Investment theory and structure

At its current valuation of around 16x EV/EBIT, I believe the market is underestimating the quality of Technogym's business and there is room for the share price to rise significantly over the next few years.

In this article, we first introduce Technogym and look at the company's management, insider ownership, financials, and current pricing. We then analyze the industry it is in, focusing on market share growth, profit margins, and return on invested capital. We then use qualitative analysis to explore the source of the above-average performance Technogym has enjoyed to date and whether it has the potential to outperform its industry peers in the future.

About Technogym

Technogym was founded in 1983 when 22-year-old Nerio Alessandri designed and built his first piece of fitness equipment in the garage of his home in Cesena, Italy. The company is known for combining the latest technology with sports equipment and giving this equipment a clean Italian design. The company initially focused on supplying products to gyms, but quickly pivoted to an ecosystem, providing products not only to fitness clubs but also to the Hospitality & Residential, HCP (Health, Corporate & Performance) and Home segments. In 2019, approximately 50% of revenue was generated in the Fitness Club segment, 10% in the Home segment and the remaining 40% in the HCP and Hospitality & Residential segments. The company's achievements include a 25% compound annual growth in revenue from its founding to 2019, its equipment is now used in 300,000 homes and 80,000 wellness centers, and it has been an official supplier to the Olympic Games since 2000.

Technogym is still run today by its founder Nerio Alessandri and his brother Pierluigi, who together own 40% of the shares issued. We own 60% of the voting power. We feel that the management team is very strong. The founders are young and have built a €1 billion business from scratch, so they have been exposed to every aspect of the business and know it inside and out. Technogym is a conservative company, with almost no net cash or net debt per reporting year, and only accepting private equity investors after 12 years. As of the end of 2019, the company had a net cash position of €3 million. I also believe there is no need to worry about what will happen to Technogym when the current CEO retires. It is very likely that Erica Alessandri, the daughter of the current CEO, will take over. She is currently a director of Technogym and has a good background, including business experience, brand management experience and an MBA from INSEAD. This video I also think this family has strong core values and integrity.

With a market capitalization of around €1.6 billion and a net cash balance of €3 billion, the company has an enterprise value of around €1.6 billion. With 2019 EBIT of just over €100 million, the company is currently trading at an EBIT/EV yield of 6% to 7%. It is difficult to say whether this is a high or low yield for the industry, as Technogym's competitors are private or loss-making. However, as we will see in the next section, the company has a barrier that allows it to grow its earnings significantly in the future. I do not have a specific earnings growth rate in mind, but I think a low double digit figure would be reasonable. Combined with the current yield, this would result in a high teens yield in the long term, which I am happy with.

(Figure 1. Source: Company website)

(Figure 1. Source: Company website)

Technogym outperforms its peers in a highly competitive industry

Fitness equipment is, to some extent, a commodity product. The materials, mainly steel and aluminum, are not hard to come by and the manufacturing part is not that complicated. A 22-year-old straight out of school could get the hang of it. You can also go to various websites and find an endless list of suppliers who offer great looking fitness products.

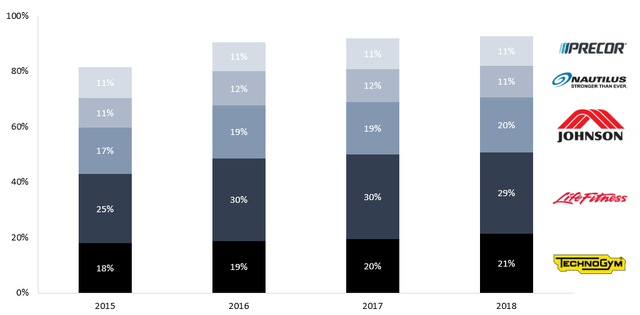

Nevertheless, in 2019, just five major companies dominated the commercial fitness equipment industry, collectively accounting for 93% of the market share. Although the market share of these five companies changed by only 2.4% in average absolute percentage terms from 2015 to 2018, their profitability and return on invested capital were highly volatile. Figure 2 shows the annual market share per company from 2015 to 2018. In these four years, Technogym was able to increase its market share from 18% to 21%.

(Figure 2. Commercial fitness industry market share trends. Authors' calculations using data from Life Fitness. Revenues used in market share calculations converted to USD using data from the Exchangerates website.)

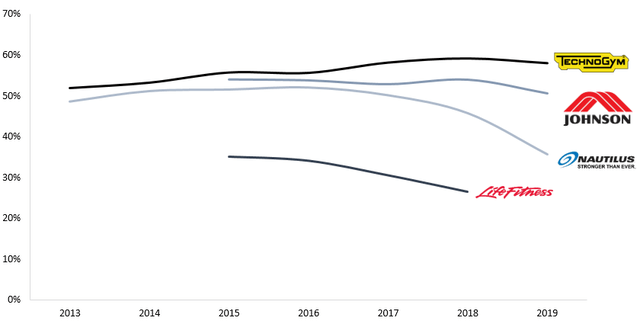

Technogym’s focus on operational control and pricing power while gaining market share has enabled it to achieve best-in-class gross margins, as shown in Figure 3.

(Figure 3. Gross profit margins by company. Created by the authors, data taken from annual reports.)

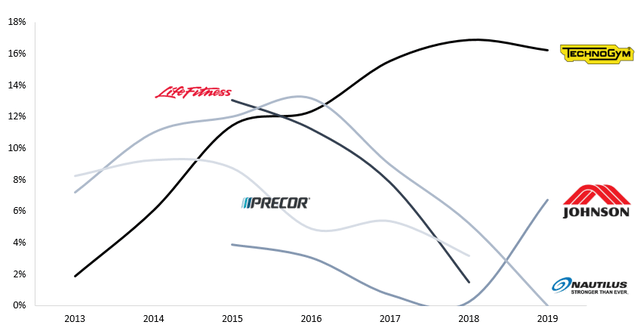

Moreover, the company has been able to steadily increase its operating margins while benefiting from economies of scale. Between 2016 and 2019, while all of Technogym's competitors suffered steep declines in their operating margins, Technogym was able to increase its profitability to levels far superior to any of its competitors, as shown in Figure 4.

(Figure 4. Operating profit margins by company. Created by the authors, data taken from annual reports.)

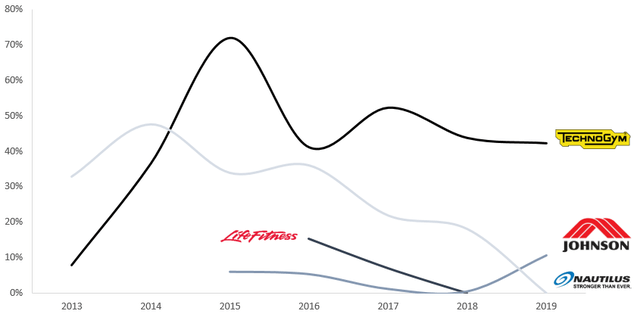

Return on invested capital also shows that Technogym is generating profits well above the industry average (Figure 5). From 2017 to 2019, the company increased its invested capital from €166 million to €257 million and increased its operating profit by €40 million. This means that the company achieved an incremental return on capital of 44%. These figures show that Technogym is well positioned and that management is allocating capital very well.

(Figure 5. Return on invested capital by company. Created by the authors, data taken from annual reports.)

The secret to turning your product into a franchise

The main reason for Technogym's strong performance is its success in transforming a commodity product into a franchise by focusing on brand management and adopting a differentiated sales approach, which we will explain in the next paragraphs.

To build a respected brand in a competitive industry, the company has strived to start with a clear sense of purpose: to promote a wellness lifestyle. This focus on purpose is evident in their annual report and various initiatives such as the creation of Wellness Valley in Romagna and running a non-profit organization promoting a lifestyle where wellness plays an important role. The distinctive black and yellow color of their equipment helps to increase brand recognition. Exposure to M&A transactions in the fitness industry and seeing gym owners citing ownership of Technogym equipment as a USP only strengthens my belief that Technogym is a respected brand.

Technogym does not focus solely on selling equipment to its customers. Rather, it focuses on selling solutions. For corporate customers, this means the company offers them a package of hardware, software, and after-sales services. In doing so, the company engages with its customers deeply, increasing the value of the relationship and the likelihood of repeat business. For end users, this means the company offers an ecosystem where personal fitness data and training programs can be accessed on any Technogym machine anywhere in the world. This solution selling approach allows the company to have a differentiated selling proposition and does not have to lower prices to compete with its peers. On the contrary, the company benefits from significant pricing power. As proof, the global financial crisis hit the fitness industry hard, but the company did not offer any discounts on its products and still managed to break even. The company is now doing the same during the COVID-19 crisis and expects to break even again.

I believe these two factors create a relatively wide moat around the company. Competitors could try to replicate the company's focus on brand management, but it would require significant investment. Competitors are smaller and tend to have less revenue to reinvest, making it difficult for them to afford such large investments. The same can be said about the sales proposition; expanding a proposition into a complete solution typically requires significant investment. Life Fitness is already at roughly the same level as Technogym, but has experienced huge losses over the past few years, which could work in Technogym's favor.

There are some things I don't like

There are many great things about Technogym, but like any company, there are always unpleasant aspects. I mainly think that the company could have been more transparent with its investors. The fitness industry is moving rapidly towards connected equipment, and Technogym is investing heavily in the research and development of these products, and talks a lot about it in its annual report. However, the company only provides a relatively crude revenue share and does not disclose any KPIs to guide investors, so investors have no way of judging the progress of these investments. But of course, given that the adoption of connected equipment is still in its early stages, things could change in the next few years. The CEO also held the property where the company's headquarters is located (“Technogym Village”) in a private company, which he later sold to Technogym in 2016. The property clearly had strategic value, so it was sold for €85 million, just below the estimated investment of €94 million. To a buyer unrelated to Technogym, the property would have had a market value of €52 million.

But overall I think Technogym is a great investment.

Overall, I think Technogym is an attractive security. A strong brand and differentiated distribution model provide a relatively broad defense and deliver a superior return on invested capital (incremental) compared to peers. It is currently run by a true “brand CEO” who has transformed a commodity into a franchise, and I am confident in his potential successor. Conservative financials, decent EBIT/EV yields, and large ownership act as further downside protection.