Philanthropy

Philanthropy

·May 5, 2020

Texas A&M University

problem:

Charitable giving is an important part of the economy and a key decision for households. In 2018, individuals in the United States donated $292 billion to charities, which represents about 1.4% of GDP. Households with incomes of more than $2 million (0.1% of the population) contributed about 30% of all household giving in 2016. However, while the wealthy are often characterized as less generous or compassionate, there is little systematic or reliable evidence to support this. Understanding the relationship between income, wealth, and charitable giving has important implications for policies such as taxation that seek to encourage charitable giving. The importance of charitable services is particularly acute during the coronavirus crisis, when needs increase amid heavy government burdens. Understanding how charitable giving depends on hard-hit income and wealth will be important for charities and policymakers to operate more effectively.

The wealthy have been characterized as less generous, but there is little systematic or reliable evidence to support this.

fact:

- There are several ways to define and measure generosity. The most commonly cited indicator of generosity is the percentage of income that an individual (or household) donates. But in reality, there are many ways to measure generosity, including likelihood to donate, amount donated, percentage of assets donated, and time spent volunteering. Even for a given indicator, different data sets produce different results. IRS tax return data only includes donation information for households that choose to itemize their donations. This excludes many low-income households (see here). Low-income households that donate enough to itemize necessarily donate a larger percentage of their income and presumably donate from assets they have accumulated (e.g., older retirees with savings). While it is technically correct to call these households “low income,” conclusions about how “percentage of income donated” varies by income will be inaccurate. The giving of retirement-age households with low incomes and high assets indicates that wealth is an important factor to consider in people's giving behavior (see here). But wealth is difficult to estimate and is not always recorded in surveys.

- Our new estimates show that giving as a percentage of income is relatively constant across the income distribution. Together with Jonathan Meer, I conducted our analysis using the Panel Study of Income and Social Security (PSID). The PSID is a national survey that includes information on income, wealth, and charitable giving (by religious and secular groups), as well as demographic characteristics such as age, race, religion, and education. Our results are based on biennial surveys of the same 10,665 households, with incomes that make up roughly 99% of the population, regardless of itemized status, from 2000 to 2016. We estimate that the average percentage of income donated to charity across income groups ranges from 1.44% to 2.01%. This is a relatively flat relationship. This contrasts with studies that show a “U-shaped” or “inverted J-shaped” giving curve, i.e., people at the bottom of the income distribution donate the largest percentage of their income, those in the middle the least, and those at the top somewhere in between. However, these other studies do not adequately take into account the skewed effects of outliers, especially low-income, high-wealth households. For example, in our data, the lowest-income group (which includes households earning up to $11,200) gives away more than 33% of their income on average, without adjusting for outliers, compared with an average of 1.84% for all other groups. However, this group includes both people living in poverty and people with significant assets but low annual incomes, such as wealthy retirees.

- Households with higher incomes and assets are more likely to give anything and more money. For example, the highest-income households in our data (average annual income of $414,400) are 27 percentage points more likely to donate than the lowest-income households, and they give 16 times as much, even controlling for characteristics such as age, education level, number of children, and location. More generally, the proportion of people who donate increases as income and wealth increase. It's not too surprising that this trend also applies to donations, because these households have more resources to donate.

- As household income and assets increase, they are more likely to give or donate more money. There are unobserved differences between households that are likely to affect giving: perceptions of the effectiveness of charities, beliefs about the role of government in providing social services, preferences for donating to others, and so on. For example, if these preferences differ between high-income and low-income individuals, this would undermine our understanding of the relationship between income and giving. To account for these differences, we can estimate how changes in income and wealth within a household affect charitable giving. Similar to the above, as a household becomes wealthier, it becomes more likely to donate or give. For example, we estimate that a household whose annual income increases from $60,000 to $70,000 (an increase of about 17 percent) would be 2.2 percentage points more likely to donate and would donate about 26 percent more, all else being equal. Increasing wealth has a similar effect. We estimate that an increase in a household's wealth from $150,000 to $200,000 would increase the likelihood of donating by 1.59 percentage points, leading to an average of donating 9.8 percent more than before.

- Although precise data on the ultra-wealthy is hard to come by, they are significant donors. Households with annual incomes over $2 million account for a significant portion of total giving, but there are only two such observations in our data. It is difficult to make definitive statements about these households because data on their income, wealth, and giving are scarce. We use IRS income statistics tables to get rough estimates for such “very high-income” people. In all three measures of giving (likelihood to give, amount given, and giving as a percentage of income), giving increases with income. 88.3% of households earning between $2 million and $5 million give, giving an average of 3.44% of their income. Compare this to households earning $10 million or more per year, where 95% give, giving an average of $2.6 million (about 8.6% of their income). However, these figures are derived from less detailed data, so generalizations should be made with caution.

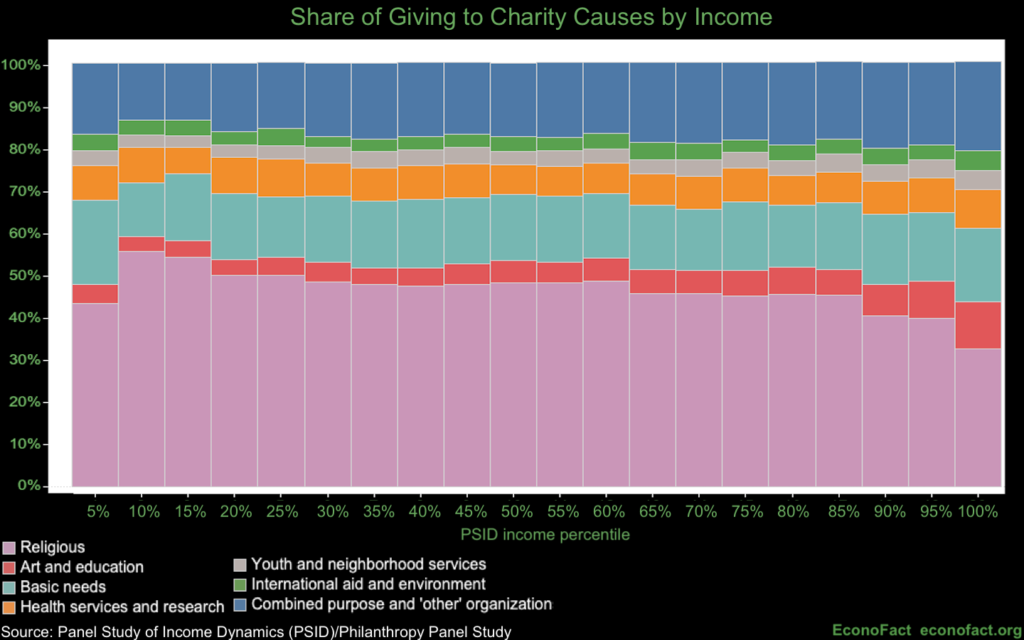

- People give to similar types of charities regardless of their income or wealth. The common idea that low-income households give primarily to religiously affiliated charities and high-income households tend to give to nonprofits such as museums, art galleries, and private schools is not entirely accurate. Our analysis shows that low-income households allocate the largest share of their donations (43% to 55%) to religious causes (places of worship and other religious activities), but so do those at the top of the income distribution, allocating 32% to 39% (see figure). Households in the highest income group in our data donate almost three times more to religiously affiliated charities than to the arts and education combined. More generally, there is some variation in the exact proportions of total donations allocated to different causes, both across income and wealth distributions, but the patterns are remarkably consistent. On average, people tend to give to similar types of charities regardless of their wealth level.

When it comes to lifetime monetary giving, we find that the wealthy are as generous, if not more so, than the poor. When analyzing giving behavior, it is clearly important to consider household assets because households give from their existing income and assets. Although the wealthy give more in absolute terms, this does not mean that wealthy types are inherently more generous. Households give more as their income and assets increase. Trends from 2000 to 2016 suggest that the common belief that the wealthy donate a smaller percentage of their income is incorrect. Previous evidence on this point may be due to outliers, insufficient data across the income distribution, or estimation techniques that confound interpretation.

topic:

Coronavirus / Charity