India's auto finance industry is undergoing major changes due to a combination of various factors. These factors include evolving consumer preferences, the growing popularity of electric vehicles, the entry of new fintech companies, and automakers' pursuit of new revenue streams. This disruption is also reshaping consumer search behavior, leading to changes in the type of information they seek online.

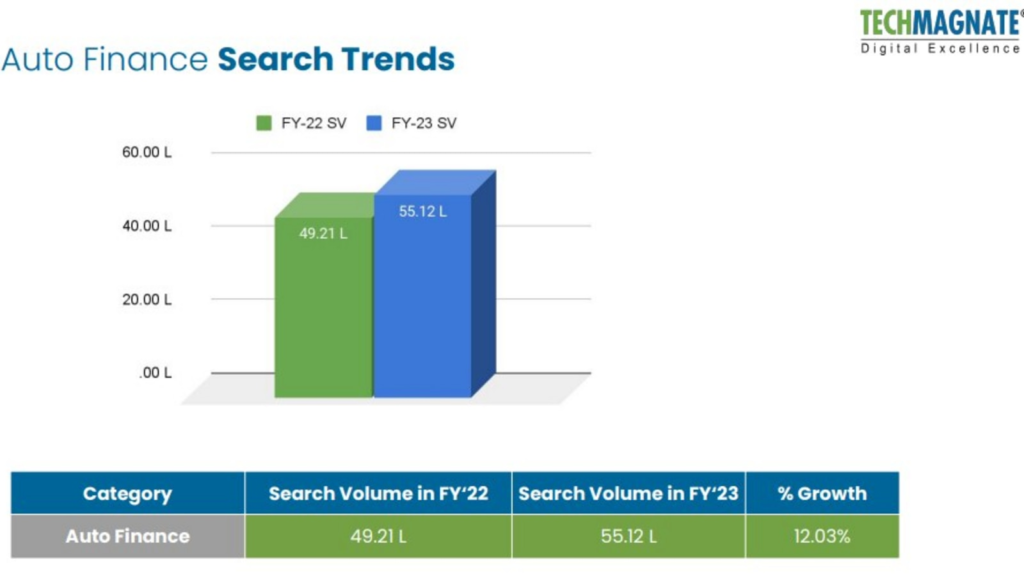

Analysis of consumer search trends by Techmagnate, India's leading digital marketing agency, reveals significant changes in search queries related to auto finance. For example:

- More focus on affordability and transparency

- Demand for alternative financing solutions

- Interest in electric vehicle financing

- Personalized and streamlined experience

These insights support new research recently released by the Reserve Bank of India (RBI), which shows that people are taking out more loans to buy cars instead of houses. This is because cars have become more popular and people are looking for personal transportation.

According to RBI data, auto loans have increased by 137% in the last three years. This made auto loans the second largest loan segment after home loans.

This dynamic transformation in the auto financing industry is being driven by a confluence of factors, including increasing demand for electric vehicles, increasing accessibility in tier 2 and 3 cities, and the rapid adoption of digital technologies. To effectively navigate this evolving landscape, it's important to stay on top of the key trends shaping the industry.

Automotive finance trends in India

- Growing demand for electric vehicles:The Indian government is promoting the introduction of electric vehicles (EVs) through various initiatives such as subsidies and tax exemptions. As a result, demand for car loans for EVs is expected to increase.

- Expansion of auto loans to tier 2 and tier 3 cities: As disposable income increases and car ownership becomes more affordable, demand for auto loans is increasing in tier 2 and tertiary cities.

- digitalization: The auto financing industry is becoming increasingly digital, with more lenders offering online application and approval.

Understand search trends for car finance in India

Further analysis and understanding of these trends requires a deeper understanding of consumer behavior.by Auto Finance Search Trend Report – 2023 According to a Techmagnate announcement, Indian consumers are increasingly making informed auto financing decisions by conducting broader searches using common terms such as: “Car loan interest rate”or “Auto loan qualification”Rather than relying solely on brand-specific queries.This change reflects an increased awareness of the options available and a growing willingness to compare and contrast services from different providers.

The growing popularity of electric vehicles is also influencing search behavior, with consumers seeking comprehensive information on financing solutions tailored to these green vehicles.They actively seek details Interest level, Loan periodand Eligibility criteria Make informed decisions about financing your electric vehicle purchase.

Affordability and transparency are paramount to consumer auto finance search patterns. They are eager to find their next option. low interest rate, flexible repayment plansand Transparent pricing structure to minimize their financial burden.

Additionally, consumers are increasingly demanding auto financing solutions that are personalized to their needs and preferences. They want a lender who can provide them with customized recommendations, streamline the application process, and improve their overall experience.

Indian car finance market size

The Indian used car financing market is expected to grow at a CAGR of approximately 11% during the forecast period (2022-2027). This growth is driven by rising disposable incomes, a growing middle class, and the growing popularity of private cars.

As a result of these factors, consumers are becoming more informed about their auto financing options and are comparing services offered by different providers. This change is reflected in the increasing proportion of non-branded searches in the auto finance industry.

For example, 2022 was dominated by branded search. 46.54% of total search volumedominated by non-branded searches, 53.46%. However, in 2023, non-branded searches grew faster than branded searches and now account for more than half of all auto finance searches. This trend is likely to continue as consumers become increasingly savvy about their auto financing options.

Key players and market share insights: Search Trends Report

We thoroughly researched the auto finance industry and performed a comprehensive analysis. 12,000 keywords It was conducted to uncover branded and non-branded trends, query patterns, and growth opportunities. This in-depth study of automotive finance search trends provides valuable insights that will help industry leaders better understand the market and make informed decisions.

Top 10 Auto Finance Brands in India

- HDFC Bank is India's leading auto finance brand with a market share of 44.84% in FY23.

- SBI and ICICI Bank are the other two major auto finance brands in India with market share of 20.68% and 11.20% respectively.

- Shriram Finance, Mahindra Finance and Bajaj Finserv are the leading non-banking financial companies (NBFCs) in India with market shares of 26.54%, 23.04% and 22.88% respectively.

- Maruti Suzuki Smart Finance is a relatively new player in the auto finance market but has experienced rapid growth in recent years.

Search volume by car type

- Four-wheelers are the most popular type of vehicle for auto financing in India with a market share of 77.78% in FY23.

- Two-wheelers are the second most popular vehicle type in auto finance with a market share of 17.18%.

Search volume by vehicle category

- New cars are the most popular type of vehicle for auto financing in India with a market share of 94.16% in FY23.

- Used cars are the second most popular vehicle type in auto financing, with a market share of 5.84%.

“Auto finance companies need to recognize these search trends and adapt their strategies to meet the needs of Indian consumers. By investing in the right digital marketing strategy and leveraging trends in the auto finance industry, businesses can reach a wider audience and provide a seamless online experience. .” Sarvesh Bagla, CEO and Founder of Techmagnate said:

Search trends by city

- The most searched city for car finance in India is Bengaluru (4.55 L), followed by Delhi (4.36 L) and Hyderabad (3.17 L).

- All cities listed in the report experienced positive growth in search volume for auto finance in 2023.

- This suggests that there is a growing demand for auto finance in India and that this demand is not limited to specific cities.

Keyword searches with high search volume

Top 10 non-brand keywords

- search volume of “Bicycle loan interest rate” It will increase significantly in 2023, suggesting that demand for motorcycles in India is increasing.

- On the other hand, the search volume for “” isUsed car loan has remained stable, indicating that consumers remain interested in buying used cars.

Top 5 query types

- The most popular query type for car finance in India is interest rate, followed by EMI.

- This suggests that consumers are primarily concerned with the affordability of a car or car loan. Search volume for “online” has increased slightly, indicating that consumers are becoming increasingly comfortable applying for car loans online.

How can you leverage search trends in auto finance for digital marketing?

1. Focus on SEO and content marketing

Non-branded searches now account for more than half of auto finance search volume, making it more important than ever for auto finance companies to rank high for relevant keywords. This can be achieved by investing in his SEO and content marketing strategies that target the keywords that consumers use when searching for auto financing information.

For example, if your top non-brand keywords are: “Car loan EMI calculator” Auto finance companies can create how-to guides and blog posts to address queries that direct consumers to websites where they can use auto loan EMI calculators.Or, if the top query types are “interest rate,”Auto finance companies can create blog posts comparing interest rates on different auto loans.

2. Develop personalized and transparent auto financing solutions

Consumers are increasingly looking for customized and transparent auto financing solutions to meet their specific needs. This means that auto finance companies need to develop different products and services that cater to different customer segments. There also needs to be transparency around fees and interest rates so that consumers can make informed decisions.

3. Reach a wider audience with digital marketing

Auto finance companies should use a variety of digital marketing channels to reach a wider audience. Social media, search engine marketingand display advertising. You should also experiment with new and innovative marketing channels, such as influencer marketing and native advertising.

4. Invest in a strong online presence

Auto finance companies need to have a strong online presence that is easy to navigate and provides valuable information to consumers. This includes having a user-friendly website, an active social media presence, and a blog that provides useful content about auto finance.

5. Use data and analytics to improve your marketing campaigns

Auto finance companies need to use data and analytics to track the performance of their marketing campaigns and make adjustments as needed. These companies also need to target their digital marketing campaigns to specific customer segments.

For example, if you're targeting young people looking for their first car loan, you can advertise on social media platforms that are popular with this demographic. This is a key strategy also used by banks in their digital marketing.

Uncovering the secrets to customer acquisition and business growth

In today's competitive auto financing market, it's not enough to offer competitive interest rates and attractive terms. You need to build real, trust-based connections with potential customers and understand their needs and aspirations.

Techmagnate's Search Trends Report helps you learn:

- Identify the most effective search engine optimization (SEO) keywords to drive relevant traffic to your website.

- Create engaging content that resonates with your target audience's search intent

- Develop targeted marketing campaigns that reach the right consumers at the right time.

- Establish your brand as a trusted advisor and guide on your auto finance journey

If you’re ready to efficiently build your brand’s digital presence, contact Techmagnate to effectively leverage auto finance trends.

Disclaimer: This article is a paid publication and has no journalistic/editorial involvement of Hindustan Times. Hindustan Times does not endorse/subscribe to the content and/or views of the articles/ads mentioned here. Hindustan Times shall not be responsible or liable in any way for any content and/or views, opinions, announcements or declarations expressed in the article. (plural), affirmations, etc. are mentioned/featured in the same content.

Unlock a world of benefits! From insightful newsletters to real-time inventory tracking, breaking news and personalized newsfeeds, it's all here, just a click away. Log in here!