- The Biden administration faces a wave of lawsuits targeting regulatory targets as business and banking groups argue federal agencies are overstepping their authority.

- The Chamber of Commerce expects to file at least 22 lawsuits against the Biden administration by the end of this term, compared to three against the Trump administration and 15 during the Obama administration's first term. A lawsuit has been filed.

- The American Bankers Association has signed on to four lawsuits against banking regulators since September 2022, after not signing any for about a decade.

WASHINGTON — When the Federal Trade Commission finalized rules banning non-compete clauses earlier this month, the backlash was immediate. Within 24 hours, the U.S. Chamber of Commerce led a small group of companies in filing a lawsuit seeking to block the ban. They argued that the FTC had no authority to impose it in the first place.

This strategy is becoming familiar. After the Biden administration finalized new rules regulating business, chambers of commerce and industry lobbying groups immediately filed lawsuits to block the agency, claiming it was overstepping its authority.

So far this year, the administration has finalized seven rules addressing everything from independent contractors to credit card late fees to climate change disclosure requirements, but they have been approved by chambers of commerce and other groups. It was met with almost immediate litigation.

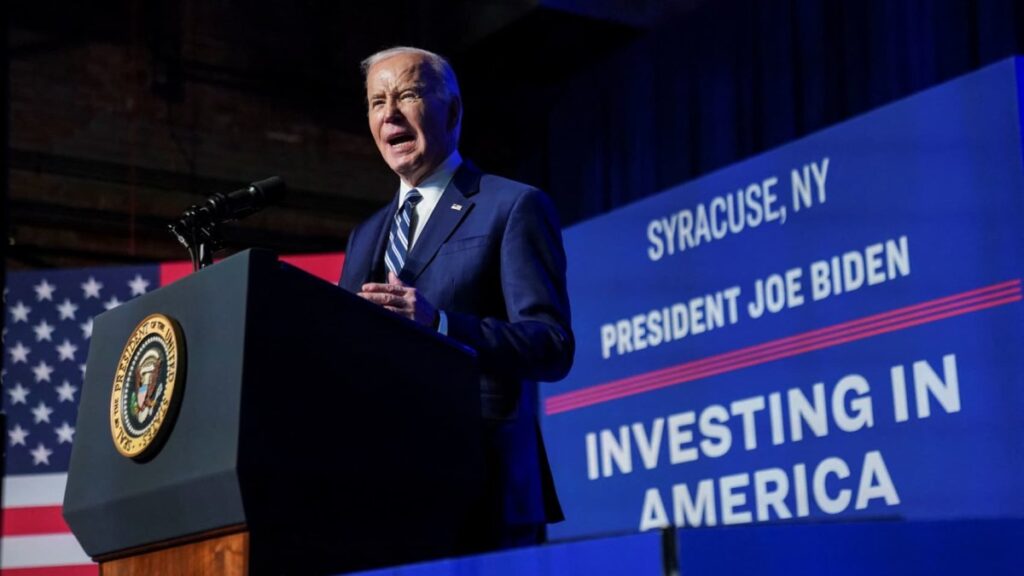

The chamber expects to file at least 22 lawsuits against the Biden administration by the end of President Joe Biden's current term, including three lawsuits filed against the Trump administration and the first term of the Obama administration. This is a significant increase from 15 cases.

And they aren't alone. The American Bankers Association, another influential lobbying group in Washington, had not signed on to any legal challenges to federal policy in nearly a decade, but starting in September 2022, the American Bankers Association Signed four lawsuits.

Chamber and ABA officials stress that litigation is always a last resort. But they believe it is a necessary step when a government agency issues regulations that go beyond its authority.

“This is not just about one regulation. It's about 1,000 regulations that will be finalized this year. More than 200 regulations with an economic impact of more than $200 million annually,” the executive said. Neil Bradley says. The chamber's vice president said in an interview with CNBC.

“We've gone from a time where we debated specific regulations to a time where we're concerned about the overall direction,” Bradley said.

Overall private sector regulation has increased under the Biden administration, and has remained roughly flat, especially when compared to the Trump administration, according to metrics from George Mason University.

But Patrick McLaughlin, director of policy analysis at the Mercatus Center, George Mason's free-market liberal think tank, which created the index, said the nature of Biden's regulations is more noteworthy than the quantity. To tell.

In McLaughlin's view, the Biden administration is “expanding the authorization law.”

“The Chamber of Commerce and others see this as an opportunity to repeal regulations that they believe go beyond what Congress authorized,” McLaughlin said.

The specific targets of the lawsuits vary, with the Chamber of Commerce already suing 12 institutions under the Biden administration, compared to just four under the Obama administration. Despite the various issues at stake, the group's arguments center primarily on the agency's attempt to set rules in areas that can only be addressed by Congress.

For example, even before the FTC announced its ban on non-compete clauses, the Chamber of Commerce vowed to take FTC Chair Lina Khan to court, regardless of the details.

Federal Trade Commission's Lina Khan speaks at The New York Times' Annual Dealbook Summit in New York City on November 29, 2023.

“She may come up with policies that we substantially agree with,” Bradley said of Kahn before the final rule was released. “But the precedent for that authority is unacceptable.”

Critics of the regulation also say the Biden administration has not followed the rulemaking process properly, including by not incorporating stakeholder input as part of the final regulations.

ABA President and CEO Rob Nichols said earlier this year that he hoped they would “stick to finalizing rules outside the scope of regulation and receive constructive feedback from banks and other stakeholders.” If we ignore it, the only tool left in our toolbox is litigation.” “It’s not a tool we want to use, but it’s one we will continue to leverage strategically as needed.”

The Biden administration has said the focus of all regulations is to protect consumers and save money. They estimate that FTC non-competes will boost wages by at least $400 billion over the next 10 years.

The administration also announced that the Consumer Financial Protection Bureau's move to reduce credit card late fees will save 45 million Americans $220 a year, and that the Environmental Protection Agency's air quality regulations will save up to $46 billion per year by 2032. It is estimated that the net health benefit would be $1,000.

“We have full confidence that these agencies are acting within the scope of their authority,” White House Deputy Press Secretary Michael Kikukawa said in a statement to CNBC. “These rules will help American workers and their families by increasing wages, lowering costs, saving lives, and building a more just economy.”

But compliance can also be costly, especially if a new administration could rewrite the rules of the road.

“If you invest in something, do you find out there's some obscure regulation that you didn't know about that suddenly causes the value of your investment to go down?” asked McLaughlin of the Mercatus Center. Or will it become completely impossible to produce?