The Indian home loan industry has seen significant year-on-year growth since FY20. More people are applying for home loans and investing in personal properties, and this trend is also reflected in searches for this product. Latest searches related to home loans include inquiries regarding home loan interest rates, EMI calculators, and a comprehensive list of interest rates of various banks. Catering to these growing consumer queries will be a significant challenge for lending institutions.

But how should NBFCs, banks and lending institutions leverage these search patterns to enhance their digital marketing strategies and drive measurable results? A report on home loan search trends by Techmagnate, a leading digital marketing agency, New Delhi, sheds light on these questions.

According to a recent CRIF Highmark report, the mortgage market has skyrocketed to staggering levels. ₹22.4 billion in FY21, registering a significant increase of 12.1% over FY20.

From 2017 to 2021, this market has seen impressive A compound annual growth rate (CAGR) of 32%. Moreover, the forecasts indicate an even stronger trajectory, with experts anticipating a projected CAGR of 22% between 2021 and 2026.

Other reports say growth in India's mortgage market is being driven by rising loan volumes and financing, with large cities leading the way.

But what is driving this market? A renewed appetite for home investment following the pandemic. People are eager to apply for mortgages despite a simultaneous rise in interest rates, signaling continued demand post-pandemic.

This trend is also reflected in the mortgage industry search trends report. Techmagnate, India's leading digital marketing agencyIn this environment, non-banking financial companies (NBFCs), traditional banks, and lending institutions have an unparalleled opportunity to leverage burgeoning search trends in the mortgage market and start connecting with their audience in a fast and profitable manner.

The data from this report highlights valuable opportunities brands can leverage to increase their online visibility and attract mortgage customers.

Mortgage Industry Search Trends

Tech Magnate's comprehensive Mortgage Search Trends Report It provides valuable insights into changing customer behavior.

Through detailed analysis, 8,000 keywords, This in-depth study, which examined branded and non-branded searches and their volume, highlighted a significant increase in overall search volume across various mortgage verticals.

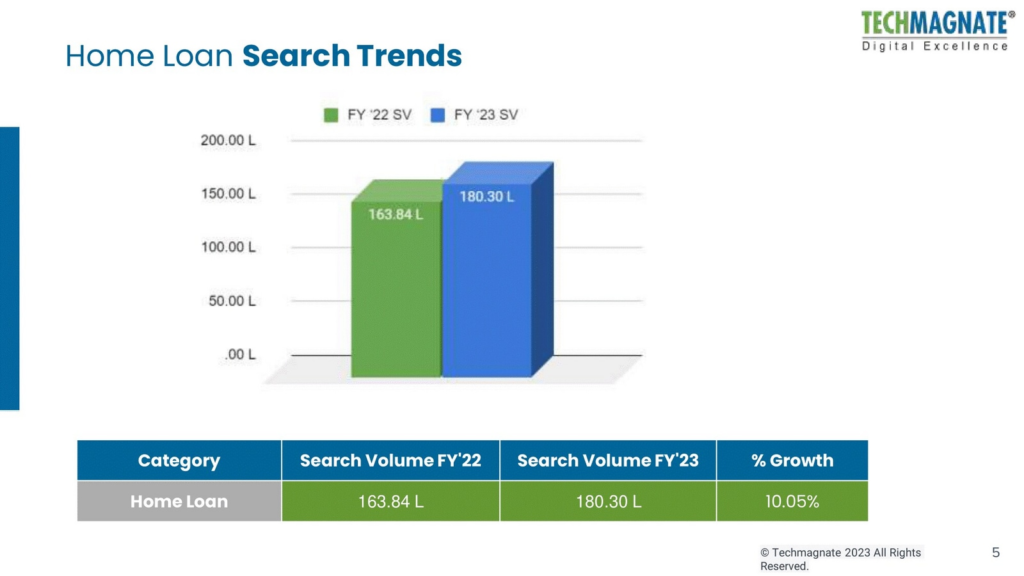

As can be seen from the table above, “Housing loan” Rapid increaseFY23 10% Compared to 2022, the data suggests there is an increased need for brands to strengthen their strategies in anticipation of increased competition and tailor their approach to attract future mortgage buyers.

Top 10 Mortgage Brands by Search Volume

A detailed study in the report shows the dominance of the top 20 brands in the mortgage sector, however, this article focuses on the top 10 brands.

Nationally known brand HDFC Bank Powerful 11.34% growth It ranked highly in terms of search volume. Other brands like SBI Bank and LIC Housing Finance also maintained a significant search volume and showed a consistent growth rate.

Meanwhile, brands like Indiabulls Housing Finance and Kotak Mahindra Bank have seen a decline in search volume, indicating a change in consumer preferences.

- HDFC It emerged as the clear leader, with large search volume and Market share: 34%.

- LIC Housing Experienced The most impressive growth In FY23, sales increased compared to FY22, solidifying the company's position as a significant competitor.

- Indiabulls Housing It is facing a dramatic decline, highlighting the dynamic nature of the market and the importance of adapting to evolving digital strategies.

- Private banks are Kotak Mahindra Bank andICICI Bank There has been a slight decrease in search volume, suggesting that you may need to reevaluate your online presence and SEO strategy.

- of The overall market is showing healthy growthThis indicates growing interest in housing finance and potential opportunities for all parties.

For the complete list of 20 brands, download Techmagnate's Mortgage Search Trends Report.

Sarvesh Bagla“The data clearly shows that there has been an overall 10% increase in searches for 'mortgage', which confirms the growth of the mortgage market. This is an opportunity for new entrants and emerging businesses to leverage these search insights to develop their marketing strategies,” said Techmagnate CEO and Founder.

On the other hand, older, more popular apps can increase their market share by being available in app search.“SBI Home Loan App” and“HDFC Home Loan App”“This represents a 23% increase to capture 84% of the market share, demonstrating the growing trust and recognition of established brands in the digital mortgage app space.”

Mortgage Industry Trends: Three Niche Insights to Explore

The mortgage industry has expanded beyond traditional physical locations into the digital realm, and it is now imperative that all stakeholders understand these evolving trends.

The search trends report reveals three specific insights that point to ongoing changes within the mortgage industry.

What exactly are these insights? Let's discuss.

1. Apps are the new battleground

Mortgage apps are no longer just a convenience but a focus for mortgage buyers. Searches for mortgage apps are growing at a rapid pace, along with the demand for a seamless mobile experience on the go. Brand-related app searches dominate the market with 84.23%This indicates a high level of trust in known players.

These leading companies can leverage this opportunity to further strengthen their advantage by developing user-friendly and feature-rich apps.

on the other hand, App-Based Search Opens Opportunities for New Players Drive user-centric innovation.

2. Localized solutions with pan-India impact

People dream of owning a home anywhere, not just in busy cities. This dream is also growing in smaller cities, as seen in the rise in local searches for home loans. Big players like HDFC and Axis account for just 18.99% of searches using phrases like:“HDFC Home Loans Near Me”Something interesting is happening.

Non-branded search, etc.“Mortgage Loans Near Me” or“Mortgage lenders near me” Soaring and huge 81.01% For all local searches.

This change prioritizes local mortgage lenders Regardless of your brand name, this is a great opportunity for businesses to adapt their local strategy, focus on specific demographic needs and build trust in the local market, which can unlock a lot of potential in the growing local homeownership scene.

3. The emergence of dialect communication

Reflecting the diverse preferences of borrowers, searches in local languages such as Hindi, Tamil and Marathi are becoming more popular.

Brand-specific keywords in local languages increased by 40% They captured a combined market share of 11%. General Inquiries It recorded a 16% increase, maintaining its dominance with a commanding market share. Market share: 89%.

For brands who want to connect with a wider audience and build deeper relationships, incorporating local language communications is essential.

These insights offer a glimpse into the dynamic transformation the mortgage industry is undergoing. Understanding these digital shifts and adjusting their strategies accordingly will enable players to adapt and stay ahead in the evolving mortgage market.

Furthermore, by integrating these Mortgage search trend insights Commitment to digital marketing strategies will be crucial for lending institutions. To succeed in a competitive market, brands will need to adapt to evolving consumer behavior and brand awareness, and capitalize on the surging demand for home loans across India.

Digital Marketing Strategies Brands Should Consider

- Target high volume branded keywords such as:“HDFC Easy Home Loan” And in a broader sense“Mortgage calculator” That's what most people are looking for.

- Create useful content in local languages“Mortgage Tips in Hindi”Dialect content connects better with local audiences.

- Run targeted PPC ads and retarget your website visitors with personalized offers.

- Big brands need to optimize their apps to be user-friendly and get better visibility in the app stores.

- Enhance your social media presence with engaging content and targeted campaigns.

Bonus Tip: Regularly track and analyze campaign results to optimize your digital marketing efforts.

As the search landscape continues to evolve, brands need to understand the trends to help them develop an effective digital marketing strategy. Here are search trends for auto insurance, giving you unique insight into users' search behavior and how they search for the term.

Mortgage Search Trends for a Competitive Edge

In India’s changing mortgage landscape, a combination of data-driven insights and creative digital marketing can lead to great success.

By adapting to changing consumer preferences and leveraging niche opportunities, NBFCs, banks and lending institutions can gain an edge over the competition and contribute to financial empowerment of a diverse and growing market.

Mortgage providers who want to capitalize on these evolving trends should work with a top-tier digital agency like Techmagnate, which has decades of proven expertise in implementing effective strategies that lead to brand growth.

Disclaimer: This article is a paid publication and has no journalistic/editorial involvement of Hindustan Times. Hindustan Times does not endorse/support the content of the article/advertisement and/or the views expressed herein. Hindustan Times is not responsible or liable in any manner whatsoever for anything stated in the article and/or any views, opinions, statements, declarations, assertions etc. expressed in the article. This article does not constitute financial advice.