTE to double by 2025, and says it has a clear path to achieving adjusted EBITDA margins in excess of 10% for the segment.

One of the most impressive statistics from HelloFresh's 2023 Capital Markets Day presentation is that Factor's growth in the U.S. has increased, as HelloFresh has been able to leverage its existing scale to strengthen Factor's brand and business. It's about incredible market share growth.

HelloFresh 2023 Capital Markets Day Presentation

Factor says HelloFresh still has plenty of growth potential, as it just launched in Canada earlier this year and is expected to launch in Europe by the end of 2023. So while there are some growth areas that HelloFresh can continue to explore (e.g., penetrated markets, new brands, new geographies, new verticals, etc.), Factor and its RTE division appear to be the real growth engines for now. Masu.

HelloFresh stock valuation

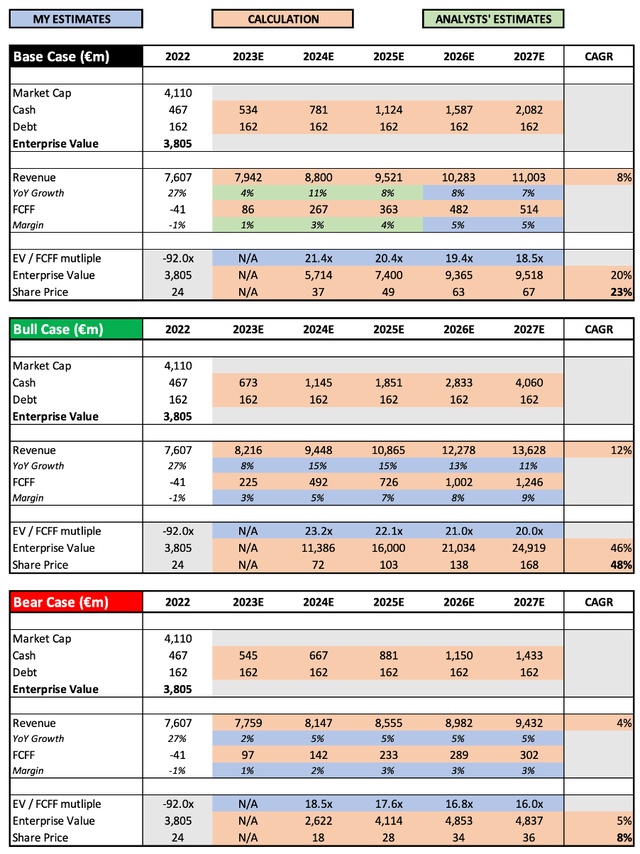

As with all companies, valuations can be very demanding. I believe my approach will give you an idea as to whether HelloFresh is highly overvalued or undervalued, but valuation is what I look at in the end, and in the long run the quality of the business itself is much more important.

Author's works / TIKR

I've gone through several iterations of the rating model over 120 Seeking Alpha articles, and I'm pretty happy with the way it's settled. We use analyst estimates in the base case to avoid overly optimistic (or pessimistic) assumptions due to personal bias. I can then be more flexible with my own bullish and bearish cases.

With this latest investment cycle and the normalization of growth rates in the world post-pandemic economic reopening, HelloFresh is firmly on track to achieve the 12% revenue CAGR to 2027 that I assumed in my bullish case. I think I have the ability to do so. This scenario is especially true if the RTE segment continues its impressive growth trajectory. We also expect free cash flow margins to the company to expand in the high single digits, as lower capital expenditures and greater economies of scale improve margins with scale, especially for RTE. , it is said that it is possible to achieve this goal. .

A bearish scenario essentially assumes the opposite. HelloFresh's era of growth is over, the company will continue to grow at around 4% for the next few years, and meal kit companies are proving to be nothing more than a fad.

Putting all this together, we see that HelloFresh stock has a CAGR of 8%, 23%, and 48% in the bearish, base, and bullish scenarios, respectively. The takeaway from this is that I believe the current price of HelloFresh stock is very attractive, and I wouldn't be surprised to see an attractive return for shareholders from a very achievable base case. about it.

conclusion

I feel a bit nostalgic writing this article, but I'll tell you one thing. I think the results will be even better if she revisits this article in a year or two.

I think HelloFresh is currently being valued as a company that did great during the pandemic but currently has no future prospects, and I don't think that could be further from the truth.

Over the next few years, low double-digit growth will return, margins will expand significantly and shareholders will It is expected that the value will increase. Macro environment.

We believe HelloFresh's future remains bright and the stock is priced very attractively, so we are upgrading our previous rating from 'Buy' to 'Strong Buy'.

See you in 15 months!

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.