The Hurun Research Institute releases Hurun China Rich List 2023, in association with premium baijiu brand Hengchang Shaofang. This is the 25th edition of the list.

l Hurun Research found 1,241 individuals with more than CNY 5 billion (equivalent to US$690 million), down 5% or 64 individuals from last year and 15% or 224 individuals from the peak two years ago. This is only the second time since records began 25yrs ago that the Hurun China Rich List has dropped two years in a row, the previous time being 2018 and 2019.

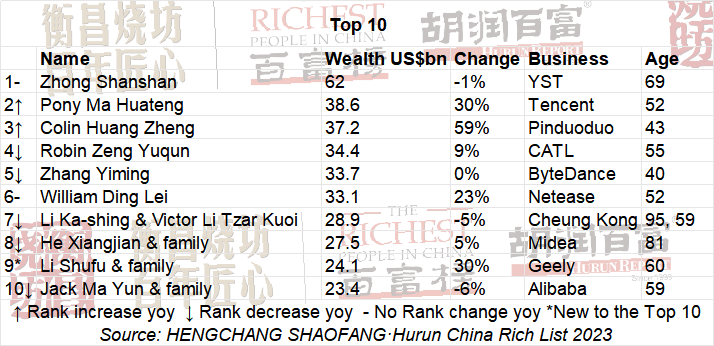

l ‘Bottled Water King’ Zhong Shanshan, 69, topped the Hurun China Rich List for the third year running with US$62bn. Despite the economic headwinds, Zhong’s wealth has remained almost unchanged.

l Pony Ma Huateng, 52, shot up three spots to second place with US$38.6bn, up US$9bn or 30%, as online gaming picked up.

l Colin Huang Zheng, 43, was the fastest riser of the year, up 7 places to break into the Top 3 for the first time, with US$37.2bn, up US$13.8bn or 59%, on the back of Pinduoduo’s growth domestically and the success of its Temu platform in the US.

l Last year’s third place Robin Zeng, 55, of battery maker CATL was down one place to fourth, despite wealth up 9% to US$34.4bn on the back of record battery sales. Last year’s second place Zhang Yiming, 40, of ByteDance dropped down to fifth with US$33.7bn, despite having the best part of 2 billion users on his short video platform.

l Jack Ma, 59, of Alibaba was down 1 place to tenth spot with his wealth down a further 6% to US$23.4bn, on the back of a further drop in the valuation of Ant Financial. The former Number One has lost US$35bn since his peak of US$58.8bn in 2020.

l 895 dollar billionaires, down 51 since last year and down 290 since the peak two years ago, but still ahead of pre-pandemic times, and still Number One in the world for billionaires, ahead of the US.

l Fastest risers, were led by Pinduoduo’s Colin Huang, up US$13.8bn, and followed by three from the online gaming: Tencent’s Pony Ma Huateng, Mihoyo’s Cai Haoyu, 36, (up US$6.3bn) and NetEase’s William Ding Lei (up US$6.2bn). Other fast risers included 2 from the EV sector: Li Shufu of Geely and Li Xiang of Li Auto and 2 from semiconductors: California-based John Tu and David Sun of Kingston Technology, each up US$4.3bn.

l 115 new faces, the lowest number of new faces since 2005. This year they are mainly from Healthcare, Software Services and Food & Beverage.

l Biggest wealth decreases. Almost 500 individuals have dropped off the list these two years. This year, former Number One Wang Jianlin of Wanda was down US$7.3bn, as real estate developers with high debt continued to lose value. Four of the Top 10 biggest wealth decreases were in solar, with Hoshine’s Luo Liguo, Longi’s Li Zhenguo and Li Xiyan, Deye’s Zhang Hejun and Tongwei’s Liu Hanyuan and Guan Yamei losing US$18bn between them. Pang Kang of Haitian lost US$6.9bn, after a food additives scandal for its flagship soy sauce product. Richard Liu Qiangdong & Zhang Zetian were down US$6.2bn, as JD lost ground to its competitors and saw costs increase for its delivery services. Qin Yinglin & Qian Ying of Muyuan were down US$5.5bn, as profits dropped on the back of a fall in pork prices.

l Real estate continued to see wealth decreases. Former Number One Xu Jiayin of Evergrande still makes the list, based on dividends paid out in previous years, even though Evergrande has all but gone bankrupt and Xu in September was detained by the authorities.

l 179 dropped off this year, led by Industrial Products accounting for 14%, followed by real estate, accounting for 15%.

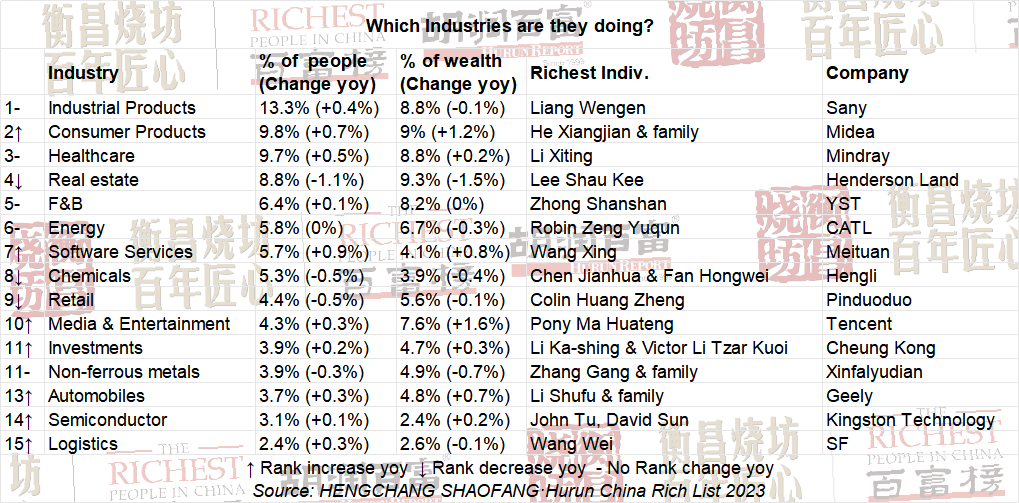

l Industrial Products have the largest number of entrants, accounting for 13.3% of the total, followed by Consumer Products with 9.8% and Healthcare with 9.7%. In terms of total wealth, Real Estate is still the highest, accounting for 9.3%.

l 101 were 40 or under, up 7, of which 39 were self-made, up 3. Zhang Yiming is far and away the richest self-made person under 40 with US$33.7bn, followed by Shanghai-based Cai Haoyu of online gaming platform Mihoyo with US$9.2bn.

l 19 were born in the 1990s, 2 more than last year, of which 3 are self-made: Nie Yunchen of bubble tea brand Heytea with US$1.2bn, Lu Jianxia of coffee chain Manner with US$960mn and Seattle-based Wang Shuo of HR service platform Deal with US$900mn.

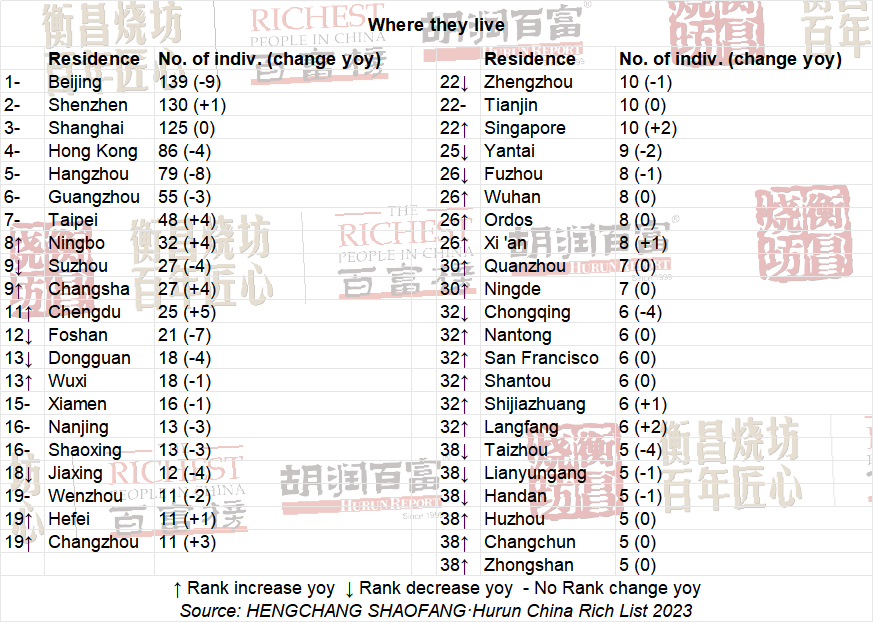

l Shenzhen continues to close the gap with Beijing, followed by Shanghai in third place. Changsha broke into the Top 10 at the expense of Foshan. The Top 10 cities accounted for 60% of the list, whilst Beijing, Shenzhen and Shanghai accounted for 30%. The preferred countries to live outside of China were the US with 16 individuals and Singapore with 10.

l 142 live in Hong Kong, Macao or Taiwan, up 2 and accounting for 11% of the list. Of those, 82 reside in Taiwan, 3 more than last year, and 60 in Hong Kong, 1 fewer than last year. 16 made the Top 100, led by Li Ka-shing and his son Victor Li.

l 25.4% are women, down slightly from 26.7% last year, of which 60% are self-made. Sun Hung Kai’s Kwong Siu-ching, 94, overtook Yang Huiyan of troubled real estate developer Country Garden to become China’s richest woman for the first time.

l Delegates to the NPC or CPPCC dropped from 8.4% of the list last year to 6.5% this year. 42 were delegates to the CPPCC, down 15, and 39 delegates to the NPC, down 11.

l Professional managers (non-founding team members) accounted for 2%, led by Haitian’s Cheng Xue (US$3.8bn, down 38%) and Tencent’s Lau Chiping (US$2.8bn, up 11%).

l 60 founders of unicorns made the cut, led by Zhang Yiming’s Bytedance, which is currently the largest unicorn in China with a valuation of US$200bn. China currently has 316 unicorns, second only to the US, according to the Hurun Global Unicorn Index 2023.

l 7 from last year’s list passed away: Rudy Ma of Yuanta in October last at the age of 82; Zhou Mingjie of Ocean’s King in November last year at 65; Liu Guoben of Camel in November last year at 79; Zheng Yonggang of Shanshan in February at 65; Li Shicong of Lungyen in March at 65; Koo Lin Jui-Hui of CTBC in April at 83; Zhao Ning of Wuxi Pharma Tech in May at 57.

l Those born in the Year of the Rabbit continue to be the best wealth creators, with the most individuals on the list for an unprecedented 12th year. Dragons and Snakes were second and third, whilst those born in the Year of the Snake were the best improved and those born in the Year of the Ox dropped down the most.

(24 October 2023, Chengdu) The Hurun Research Institute today released, in association with premium baijiu brand Hengchang Shaofang, the Hurun China Rich List 2023, a ranking of the richest individuals in China. The cut-off was CNY 5 billion (equivalent to US$690 million), and wealth calculations are from 1 September. This is the 25th year of the list.

This is a brief translation from the original Chinese-language press release, which can be found on www.hurun.net.

Hurun Research found 1,241 individuals with more than CNY 5 billion (equivalent to US$690 million), down 5% (64 individuals) from last year and spread across 144 cities. Total wealth dropped 4% to US$3.2tn. 522 saw their wealth increase, of which 115 were new faces. 898 saw their wealth decrease or remain unchanged, of which 179 dropped off the list. The Top 3 cities with the highest concentration of entrepreneurs on the list were Beijing, Shenzhen and Shanghai, followed by Hong Kong and Hangzhou. The average age was 59.

Stock markets in China have had a difficult year, with Shenzhen down 11%, HK down 6% and Shanghai down 2%. Nasdaq rose 19%. The renminbi fell 3.7% against the dollar.

Rupert Hoogewerf, Hurun Report Chairman and Chief Researcher, said:

“This year the continued slowdown in the Chinese economy resulted in 4% fewer than last year making the cut and 15% fewer than the peak two years ago. It is only the second time in 25 years that the number of individuals on the Hurun China Rich List has decreased for two consecutive years, the last time being 2018 and 2019, after which there was a significant bounce back. Looking at it from another angle, the Hurun list is still up 40% from before the pandemic, 4 times that of 10 years ago and 120 times that of 20 years ago.”

“Whilst the number of dollar billionaires from China has dropped by 51 in one year and 290 in two years, it is worth noting that China is still the ‘billionaire capital of the world’ with 895 billionaires, almost 200 ahead of the US and more than triple the number in India. The growth over the last 25 years has been eye watering with the number of billionaires in China going from zero since the first Hurun list in 1999 to break through the 100-mark in 2007 and then doubling roughly every four years to hit the peak two years ago with 1185 billionaires.”

“80% of the Hurun list from ten years ago are new faces, showing that wealth creation in China has gone through a massive change as entrepreneurs in the fields of healthcare and advanced technologies replace those from real estate and traditional manufacturing.”

“Going global has been one of the key sources of growth this year. The story of China ‘going global’ is best told this year through the stories of Singapore-based Zhang Yiming with his short video platform TikTok, Shanghai-based Colin Huang with his e-commerce Temu platform and Guangzhou-based Xu Yangtian with his fast fashion platform Shein. These three platforms are amongst the most downloaded apps in the world, with Temu and Shein successfully leveraging China’s ‘made in China’ supply chain, combined with new online sales channels and super-fast cross-border delivery. Others of note include Guangzhou-based Ye Guofu & Yang Yunyun, who saw their wealth triple to US$5.3bn on the back of Miniso’s fast international growth, as well as EV-makers such as Shenzhen-based Wang Chuanfu of BYD and online gamers such as Shanghai-based Cai Haoyu of Mihoyo.”

“Online gaming, Semiconductors and F&B had a good year. Three of the Top 10 biggest risers this year were in online gaming. Semiconductors grew on the back of a surge in demand for higher quality chips. F&B and travel saw a rebound, with the likes of casino operator Lui Che Woo of Galaxy Entertainment and Zhang Yong & Shu Ping of hotpot chain HaiDiLao seeing their wealth up US$3.5bn and US$2bn respectively.”

“There were only 115 new faces this year, the lowest number in almost 20 years, with 5 of the Top 10 new entries coming from pharma and healthcare services.”

“Real estate was the hardest hit industry for the second year running, as developers with high debt loads continued to see liquidity crunches. Many developers whose businesses are all but bankrupt, such as former Number One Xu Jiayin of Evergrande, still make the list, based on dividends paid out in previous years. On this basis, Xu, despite his arrest and the imminent bankruptcy of Evergrande, made the list with US$2.75bn. Other industries hurt this year include renewables, especially solar and batteries, and pharma, as China’s healthcare reforms deepen.”

“Curiously, the Hurun Top 5 this year are born in the 50s, 60s, 70s and 80s, each decade with their own characteristics. Number One Zhong Shanshan, born in the 50s, has taken a traditional sector to new heights. Robin Zeng Yuqun, born in the 60s, has built a world-beating battery manufacturer on the back of technology and engineering innovation. Pony Ma Huateng, born in the 70s, built a platform for young consumer groups. Colin Huang Zheng and Zhang Yiming were both born in the 80s and have been phenomenally successful in taking their businesses global.”

“Wealth creation is becoming more spread out geographically, with this year’s 1241 individuals coming from 144 cities, 12% more than five years ago. The preferred cities to live in for Hurun Rich Listers are the ‘Big Three’ of Beijing, Shenzhen and Shanghai, each with 130 or more individuals, ‘plus 2’ (HK and Hangzhou) ‘plus 2’ (Guangzhou and Taipei) and ‘plus 4’ (Ningbo, Suzhou, Changsha and Chengdu). Changsha replaced Foshan in the Top 10. In recent years, many cities have made efforts to develop their own distinctive economies and increased support for entrepreneurship and innovation.”

“This is the 25th anniversary of the Hurun China Rich List, meaning that we have now covered one third of the period since modern China was established in 1949, 60% of the Open Door period since 1978 and 80% of the period since Deng Xiaoping made his famous tour to the South of China in 1992.”

“Hurun Report has been promoting entrepreneurship through its lists and research since 1999. You can think of the rich list as an annual snapshot of China’s private sector with the stories of these entrepreneurs telling the story of China’s economy. I would like to thank our title sponsor Hengchang Shaofang, a premium baijiu brand from the Maotai region, for partnering with us for the fourth year running.”

Deng Hong, chairman of Global Premium Wines and Spirits Group, said: “Quality, brand, scale and planning for the long-term lie at the core of Hengchang Shaofang’s hundred-year history. This, coupled with the operational strength of Hengchang Shaofang’s owner Global Premium Wines and Spirits Group, has won the respect of the market. Hengchang Shaofang is continuously improving the quality of our product. We are meeting demand by expanding our production in the Maotai region, by increasing our sorghum plantations and by responding to the national call to revitalize the rural economy. For us, it is about making a bottle of baijiu with ‘heart’ and the ‘spirit of craftsmanship’. We owe a strong duty of care to the century old brand of Hengchang Shaofang.”

“Hengchang Shaofang is delighted to join with leading rich list producer Hurun Report to release the Hengchang Shaofang • Hurun China Rich List 2023 and celebrate entrepreneurship and responsible wealth creation, through the telling of the stories of China’s successful entrepreneurs.”

Top 10

Geely ’s Li Shufu & family broke into this year’s Top 10 at the expense of the world’s richest farmers Qin Yinglin & Qian Ying of pork producing Muyuan, who dropped down to 13th. The threshold for the Top 10 was US$23.4bn, down from US$24.3bn last year. The average age of the Top 10 is 61, two years older than last year. Five of the Top 10 are from Zhejiang, three from Guangdong and two from Fujian.

‘Bottled Water King’ Zhong Shanshan, 69, topped the Hurun China Rich List for the third time with US$62bn, almost unchanged these past three years. Hong Kong-listed Nongfu Spring saw sales up strongly in the first half of this year and made up 90% of Zhong’s wealth. Zhong’s other main business, the A-share-listed Wantai Biological Pharmacy, saw its market value down by US$5bn. Nongfu Spring made the Top 15 of the Hurun China 500 Most Valuable Private Companies 2022. Five shareholders made the list this year. Zhong is the fifth person to top the Hurun China Rich List for more than three times in the past 25 years, following Rong Zhijian, Huang Guangyu, Wang Jianlin and Jack Ma Yun.

Pony Ma Huateng, 52, returned to second spot with US$38.6bn, up 30% and 3 places. In the first half of this year, Tencent saw revenues up 11%, mainly due to growth in its online gaming, the increase in the number of WeChat Video Channel and WeChat Mini Program’s users, and control of costs and fees. In the third quarter of last year, Tencent announced that it would distribute 958 million Meituan shares to shareholders in the form of a special dividend. Tencent ranked 2nd on the Hurun China 500 Most Valuable Private Companies 2022. Six Tencent shareholders made the list this year.

‘Cross-border Ecommerce King’ Colin Huang Zheng, 43, was up 7 places to break into the Top 3 for the first time, with his wealth up 59% to US$37.2bn, the biggest riser of the year. Pinduoduo saw revenues up by more than 60% year-on-year, far exceeding market expectations. In addition, overseas business Temu and Kuaituantuan saw strong traction. Temu became one of the most downloaded apps in the United States. Pinduoduo made the Top 15 on the Hurun China 500 Most Valuable Private Companies 2022.

‘Battery King’ Robin Zeng Yuqun, 55, was down one place to 4th with US$34.4bn, up 9%. Its been a busy year for Zeng. In the first half of this year, battery maker CATL’s revenue rose nearly 70%, and its net profit more than doubled as its battery capacity hit 130GWh, accounting for more than one-third of the global market share, far ahead of its competitors. CATL made the Top 10 of the Hurun China 500 Most Valuable Private Companies 2022, with nine shareholders on the list this year. However, since the cut-off for the Hurun list on 1 September, Zeng’s share price has dropped 25%, wiping almost US$9bn from Zeng’s wealth.

Zhang Yiming, 40, down 3 places to 5th with US$33.7bn. ByteDance’s total revenue grew 38%, largely due to its overseas business, led by TikTok, more than doubling. By the end of last year, ByteDance had 840 million daily active users outside China, up 40% year on year, and 850 million daily active users in China, up 13% year on year. Bytedance made the Top 5 on the Hurun China 500 Most Valuable Private Companies 2022.

William Ding Lei, 52, ranked 6th with US$33.1bn, an increase of 23%. NetEase’s net income rose 10% last year from the previous year and its online gaming division had sales of US$10.3bn. NetEase made the Top 20 on the Hurun China 500 Most Valuable Private Companies 2022.

Li Ka-shing & Victor Li Tzar Kuoi, ranked 7th with US$28.9bn, down 3 places. Li’s two main listed companies, CK Hutchison and CK Asset, are into property, retail, telecommunications, infrastructure, ports and energy. This is the first year that Victor Li has made the list in his own name. His brother Richard Li made the list with US$10.6bn.

He Xiangjian & family, was down one place to 8th with US$27.5bn, up 5%. In a difficult domestic economic climate, Midea’s business managed to grow, albeit only 1%. Midea is the market leader for home air conditioning, desktop pan microwaves, desktop ovens, electric heaters, induction cookers and electric kettles. Midea made the Top 20 on the Hurun China 500 Most Valuable Private Companies 2022, with three shareholders on the list this year.

Li Shufu, 60, was up 9 spots to break back into the Top 10 with US$24.1bn, up 30%, on the back of his investments into EV makers Hangzhou-based Zeekr and Sweden-based Polarstar. Li’s main business Hong Kong-listed Geely posted revenue growth of 46% last year, whilst Volvo Cars, Li’s other core business, also saw strong growth. Li this year became the third largest shareholder of Aston Martin. Geely ranked among the Top 100 on the Hurun China 500 Most Valuable Private Companies 2022.

Jack Ma Yun, 59, down 1 place to 10th with US$23.4bn. Alibaba this year has seen sales rebound, whilst the valuation of Ant Group has continued to fall over the past year. On the Hurun China 500 Most Valuable Private Companies 2022, Alibaba ranked 3rd and Ant Group ranked in the Top 10. Alibaba has 12 shareholders on the list this year, six fewer than last year.

Biggest risers

522 saw their wealth increase, of which 115 were new faces.

This year’s Top 10 biggest risers added US$65bn, compared with US$43.6bn last year.

Shanghai-born Taiwan-based Barry Lam, also known as Lin Baili, saw his wealth shoot up on the back of a strong growth in servers and data centers, driven in part by the success of ChatGPT. Quanta Computer is a leading manufacturer of Apple notebooks and a partner of Nvidea.

Chongqing-born John Tu and Taiwan-born David Sun of Kingston Technology saw their wealth grow on the back of a jump in the demand for data and memory storage products.

Others that showed strong growth included Ye Guofu & Yang Yunyun of Miniso, which continued to grow internationally, Lui Che Woo of casino operator Galaxy Entertainment, as travel rebounded and Lei Jun of Xiaomi.

One of the stories that resonated deeply has been the story of Michael Yu Minhong of New Oriental, who has bounced back 65% to US$1.86bn. When Yu’s education business all but closed down as part of the education reforms two years ago, Yu repositioned New Oriental as a platform for Key Opinion Leaders.

Top 10 New Faces

Taiwan-based investor Samuel Chen was the highest new entry with US$6.2bn, the only new entry to break straight into the Top 100, on the back of the IPO of pharma platform Polaris and an early investment into video conferencing platform Zoom. Pharma tycoons Zhu Yi of Biokin and Yan Jianya & Fan Daidi both had successful IPOs. Five of the Top 10 new entries are from healthcare, showing the evolution of the industry.

Others include Chengdu-based Wang Xiaokun & Liu Weihong of tea brand ChaPanda and Jakarta-based Li Jie, 48, of delivery platform J&T Global Express.

Biggest drops in wealth

898 saw their wealth decrease or remain unchanged, of which 179 dropped off the list, including 45 former billionaires. Real estate and solar were amongst the hardest hit this year. Real estate developers with high debt loads continued to go through a credit crunch, whilst solar has suffered from overexpansion.

Drop-offs included former Number One Huang Guangyu of Gome, as well as Che Jianxing of Macalline and Wang Wenbiao of Ellion.

Where they live

Which Industries are they doing?

The Top 2 industries lie at the heart of ‘Made in China’. Healthcare has been going through significant reforms, resulting in a changing of the guard. Real estate has continued to be hit by liquidity crises.

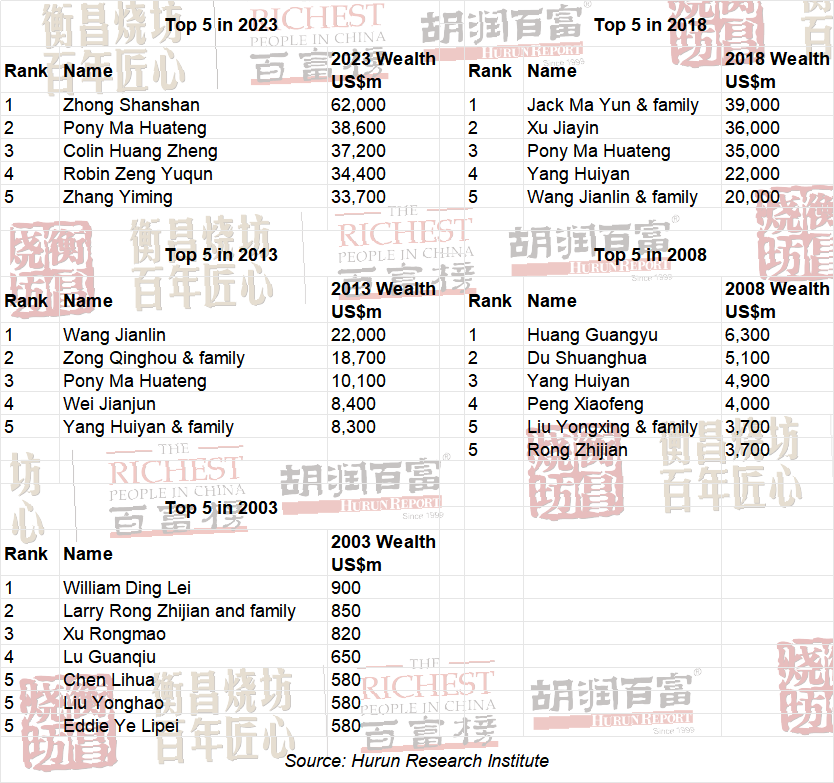

Compared with 5, 10, 15 and 20 years ago

2023 is the 25th anniversary of the Hurun China Rich List.

The richest person this year has US$62bn, more than triple that of 10 years ago and 60 times 20 years ago.

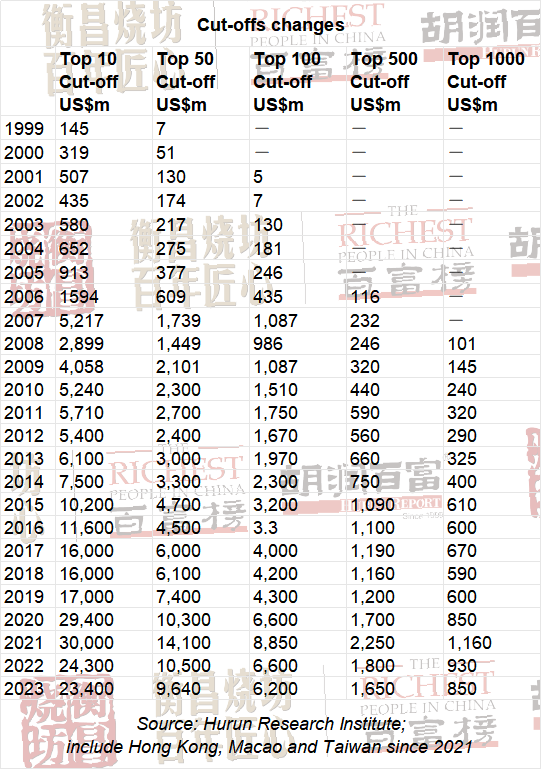

The cut-off to make the Top 10 has risen from US$145mn in 1999 to US$23.4bn today, up 161 times. The number of dollar billionaires has gone from zero in 1999 to break through the 100-mark in 2007, to more than 200 in 2011 to over 500 in 2015 and hitting 1185 in 2021.

The total wealth of entrepreneurs on this year’s list is US$3.2tn, an increase of 40% over five years, 4 times that of 10 years ago, 8 times that of 15 years ago, and more than 120 times that of 20 years ago.

By industry, the proportion of the list making their money in real estate has dropped significantly, from almost half 25 years ago, down to 23% ten years ago, 15% five years ago, and 9% this year.

The changes of the Top 5 in each of these years makes for interesting reading. 10 years ago, Great Wall Motor’s Wei Jianjun made the Top 5. 15 years ago, Peng Xiaofeng of LDK Solar made the Top 5. 20 years ago, William Ding Lei became the youngest person to be Number One in China, aged only 32, and is the only one of the Top 5 then to still make the Top 10 this year.

Chinese Star Signs

In trouble

In prison: Wang Zhenhua of Seazen (US$1.4bn).

Under investigation: Xu Jiayin of Evergrande (US$2.7bn).

Cashflow challenges: Real estate entrepreneurs with high debt loads continue to have liquidity challenges, with Che Jianxing of Macalline, Li Wenbin of Junfa, Chen Hongtian of Cheung Kei, Yi Rubo of Zhongall and Tang Lixin of Shinesun dropping off the list, whilst Yang Huiyan & family of Country Garden, Zhang Li of R&F, Ji Haipeng & family of Logan Property and Xu Rongmao & family of Shimao are still on the list but their companies have shrunk in value considerably.

Divorce: Liu Dongsheng & Zhang Ning of Red Avenue, Zhou Hongyi & Hu Huan of 360 Security Technology, Tang Zhuang & Yi Gebing of Guide Electrics. Zhang Ning makes the list with US$1.65bn and Hu Huan makes the list with US$690mn. After the divorce, both Tang Zhuang and Yi Gebing fell off the list.

Stats throughout the years

Methodology

The List is a snapshot of wealth as of September 1. The exchange rate used for the US dollar was CNY 7.26, for the Hong Kong dollar was CNY 0.926, for New Taiwan Dollar was CNY 0.23.

Valuing the wealth of China’s richest is as much an art as it is a science. We have missed some people, many of whom go to extraordinary lengths to hide their wealth, but we believe the Hurun Rich List to be the most serious attempt to identify China’s top entrepreneurs and to measure their holdings. There are shareholders missing from the likes of ByteDance, Alibaba, Tencent, and other big companies, where as little as 0.1% ownership of the company might be enough to make our cut. Our team of researchers has – for the 25th year running – traveled the length and breadth of the country cross-checking information with entrepreneurs, local government, industry experts, journalists, bankers and regulators, as well as previous years’ databases. For non-listed companies our valuation was based on a comparison with their listed equivalents using prevailing industry Price/Earnings ratios.

People that ought perhaps to be on the list, but where we cannot find reliable date include the likes of Haier’s Zhang Ruimin, PingAn’s Peter Ma Mingzhe, and Huawei’s Sun Yafang, because they are hidden behind employee stock holdings.

HENGCHANG SHAOFANG · Hurun China Rich List 2023 Top 100

About Global Premium Wines and Spirits Group (GPWS)

Global Premium Wines and Spirits Group (GPWS) was founded with huge investment by Mr. Deng Hong, an entrepreneur. He is also the founder of Jiuzhai Paradise International Convention & Holiday Center, Century New International Convention & Exhibition Center.

Today, he is engaged in Baijiu industry, integrating, building and cooperating with excellent liquor production and circulation enterprises worldwide.

In order to incubate influential and representative product brands among various kinds of liquors and sell them, and actively carry out diversified cooperation with domestic high-quality enterprises. It is committed to building an international liquor group based in China and distributed globally.

GPWS has carried out the industrial layout based on the enterprise strategy: in the Baijiu sector, it spent huge capital to acquire Baijiu brands such as “Hengchang Shaofang”, “Sichuan Liquor”, “National Essence” and “Kasasha” in Maotai Town, Chengdu and Luzhou. At the same time, the company has a strong professional and technical capability, including national level judges, provincial judges, liquor tasters, winemakers and other professional and technical personnel.

At present, GPWS is in a period of vigorous development, and mainly focuses on: “planting good sorghum” and “brewing good liquors”. With the positioning of “incubating global liquors”, it plans the future business direction: finding liquor producing areas with unique value in China, incubating and reviving a batch of historic and representative liquor brands through industry finance interaction, and developing high-quality Baijiu popular with consumers.

About Hengchang Shaofang

In 2017, Global Premium Wines and Spirits Group (GPWS) acquired Hengchang Shaofang brand in Maotai Town, creating a century old brand revival plan.

Hengchang Shaofang has been recognized by the market with its excellent quality and profound brand, and has always followed the brand development strategy of “quality, brand, scale and long-term”. Inherit the authentic Kunsha brewing technology and the top 10 secrets of Mr. Da’s family on the basis of strictly following the 12987 maotai-flavor baijiu brewing, and ensure that the quality of each bottle of Hengchang Shaofang liquor is the same.

In 2021, it achieved excellent sales performance. According to the embodiment of market changes and keeping pace with the times, it built a good foundation for the development model of breaking 10 billion yuan in the future. In addition, Hengchang Shaofang has worked with Zhongyu Holding Group, Hurun Report and other well-known enterprises to develop co-branded high-end products based on the core IP, further penetrating the brand image into high-end enterprises and high net worth circles, and continuously realizing the interaction between core consumers and brand image.

The plan is to mass produce more than 2000 tons of high-quality raw baijiu in 2022 and more than 10000 tons in 2023. In April 2022, Hengchang Shaofang started the brewing base project, which is located in Tsubaki Village, Moutai Town, located in the core production area of China’s maotai-flavor baijiu. The overall planning land will be 1,500 acres, and the first phase of the land area is 300 acres, to create a project composed of the boutique hotels, museums, the old Brewery, the baijiu library and other functional modes. The project is to intergrate the production, display, sales into a baijiu brewing base, it will become the second largest brewery in Maotai Town and the most luxurious Baijiu winery in China.

Honors:

1.In 2017,won the Sensory Quality Award of the National Liquor Judges of China

2. In 2019 won the Tax Contribution Award of the Fourth RedSorghum Award in Zunyi city.

3.In 2020,won the Golden Award and the 2020 High-end Maotai-flavor Liquor Award.

4. In 2020,won the China Liquor Qingyun Award for Year’s High-end Product.

5. In 2021, won the Best Performance of High-end Maotai-flavor Baijiu of the 17th Hurun Best of the Best Award

6. In 2022, won the Best Performance of High-end Maotai-flavor Baijiu of the 18th Hurun Best of the Best Award

7. In 2022, won the Integrity Management Award of the sixth “Red Sorghum Award” in Zunyi region

8. In 2022, won the title of “Top Ten Famous Liquors” in the core production area (Renhuai) of Maotai-flavor Baijiu in China

9. In 2022, won the title of “Baijiu New National Standard Quality Demonstration Product” (Tianfuchuan Liquor · Sichuan Brand Baijiu)

10. In 2022, won China Golden Cup Award – Outstanding Maotai-flavor Liquor Brand

11. 2022 China Golden Cup Award – Chinese Liquor Star Product

12. 2023 Honors Certified by the Municipal Party Committee and People’s Government of Renhuai, Guizhou – Top 10 Private Enterprises Paying Taxes in 2022

About Hurun Inc.

Promoting Entrepreneurship Through Lists and Research

Oxford, Shanghai, Mumbai

Established in the UK in 1999, Hurun is a research, media and investments group, promoting entrepreneurship through its lists and research. Widely regarded as an opinion-leader in the world of business, Hurun generated 8 billion views on the Hurun brand last year, mainly in China and India.

Best-known today for the Hurun Rich List series, telling the stories of the world’s successful entrepreneurs in China, India and the world, Hurun’s other key series is the Hurun Start-up series, ranking the world’s unicorns and future unicorns, as well as giving recognition to young start-up founders.

Hurun has grown to become the world’s largest researcher and list compiler of startups, ranking 4000 startups across the world through its annual Unicorns list (US$1bn+), and two future unicorn lists (Gazelles from US$500mn, and Cheetahs from US$300mn).

For the young start-up founders, Hurun has created the Under30s, Under35s and Under40s awards, representing the cream of young entrepreneurs who have founded businesses with a social impact and worth around US$10mn, US$50mn and US$100mn respectively.

Other lists include the Hurun Global Highschools List, ranking the world’s best independent highschools, the Hurun Philanthropy List, ranking the biggest philanthropists, the Hurun Art List, ranking the world’s most successful artists alive today, etc…

Hurun provides research reports co-branded with some of the world’s leading financial institutions, real estate developers and regional governments.

Hurun hosts high-profile events across China and India, as well as London, Paris, New York, LA, Toronto, Sydney, Luxembourg, Istanbul, Dubai and Singapore.

For further information, see www.hurun.net.

For media inquiries, please contact:

Hurun Report

Porsha Pan

Tel: +86-21-50105808*601

Mobile: +86-139 1838 7446

Email: porsha.pan@hurun.net

Grace Liu

Tel: +86-21-50105808

Mobile: +86 136 7195 4611

Email: grace.liu@hurun.net