- Two federal judges in Kansas and Missouri have blocked the SAVE plan's student loan forgiveness and lower payments.

- A series of SAVE provisions that were due to come into effect on July 1st are currently suspended.

- While the legal process continues, borrowers can continue to enroll in the SAVE Plan.

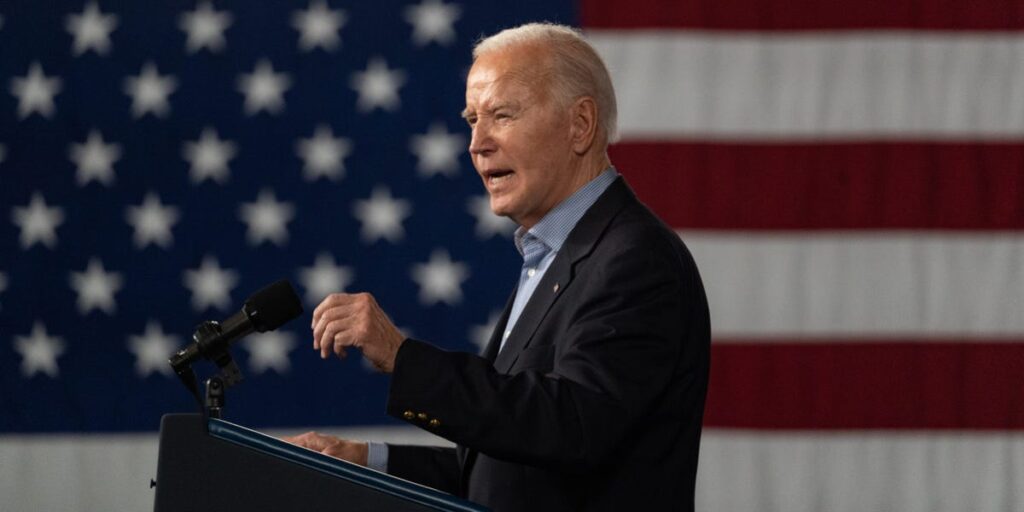

President Joe Biden's new student loan forgiveness plan has been hit twice by federal courts.

On Monday, district court judges in Kansas and Missouri ruled in two separate lawsuits brought by Republican state attorneys general seeking to block SAVE, an income-contingent repayment plan introduced last summer to reduce borrowers' monthly payments.

Earlier this year, the Department of Education began implementing the SAVE provision ahead of schedule, which would have forgiven student loan payments on student loans with original balances of $12,000 or less and that had made qualifying payments over 10 years or less. The attorneys general, among other things, argued that the relief was unconstitutional and sought to block the relief and the entire program.

A Missouri court ruled that the Department of Education cannot implement student loan forgiveness through SAVE while the legal process is ongoing in one of the cases led by Missouri Attorney General Andrew Bailey, preserving borrowers' right to continue enrolling and repaying their student loans.

“These borrowers have already made payments under the program, those payments have been calculated based on the early implementation of certain provisions of the final rule, and some borrowers expect imminent relief,” the ruling said. “These borrowers and the public have an interest in ensuring consistency in the loan repayment program, and any preliminary injunction would undermine their expectation of consistency.”

The Department of Education did not immediately respond to Business Insider's request for comment.

Meanwhile, a Kansas court ruled that the Department of Education could uphold measures already in place through the SAVE plan, but halted new provisions set to take effect July 1, including cutting repayment amounts for undergraduate students in half.

The Kansas ruling goes into effect on June 30th.

Both rulings are provisional and will halt student loan forgiveness for the time being, but the court has not yet issued a final decision.

“Millions of borrowers are left in limbo, unable to understand their legal rights or the information they're being given by the government and student loan companies,” Mike Pierce, executive director of the Student Loan Borrower Protection Center, said in a statement.

“Are borrowers' invoices accurate? Are the interest charges correct? Will the amount due today be the same tomorrow? Will the payment forgiveness that borrowers were promised still provide significant relief? These basic and essential questions remain unanswered,” he said.

Judge Daniel Crabtree, who ruled in Kansas, had previously been skeptical of the Republican attorneys general's arguments, and on June 7 ruled that only three of the original 11 states had the right to challenge the plan.

Still, the two rulings are a setback for borrowers who were hoping to benefit from the SAVE plan that the Department of Education has been touting for the past year. While the department continues to provide individual relief to borrowers through temporary account adjustments, its broader plan for debt forgiveness, expected to benefit more than 30 million borrowers, is likely to face legal challenges as soon as this fall.

The attorneys general of Kansas and Missouri celebrated the ruling. Kansas Attorney General Kris Kobach I have written “Today's victory in Kansas is a victory for the country. As the Court rightly ruled, whether to forgive billions of dollars in student loan debt is a critical question only Congress can answer. The Biden Administration is trying to usurp Congress' authority,” X said.