For every money, work, or travel problem you've ever had, Vivian Tu (aka rich man's BFF and Wall Street's favorite girl) has a solution… and maybe she does too. You've probably made a TikTok about it. Do you want to know how to make your child wealthy? What should I do if I get fired? How much is too much to hold in Venmo? FYI: She's been there, done that.

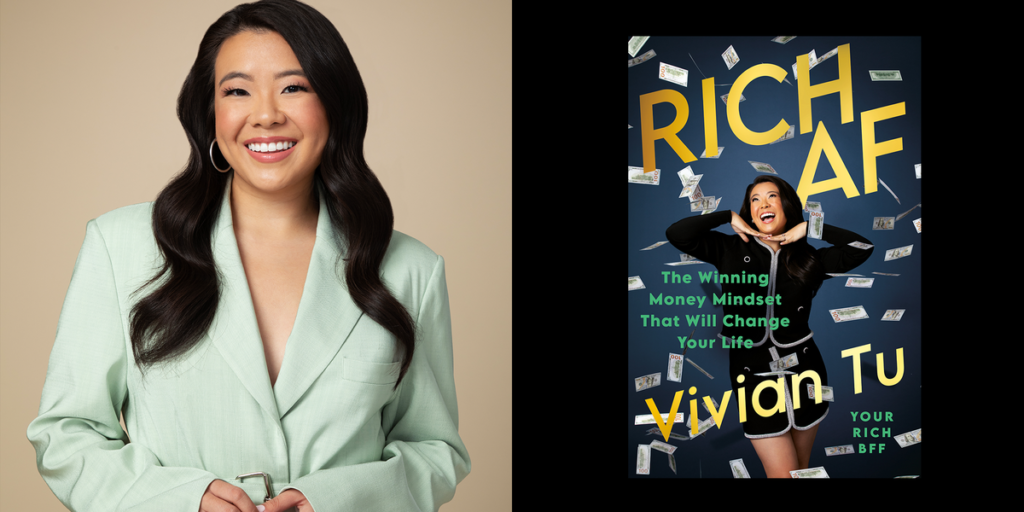

But if you're itching for more in-depth money advice and (let's be real) finance books with Vivian's signature anti-gatekeeping approach, It's something like this: actually fun to readcan I introduce you to Vivian's first book, which will be released on December 26, 2023?!

Cosmo got early access to Rich AF: A winning money mindset that will change your life, And let's just say it has none of the latte-and-avocado-toast embarrassment and is totally full of fun, easy-to-digest wisdom about handling money.Vivian is the big sister you've always wanted. Abundant AF, We dive deep into taxes and HSAs in an incredibly easy-to-understand way, while sharing practical tips for asking for a raise and finding your “FU number.”

According to Penguin Random House, you can expect:

The definitive book on personal finance for a new generation by Vivian Tu, TikTok star and your (favorite) rich BFF.

When Vivian Tu started working on Wall Street as an undergraduate, all she knew was that she was making more money than she'd ever seen in her life. But it was in her trading that she began to understand what the wealthy intuitively know: the secret to winning the proverbial financial game that has been masculine, pale, and outdated for far too long. That's when I found my own mentor on the floor. .

Drawing on the lessons she learned about money and markets on Wall Street, Vivian is a great book for readers of all ages and demographics to help anyone get rich, whether they grew up knowing the rules of the game or not. offers personal finance tips and tricks. or not. Vivian will be your mentor, offering fresh, unfounded advice on how to think like a rich person and develop smart money habits. Throughout the page, Rich AFVivian breaks down her best recommendations for maximizing your income to make the most of your 9-to-5 job, understanding the differences between savings accounts and where to keep your money, and helping you understand your taxes. Identify countermeasures and (legal) loopholes. You need to overcome your fear of investing to retire in style and secure wealth for generations.

Rich AF Readers will not only understand their financial situation, but also gain the tools and knowledge to build their own financial strategy. And with a rich friend by your side, you can start your financial journey with an already wealthy mindset, helping you make the most of your money and grow your wealth for years to come.

Sounds pretty good, right? Don't forget to pre-order Rich AF Keep scrolling to read an exclusive excerpt from Vivian's book before it officially launches on December 26th.

Excerpt from Rich AF: A winning money mindset that will change your life.

Written by Vivian Tu

I value my future self: Save section

To illustrate the importance of saving money, I cut off part of my finger with a bread knife, how it grew back, and why you should have an emergency fund. Let's talk about it. (TW: Mistakes caused by blood, medical debt, and alcohol)

For my 25th birthday, I reserved a private section of the fun bar so I could drink and eat tacos with friends. I was excited and wanted to get ready for the party and go. So that afternoon I took a nap (because I didn't want to get sleepy at the bar) and when I woke up I thought, “Oh, I can have a snack” (I didn't want to get drunk too quickly). (because there weren't any), despite the tacos).

So I grabbed the rolls and bread knife I bought at Maison Kayser that morning and started making sandwiches. But when I try to slice this tough roll, my knife slips.

I look down and see only a small lump on the white kitchen counter.

I look at Nabu. I look at my fingers. I look at Nabu.

And all I could say was, “Oh, no, I think I need to go to the hospital.”

My boyfriend sprang into action and grabbed a paper towel. He quickly wrapped his fingers around me and squeezed them very tightly. We took the elevator down from our apartment. Meanwhile, her husband searched for “the nearest hospital” on his cell phone while carrying my nub in a Tupperware.

In the most New York thing ever, we boarded a yellow cab and headed up scenic Eighth Avenue to the Mount Sinai ER. So I sat in the taxi, sobbing hysterically as the shock wore off and my fingers hurt. Your fingertips have millions of nerve endings, and mine were all not having a good time at all.

And after a nightmare ending up in the ER, I had to go through a full-body metal detector, sit in the lobby, and act like I didn't have blood oozing out onto a bright red paper towel. (Oh, and while I was sitting there, I literally heard a voice over the PA system say “Storage Service to Lobby” and that they were talking about the pool of blood that was now pooling at my feet. I noticed that.)

Fortunately, I was able to go to the doctor, who injected my finger full of lidocaine, took an X-ray, and bandaged it. I was in the hospital for about 6 hours. Worst birthday ever.

The happy ending is that my fingers literally regenerated over the next few months. (Which…apparently, it's the fingers?! Who would have known?) But isn't there a happy ending? The most infuriating part of this whole experience?! A month later, we received the bill for a small birthday party at Mount Sinai.

For $16,000.

Luckily, I had good insurance, so I personally didn't go into too much debt. But my bill was still $1,300, which is a legit pile of change.

That's why, friends, I always advise people to have savings and an emergency fund before they start investing. If my money was tied up and he didn't have $1,300 in his account, basically for emergencies, I wouldn't have been able to pay my medical bills in a timely manner. This could have exposed me to medical debt and negatively impacted my credit score.

Saving money can save you when you fail (or get stuck in life) and help you realize your dreams at the right time. Fundamentally, savings are the basis of financial stability.

Some of the people who make the worst and worst decisions with their money? It's not a specific gender. Not a specific race. It's not a specific age group. These are people who don't have a choice. It is the people who are in despair.

Having a large amount of savings means you don't have to make decisions out of desperation. You know you have enough money to cover your basic expenses, deal with unexpected bills, and gradually save up cash to buy the things you want. There is a sense of security and stability, and an overall feeling of calm.

Because if you're saving, your needs are met, and you're not constantly stressed about bills, then you can graduate and do other great financial things like investing, preparing for retirement, buying real estate, etc. Because you can. What makes you money is what makes you money, which means living like a rich person.

How to bank like a rich person

When we talk about “saving money,” we're actually talking about two different things. It's about (1) spending less money on things, and (2) literally keeping your money in a designated container (i.e., your bank account). But let's be real. Do you actually understand how your bank account works, or even if it's the best one for you?

Rich people engage and shop with banks early in life, building Avengers-level account teams. They shamelessly have long-term relationships with multiple financial institutions. They keep their savings in Bank A for killer high-yield savings products, but check out Bank B because they get unlimited ATM fee refunds. They know that all banks want to reward and retain their loyal customers, so why not become a loyal customer of multiple banks so you can choose from a large number of insider offers? Is not it?

While most of us just choose to acquire ourselves as customers whenever a bank happens to pop into our sights, rich people know that they are of great value to that bank. I know. It's not like, “We're all family and we really care about our customers.'' In a cold, hard, cash way.

When you put money into a checking or savings account, the money doesn't just sit there. It goes out and makes banks make money. It's not you, it's the bank.

In other words, when you put money into a savings account, you're essentially making a loan to your bank or credit union. Then they would turn around and lend that money to people. And you better believe they're charging those people interest. And in return for parking your money there, banks pay you an average of about 0.06% interest each year. And since banks are paying you literal pennies compared to the interest rates they charge when lending you money, they really need you as a customer.

For the wealthy, this dynamic is very obvious. That's why they have no problem shopping around for the best accounts to use with their “teams,” as well as leveraging their value as a customer in a way that banks don't impose on them.

So there are two things you should keep in mind to bank like a rich person. The first is that banks don't want you to change banks. They expect you to be lazy. Take advantage of that and look around. Look for another, perhaps better, bank to which you can move your money (or some of it).

Second, banks can do a tremendous amount for you before you retire. Not only will they waive late fees, send you free check books, etc., but they're more than happy to do it because it makes good business sense. Are there overdraft fees? Did you get ATM fees snatched? Just call them and ask them to turn it off. You'll be shocked at how easy this is.

From RICH AF: The Winning Money Mindset That Will Change Your Life by Vivian Tu, under agreement with Portfolio, a publication of Penguin Publishing Group, a division of Penguin Random House LLC. Copyright © Vivian Tu, 2023.

Rich AF: A winning money mindset that will change your life, Written by Vivian Tu, scheduled to be released on December 26, 2023. To pre-order this book, click on your retailer of choice.

Amazon Barnes & Noble Bookshop.org Hudson Bookstore Books 1 Million Books Walmart

Hannah is an assistant shopping editor. cosmopolitan, We've covered everything from cute apartment decor to trendy fashion finds, TikTok products that are actually worth $$$, and the perfect gift for your boyfriend's mom.she previously wrote Seventeen and CR fashion book. Follow her on Instagram for the latest on red carpet fashion and carefree updates on the books she's reading on the train.