WORLD ADDED 167 BILLIONAIRES TO TAKE TOTAL TO 3279

AI LED BOOM OF NEW BILLIONAIRES, WITH OVER HALF OF ALL NEW WEALTH DRIVEN BY AI

USA ADDED 109 BILLIONAIRES TO TOTAL OF 800

CHINA DOWN 155 BILLIONAIRES, BUT STILL WORLD NUMBER ONE WITH 814

INDIA THIRD WITH 271 BILLIONAIRES, UP 84, SECOND HIGHEST RISE AFTER USA.

UK OVERTOOK GERMANY TO FOURTH SPOT WITH 146 BILLIONAIRES, UP 12. GERMANY DOWN 4 TO 140.

ELON MUSK RICHEST PERSON IN THE WORLD FOR THIRD TIME IN 4 YEARS, WITH US$231BN, UP US$74BN, ON BACK OF SURGE IN TESLA SHARES.

JEFF BEZOS OF AMAZON UP TWO PLACES TO SECOND, ADDING US$67BN OR 57% TO US$185BN. LAST YEAR’S NUMBER ONE BERNARD ARNAULT DOWN TO THIRD, DOWN US$27BN TO US$175BN.

MARK ZUCKERBERG UP 12 PLACES AND US$90BN, BIGGEST WEALTH ADDITION OF THE YEAR, TO 4TH PLACE AND US$158BN.

LARRY ELLISON UP THREE PLACES TO 5TH, ADDING US$44BN TO US$144BN, ON BACK OF ORACLE CLOUD GROWTH

‘BOTTLE WATER KING’ ZHONG SHANSHAN NUMBER ONE IN CHINA. HUANG ZHENG OF PINDUODUO OVERTAKES PONY MA OF TENCENT TO SECOND PLACE.

MUKESH AMBANI OF RELIANCE ADDED US$33BN TO KEEP TITLE OF ‘RICHEST PERSON IN ASIA’. GAUTAM ADANI WEALTH ROSE 62% TO 15TH PLACE IN WORLD WITH US$86BN.

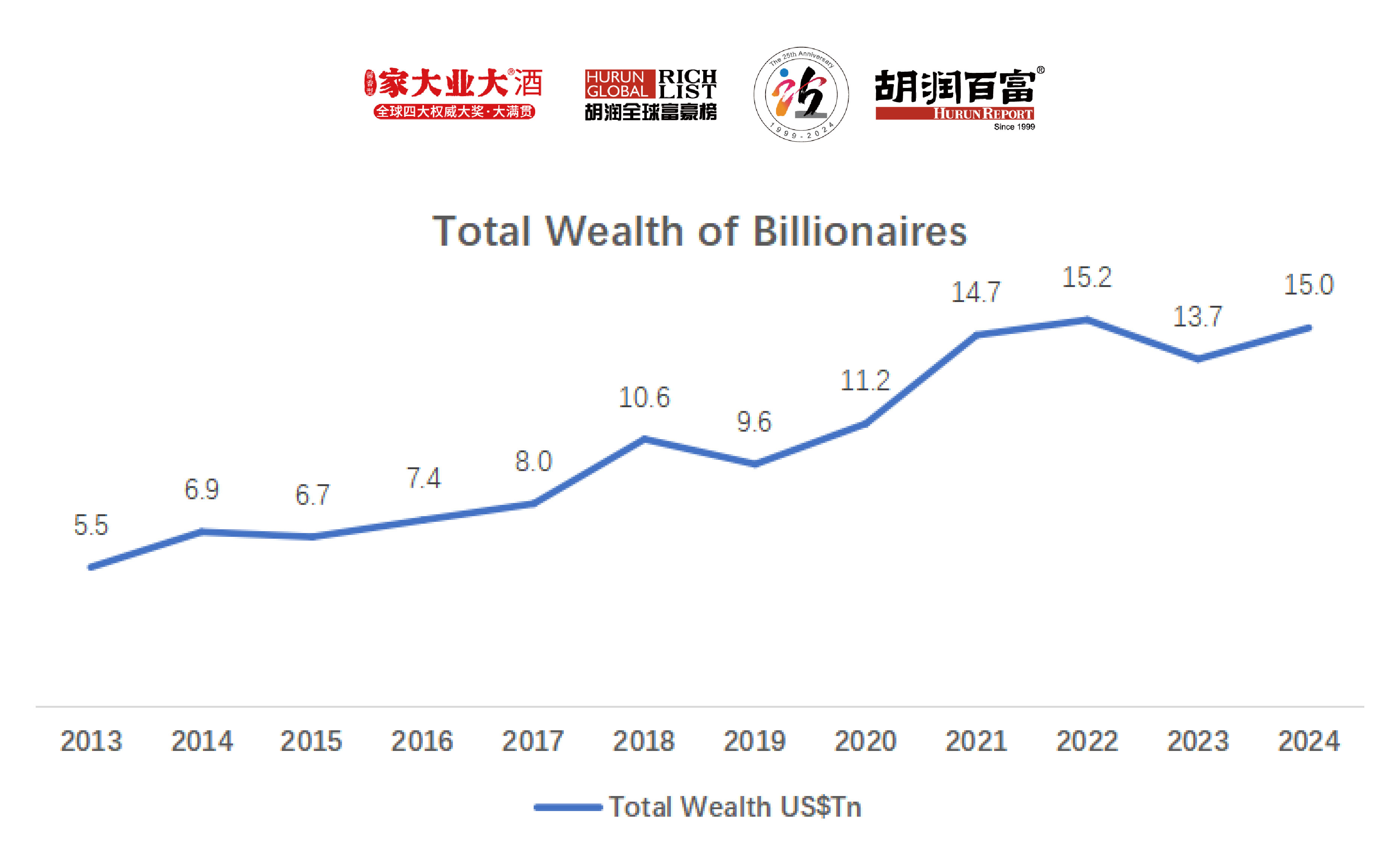

CUMULATIVE WEALTH OF HURUN GLOBAL RICH LIST UP 9% TO US$15TN

278 PEOPLE LOST THEIR BILLIONAIRE STATUS, OF WHICH 208 FROM CHINA

480 JOINED THE LIST, OF WHICH 132 FROM USA, 94 FROM INDIA AND 55 FROM CHINA

MUMBAI OVERTOOK BEIJING TO BECOME ASIA’S BILLIONAIRE CAPITAL FOR FIRST TIME AND BREAK INTO WORLD’S TOP 3.

NEW YORK TOOK BACK STATUS OF BILLIONAIRE CAPITAL OF WORLD FOR FIRST TIME IN 7 YEARS, WITH 119 BILLIONAIRES CHOOSING TO LIVE THERE, FOLLOWED BY LONDON WITH 97. BEIJING DROPPED DOWN FROM FIRST PLACE LAST YEAR TO FOURTH.

MUSIC ARTIST TAYLOR SWIFT, 34, DEBUTED ON HURUN GLOBAL RICH LIST WITH US$1.2BN.

MIAMI-BASED SERIAL ENTREPRENEUR RYAN BRESLOW, 29, OF FINTECH PLATFORM BOLT BECOMES YOUNGEST SELF-MADE BILLIONAIRE IN WORLD WITH US$1.3BN.

LEADING AUTHORITY ON GLOBAL WEALTH, HURUN REPORT, RELEASES 13TH HURUN GLOBAL RICH LIST.

Key Findings

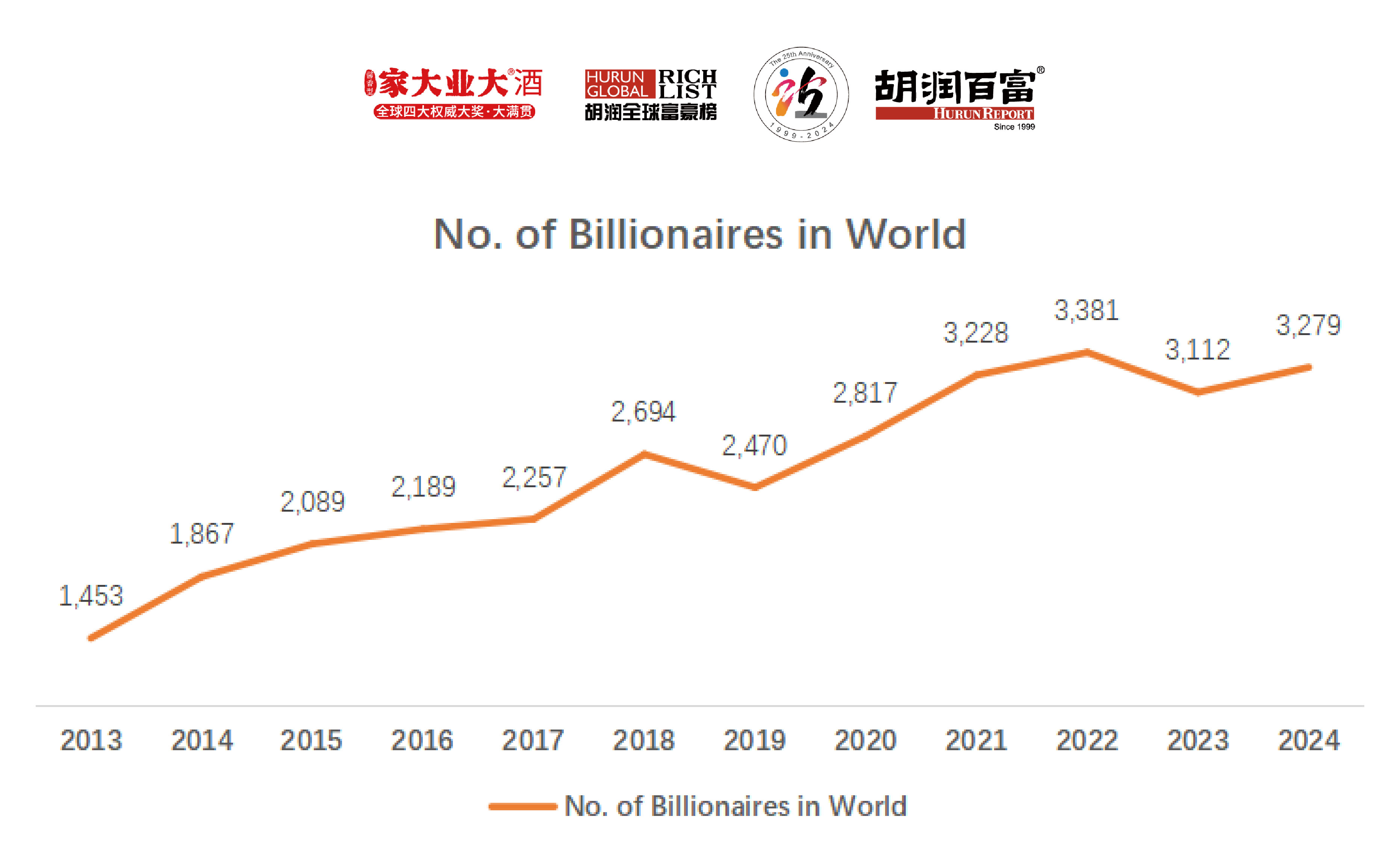

1. 3,279 BILLIONAIRES IN THE WORLD, UP 5% OR 167 FROM LAST YEAR.

2. TOTAL WEALTH UP 9% TO US$15TN.

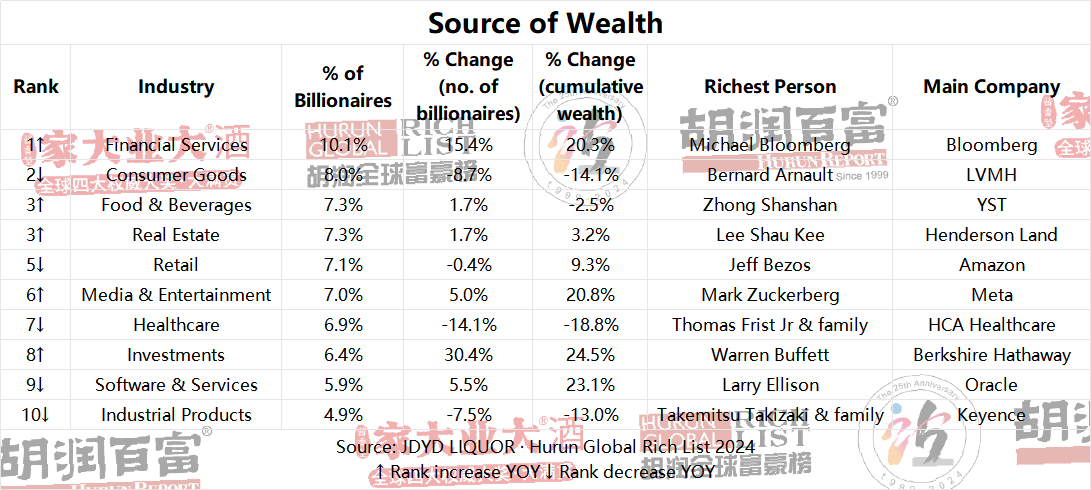

3. SOURCE OF WEALTH. BILLIONAIRES MADE THEIR WEALTH IN FINANCIAL SERVICES (10%), FOLLOWED BY CONSUMER GOODS (8%), AND FOOD & BEVERAGES (7%) AND REAL ESTATE (7%).

4. GOOD YEAR FOR MEDIA & ENTERTAINMENT, WHICH ADDED US$226BN, OUTPACING SOFTWARE & SERVICES US$149BN, FINANCIAL SERVICES US$118BN AND RETAIL US$104BN.

5. BAD YEAR FOR HEALTHCARE, WHICH LOST US$75BN, FOLLOWED BY INDUSTRIAL PRODUCTS US$46BN, FOOD & BEVERAGES US$40BN AND REAL ESTATE US$32BN.

6. FASTEST RISERS IN THE YEAR. 59 INDIVIDUALS ADDED US$5BN OR MORE, UP FROM 31 LAST YEAR.

7. 93 ARE FORTY OR UNDER, OF WHICH 61, UP 5, WERE SELF-MADE, AND 32 INHERITED. 8 ARE UNDER 30, LED BY CLEMENTE DEL VECCHIO OF ESSILORLUXOTTICA, WITH US$4.6BN AGED JUST 19. YOUNGEST SELF-MADE BILLIONAIRE IS RYAN BRESLOW OF BOLT, WITH US$1.3BN AGED JUST 29.

8. 218 SELF-MADE WOMEN, DOWN 29. CHINA CONTINUED TO DOMINATE WITH 74%. OKLAHOMA-BASED ‘ROOFING QUEEN’ DIANE HENDRICKS, 77, OF ABC SUPPLY RICHEST SELF-MADE WOMAN IN WORLD FOR THE SECOND YEAR WITH US$22BN, WHILST FRANCOISE BETTENCOURT MEYERS, 70, OF L’OREAL RICHEST WOMAN IN THE WORLD WITH US$91BN.

9. 15.4% ARE IMMIGRANT BILLIONAIRES, UP FROM 13.7% FROM LAST YEAR AND 10% FROM FIVE YEARS AGO. USA LED WITH 144 IMMIGRANT BILLIONAIRES, FOLLOWED BY 67 IN THE UK AND 60 IN SWITZERLAND. TOP IMMIGRANTS INCLUDED ELON MUSK (BORN IN SOUTH AFRICA), SERGEY BRIN (BORN IN RUSSIA) AND JENSEN HUANG (BORN IN TAIWAN).

10. OLDEST FAMILIES. 118 ARE BILLIONAIRES FOR 4TH GENERATION OR MORE, Up 7.

(25 March 2024, Shanghai and Mumbai) Hurun Report today released the Hurun Global Rich List 2024, a ranking of the US dollar billionaires in the world. Wealth calculations are a snapshot of 15 January 2024. This is the 13th year of the ranking. JDYD Liquor, a premium Chinese baijiu brand, is the title sponsor of the list for the third year.

Stock Markets and Currencies. In the year to 15 January 2024, stock markets generally had a good year, with the notable exceptions of China and the UK. In the US, Nasdaq was up 35% and the S&P 500 up 27%. In India the SENSEX was up 23%, whilst in Europe, Russia’s MOEX was up 44%, Germany’s DAX Index was up 13% and the Euronext 100 Index up 8%. China had a bad year. HK was down 20%, Shenzhen down 19% and Shanghai down 7%. The UK’s FTSE 100 Index was also down, dropping 3%.

The dollar rose against the Japanese Yen by 11% and the Chinese Yuan by 9%, but was down against the British Pound Sterling by 3% and the Euro by 2%. For the Indian Rupee, there was no change.

The List at a glance

The JDYD LIQUOR · Hurun Global Rich List 2024 ranked 3,279 billionaires, up from 3,112 last year, from 2,435 companies and 73 countries. The number of billionaires increased by 5% and their total wealth was up 9%.

1,933 saw their wealth increase, of which 480 were new faces. 1,346 saw their wealth decrease, of which 278 dropped off. A further 278 stayed the same. 67% were self-made, 33% inherited their wealth. 61% made their money by selling to businesses, ie B2C, whilst 39% sell to businesses, ie B2B. 62% sell physical products, whilst 38% sell software and services. The average age was 66.

Hurun Report chairman and chief researcher Rupert Hoogewerf said, “The number of known billionaires in the world is up 5% to just under 3300, mainly on the back of a strong performance in stock markets. The Hurun Global Rich List tells the story of the global economy through the stories of the world’s richest individuals. Who’s up and who’s down highlights the economic trends of sectors and countries.”

“AI has been the major driver for wealth growth, generating over half of all the new wealth this year. Whilst Jensen Huang has grabbed many of the headlines as Nvidia broke through the US$2tn mark and catapulting him into the Hurun Top 30 as a result, the billionaires behind Microsoft, Google, Amazon, Oracle and Meta have seen significant surges in their wealth as investors bet on the value generated by AI.”

“The US led the way for new billionaires as stock markets rose to record heights. New York took back its crown of ‘Billionaire Capital of the World’ for the first time in seven years.”

“India has had a super strong year, adding almost 100 billionaires. Confidence in the economy grew to record levels. Mumbai overtook Beijing to become Asia’s billionaire capital and Top 3 cities globally.”

“Wealth creation in China has gone through deep changes these last few years, with the wealth of billionaires from real estate and renewables down. Whilst as many as 40% of the Hurun Global Rich List from the high water mark two years ago have lost their billionaires status, China has added a 120 new faces to the list. Despite the large drop in the number of billionaires, China still has more known billionaires than the US.”

“Russia added 6 billionaires in a year when the Ruble fell by 21% against the dollar and the MOEX Russia Index leaped by 44%. Metals & Mining and Energy had a good year, whilst Financial Services had a difficult year.”

“Despite the ongoing war in Gaza, Israel added 9 billionaires to break into the Top 20 countries for billionaires with 29.”

“Whilst ‘Bottled Water King’ Zhong Shanshan, 70, retained his position as China’s richest person, the focus was on Colin Huang, 44, who overtook Pony Ma, 53, of Tencent and Zhang Yiming, 40, of Bytedance, for second place as Pinduoduo’s domestic and international businesses continued to defy market expectations. Several of the other wealth increases can be attributed to the rise of ChatGPT and AI: Barry Lin, 75, of Taiwan-based Quanta Computer; Chen Tianshi, 39, of chip start-up Cambricon; Zhou Chaonan, 64, of data center business Range Technology; and Yuan Jiangtao, 45, Ding Hui, 45, and Ding Huixiang, 42, of circuit board maker JLC. Renewables and real estate both had difficult years, as shown by ‘Battery King’ Robin Zeng, 56, of CATL and Wang Jianlin, 70, of Wanda, who both saw their wealth down for a second year running.”

“Crypto seems to have moved on since the FTX scandal. Despite a record US$4bn fine by the US government for money laundering, CZ Zhao Changpeng saw his wealth grow to US$18bn as interest in cryptocurrencies surged. Coinbase founder Brian Armstrong and Chris Larsen of Ripple both saw their wealth also growth by 50%, taking them to US$6.4bn and US$3.4bn respectively.

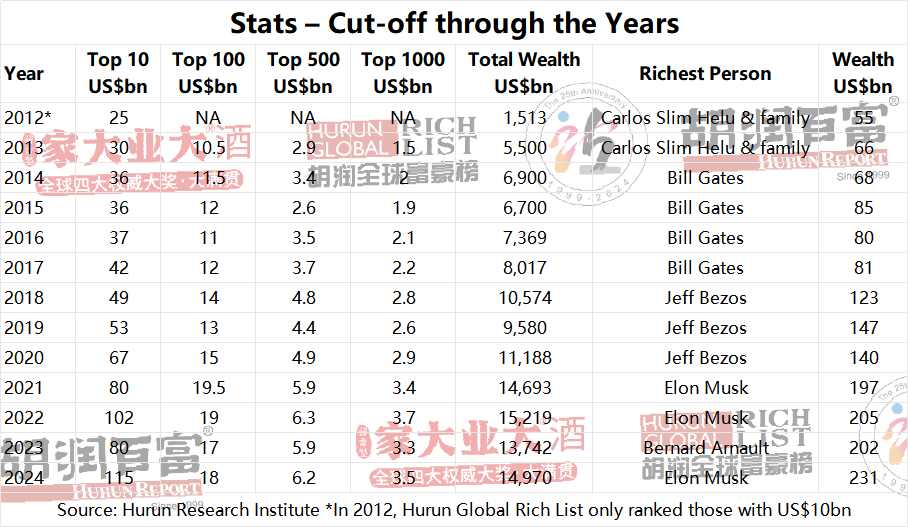

“The concentration of wealth is reaching unprecedented heights. The cut-off to make the Hurun Top 10 has more than tripled this past decade to over US$100 billion today. The Hurun Top 10 generated a staggering 60% of all the new wealth generated this year. There are now 13 individuals with more than US$100bn, with only the first member of this ‘10-zeroclub’ coming in 2018. At this rate, expect to see the world’s first trillionaires by 2030.”

“Betting against the billionaires is a risky punt. Most have made up their losses of last year, led by the likes of Jeff Bezos, who added US$67bn after losing US$70bn last year, and Larry Page, who added US$48bn after losing US$41bn last year.”

“Financial services saw a strong resurgence, partly on the back of expectations that interest rates in the US will come down, with the likes of Steve Schwarzman of Blackstone adding US$11bn to shoot him back into the Top 40.”

“A post-Covid hangover contributed to making it a tough year for the healthcare sector, with over 100 healthcare billionaires seeing their wealth shrink.”

“This year has not been a standout year for philanthropy. Whilst there were a handful of billion-dollar donations, this year from the likes of Gates, Buffett and Michael Bloomberg, what stood out was the burgeoning value of charitable foundations, with the likes of the foundations behind weight-loss drug makers like Novo Nordisk and Eli Lily now worth US$130bn and US$70bn.”

“Whilst emigration is a big topic in China, few of the Hurun Global Rich List have migrated abroad. 62 individuals born in China are now living outside of Greater China today, with the vast majority emigrating to South East Asia or the US some forty or more years ago. In recent years, Singapore has proven a popular place to take up residence, with the likes of Zhang Yiming of ByteDance, Li Xiting of medical device maker Mindray and Zhang Yong of hotpot chain HaiDiLao said to be living there. Others include well-known investors like Duan Yongping and Chen Tianqiao, who live in the US, and CZ Zhao of crypto exchange Binance, in Dubai.”

“Immigration billionaires are on the rise. This year, 15% of the Hurun Global Rich List were immigrants, up from 9% five years ago. The US was the preferred destination to migrate to, followed by the UK, Switzerland and Singapore. Top migrants include Elon Musk, born in South Africa, Sergey Brin, born in Russia, and Jensen Huang, born in Taiwan, now all living in the US.”

“At 34, Taylor Swift joins the billionaire club with US$1.2 billion, not from typical celebrity side hustles, but uniquely through her music. Over half her fortune stems from royalties and touring, including US$190 million from the Eras tour’s first leg and US$35 million from its concert film. The rest is buoyed by her music catalogue’s value, notably after her first six albums were sold to Shamrock Capital for US$300 million in 2020.”

A Representative of JDYD LIQUOR said, “There is a Chinese saying that goes ‘All wealth is JDYD, meaning ‘a big family and a big business. JDYD Liquor and Hurun jointly released the ‘JDYD LIQUOR·Hurun Global Rich List 2024’, to give insights into wealth creation. JDYD Liquor originates from the core production area of Maotai Town and is known as the ‘Eight Great Valiants’ of Jiangxiangqing Baijiu. With its historical heritage, scarce jiangxiangqing resources and brand connotations, JDYD LIQUOR has achieved remarkable achievements both inside and outside the industry, becoming a Top Ten Jiangxiangqing Baijiu brand from the world’s four authoritative awards including Panama International Expo Award, IWSC, CMB and SFWSC, and receiving high recognition from both inside and outside the industry. At the same time, JDYD Liquor offline and online sales have repeatedly reached new highs, earning consumers the title of ‘the most worthwhile wealth wine to purchase’, achieving a win-win situation in sales and reputation! Now as the exclusive sponsor of Hurun Global Rich List, it is a great gathering chance for JDYD LIQUOR and great entrepreneurs to witness the bellwether of the world’s top wealth. Drink JDYD LIQUOR, Achieve greatness!”

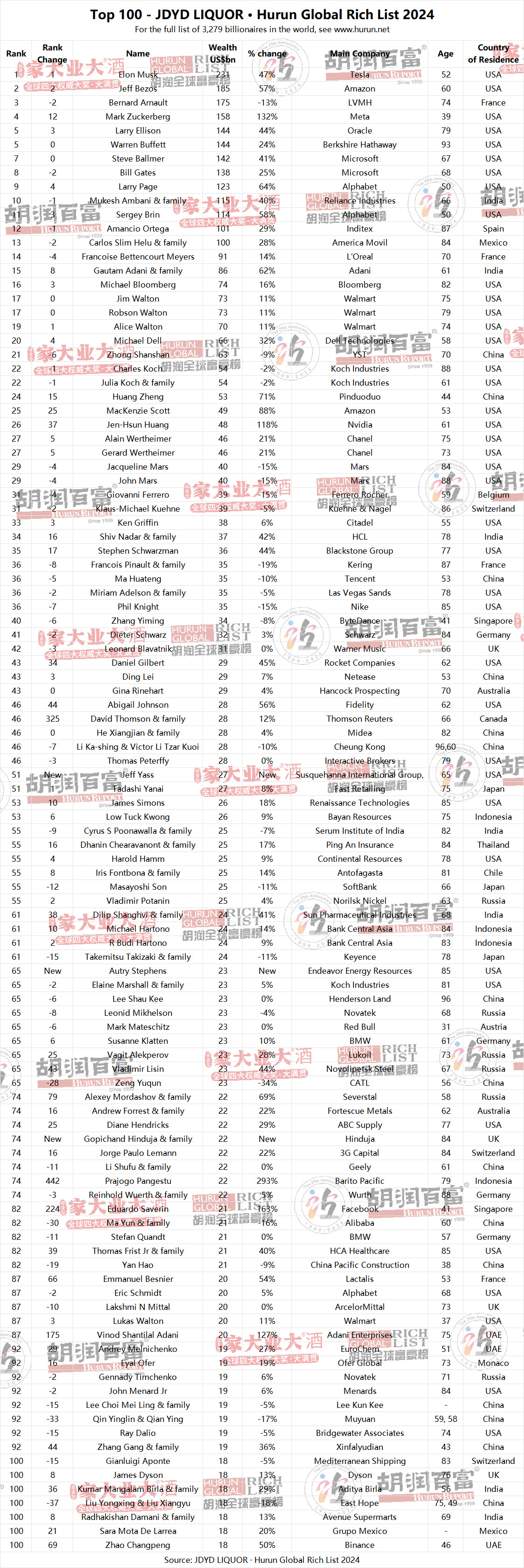

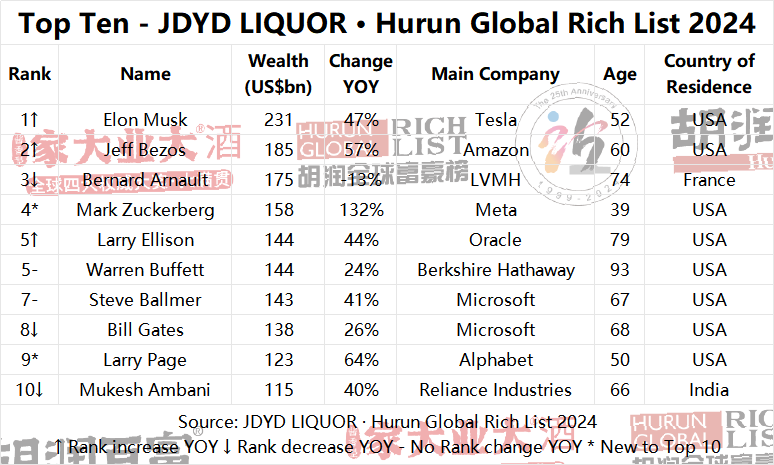

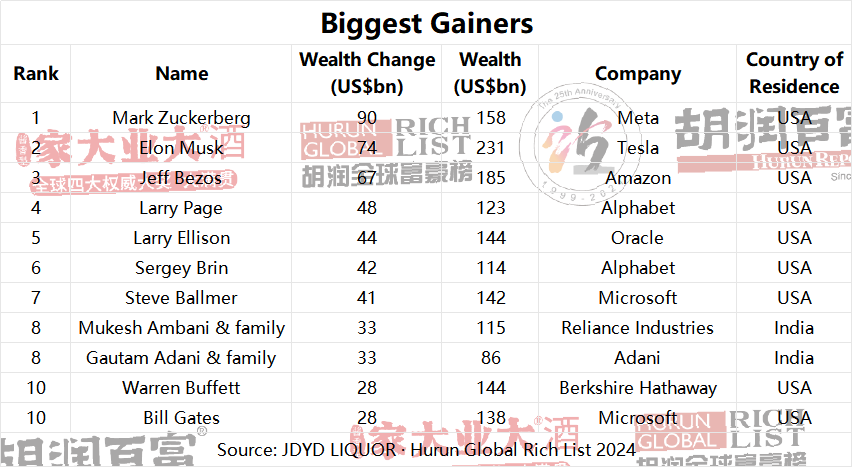

Top Ten – JDYD LIQUOR · Hurun Global Rich List 2024

Two new faces made the Hurun Global Top 10: Mark Zuckerberg (US$158bn) of Meta and Larry Page (US$123bn), at the expense of Bertrand Puech of Hermes (who passed away) and Francoise Bettencourt Meyers (US$91bn) of L’Oreal.

The Top 10 added US$426bn, 56% of total new wealth, and are worth US$1.5tn, making up 10% of the total list.

8 are from the USA and 1 from each of France and India. Bernard Arnault was the only one of the Hurun Top 10 to see his wealth go down.

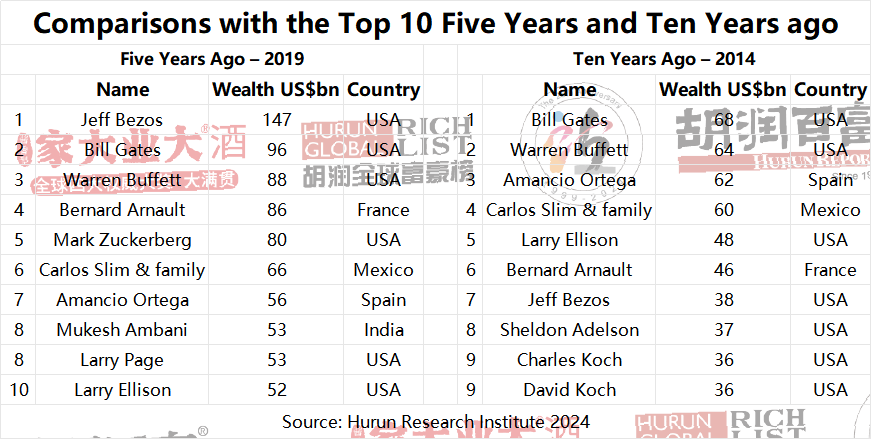

The cut-off to make the Hurun Top 10 in the world has almost doubled every five years, from US$36bn ten years ago to US$53bn five years ago and US$115bn this year.

At 52, Elon Musk (US$231bn) reclaimed the title of the richest person in the world for the third time in four years, propelled by a surge in Tesla’s stock. Simultaneously, SpaceX, Musk’s aerospace venture, saw its valuation hit new heights on the back of successful launches, satellite internet ventures, and lucrative government contracts.

Jeff Bezos, 60, rose to second with US$185bn, as his wealth grew 57% this year, driven primarily by Amazon’s cloud computing winning market share and making up for all his losses last year.

‘Luxury King’ Bernard Arnault, 74, lost US$27bn, more than anyone else this year and dropping him to third place with US$175bn, as luxury lost some of its lustre. LVMH also lost its crown to weight loss drug maker Novo Nordisk as Europe’s most valuable business.

Mark Zuckerberg, 39, with US$158bn, added more wealth than anyone on the list as Meta shares more than doubled.

At 79, Larry Ellison rose three spots in the rankings with US$144bn, up US$44bn, as Oracle expanded its cloud services and made strategic acquisitions.

Warren Buffett, 93, sustained his fifth position with US$144bn, showing no signs of slowing down as he continues to live modestly despite his immense wealth. Committing to donate over 99% of his wealth, he has already contributed more than US$56bn, primarily through the Gates Foundation and foundations established by his children.

Steve Ballmer, 67, was up 41% to US$143bn and 7th place, with the bulk of his wealth still in Microsoft shares.

Bill Gates (US$138bn), aged 68, held on the 8th place, as his wealth was up 25%. Gates’ main business is now investments, having divested all but 1% down from his original 45% share of Microsoft.

Larry Page, 50, was up 64% taking him to 9th place with US$123bn. Interestingly, Page is known for his passion for kiteboarding.

Mukesh Ambani, 66, dropped down one place to 10th, despite his wealth rising 40% to US$115bn. Ambani made headlines earlier this month for the lavish pre-wedding of his youngest son.

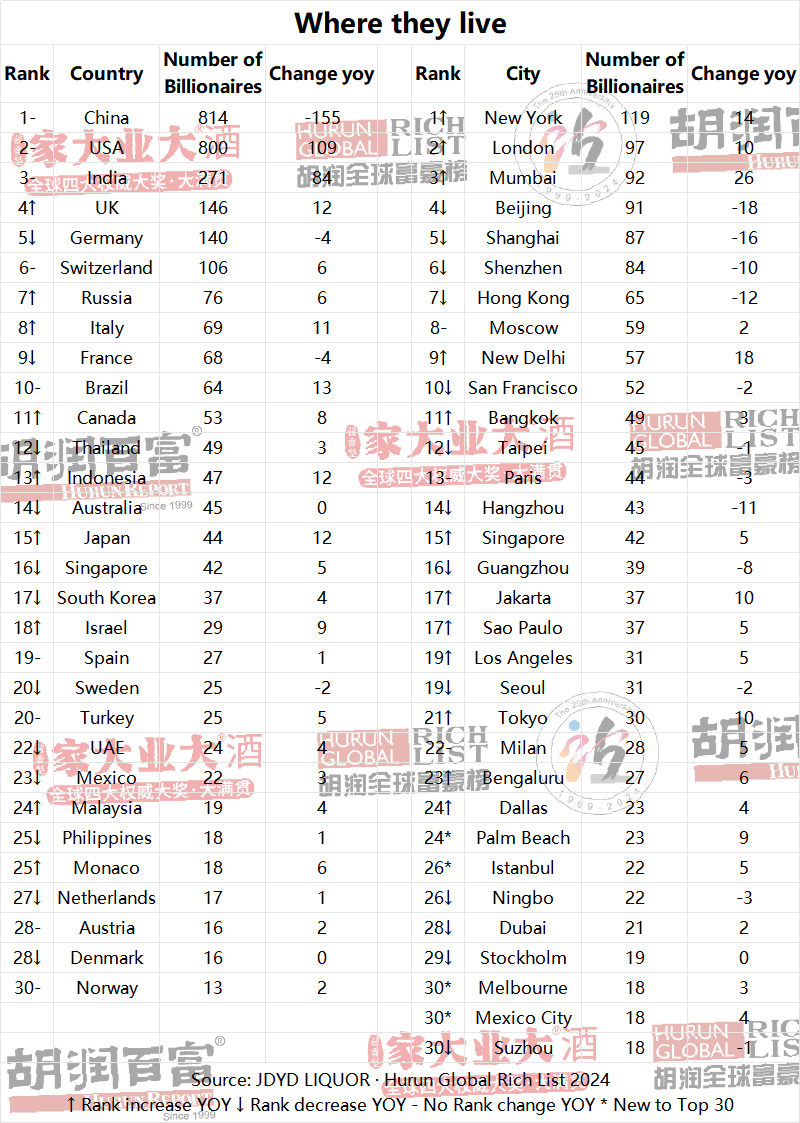

Where they live

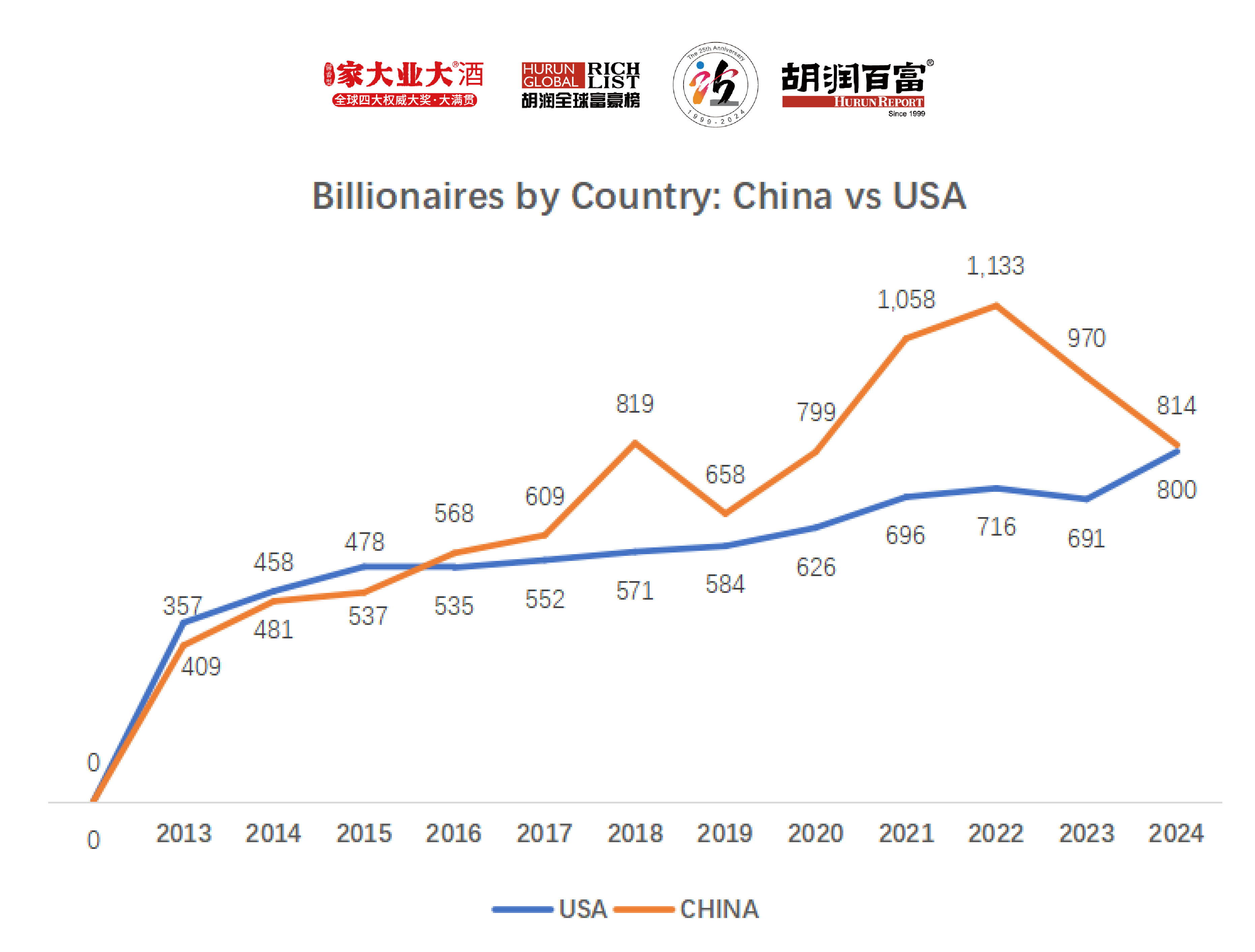

Despite losing 155 billionaires, China is still the world capital for billionaires with 814. The USA was just behind with 800 billionaires, adding 109. Between the ‘Big Two’, China and the USA have 49% of the known billionaires on the planet, down 4%.

India added 84 billionaires, now almost double the number of billionaires in the UK. Brazil, Indonesia and Japan had good years, whilst China had a bad year.

By city, New York is back again as the billionaire capital of the world, with London up to second spot.

Mumbai was the fastest growing billionaire capital in the world, adding 26 in the year and taking it to third in the world and Asia’s billionaire capital. New Delhi broke into the Top 10 for the first time. Palm Beach, Istanbul, Mexico City and Melbourne broke into the Hurun Top 30 Cities.

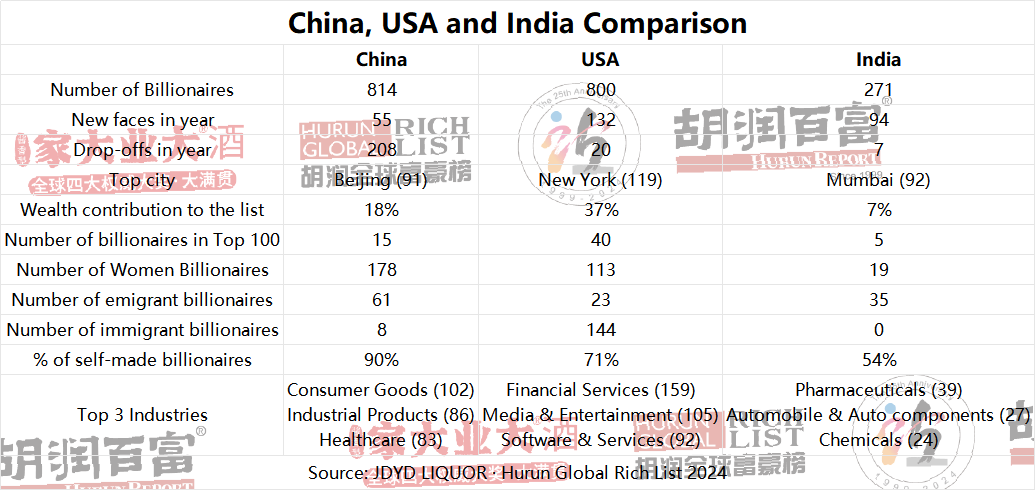

China, USA and India Comparison

China: Still the world’s Number One when it comes to billionaires.

‘Bottled Water King’ Zhong Shanshan, 70, retained his position as China’s richest person with US$63bn, down 9%. Colin Huang Zheng was up three spots to 2nd place with US$53bn, up 71% from last year, as Pinduoduo’s results far exceeded market expectations, whilst its overseas platforms of Temu and Kuaituantuan continued showing strong growth. In November, Pinduoduo briefly surpassed Alibaba in market value. Pony Ma of Tencent was down 1 spot to 3rd place with US$35bn. Zhang Yiming, 40, ranked 4th with US$34bn, down 8%. Bytedance’s revenue was up 30% last year to US$110bn, despite it battling legal threats to discontinue its operations in the US. Ding Lei, 53, made up the Top 5 with US$29bn, up 7%, as its online game business continued to grow.

By cities, it is 3+1+3. The ‘Big Three’ are Beijing, Shanghai and Shenzhen, with the ‘One’ being HK and the ‘Next Three’ Taipei, Hangzhou and Guangzhou.

The average age is 60 years old, 6 years younger than the average of the list. China has the largest number of self-made billion-dollar entrepreneurs in the world, and is head and shoulders the world’s capital for self-made women billionaires.

China’s billionaires total wealth was down 15%. 702 people saw their wealth drop, of which 208 fell off the list. 241 saw their wealth grow, of which 55 were new faces. 80 remained unchanged.

Notable changes include:

l The fastest risers were Cai Haoyu, 39, of online gaming platform Mihoyo, Barry Lin Bai-Li & family, 75, of Quanta Computer, Chen Tianshi, 39, of chip start-up Cambricon, and Zhang Liguo, 60, of skincare products business Voolga.

l New faces: Chen Shyan Tser & family, 71, of Polaris, an early investor in Zoom; Chow Shing Yuk, 47, of logistics and delivery platform Lalatech; Zhou Chaonan & family, 64, of data center business Range Technology, and Yuan Jiangtao, 45, of circuit board maker JLC.

l Renewables were down as Zeng Yuqun of lithium battery maker CATL and Li Zhenguo of solar panel maker Longi was both down for the second year running as oversupply continued to plague the industry.

l Real estate continued to suffer. Wang Jianlin of Wanda saw his wealth drop US$11bn to US$4.2bn, the most of anyone from China in the year as more of his company’s assets were frozen, whilst Yang Huiyan & family of Country Garden lost US$9bn.

l Biggest % drops: Li Hua, 46, of fintech Futu Holdings, down 69% to US$3.1bn, Wang Zhenhua & family of real estate developer Xincheng and Ren Jinsheng & family of pharmaceutical supplier Simcere, both down 67% to US$1bn.

l Cars. Li Shufu & family of Geely overtook BYD’s Wang Chuanfu and Great Wall Motor’s Wei Jianjun & Han Xuejuan.

l Youngest self-made. Heytea’s 33-year-old Nie Yunchen saw his wealth rise 20% to US$1.2bn, making him China’s youngest self-made billionaire.

The USA had a strong year on this latest Hurun Global Rich List, with its 800 entrants contributing a notable 37% of the overall wealth of the list. Adding 132 new faces, the American landscape continues to showcase entrepreneurial dynamism. Key sectors include Financial Services with (159) billionaires, followed by Media & Entertainment (105) and Software & Services (92). With an average age of 67, these billionaires embody a mix of seasoned experience and innovative spirit.

India had a super strong year, adding 94 new faces, the most of any country other than the US, taking the total to 271 entrants. Dominant industries include Pharmaceuticals (39), Automobile & Auto Components (27) and Chemicals (24). The collective wealth of Indian billionaires amounts to US$1tn of 7% of total wealth, emphasizing the nation’s substantial economic influence. The average age was 67.

● Gautam Adani (US$86bn), 61, & family of the Adani Group energy conglomerate, witnessed a US$33bn surge in wealth this year, attributed to a rally in their companies’ shares following a Supreme Court hearing on Hindenburg report-related issues.

● Mukesh Ambani and family (US$115bn) kept the title of India’s richest person.

Who’s Up?

1,933 saw their wealth increase, of which 480 were new faces.

The biggest gainers of the year were Mark Zuckerberg, adding US$90bn, and Elon Musk adding US$74bn.

Jensen Huang of Nvidia saw his wealth double to US$48bn and a place in the Hurun Top 30. Others like Jeff Bezos and Larry Page clawed back their losses from the previous year, with Bezos adding US$67bn after losing US$70bn last year, and Page adding US$48bn, after losing US$41bn last year.

Huang Zheng, 44, of Pinduoduo saw his wealth rise US$22bn on the back of a more than US$10bn rise the previous year to shoot him into the Hurun Top 30 with US$53bn.

Others whose wealth grew. Pakistani American billionaire Shahid Khan, with a wealth surge of US$2.7bn in the auto components industry through Flex N Gate, exemplifies the dynamic recovery and forward-thinking adaptation of the automotive sector.

Italian billionaire Leonid Boguslavsky, whose fortune increased by US$2.5bn in the investment management realm via RTP Global, has capitalized on the exponential growth of high-tech startups and digital platforms.

Indonesian billionaire Low Tuck Kwong in the mining industry, with Bayan Resources, has seen his wealth grow by US$2.2bn. This wealth boost is a direct result of the escalating demand for coal and other commodities, fuelled by the global energy sector’s needs and the economic resurgence post-pandemic.

Investments did well this past year, especially in the US stock markets. American billionaire Ken Fisher of Fisher Investments and Belgian billionaire Eric Wittouck of Artel, grew US$3bn and US$2.5bn.

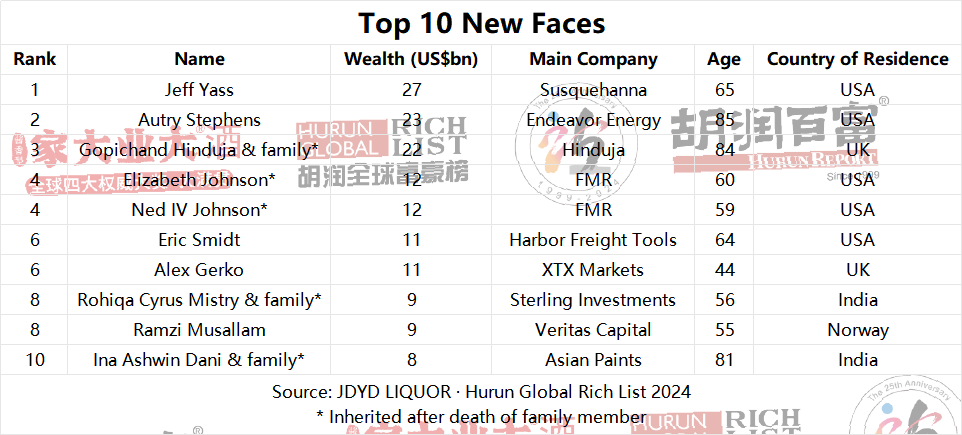

Leading the new faces on this year’s list were Pennsylvania-based Jeff Yass (US$27bn), 65, of Susquehanna International and Autry Stephens (US$23bn), 85, of oil exploration platform Endeavor Energy, who both broke into the Top 100.

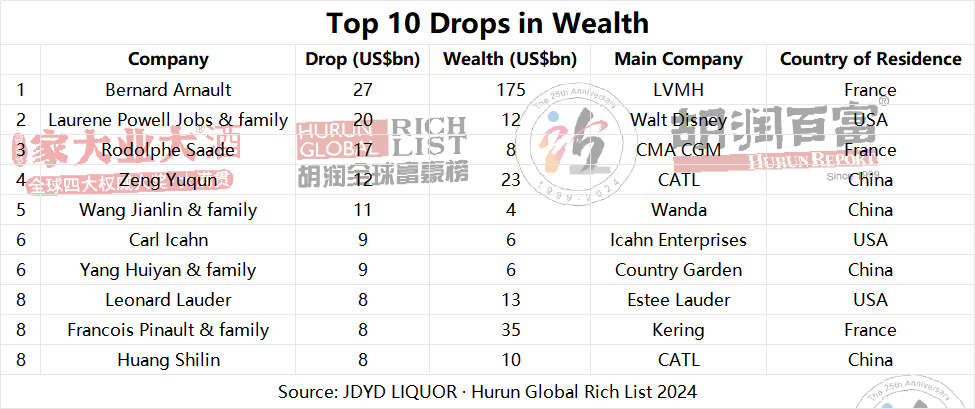

And, Who’s Down?

1,346 saw their wealth decrease, of which 278 dropped off.

Bernard Arnault lost the most this year, down US$27bn, as luxury had a relatively difficult year. Others in luxury that were amongst the Top 10 biggest drops included Francois Pinault of Kering and Leonord Lauder of Estee Lauder.

Laurene Powell Jobs & family (US$12bn) was down on the back of a drop in the value of Walt Disney shares and a revaluation of her wealth.

China’s renewables had a difficult year, with Robin Zeng of Fujian-based battery-maker CATL down US$12bn. Real estate continued to suffer in China with Wang Jianlin of Wanda down US$10.8bn.

Carl Icahn saw his wealth plummet US$9.4bn after claims his company was over-leveraged and traded at an extreme premium to its net asset value.

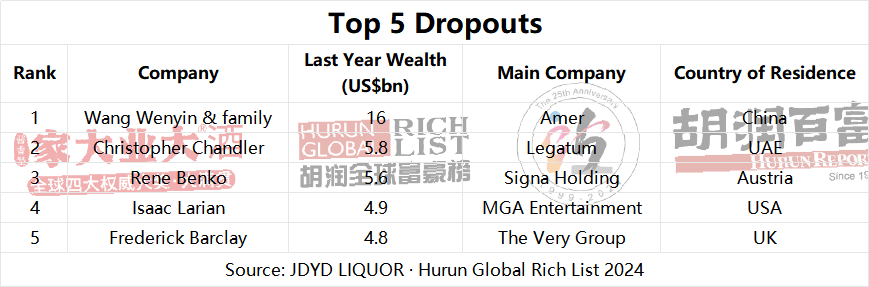

Shenzhen-based copper trader Wang Wenying of Amer was the biggest casualty of the year, dropping off despite having as much as US$16bn last year, as his company hit significant cash flow problems. Austria-based real estate developer Rene Benko, 45, dropped off, after Sigma Holdings declared bankruptcy. Last year Benko had US$5.6bn.

Source of Wealth by Industry – JDYD LIQUOR · Hurun Global Rich List 2024

By number of billionaires. Financial Services overtook Consumer Goods for first place. Food & Beverages and Real Estate overtook Retail for third and fourth places.

It has been a good year for billionaires in the fields of Media & Entertainment, Software & Services and Financial Services and a relatively tough year for those in Healthcare, Industrial Products and Food & Beverages.

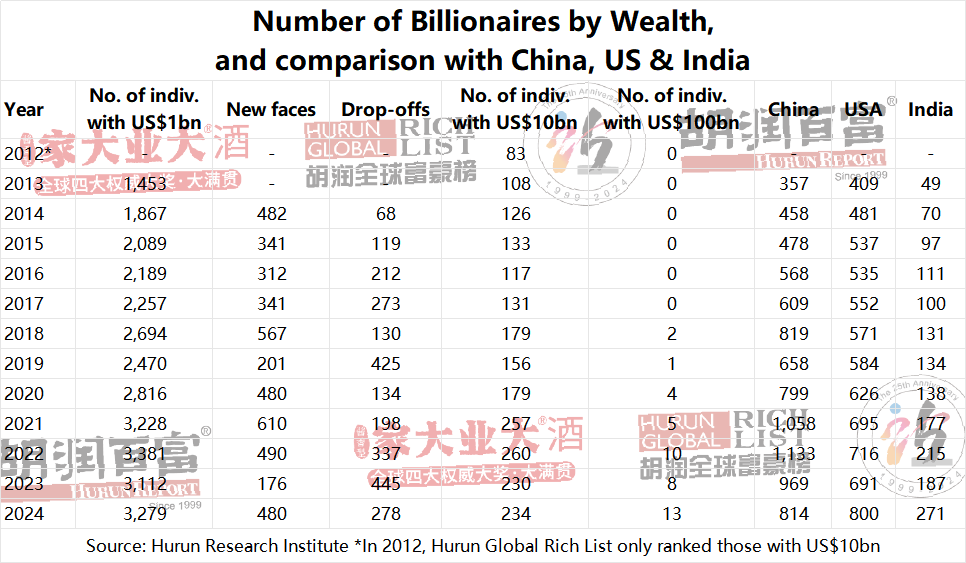

Comparison of China and USA billionaires. China overtook the US in terms of number of billionaires in 2016 and had over 400 more known billionaires than the US in 2022. Since then, the Chinese economy has slowed, and the US has grown, such that China and the US are now neck and neck when it comes to billionaires.

Source: JDYD LIQUOR · Hurun Global Rich List 2024

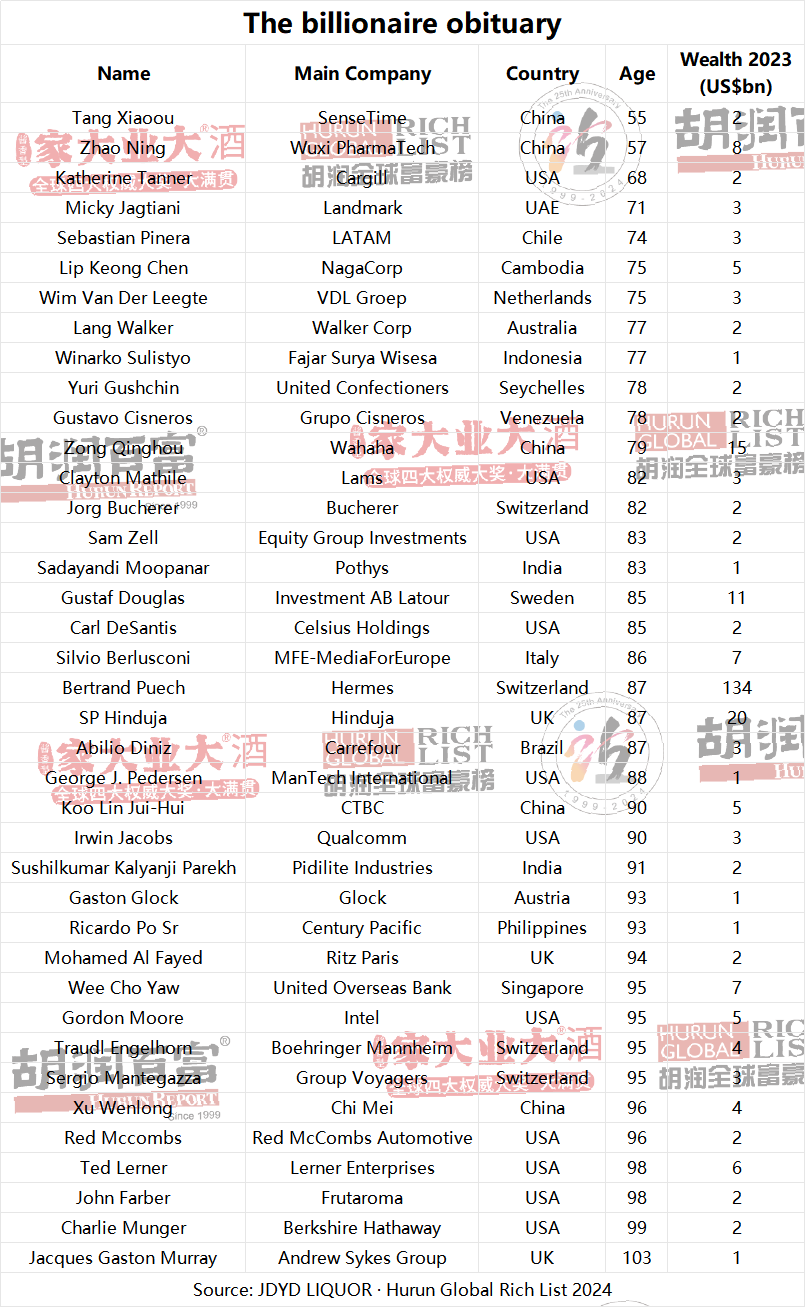

Deaths

39 billionaires died during the past year, the most in any one year since records begun.

Of the deaths listed, the youngest were Tang Xiao’ou of facial recognition software SenseTime, aged 55 and Zhao Ning of pharma research firm Wuxi PharmaTech aged 57. 16 were over the age of 90, with UK-based Jacques Gaston Murray (US$1.1bn) aged 103 and Berkshire Hathaway’s Charlie Munger (US$2.3bn) aged 99.

Between them, they passed down US$284bn to family members.

By Continent. Asia has just under half the world’s known billionaires. North America was the fast-growing.

Stats – Number of Billionaires through the Years

This year saw total wealth and the number of billionaires bounce back, closing in on the record year of 2022. There are more than double the number of known billionaires than ten years ago, whilst their wealth has almost tripled.

The ‘nine-zero club’, those with US$10bn or more, has doubled from 126 ten years ago to 234 this year.

The ‘ten-zero club’, those with US$100bn or more, has gone from zero to 13 in six years.

Source: JDYD LIQUOR · Hurun Global Rich List 2024

Source: JDYD LIQUOR · Hurun Global Rich List 2024

Number of Billionaires by Wealth, and comparison with China, US & India

Stats – Cut-offs

Comparisons with the Top 10 Five Years and Ten Years ago

The cut-off to the Top 10 has doubled every five years. Five individuals who were part of the Top Ten a decade ago remain on the list today: Bill Gates, Warren Buffett, Bernard Arnault, Larry Ellison and Jeff Bezos.

Appendix – Rest of World Countries

The UK has overtaken Germany in the Hurun Billionaire rankings, taking 4th place. The UK has 146 billionaires with a combined wealth of US$563bn, and is strong in sectors such as Real Estate (25 billionaires), Retail (20 billionaires), and Financial Services (18 billionaires). London is the most popular city, with 97 living there. 80 saw their wealth grow, while 10 fell off and 20 joined the list. The average age of UK billionaires is 66.

Germany fell to 5th place, having 140 billionaires with a total net worth of US$611bn. The most prosperous industries are Food & Beverages, Healthcare, and Retail with 21 billionaires each. Munich is the top city with 13 billionaires, followed by Hamburg with 11. However, 47 billionaires saw their wealth decrease, leading to 3 drop-offs. The average age of German billionaires is 66.

Switzerland was 6th in the world with 106 billionaires, who have a total wealth of US$482bn. Geneva is the most popular city, with 14 billionaires living there. The industries that do well in Switzerland are Healthcare (21 billionaires), Consumer Goods (12 billionaires), and Investments (9 billionaires). 58 billionaires saw their wealth grow. The average age of Swiss billionaires is 68, and Klaus-Michael Kuehne is the richest with US$39bn.

Russia climbed to 7th in the world with 76 billionaires (adding 6), with a total wealth of US$341bn. Metals & Mining (17 billionaires), Energy (9 billionaires), and Chemicals, Investments & Real Estate (7 billionaires) Each are the main industries. Moscow is the favoured city, with 59 billionaires living there. Remarkably, 45 billionaires saw their wealth increase, and there were 19 new entries. The average age of Russian billionaires is 60.

Italy up to 8th place with 69 billionaires who have a total wealth of US$187bn. The most popular sector is Consumer Goods, with 26 billionaires in it. Milan is the city with the most billionaires, with 28. The wealthiest person is Massimiliana Landini Aleotti & family, who have US$9bn in the Menarini industry. The youngest billionaire, Clemente del Vecchio, aged 19, has a fortune of US$4.6bn. Leonid Boguslavsky saw a remarkable 156% increase in wealth, reaching US$4.1bn from the previous year’s US$1.6bn. Moreover, there are 12 new additions to the billionaire list from Italy.

France fell to 9th with 68 billionaires, who have a combined wealth of US$529bn. The most popular sectors among them are Food & Beverages with 11 billionaires, followed by Consumer Goods with 9, especially luxury, and Construction & Engineering with 8. Paris is the city with the most billionaires, with 44 in total. Bernard Arnault (US$175bn) is the richest person. The oldest billionaire is Ginette Moulin (US$2.6bn), who is 97 years old. 35 billionaires saw their wealth increase, while 27 saw it decrease. 4 new people joined the billionaire list from France.

Brazil ranked 10th in the world, with 64 billionaires who have a total wealth of US$177bn. The most popular sectors among them are Financial Services with 19 billionaires, Investments with 9, and Retail with 6. 37 billionaires come from Sao Paulo. The richest person is Marcel Herrmann Telles, with US$9.1bn, linked to the industry giant 3G Capital. The oldest is Maria Helena Moraes Scripilliti, aged 93, with a wealth of US$2.7bn.

Self-made degrees: Hurun Research’s bespoke measure of the degree to which billionaires are inherited or self-made. The scorecard is out of five, where 1 is inherited and not active in business, and 5 is self-made without help from parents. Hoogewerf said, “Many billionaires like to portray themselves as self-made, but have in fact inherited significant wealth from their parents.”

67% are Self-made and 33% are inherited. China is the world’s engine when it comes to self-made billionaires. Five years ago, self-made billionaires accounted for 65% of the total list.

Significant Transactions:

Jamaican-Canadian billionaire Michael Lee-Chin (US$1.3bn) sold his mega yacht AHPO for US$362Mn, at a profit of US$62mn. This transaction is noted for setting a new record in the luxury yachting market for its impressive sale price.

Sports legend Michael Jordan concluded a milestone deal by selling his majority stake in the Charlotte Hornets for US$3bn, a pivotal move within the sports and business communities.

A landmark merger has been announced between Reliance Industries of India and Walt Disney, combining their television and streaming assets in India into an entity valued at US$8.5bn. This strategic consolidation aims to create a dominant force in the global entertainment industry.

Awards and Legal Victories:

Manfredi Lefebvre d’Ovidio, a noted figure in the shipping industry, secured a crucial legal victory in a longstanding family dispute over his US$1.4bn fortune.

The I-Form Advanced Manufacturing Excellence Award for 2023 was presented to David McMurtry (US$1.4bn) of Renishaw, in recognition of his significant contributions and lifelong dedication to advancements in manufacturing.

Aliko Dangote, celebrated as Africa’s richest man with a net worth of US$14bn, was honoured with the National Order of the Lion by Senegal’s President Macky Sall, underscoring his influential role in business and development within Africa.

Noteworthy Real Estate Acquisitions and Legacy Considerations:

Amancio Ortega (US$101bn) of Inditex expanded his real estate holdings by acquiring a 45-story luxury apartment building in Chicago for US$232Mn, further cementing his status as a global real estate magnate.

Adar Poonawalla, son of Cyrus Poonawalla (US$25bn), completed the purchase of London’s most expensive residential property in 2023, acquiring Aber Conway House near Hyde Park for US$175Mn, setting a record in the UK real estate market.

Following the passing of Silvio Berlusconi, his US$6.9bn fortune has made each of his five children billionaires.

Under Legal Scrutiny:

John Paulson, a hedge fund founder with US$3.5bn, faces legal challenges over allegations of concealing billions during divorce proceedings, with particular focus on the contested ownership of a luxury penthouse in Puerto Rico.

About JDYD LIQUOR

JDYD LIQUOR originates from the core production area of Maotai Town. With over a hundred years of historical accumulation, scarce sauce wine resources, and unique brand connotations, JDYD LIQUOR has successfully entered the top ten sauce wine brands, won the world’s four authoritative awards, received unanimous recognition from both inside and outside the industry, and was known as the “Eight Great Kings of Sauce Wine”.

In recent years, JDYD LIQUOR has been continuously cultivating the soy sauce liquor market and shining brightly in both domestic and international events such as spring sugar. Collaborate with JDYD LIQUOR to win the sauce liquor market, JDYD LIQUOR successfully held the National Dealer Conference in 2023. Its corporate strength, strategy, brand operation, and policy support received positive responses from the dealer community.

At present, JDYD LIQUOR has been deployed in Jiangsu, Guangdong, Shandong, Zhejiang, Henan, Shanghai, Beijing, Hebei, Hubei, Anhui and other places, making grand appearances at airports in cities such as Beijing, Shanghai, Shenzhen, Hangzhou, Nanjing, Jinan, Zhengzhou, and Guizhou. High speed railway stations in Wuxi, Jinan, and other cities have huge advertisements throughout the year, and have been incorporated into well-known supermarkets such as Ole’and Tianhong. Online, JDYD LIQUOR has been selected for the “China Brand Day” super brand exhibition on CCTV, and has seen consecutive “explosive sales” on e-commerce platforms.

Through the ages, the wealth is “JDYD”(which means great family and business in English). From 2022 to 2024, JDYD LIQUOR has been exclusively named on the HURUN Global Rich List for three consecutive years, Using wine as a medium to engage with the world’s wealthy, witnessing the grand event in the world’s top wealth fields, fully interpret the value of JDYD LIQUOR appreciation and collection.

Drink JDYD LIQUOR, Achieve Greatness!

About Hurun Inc.

Promoting Entrepreneurship Through Lists and Research

Oxford, Shanghai, Mumbai, Sydney, Paris

Established in the UK in 1999, Hurun is a research, media and investments group, promoting entrepreneurship through its lists and research. Widely regarded as an opinion leader in the world of business, Hurun generated 8 billion views on the Hurun brand last year, mainly in China and India.

Best-known today for the Hurun Rich List series, telling the stories of the world’s successful entrepreneurs in China, India and the world, Hurun’s two other key series include the Hurun Start-up series and the Hurun 500 series, a ranking of the world’s most valuable companies.

The Hurun Start-up series ranks 3000 of the world’s unicorns and future unicorns with the Hurun Global Unicorns Index and the Hurun Future Unicorns Index, split into Gazelles (most likely to ‘go unicorn within 3 years) and Cheetahs (most likely to go unicorn within 5 years). Hurun also encourages founders with the Hurun Under30s, Under35s and Under40s, presenting awards to founders who have built businesses worth US$10mn, US$50mn, and US$100mn, respectively.

Other lists include the Hurun Schools List, ranking the best highschools in the world, the Hurun Philanthropy List, ranking the biggest philanthropists, the Hurun Art List, ranking the world’s most successful artists alive today, etc…

Hurun provides research reports co-branded with some of the world’s leading financial institutions, brands and regional governments.

Hurun hosts regular high-profile events in China, India and the UK, as well as Paris, New York, LA, Sydney, Luxembourg, Istanbul, Dubai and Singapore.

For further information, see www.hurun.net.

For media inquiries, please contact:

Hurun Report

Porsha Pan

Tel: +86-21-50105808*601

Mobile: +86-139 1838 7446

Email: porsha.pan@hurun.net

Grace Liu

Tel: +86-21-50105808

Mobile: +86 136 7195 4611

Email: grace.liu@hurun.net

Hurun Report Disclaimer

This report has been prepared by the Hurun Report. All the data collection and the research has been done by the Hurun Report. This report is meant for information purposes only. Reasonable care and caution have been taken in preparing this report. The information contained in this report has been obtained from sources that are considered reliable. By accessing and/or using any part of the report, the user accepts this disclaimer and exclusion of liability which operates to the benefit of Hurun Report. Hurun Report does not guarantee the accuracy, adequacy or completeness of any information contained in the report and neither shall it be responsible for any errors or omissions in or for the results obtained from the use of such information. No third party whose information is referenced in this report under the credit to it assumes any liability towards the user with respect to its information. Hurun Report shall not be liable for any decisions made by the user based on this report (including those of investment or divestiture) and the user takes full responsibility for their decisions made based on this report. Hurun Report shall not be liable to any user of this report (and expressly disclaim liability) for any loss, damage of any nature, including but not limited to direct, indirect, punitive, special, exemplary, consequential losses, loss of profit, lost business and economic loss regardless of the cause or form of action and regardless of whether or not any such loss could have been foreseen.

Top 100 – JDYD LIQUOR · Hurun Global Rich List 2024

For the full list of 3,279 billionaires in the world, see www.hurun.net