IRVINGTON, New Jersey (WABC) — We all know that check fraud has become a big problem as banks have stepped up efforts to combat check fraud and check theft.

But what happens when a legitimate business owner receives payment from another company and the check is processed, but the account is frozen due to suspected fraud and cannot be “unfrozen”?

The frozen checks snowballed: A family-owned contracting company in New Jersey deposited $23,000 it couldn't spend, forcing the company to turn down work.

In the construction industry, you need to get paid to get the materials you need for the next job. You have to pay your workers, but their funds were frozen, so there were no new jobs.

“You can look at it on your phone all day. It looks nice on your phone, but you can't touch it,” said store owner Andre Lockhart.

Andre and Maggie Lockhart's small business bank accounts have been closed.

“It says deposits only. How can you run a business like that? It's like putting money into a bottomless pit,” Maggie said.

They've been struggling to dig themselves out of that hole ever since receiving a $23,000 check for recently completed repair work at the rehab center.

All funds were frozen.

“Oh, this is tragic,” Maggie said.

“I'm very sad. I'm very upset and hurt,” Andre said.

An Essex County couple doesn't understand why a deposit they made over the counter at a branch was deemed unusual and their account was restricted.

“He said at the very end, 'Oh, this is a scam. We're investigating,' and then we just had to sit and wait,” she said.

The couple built their company from the ground up in Irvington, New Jersey.

“She handles the accounting and I handle the business,” Andre said. “I work with my people.”

Superior Contracting and Property Management, LLC started out doing small jobs and has grown to include building management.

“All I wanted was to be an African-American who could be trusted in my business,” Andre said.

But now their business is at a standstill, despite weeks of trying to prove that the cleared cheques were genuine.

“I'm this person. I'm the person primarily responsible for this. They said it's a scam,” she said.

With their funds frozen, they have had to dip into their savings to pay salaries.

“Employees need to get paid, they have bills to pay and they have responsibilities,” he said.

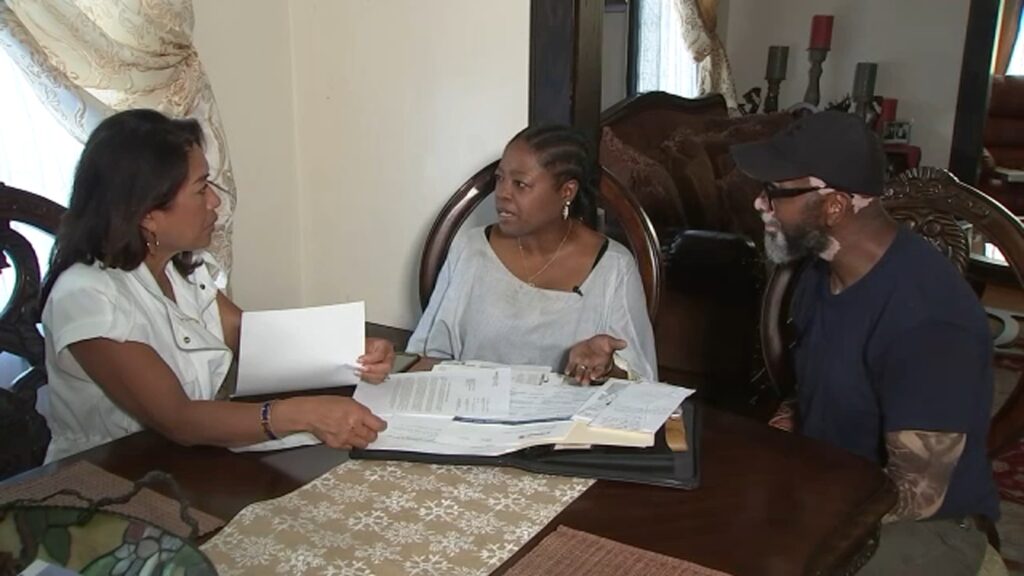

“Mehl, how many times have you been there?” asked 7 On Your Side's Nina Pineda.

“More than 10 times,” he said.

Frustrated, they emailed 7 On Your Side.

Pineda contacted Capital One to request the thaw, which was done within 24 hours.

“They called me right away and said, 'Hey, come and get your money,'” he said.

$23,300 has been released and is ready to go.

“Thank you, thank you, thank you Nina Pineda,” Andre said. “You're the best, she's number one, after my wife and my mother, she's number one!”

Capital One told 7 On Your Side it is happy to confirm that the bank worked directly with the customer to resolve the issue.

Some points are:

Don't put big checks in ATMs. Mr. and Mrs. Lockhart went to the teller. That's a good thing.

If you're dealing with a large deposit, bring your ID and business documents and ask to speak to a manager.

Unfreezing a frozen account is not easy.

It can take weeks for banks to investigate possible fraud, and if your business is frozen, it could cause real damage.

Also read: Tips to save money when booking your next holiday

7 On Your Side's Nina Pineda shares tips to save money when booking your next vacation.

———-

Share your story

Are you having an issue with a company that you just can't resolve? If so, 7 On Your Side is here to help!

Fill out the form below or send us an email with your question, issue, or story idea. 7OnYourSideNina@abc.comAll emails Please be sure to include your name and mobile phone number. Without a phone number, 7 On Your Side cannot respond.

Copyright © 2024 WABC-TV. All rights reserved.