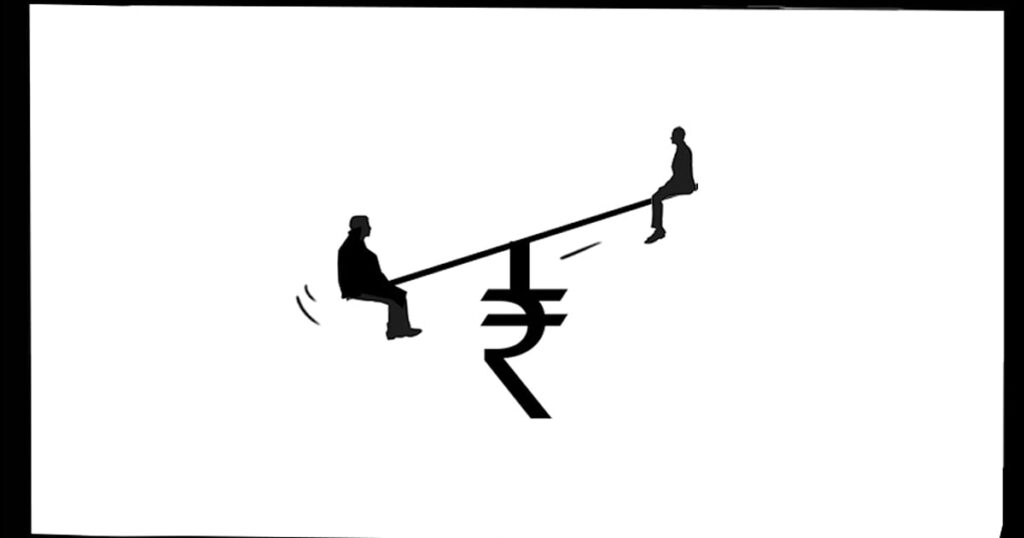

India has long suffered from inequality, which has worsened in recent years, especially during the pandemic. India ranks fifth in the world in terms of GDP and is the fastest growing major economy, but this growth has been accompanied by sharp increases in inequality. According to UNDP's recent report on human development in Asia and the Pacific, while India has added nearly 40 millionaires (the number has grown from 102 to 143), an additional 46 million Indians have fallen below the poverty line. below.

While India's per capita income has increased from $442 to $2,389 over the past two decades, this statistic shows that much of the new income and wealth has gone into the hands of the top 1 percent and top 10 percent of the population. It hides the reality. The poor became even poorer. Growth in per capita income has also been concentrated in a few states, with the least developed states housing 42 percent of the total population and 62 percent of those living below the poverty line.

As a result, while GDP is growing, disparities within countries are widening in both income and wealth. The highest-income 10 percent of the population receives 57 percent of the country's total income, and only the top 1 percent receives 22 percent of that, presenting one of the most unequal income distributions. Wealth disparities are similarly evident, with the richest 10 percent of the population owning more than 65 percent of the country's total wealth. The UNDP report asks an important question: Why is India experiencing rising inequality despite significant economic growth in recent decades?

To answer this question, it is important to look back at India's post-independence planning regime, which emphasized socialism (1950s to 1980s) and contributed to reducing inequality. This approach reduced the concentration of economic power among the wealthy, and the share of the top 1 percent of the population in national income fell from 12 percent in 1951 to 6 percent in 1982.

The 1991 reforms brought about economic liberalization, privatization, and globalization. This led to a series of laws and policies aimed at liberalizing the Indian economy to an unprecedented degree. These reforms have created an environment in which the wealthy can benefit from the less wealthy without being affected. Data from the World Inequality Database (WID) clearly shows how the top 1 percent's share of national income has steadily increased since 1991, with a corresponding decline in the bottom 50 percent's share.

Although the wealthy have had greater economic benefits than the less well-off, overall living standards have improved for everyone, with positive outcomes despite unequal wealth accumulation. It is argued that this suggests that However, this claim can be challenged using his WID data on trends in absolute income for the two income classes. Since 1991, we see a large increase in the absolute income of the top 1 percent compared to a small increase in the absolute income of the bottom 50 percent.

The argument that the 1991 reforms were the main driver of inequality in India receives further support when we consider annual industry survey data. In 1981-82, India's organized sector exhibited a net value added (expressed as value added to products during the manufacturing process) of about Rs 14,500 billion. During this period, the worker received 30.3% of this as wages, and the factory owner and shareholder received his 23.4% as profit. Before liberalization, the proportion of wages in wages remained at more than 30%. However, after liberalization, although the profit share steadily increased, the portion allocated to workers' wages decreased markedly. By 2019-20, the net value added increased to Rs 12.1 billion. Remarkably, profits soared to 38.6% while only 18.9% went towards employee wages.

A recent reform that widened inequality within India was the introduction of the Goods and Services Tax (GST) in 2017. Additionally, around the same time, the government lowered the corporate tax rate, ostensibly to encourage investment by domestic companies. . These two factors contribute to rising inequality by increasing the share of indirect taxes and decreasing the share of direct taxes in India's tax revenue. Indirect taxes (taxes on goods and services bought and sold) are paid by all citizens, regardless of income class. Includes taxes on goods such as food and services such as accommodation. Direct taxes, on the other hand, are taxes paid by businesses on their profits and by citizens on their income (above a certain level). Therefore, a higher proportion of indirect taxes in total tax collection imposes a more equal distribution of the tax burden among unequal citizens. This equal distribution is not fair because the poor are forced to contribute equally to the collected taxes as the rich. This increases inequality, which is exactly what the introduction of GST has done.

Inequalities within India have grown so wide that small-scale policies aimed at addressing them may prove ineffective. Therefore, a more radical and comprehensive approach must be adopted. For example, the introduction of a wealth tax could play an important role in reducing inequality. By taxing the accumulated wealth of the wealthiest individuals, governments can generate additional revenue to invest in social welfare programs, education, and health care, promoting greater economic opportunity for the disadvantaged. . However, accurately determining the value of a wealthy person's assets can be difficult, leading to potential conflicts and tax evasion. Wealthy people may relocate their assets, and even themselves, to countries with more favorable tax policies, resulting in capital flight and reduced tax revenues. Wealth taxes must therefore be carefully crafted to be effective, taking these challenges into account, while seeking to strike a balance between reducing inequality and promoting economic prosperity. . Furthermore, to balance the two sides of the same coin of growth and inequality, we need to provide better social protection, along with more active investments in health and education, especially region-specific investments such as agriculture, skills development, and job creation. It is necessary to.

(Mr. Yash Tayal is a student and Dr. Subhashree Banerjee is an assistant professor in the Department of Economics, Faculty of Social Sciences, Christ University, Bengaluru)

(issued January 3, 2024, 21:14 IST)