- Nvidia is using sky-high demand for its chips to its advantage.

- Its cloud services and forays into new hardware will put Nvidia in competition with its own customers.

- And Nvidia's customers like Amazon are desperate for the chips, helping the company compete, according to The Information.

Nvidia knows that customers are desperate to get their hands on its GPUs, and it's using that to its advantage.

According to a new report from The Information, even Amazon is bowing down.

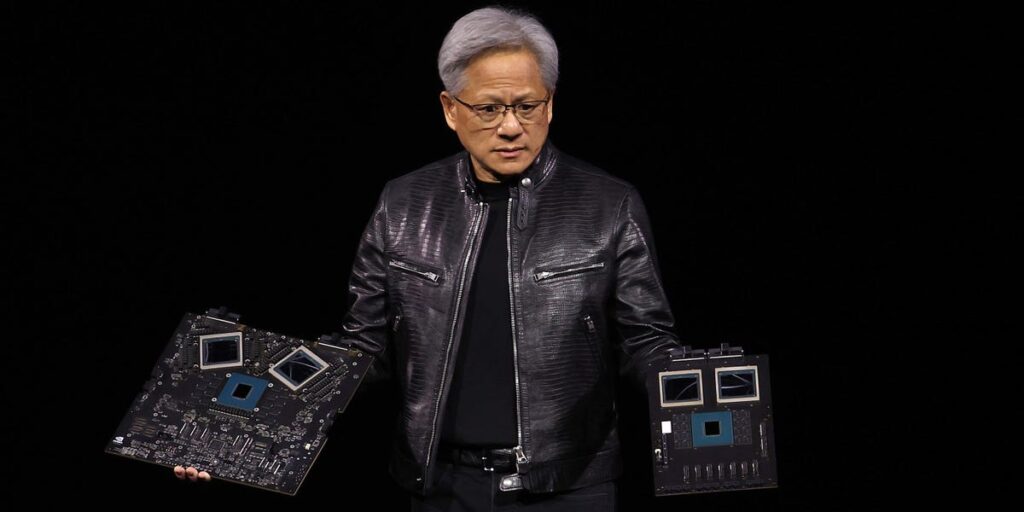

Demand for Nvidia's GPUs — the powerful chips that power artificial intelligence — remains high, but the company's biggest existential threat is a slowdown in demand. So to stay ahead of the competition, Nvidia is diversifying into cloud-services software and rentals.

Last year, Nvidia launched a cloud service, DGX Cloud, to compete with some of Nvidia's customers, including Microsoft and Amazon Web Services. DGX Cloud rents Nvidia-powered servers from within AWS data centers and leases them to Nvidia customers, promising greater computing power, The Information reported.

According to The Information, AWS was initially reluctant to allow Nvidia to set up a competitor store so close to its own, but once other rivals agreed to the terms of DGX Cloud, AWS was forced to back down: It couldn't risk damaging its relationship with a key chip supplier, the outlet reported.

An Amazon spokesperson told The Information that suggestions AWS was worried about angering Nvidia were “speculative and false.”

When contacted by Business Insider, a spokesperson said that Amazon worked closely with Nvidia to develop features for its DGX Cloud service that give customers “the best of both companies.”

“We have worked closely with Nvidia for over 13 years, together we launched the world's first GPU cloud instances on AWS, and now we offer our customers the widest range of Nvidia GPU solutions,” an Amazon spokesperson told BI.

Through DGX Cloud, Nvidia has been positioning itself to help its customers compete with creative strategies. But according to The Information, CEO Jensen Huang's aggressive tactics to stay ahead don't stop there. Nvidia is also demanding that customers create more space to house the GPUs they buy, and telling them how to do it.

“NVIDIA won't ship GPUs unless customers can prove they have the data center capacity to place them,” Raul Martinek, who works with cloud providers as CEO of Databank, told The Information.

According to the media report, the chip giant is not only asking its customers to provide evidence of data center capacity expansion, but is also telling them how to design the racks that will house the servers and GPUs inside their data centers.

And because the racks are specifically designed for Nvidia's chips, it could make it difficult for customers to switch to a competitor's chips without incurring huge costs.

For now, Nvidia and customers like Amazon have agreed to continue a somewhat symbiotic relationship, but that won't stop competition from emerging between the two sides: While Nvidia is expanding into cloud services, AWS is also developing its own AI chips, called Trainium and Inferentia, that it hopes to rival Nvidia's chips.

While the current strategy has been sophisticated enough to make Nvidia the world's most valuable company, the company's attempts to dominate the industry could come back to bite it later: The Department of Justice plans to open an investigation into possible antitrust violations, Politico reported earlier this month.

According to Politico, the federal government is preparing to investigate whether Nvidia became a leading supplier of high-performance semiconductors through anti-competitive practices.

An Nvidia spokesperson declined to comment when contacted by Business Insider.