Justin Sullivan

Unity (New York Stock Exchange:U), a leading real-time 3D development platform, is poised to become an industry leader with the release of the Apple (AAPL) Vision Pro headset. The headset includes native support for Unity-built projects. The go-to platform for developers creating immersive mixed reality experiences.

Given how important spatial computing is to the future of computing in general, this is a key moment for the company to solidify its place in tomorrow's technology stack.

Today, we'll explore why we think Unity's inclusion in Apple's ecosystem is such a positive development, and the potential implications for its financials and stock price.

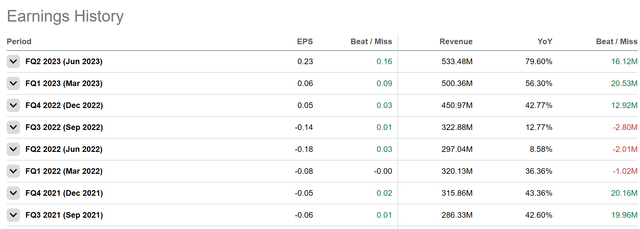

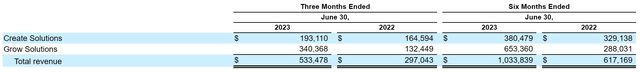

Summary of financial results

As always, let's start with the financials.

Unity's revenue growth has been strong in recent quarters. In the second quarter of 2023, the company's revenue increased by 80% (!) from the previous year to $ 533 million.

In search of alpha

This was the highest quarterly sales in the company's history. Over the next 12 months, Unity's revenue increased 48% year over year to his $1.8 billion.

This significant revenue growth is driven by the growing popularity of real-time 3D content.

Unity's platform is used to create games and mixed reality experiences, and the company's customers include some of the biggest names in the technology industry, including Google (GOOGL), Microsoft (MSFT), and Amazon (AMZN).

Unity is monetizing this trend towards gaming and 3D in a few different ways.

First, the company growing up segment. Grow primarily houses the company's advertising solution, which is how it monetizes its “free” developer user base.

Grow your solution revenue [as our] Monetization solutions allow publishers, original equipment manufacturers, and mobile carriers to sell ad inventory available on mobile applications or hardware devices to advertisers for in-app or on-device placements. You can do it. Our revenue represents the amount we earn from the transactions we facilitate through our integrated auction and brokerage platform.

Second, Unity create This segment includes per-seat subscription revenue that game developers pay for advanced features and premium services. This is revenue from the “paid” developer user base.

We primarily generate revenue for Create Solutions through our suite of Create Solutions subscriptions, enterprise support, professional services, and cloud and hosting services. Our subscriptions give you access to technology that allows you to edit, run, and iterate on interactive RT3D and 2D experiences that you can create once and deploy across a variety of platforms.

Both have seen solid growth, with Grow accounting for the majority of Unity's year-over-year gains.

10Q

However, despite strong revenue growth, Unity has not been profitable since its 2021 IPO. In the most recent quarter, the company reported a net loss of $192 million. That's an improvement from the previous four quarters, when the company lost more than $200 million in each quarter, but many critics are calling for the company to improve its cost structure.

Unity's profitability problems are due to many factors, including high sales and marketing costs and the need for large investments in research and development. The company also faces increasing competition from other real-time 3D development platforms such as Unreal Engine.

However, in our view, things are not as bad as they seem. The majority of the net income loss was due to D&A and stock-based compensation, which are non-cash expenses. On a cash basis, Unity is actually profitable, generating over $351 million in TTM free cash flow.

Although this makes the situation a bit vague, much of the company's talent is only retained thanks to the SBC, so the company is actually harming investors by financing its expenses this way. There is only one.

The business has a good liquidity position, as Unity has over $1.6 billion in cash and only about $975 million in current liabilities.

Taken together, it's best to view Unity as a high-growth company with profitability issues but no immediate liquidity concerns.

Vision Pro Unity

Things improved significantly for Unity when Apple announced its Vision Pro product in early June of this year. In a brief moment you might have missed during the presentation, Apple has confirmed that its new Vision Pro headset will natively support Unity.

apple

Unity later clarified questions about this integration by stating:

Let's see how to run apps on Apple Vision Pro. There are three main approaches to creating spatial experiences on the visionOS platform using Unity.

- Port existing virtual reality games or replace the player's surroundings with your own environment to create new, fully immersive experiences.

- Combine content and passthrough to create immersive experiences that blend digital content with the real world.

- Run multiple immersive applications side by side in a passthrough while in a shared space.

The integration therefore runs fairly deep, allowing developers to import Unity apps into visionOS and build new ones natively using Unity's suite of products.

unity

Network benefits

For us, adding this feature is a game-changer for Unity for three main reasons.

1.) Unity will become the standard for spatial computing.

2.) Unity owns the developer talent pipeline.

3.) Apple's network effects could have serious revenue implications.

Let's start with the first two, which are more strategic, and finish with point three, which can quickly lead to improved short-term performance.

First, in our view, this move positions Unity as the only natively supported 3D platform for what could be one of the largest mixed reality consumer products. This will effectively position you as a leader. The fact that Apple is one of the most popular brands in the world doesn't hurt either. This gives Unity a huge advantage over competitors such as his Unreal Engine and Magic Leap.

Developers who want to create mixed reality experiences have no choice but to use Unity, which has become the de facto standard for Metaverse/XR development.

Like the second point, there are also all kinds of important ramifications. Unity will own the talent developer pipeline.

When it comes to building a moat around a product, something that is often not discussed enough is how new entrants to the specialty end up being trained. If Unity continues to be the only 3D development suite natively supported by Vision Pro, then all else being equal, newcomers to the gaming and 3D development field will have a reasonable choice. , you will be learning Unity first. This leads to custom workflows and assets, which ultimately leads to retention.

Finally, as Made Easy – Finance pointed out in a recent article, even a small portion of Apple's developer ecosystem migrating to try Unity could have a significant impact on medium-term financial performance. there is.

First, AAPL's partnership gives more than 34 million registered developers access to Unity. We believe this is a relatively untapped market for Unity. For example, if his 10% of AAPL's registered developers subscribed to Unity's Pro plan (annual fee of $2,040), Unity could earn an additional $7 billion per year in developer seats alone. .

AAPL's new cloud computing platform also introduces an addressable marketplace for Unity's advertising segment (Grow). With more affordable AR/VR/XR headsets planned, spatial computing platforms appear to be on the verge of early mass adoption. The increase in AR/VR/XR users means an expanding addressable advertising market.

We expect Unity to take 1.5 years to begin to reflect the increased number of developers coinciding with the official launch of Apple Vision Pro. Additionally, we expect it will take three to five years for Unity to begin to reflect advertising revenue growth associated with AAPL's spatial computing platform.

Overall, we expect this Vision Pro integration to significantly strengthen what was a rapidly growing company, and with increased adoption, further revenue growth could translate into net income profitability as well. .

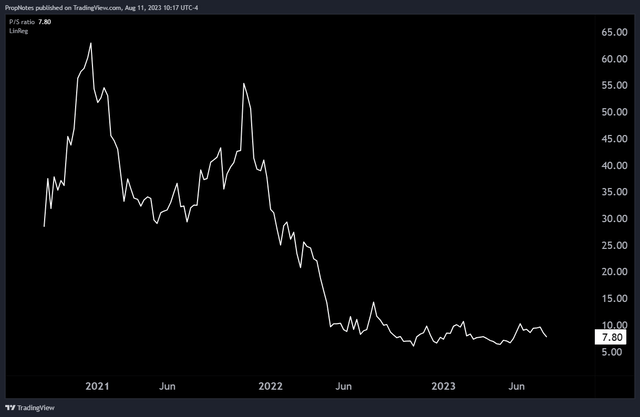

We expect the stock to have considerable room for upside, especially considering the current sales valuation.

TradingView

If Unity can recoup a quarter of its previous valuation at 60x sales (15x), the stock could more than double from here. This seems very likely, especially given the potential profitability outlook and high trigger-prone short float. .

risk

The main risk in this story is that Apple will support another 3D development product like Unreal Engine with Vision Pro at some point in the future.

For now, Vision Pro is only being released with Unity as a partner, but there's nothing stopping us from adding more natively supported engines in the future.

Apple likely chose Unity instead of Unreal Engine, as Unreal Engine is owned and operated by Epic Games, and Apple has been legally at loggerheads with the game for some time.

That competitive advantage disappears, however, if the companies mend fences or another up-and-coming platform, Godot, is integrated.

summary

Unity is trying to become the industry leader in the Metaverse. The company's platform is already the most popular platform for creating immersive experiences, and its inclusion in the Vision Pro headset will further strengthen Unity's position.

Unity is well-positioned to take full advantage of the growth in mixed reality and become an industry leader.