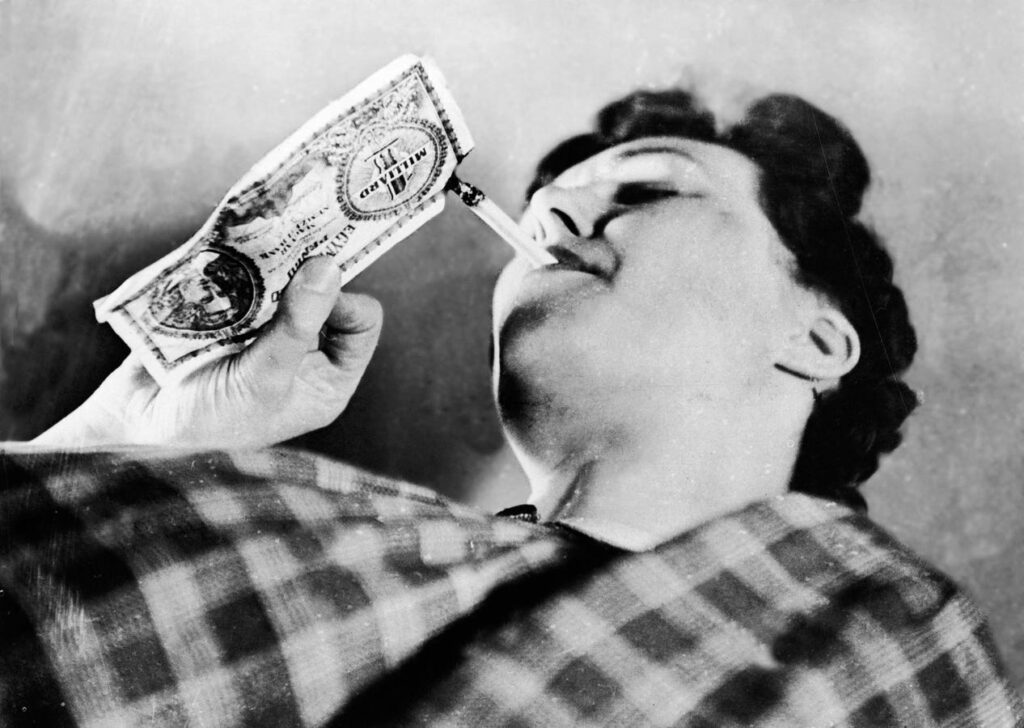

HUNGARY – JUNE 28: A woman lights a cigarette with a 1 billion pengo banknote. … [+]

The recent surge in inflation is putting a strain on household finances, but maybe not in the way you might think: It's hitting the wealthy disproportionately, according to a new study.

Inflation peaked at 9.1% in June 2022 before falling recently to 3.4% in April, according to data collected by TradingEconomics. But inflation is still much higher than in the five years leading up to 2020, when the consumer price index hovered around 2% and was sometimes negative.

In many ways, that stability has been good for the economy, but the surge in inflation since the pandemic hit everyone's wallets, experts say, though some groups have been hit harder than others.

“Virtually all households are hurt by inflation,” says a working paper recently distributed by the National Bureau of Economic Research titled “How Inflation Affects American Households.” “But wealthier households typically face a larger percentage of losses because they have a higher share of asset income relative to labor income.”

Simply put, wealthy people tend to earn more from dividends and interest on investments than from a salary, and inflation has a much bigger impact on the former.

“The net tax on inflation is highly progressive, with the wealthiest 1% experiencing a decline in lifetime spending about 2.6 times larger than the bottom half,” said the study, written by David Altig, Alan J. Auerbach, Erin F. Eidshun, Lawrence J. Kotlikoff and Victor Yifan Ye.

The authors give the example that if inflation were to jump from zero to 10% per year, the top quarter of earners would see their inflation-adjusted spending fall by 9.84%, but their analysis shows that spending for those in the 75th percentile would fall by an average of 4.83%.

The downside for an economy is that the wealthy invest a lot of money in the economy, which leads to growth and job creation. If the wealthy feel financially squeezed, rightly or wrongly, the rest of us suffer. Investment is a key variable that determines growth, and most economists believe that without foreign and domestic investment, any economy will suffer.

The paper's findings also suggest that an inflation tax (levied to strip people of the purchasing power of their savings) may be progressive, meaning that the rich would be hit much harder than the poor by this unlegislated hit to wealth.

“Even if inflation were perfectly expected and fiscally neutral, it would have a large, fairly incremental effect on the average level and allocation of Americans' lifetime expenditures through the fiscal system,” the report states. In other words, the poorer you are, the less negatively impacted inflation will be on your net worth, and vice versa.

That may be a good thing at the moment, given the White House's left-leaning political leanings, but what would that mean for the economy if we add in higher nominal tax rates? How bad would that be for the US?