RepRisk Launches Industry-First Thematic Due Diligence Score to Streamline Monitoring of Business Conduct Risk

Pioneering technology company becomes first data provider to offer full suite of transparent, actionable risk scores for due diligence as businesses prepare for regulation

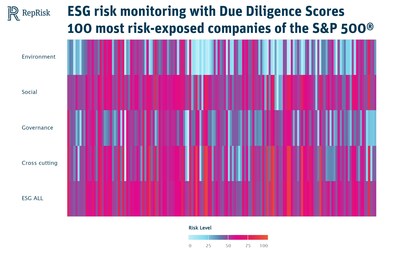

ZURICH, June 5, 2024 /PRNewswire/ — Today, RepRisk, a global technology company providing transparency into corporate conduct and ESG risk, announced a new addition to its data solutions suite: Due Diligence Score. Pioneering the next generation of ESG risk management, the score assesses specific risk factors, such as biodiversity and human rights, on a scale of 0 (low risk) to 100 (high risk), enabling a fast and focused assessment of a company's risk profile. Recognizing that companies may be at low risk in some areas while being at high risk in others, the disaggregated score empowers decision-makers to pinpoint material risks. These industry-first thematic scores are now available to all RepRisk data feed clients.1.

“Banks, investors and companies have long been looking for quickly deployable thematic risk indicators to streamline the due diligence process when raising capital or making investment decisions, signing new suppliers or expanding their businesses,” he said. Alexandra Mihailescu-Cichon, Chief Commercial Officer at RepRisk“The RepRisk Due Diligence Score provides organizations of any size and scope with easy access to transparent, off-the-shelf metrics to accurately assess the risk factors that matter to their organization.”

Clients can choose from a range of ready-to-use packages or customize their own set of over 200 individual scores to align with their specific risk priorities. Scores are made up of individual ESG pillars (environmental, social and governance), frameworks, regulations such as SDGs, SASB, SFDR, German supply chain law and modern slavery law, as well as specific issues ranging from human rights and biodiversity to climate and greenwashing.

According to a recent report from RepRisk, within the S&P 500®, companies have varying levels of risk across the various ESG pillars, as shown in the chart below: Typically, higher risk levels are concentrated in one particular area, rather than across all three pillars.

Photo – https://mma.prnewswire.com/media/2429972/RepRisk_1.jpg

Expanding regulatory requirements, and most recently the introduction of the EU's Corporate Sustainability Due Diligence Directive (CSDDD), mean investors and companies are becoming increasingly reliant on granular and timely data.2 To ensure compliance. Regulations are increasingly requiring companies to implement due diligence and risk management processes, moving beyond annual disclosure of sustainability data to active management of sustainability issues and risks. Investors and companies that take a proactive approach to this paradigm shift will not only benefit from ensuring regulatory compliance, but also preserve value for shareholders and stakeholders, as well as the environment and society at large.

Notes to editors

1 – Due Diligence Scores will be available to all RepRisk Data Feed clients from May 31, 2024, and will be updated on-demand, weekly or monthly. Daily updated Due Diligence Scores will be available to Data Feed clients in September 2024. Due Diligence Scores are expected to be available to RepRisk Platform clients in early 2025.

2 – The Due Diligence Score is calculated based on RepRisk's comprehensive ESG risk database covering 260,000+ companies worldwide, and takes an outside-in approach that disregards self-reported information from companies. RepRisk's data is created through a unique combination of AI and human curation, achieved by screening over 2 million documents daily from 100,000+ sources in 23 languages. The result is high-quality, timely, decision-useful data that supports due diligence and risk management across industries and functions.

about Rep Risk

Founded in 1998 and headquartered in Switzerland, RepRisk is a global technology company providing transparency on corporate conduct risks including deforestation, human rights violations and corruption. RepRisk enables clients to make efficient decisions, helping them generate alpha and preserve value for their organizations, investments and business interests. RepRisk is trusted in the due diligence process by over 80 of the world's leading banks, 17 of the 25 largest investment managers, corporations and the world's largest sovereign wealth funds. RepRisk uses human curation and cutting-edge artificial intelligence to generate the world's most comprehensive corporate conduct and biodiversity risk datasets for public and private companies, real assets and countries.

Please visit www.reprisk.com.

contact

Matthias Fürer

+41 41 552 30 01

media

Source RepRisk