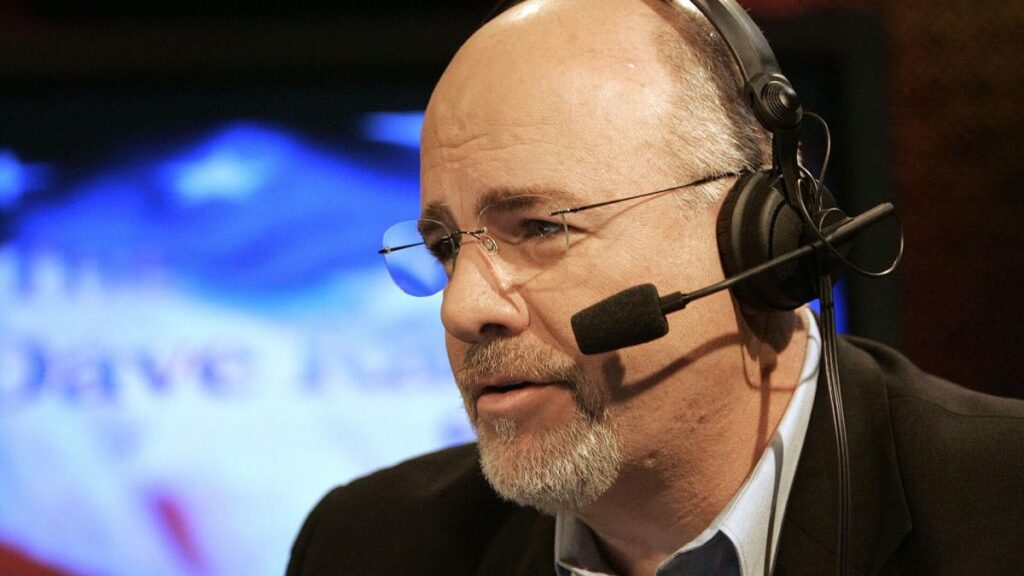

The biggest tool for building assets is your income, and it's up to you to protect it.money expert dave ramsey tweeted Even though your money is tied up in monthly debt payments, your hard work makes others rich, not you.

Suze Orman: This common financial choice is 'the biggest waste of money'

Read more: Put an extra $400 in your pocket every month with this easy hack

What expenses are holding you back from building wealth? Read on to discover three expenses you should cut from your budget today.

sponsor: Get paid for scrolling.Get started now

overuse of credit cards

In a video included in Ramsey's tweet, Ramsey said that billionaires he has known over the years became millionaires by saving and investing their income. What they weren't doing, Ramsey said, was sitting down and counting Discover Points or buying flat-screen TVs at Best Buy.

Mr. Ramsey, who has met with thousands of millionaires, said that not one of them made money with airline miles or “got into financial trouble because of Discover Points.”

I'm a Financial Advisor: The best advice I would give my younger self is this.

student loan

Student loans are another expense that takes up a large portion of your income. According to Ramsey, only 52% of people who enroll in college graduate.

Student loan debt is not subject to bankruptcy and can be eliminated in one of two ways: by the borrower paying it off in full or by death. Ramsey urges people to think twice before taking out student loan debt. According to him, having to borrow money is not an investment in yourself.

“We don't borrow money to invest,” Ramsey said. “If you give up your income, you have nothing left.”

expensive car

Drivers who buy luxury cars to impress people they've never met at a stoplight are spending income that could be used to build wealth. Mr. Ramsey doesn't care about people owning cars costing more than $25,000, but these cars should be paid off and account for a small percentage of income.

The average car payment in the U.S. is $499 a month, Ramsey said. From the age of 30 to the age of 70, a month he receives $500 and invests it, he gets more than $5 million.

GOBankingRates Details

This article originally appeared on GOBankingRates.com: Dave Ramsey: Don't make other people rich — 3 expenses to cut