Reisegraf

Investing in ASML Holding NV (ASML), a Netherlands-based leading global supplier of lithography equipment for chip manufacturers, and Denmark-based Novo Nordisk A/S (NVO), a global leader in diabetes and obesity. Are there any investors who think there is nothing wrong with that? If you knew that the world's largest pulp and paper producer was based in Brazil, would you be willing to invest?

yes, what i'm talking about is Suzano SA (New York Stock Exchange: Suze).

Let me explain below why a reasonable value investor should consider Suzano as a long-term investment.

Business summary

Suzano SA, headquartered in Salvador, Bahia, Brazil, is one of the world's leading pulp and paper producers, and is approximately 43% controlled by the Pfeffer family. We specialize in manufacturing and supplying various types of pulp that are used as raw materials for paper products.Suzano has the highest pulp production capacity. It is the industry's largest manufacturer with a global market share of 10.9%.

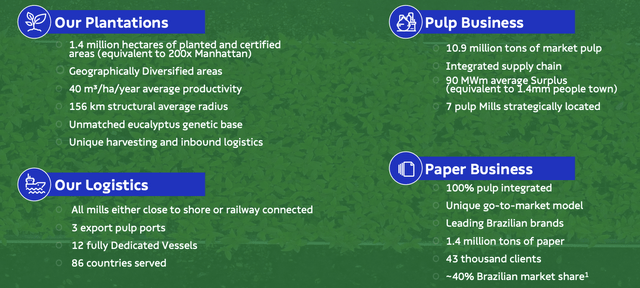

As a vertically integrated business, Suzano sources its raw materials from renewable, fast-growing, sustainable eucalyptus hardwoods grown on 1.4 million hectares of plantations in Brazil. Suzano processes wood fibers into high-quality pulp in his seven strategically located factories. The pulp is then supplied to paper manufacturers to produce various types of paper products, including its own integrated plant capable of producing 1.4 million tons of paper per year. Suzano also owns three export ports and his 12 fully dedicated vessels to provide logistical support to his chain of pulp and paper supplies, as shown in Figure 1.

Figure 1 Vertically integrated business segments such as plantations, pulp business, and paper business that support Suzano's logistics (Suzano)

Competitive position in the industry

There are two types of pulp: hardwood pulp and softwood pulp.

- Hardwood pulp is commonly used to make printing and writing paper, tissue paper, fine paperboard, and specialty papers. This is because hardwood fibers are generally shorter, denser, irregularly shaped, and more rigid.

- On the other hand, softwood pulp is often used to manufacture packaging materials such as cardboard, paper bags, and newspapers because the fibers of softwood are long, thin, and flexible, making it suitable for producing pulp with excellent tensile strength and strength. will be used. The paper has high rigidity.

In general, profit margins for hardwood pulp tend to be higher than for softwood pulp. This is because hardwood pulp is often used for high-value products, while softwood pulp is often used for low-value products.

competitive advantage

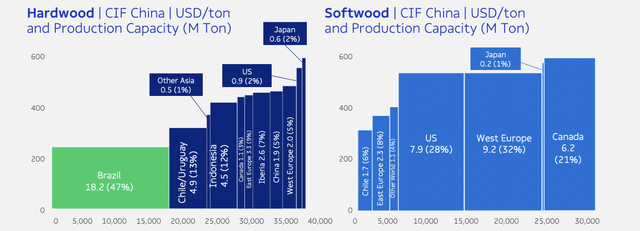

Thanks to its eucalyptus plantations in Brazil, Suzano enjoys a significant competitive advantage in the production of high-margin hardwood pulp. Just as Saudi Arabia is rich in oil, Brazil has a comparative advantage in growing eucalyptus hardwood forests within a vast tropical savanna biome known for its rich biodiversity and unique ecosystems. have. This advantage is evident from Suzano's low production unit costs and outstanding hardwood pulp production capabilities, as shown in Figure 2.

Figure 2. Hardwood and softwood pulp production capacity and unit price by country (adapted from Suzano)

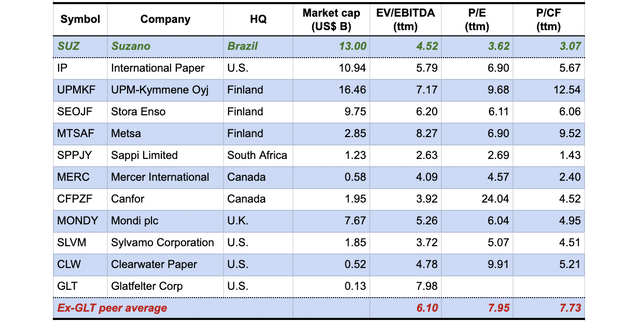

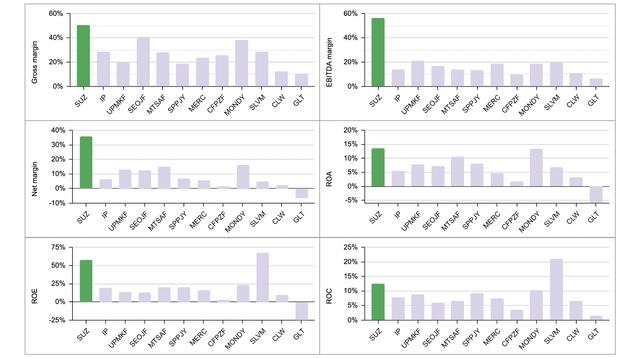

Selected pulp and paper producer peers including International Paper (IP), UPM-Kymmene Oyj (OTCPK:UPMKF), Stora Enso (OTCQX:SEOJF), Metsa (OTC:MTSAF), and Sappi Limited (OTCPK:SPPJY) Among the groups, Mercer International (MERC), Canfor (OTCPK:CFPZF), Mondi plc (OTCPK:MONDY), Sylvamo Corp. (SLVM), Clearwater Paper (CLW), and Within Glatfelter Corp. (GLT), Suzano stands out. As shown in Figure 3, it can be viewed in terms of gross profit margin, EBITDA margin, net margin, as well as return on assets, return on equity, and return on total capital.

Table 1. Selected group of pulp and paper producers in terms of market capitalization, EV/EBITDA, PER, and P/CF multiples (compiled by Laurentian Research for The Natural Resources Hub, based on data collected from Seeking Alpha) Figure 3. Comparison of Suzano with selected peers in terms of gross margin, EBITDA margin, net margin, ROA, ROE, ROC (Natural Resources based on data collected from Seeking Alpha and published financial reports) Hub Laurentian Research)

Importantly, on a trailing 12-month basis, Suzano has achieved an ROIC of 20.5%, which is significantly higher than WACC's 7.0%. This shows that Suzano has a significant competitive advantage.

growth

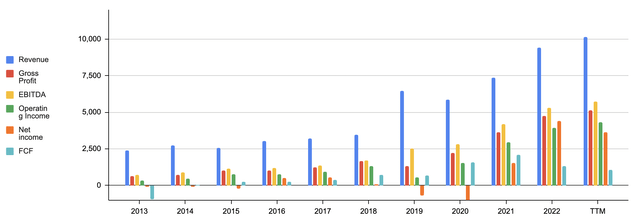

Over the 10-year period from 2013 to 2022, Suzano achieved a compound annual growth rate (CAGR) of 16.4% in sales, 25.0% in gross profit, 24.8% in EBITDA, 30.9% in operating profit, and 56.3%. I was able to do. It is expressed in free cash flow (FCF), as shown in Figure 4.

Figure 4. Suzano's annual revenue, gross profit, EBITDA, operating income, net income, FCF (Laurentian Research of Natural Resource Hubs based on data collected from Seeking Alpha and Suzano's published financial statements)

The merger of Suzano Papel e Celulose and Fibria in 2019 was a major event in the history of Suzano SA. The business combination nearly doubled Suzano SA's annual revenue. Since the merger, Suzano has grown sales at a CAGR of 10.5%, profit of 35.4%, EBITDA of 20.0%, operating profit of 57.3%, and FCF of 10.7%.

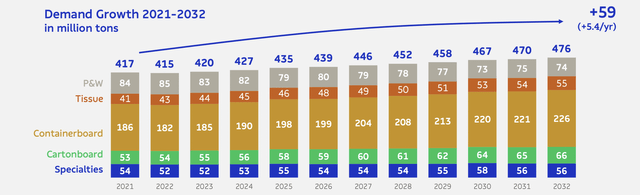

Looking ahead, the continued growth of Suzano's business will be supported by the expected growth in global end-use consumption at a CAGR of 5.4% over the next 10 years, as shown in Figure 5. This growth is driven by population growth and increasing per capita consumption. This is despite an expected decline in the consumption of printing and writing paper. In addition, Suzano will benefit from replacing bleached softwood kraft pulp (BSKP) and recycled paper with bleached hardwood kraft pulp (also known as BHKP) in tissue and cardboard production.

Figure 5. Actual and projected global end-use paper products. P&W stands for Print and Write (Suzano)

cerrado project

The $2.8 billion Cerrado project is a major initiative undertaken by Suzano to meet anticipated increases in global demand. This project will expand Suzano's eucalyptus plantation in Brazil's Cerrado region and increase its pulp production capacity by building a new eucalyptus pulp mill capable of producing 2.3 million tons of pulp.

Upon completion of the Cerrado project by early 2024, Suzano will reduce its average forest-to-mill distance from 203 km to 140 km, increase its pulp production capacity by 20%, and further strengthen its position as a world leader in pulp. It is expected to be. and the paper industry.

Bio business challenges

Furthermore, Suzano biobusiness agendaBeyond its traditional pulp and paper business, the company is targeting new and challenging $115 billion annual markets in four areas: fibers, microfibrillated cellulose (MFC), biofuels and carbon.

- The first textile mill, a joint venture with Spinnova and utilizing MFC supplied by Suzano, will begin production in February 2023, with the second mill expected to be completed from 2024 onwards.

- Suzano is also prepared to trade 7.5 million tonnes of carbon equivalent on the independent market.

Evaluation and risk

Despite being the undisputed leader in the pulp and paper industry, Suzano has significantly lower EV/EBITDA, P/E, and P/CF multiples than its average peer, as shown in Table 1. It will be lower. For example, Suzano owns an EV. The trailing 12-month /EBITDA multiple is 4.5x, UPM-Kymmene is 7.2x, International Paper is 5.8x, Stora Enso is 6.2x, and Mondi is 5.3x.

From a historical perspective, Suzano's 4.5x EV/EBITDA multiple is significantly cheaper than the median EV/EBITDA multiple of 12.3x over the past 10 years.

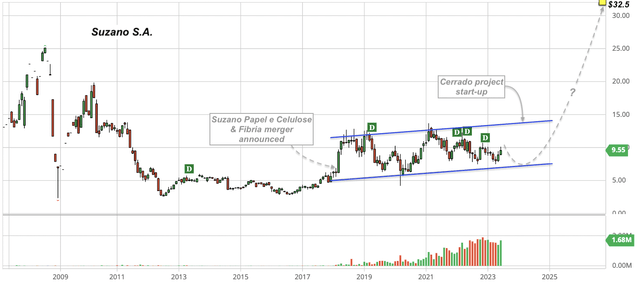

Assuming Suzano maintains its FCF growth pace at a CAGR of 10.7% over the next 10 years and no growth thereafter, my calculations at a WACC of 7.0% mean that the stock's intrinsic value is $32.5 per share. Suggested. The stock price of $9.55 as of June 23, 2023 represents a discount of more than 70%. This means that investors are provided with a very large margin of safety to compensate for all the perceived risks.

risk

To be sure, Suzano exposes shareholders to a number of risks, some of which are specific to the company and others common to the pulp and paper industry.

- First, Suzano is exposed to jurisdictional risks in the form of Brazil's environmental regulations, sustainability standards and government fiscal policies. There have been concerns that left-leaning President Luiz Inacio Lula da Silva may implement anti-market reforms in the post-Jair Bolsonaro era. Perceptions of political risk may be contributing to Suzano's current severe underestimation.

- Second, fluctuations in the Brazilian real's exchange rate relative to other currencies create uncertainty in Suzano's export earnings and debt.

- Third, the stable supply of raw materials, especially eucalyptus hardwood, can be interrupted or become more expensive due to changes in Brazil's weather conditions and pests and plant diseases.

- Fourth, while the pulp and paper industry is known to be highly cyclical, BHKP's volatility is 12%, compared to cattle (20%), copper (21%), and soybeans (22%). , which is lower than the volatility of other commodities such as sugar. (28%), crude oil (39%), iron ore (47%). Industry downturns or supply chain disruptions could affect Suzano's financial performance in the short to medium term.

- Finally, Suzano operates in a highly competitive industry and faces competition from domestic and international pulp and paper producers. Changes in market dynamics, technological advances or new market entrants could challenge Suzano's leading market share position, erode pricing power and harm profitability.

Key points for investors

Overall, we believe Suzano offers a very attractive risk-reward profile for long-term oriented investors. The stock currently trades at a very high valuation relative to both its peers and its estimated intrinsic value, likely due to the perceived high political risk under Lula's government. In my opinion, such deep discounts are not justified given Suzano's competitive position as a leader in the pulp and paper industry.

Strong growth momentum in Suzano's underlying business, supported by the expected start-up of the Cerrado project in early 2024, and a rate cut by Brazil's central bank likely in August or September 2023 as inflation rates decline This may provide the necessary impetus. Suzano's stock price will rise significantly in the near future.

Therefore, long-term investors wanting exposure to Brazilian stocks may consider allocating some of their capital to Suzano in the coming months, if not immediately, as shown in Figure 6. there is.

Figure 6. Suzano SA stock price chart (back-adjusted for dividends). Displayed with announcement of Suzano Papel and Cellulose Fibria merger, start of production of Cerrado project, dividend payment date (D), and estimated intrinsic value (revised) (from Barchart and Seeking Alpha)

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.