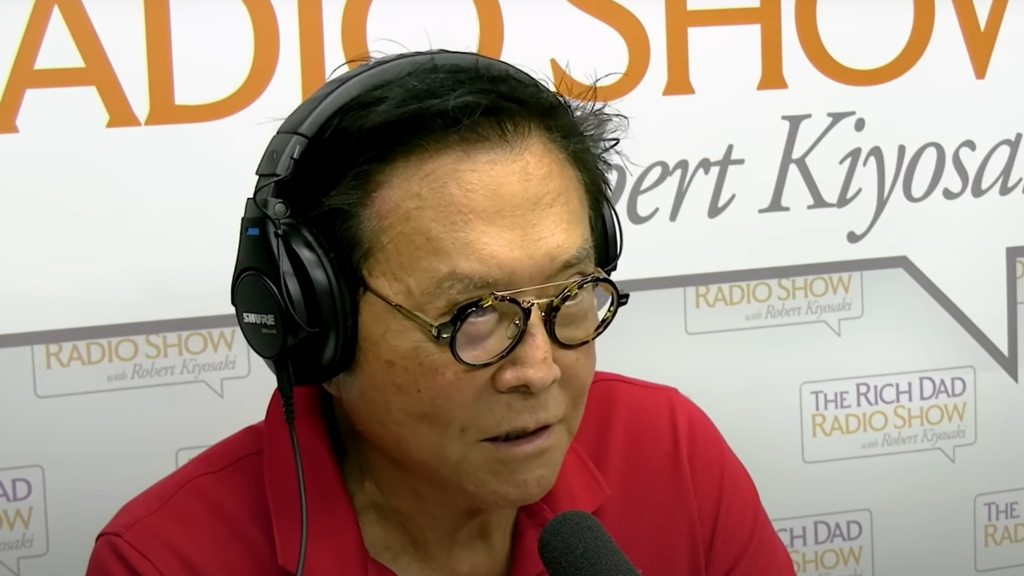

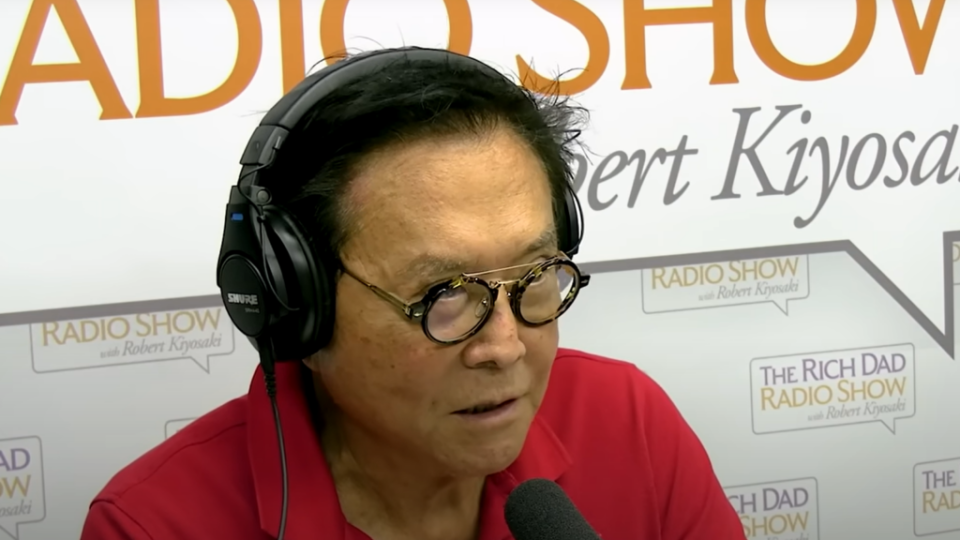

Best-selling author and experienced investor Robert Kiyosaki has a clear philosophy on debt and investing. Kiyosaki detailed his debt philosophy in an Instagram Reel on Nov. 30, highlighting the important difference between assets and liabilities.

He said that while many people use debt to buy debt, he uses debt to buy assets. Explaining his approach, Kiyosaki said luxury cars like Ferraris and Rolls-Royces are fully paid off and he classifies them as liabilities rather than assets.

In Reel, Kiyosaki expressed skepticism about hoarding cash, citing the U.S. dollar's departure from the gold standard in 1971 under President Richard Nixon. Instead of saving cash, he saves gold and converts the income into silver or gold. The strategy has led to the company accumulating $1.2 billion in debt, a figure Kiyosaki acknowledges. He says he's in debt, “If I go bankrupt, the bank will go bankrupt, too.'' It's not my problem. “

Do not miss it:

His approach includes using debt strategically to increase wealth. Kiyosaki categorizes debt into good debt and bad debt, with good debt being those that help build wealth, such as loans used to acquire income-producing assets such as real estate, businesses, and investments. He is an advocate of using debt as leverage in investments, particularly in real estate, and believes it is an effective way to capitalize on market fluctuations and take advantage of opportunities.

Mr. Kiyosaki's investment strategy is multifaceted. He is known for his stance on fiat currencies, labeling them with derogatory terms and instead investing in what he calls “real assets” such as Bitcoin, silver, gold, and Wagyu beef. is advocating. Bitcoin in particular is his favorite and is seen as a hedge against the deterioration in the value of the US dollar. Mr. Kiyosaki considers gold, another important component of his own portfolio, to be more stable and reliable than cash, but he simply “doesn't trust the dollar” and is reluctant to use cash. It's called “garbage”. If prices drop significantly.

Silver is also an important part of his investment strategy. He sees this as a long-term investment, especially because of its increasing scarcity and relatively low price compared to gold. Real estate remains the cornerstone of his investments, valued for its dual benefits of rental income and capital appreciation. His investment in Wagyu beef, a less common asset, reflects his belief in diversifying portfolios beyond traditional investments.

Kiyosaki's approach to debt and investing is rooted in a broader perspective on finance and wealth. He views money as a type of debt or obligation and a tool that can be used to acquire assets and create wealth. His philosophy emphasizes financial education and suggests that people should be well informed about financial issues.

While Kiyosaki's methods have been successful for him, they also come with risks, as his past financial troubles, including filing for bankruptcy in 2012 after a legal dispute over royalties, have shown.

Read next:

“The Active Investor's Secret Weapon'' Step up your stock market game with the #1 News & Everything else trading tool: Benzinga Pro – Click here to start your 14-day trial now!

Want the latest stock analysis from Benzinga?

This article Robert Kiyosaki of “Rich Dad, Poor Dad'' says he owes $1.2 billion because “If I go bankrupt, the bank will go bankrupt, too.''It’s not my problem” originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.