Justin Sullivan

There is perhaps no better known company in the sporting goods retail industry. dicks sporting goods (New York Stock Exchange:DKS). It has a large retail footprint, including 858 stores as of this writing, and a rapidly growing e-commerce presence. This retailer is a big name in the field of sporting goods. Although it faces stiff competition from other players in the space, including online, the company has done incredibly well in recent years to grow both sales and earnings. Growth from 2020 to date has been particularly strong. But recent performance suggests a return to normalcy may be on the way. But even if we base our valuation on the company's expected 2022 earnings, the stock still looks cheap in absolute terms, even if it's expensive compared to similar companies.All in all, I expect the future to be a little less bullish than it is now. Even though it's only been in recent years, I still think the company could be a good bet for long-term investors looking for an industry leader.

Shop at DICK'S Sporting Goods

As previously mentioned, DICK'S Sporting Goods operates as an omnichannel sporting goods retailer. The company proudly offers a wide range of products at its signature DICK'S sporting goods retail stores and online. However, the company has other assets worth mentioning. For example, the company currently owns and operates Golf Galaxy, Field & Stream, Public Lands, Going Going Gone! retail store. Additionally, it has a fairly large presence in e-commerce. For example, in 2021, 21% of the company's revenue came from online channels.

Most often, the products sold by the company fall into the hardline category. In fact, 44% of his sales are under this umbrella. Products in this category include sporting goods, fitness equipment, golf equipment, hunting equipment, and fishing equipment. Apparel accounts for another 34% of sales, with footwear accounting for a whopping 21%. The remaining 1% of last year's revenue came from the “other” category, which includes non-merchandise sales categories such as in-store services, shipping revenue, software subscription revenue, and credit card processing revenue.

The sporting goods sector is notorious for its concentration on a few major brands, but the company only had one serious supplier last year.This supplier Nike (NKE) accounted for 17% of the company's merchandise purchases. Additionally, the company's customer mix is highly diverse, purchasing from approximately 1,400 different vendors throughout the year. The company distributes these products through his five regional distribution centers that the company operates, with more than 90% of his final sales going through these distribution centers, and the remaining 10 % comes directly from the vendor to the store.

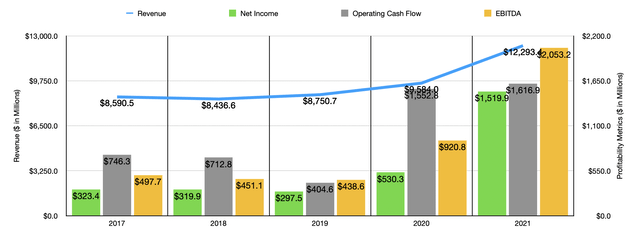

Author – SEC EDGAR Data

Our growth over the past few years has been truly impressive. Revenue increased from $8.59 billion in 2017 to $8.75 billion in 2019. Revenue soared to $9.58 billion in 2020 and $12.9 billion last year. Interestingly, this revenue increase was not due to an expansion in the number of stores in the company's network. In his five years, the company's store count increased from his 846 stores to his 861 stores. Rather, the increase was largely due to higher same-store sales. From 2017 to 2019, total same-store sales increased by just 0.08%. However, in 2020 this number increased by 9.9% and last year by 26.5%. According to management, same-store sales growth from 2020 to 2021 was driven by two key factors. The largest increase was an 18.8% increase in the number of transactions, and the other was a 7.7% increase in revenue per transaction. E-commerce sales have been particularly strong, increasing 81% from 2019 to 2021. This increase can be attributed to social distancing efforts due to the pandemic. After all, shopping at home is much safer than going to the store. While this increase in income may seem strange, it is important to note that increased social distancing and temporary economic closures would have helped people get out more for play activities and exercise. When you think about it, it makes sense.

As revenue increased, so did profitability. Net income increased from $323.4 million in 2017 to $530.3 million in 2020, and jumped to $1.52 billion last year. This is understandable considering that the company's number of stores has not increased that much. This means that while the company's fixed cost structure has remained largely unchanged, the volume and price of products sold in its stores and website has increased significantly. This will have a significant positive impact on profits. This can be seen by looking at other profitability indicators. From 2017 to 2021, operating cash flow increased from $746.3 million to $1.62 billion, and EBITDA jumped from $451.1 million to $2.05 billion.

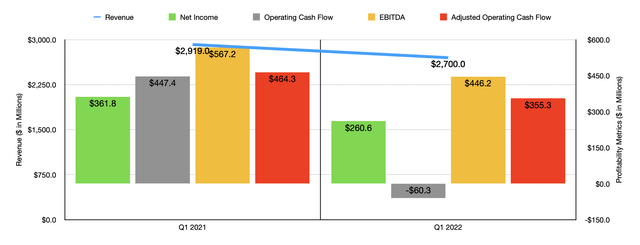

Author – SEC EDGAR Data

Now, come fiscal 2022, management is not so optimistic. For example, total revenue in the first quarter of this year was $ 2.7 billion. This is down from his $2.92 billion just a year ago. During this period, the company's store count increased from 855 to 858 stores, but same-store sales decreased by 8.4%. Naturally, profitability has also shrunk. Net income decreased from $361.8 million to $260.6 million. Operating cash flow decreased from $447.4 million to negative $60.3 million. Even adjusting for changes in working capital, this metric would decrease from $464.3 million to $355.3 million. Meanwhile, EBITDA also deteriorated, decreasing from $567.2 million to $446.2 million.

Management expects this weakness to continue for the remainder of the current fiscal year. They currently expect same-store sales to be down 2% to 8% year over year, which makes sense given my explanation of the reason for the initial sales spike anyway. Masu. Earnings per share should be between $7.95 and $10.15. This would give him a net income of $932.2 million at the midpoint, including $300 million worth of stock buybacks. No guidance was given regarding other profitability indicators. However, if these changed at the same rate as net income, we should expect adjusted operating cash flow to be approximately $991.7 million and EBITDA to be approximately $1.26 billion.

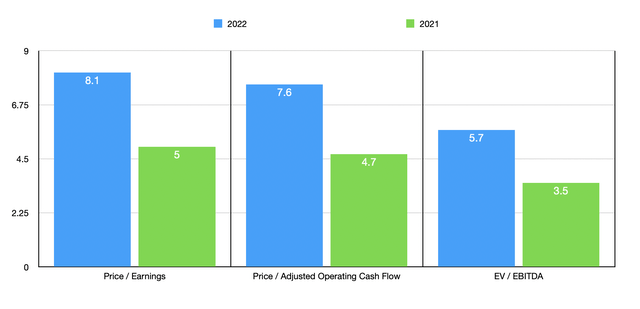

Author – SEC EDGAR Data

Using this data, you can easily determine the valuation of a company. On a forward basis, the company trades at a price-to-earnings ratio of 8.1. This is an increase from the 5x you would get if you relied on 2021 numbers. The adjusted operating cash flow multiple is 7.6x. This is higher than the measurement of 4.7 obtained using 2021 numbers. Meanwhile, the EV to EBITDA multiple is expected to rise from 3.5x last year to 5.7x this year. To put all this into perspective, I decided to compare the company to five similar companies. For context, I also evaluated them based on their forward multiples. Price-to-earnings ratios for these companies ranged from a low of 3.2 times to a high of 14.7 times. Additionally, using the price and operating cash flow approach, the range was 3.9 to 17.9. In both cases, 4 out of 5 companies were cheaper than DICK'S Sporting Goods. Meanwhile, using the EV vs. EBITDA approach, the range was 3.4 to 6.7. In this scenario, three of the five businesses were cheaper than our outlook.

| company | price/revenue | Price/operating cash flow | EV/EBITDA |

| dicks sporting goods | 8.1 | 7.6 | 5.7 |

| Academy Sports and Outdoors (ASO) | 6.2 | 5.7 | 5.3 |

| Big 5 Sporting Goods (BGFV) | 3.2 | 5.7 | 5.8 |

| Hibbett (HIBB) | 4.8 | 3.9 | 4.2 |

| Vista Outdoor (VSTO) | 4.2 | 4.3 | 3.4 |

| Johnson Outdoors (JOUT) | 14.7 | 17.9 | 6.7 |

remove

All things considered, DICK'S Sporting Goods has had an impressive run over the last few years. The company is expected to perform poorly this year, which isn't all that surprising. Assuming things don't get any worse than management expects, the stock is still fairly cheap in absolute terms, although it's a bit expensive compared to similar companies. This suggests that there may be better opportunities in this space for investors who like sporting goods. But for those looking for a stable and promising industry leader, DICK'S Sporting Goods may be worth its relative premium.