Jet City Image

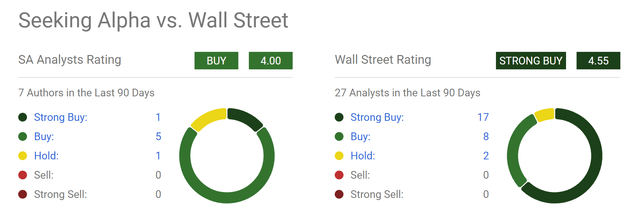

UNH stock is loved by Wall Street

As contrarian investors, we often bet against Wall Street. But UnitedHealth Group Inc.NYSE:UNH) (NEOE:UNH:CA), in line with Wall Street's assessment. As you can see from the chart below, current sentiment towards UNH stock from Wall Street analysts is very strong. That is, Wall Street rates the stock as a “Strong Buy” with a score of 4.55. Of the 27 analysts who have written in the past 90 days, 17 recommend a “Strong Buy” and 8 recommend a “Buy.” Only two recommend a “Hold” and none recommend a “Sell” or “Strong Sell.” Seeking Alpha analyst ratings are a little less enthusiastic, but still indicate a “Buy.”

When examining the reasons for the above assessment, two things emerge. The first driver of bullish sentiment is Share price and long-term earnings power. The second factor is that the recent price correction has brought valuations down to more reasonable levels.

In the remainder of this article, I present my own assessment of both issues and hope you will find that my results support both factors.

Find Alpha

UNH Stock: EPS Headwinds Are Temporary

The recent price correction was driven by some very legitimate concerns. However, it is my view that these headwinds will likely only be temporary. The key concern at the top of my list is the Medicaid eligibility redetermination process. For this, I believe that increased enrollment, especially among commercial and elderly patients, will more than offset any negative impacts from this process. The second key concern on my list is the surge in insurance utilization. To me, this was largely predictable as we are gradually emerging from the pandemic. In fact, by the end of 2023, UNH's medical expense ratio will average 83.2%, up from 82.0% the year before. Moreover, that figure reached 85.0% in the December period. However, I believe such a surge is a temporary event (again, due to the aftermath of the pandemic).

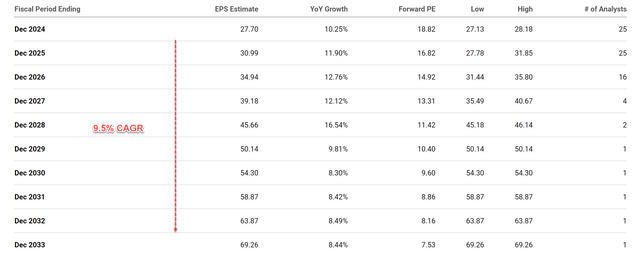

Going forward, consensus EPS forecasts show a robust growth trajectory, as shown in the chart below. Analysts expect EPS to grow steadily at a CAGR of 9.5% over the next decade. Given UNH's scale and differentiated business model, I believe such growth projections are quite reasonable. I believe the two key differentiators are vertical integration and a data-driven approach. Vertical integration could enable UNH to more effectively manage costs and capture a larger share of healthcare dollars. UNH has consistently invested in technology and data analytics, aiming to improve care coordination and optimize health outcomes for its members. I believe that its focus on data-driven insights positions UNH very well in the evolving healthcare environment.

Find Alpha

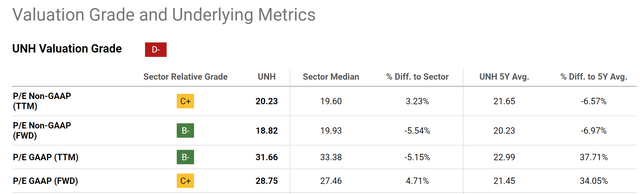

UNH Stock: Focus on Valuation

Let's look at the second factor, valuation. UNH has almost always commanded a higher valuation than its sector in the past due to its leadership position and the competitive advantages mentioned above. However, with the recent price correction, the stock is not trading at a slight discount to the sector, as can be seen in the chart below. On a non-GAAP FWD P/E, it is trading at 18.8x, about 6% lower than the sector median of 19.9x, and about 7% lower than the 5-year average P/E of 20.2x.

Find Alpha

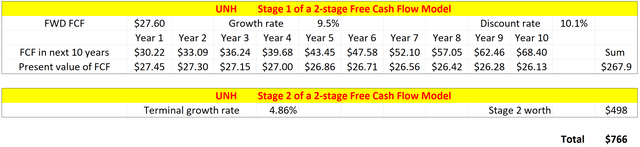

The discount is larger when compared to the fair value estimated from a two-stage discounted FCF model (free cash flow). This model is similar to the Discounted Dividend Model (“DDM”) used in my previous article on Microsoft (MSFT). The only change I made is replacing dividends with FCF, since UNH pays out only a small portion of its earnings as dividends (less than 30% on average). To return to UNH, I will summarize the main features of the model:

The two-stage discounted FCF model has three main parameters: the discount rate, the first-stage growth rate, and the final growth rate. For the discount rate, we relied on the so-called WACC (Weighted Average Cost of Capital) model. According to this model, UNH's discount rate has averaged around 10.1% in recent years.

For the first stage growth rate, we use the market consensus estimate of 9.5% based on the discussion above. For the terminal growth rate, we estimate it based on the return on invested capital and the reinvestment rate. This methodology is explained in detail in other articles. Here, we quote the final results from UNH.

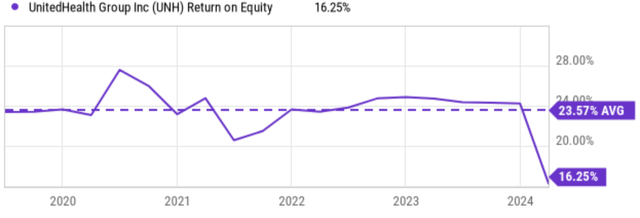

This method involves the Return on Invested Capital (ROCE) and the Reinvestment Rate (RR). For a capital-light company like UNH (with little inventory and minimal requirements for property, plant and equipment), the ROE (Return on Equity) is a good approximation of the ROCE. As shown in the chart below, UNH's ROE has averaged about 23.57% in recent years. If we assume an RR of 10% over the long term, UNH's perpetual growth rate is about 2.36% (23.57% ROCE x 10% RR = 2.36%). Note that this figure is the actual growth rate without inflation. To get the nominal growth rate, we need to add in an inflation escalator. If we assume an average inflation rate of 2.5%, the terminal growth rate is 4.86%.

Find Alpha

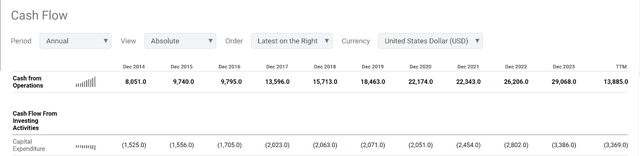

Finally, to estimate FCF per share, we consulted the 2023 cash flow statement in the following table. FCF for that year was $27.6 per share, with operating cash flow of $29 billion and capital expenditures of $3.4 billion. Taking all these parameters into account, the final table summarizes the results of a two-stage discounted FCF calculation. As we can see, a fair value for UNH is around $766. Compared to the current price of $581 as of this writing, this represents a significant margin of safety in the current environment.

Find Alpha

author

Other risks and final considerations

In terms of downside risks, like other health insurers, UNH faces industry-wide risks, including rising health care costs and potential changes in government regulations. The Medicaid eligibility redetermination process is a good example of this risk. There are also other potential regulatory changes that could adversely affect UNH. For example, changes in Medicare/Medicaid reimbursement rates could have a significant impact on UNH. The government sets the reimbursement rates for services provided to patients under Medicare and Medicaid. If these rates are reduced, UNH's revenue for these programs could decrease. Another potential risk is regulations regarding prescription drug pricing. Recent efforts to address rising prescription drug costs could limit UNH's ability to negotiate favorable prices with pharmaceutical companies, impacting profit margins. Additionally, both UNH and its peers are grappling with intense competition within the health insurance marketplace. Additionally, the success of UNH's data-driven approach could be hindered by the recent rise of AI. The future of the sector is likely to be complicated by fiercer competition (e.g., the proliferation of AI applications) and stricter regulations to protect sensitive patient information.

Ultimately, I agree with Wall Street and believe UNH represents an attractive buying opportunity under current conditions. My overall impression is that the positives far outweigh the negatives. It offers a balanced combination of growth potential, an attractive valuation and a stable fundamental position in a sector that is supported by secular tailwinds from an aging population. Finally, its excellent balance sheet strength provides an added layer of safety.